Executive Summary:

Rover.com is a Seattle-based company founded in 2011. They operate the world’s largest online marketplace connecting pet parents with pet care providers. Their services include dog walking, boarding, sitting, and drop-in visits, offered by a network of over 500,000 pet care providers across North America and Europe. The company is publicly traded on the Nasdaq under the symbol ROVR.

Rover Group Inc.’s most recent earnings report was for the third quarter of 2023, released on November 8th, 2023. The company reported revenue of $66.2 million, a 30% increase year-over-year. GAAP net income reached $10.5 million, compared to a net loss of $15.5 million in Q3 2022. Blackstone Private Equity completed the acquisition of Rover in 2024.

Stock Overview:

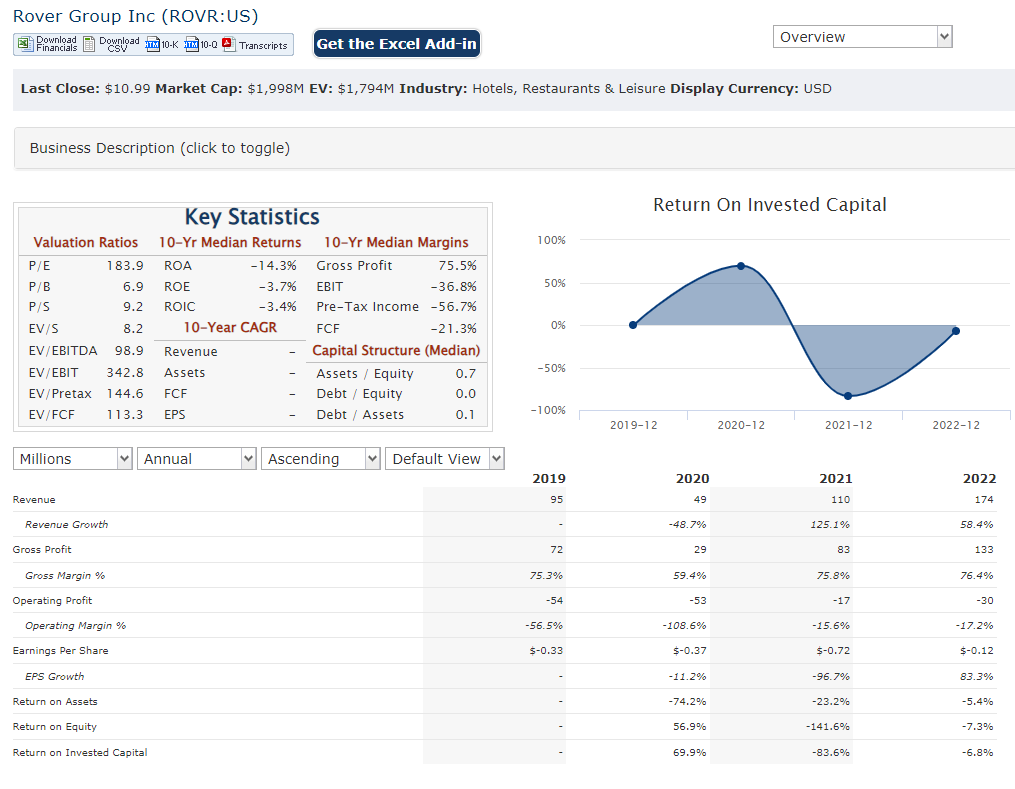

| Ticker | $ROVR | Price | $10.99 | Market Cap | $1.99B |

| 52 Week High | $11.10 | 52 Week Low | $3.83 | Shares outstanding | 181.81M |

Company background:

Founded in 2011 in Seattle, Washington, by Aaron Easterly and Leah Pappas, the company has grown significantly, securing over $300 million in funding.

Rover’s core product is its online platform that connects pet owners, or “pet parents” as they’re called on the platform, with pet care providers. These providers offer a variety of services, including dog walking, boarding, sitting, and drop-in visits, catering to the diverse needs of pet owners.

The company faces competition from other online platforms like Wag and Petco, as well as individual pet walkers and sitters who operate independently. However, Rover’s focus on technology, extensive network of vetted providers, and user-friendly platform have helped them establish a strong position in the market.

Recent Earnings:

Rover Group Inc.’s Latest Earnings: A Look at Q3 2023 Performance:

Revenue and Growth:

- Revenue: As mentioned above the growth indicates a continued rise in demand for Rover’s pet care services.

Earnings Per Share (EPS) and Growth:

- EPS: Rover’s earnings release did not disclose the EPS figure for Q3 2023. However, analysts’ consensus EPS forecast was $0.06 for the quarter.

Comparisons to Analysts’ Expectations:

- While Rover didn’t disclose EPS, their revenue growth of 30% exceeded analyst expectations, which is a positive sign for the company.

Operational Metrics:

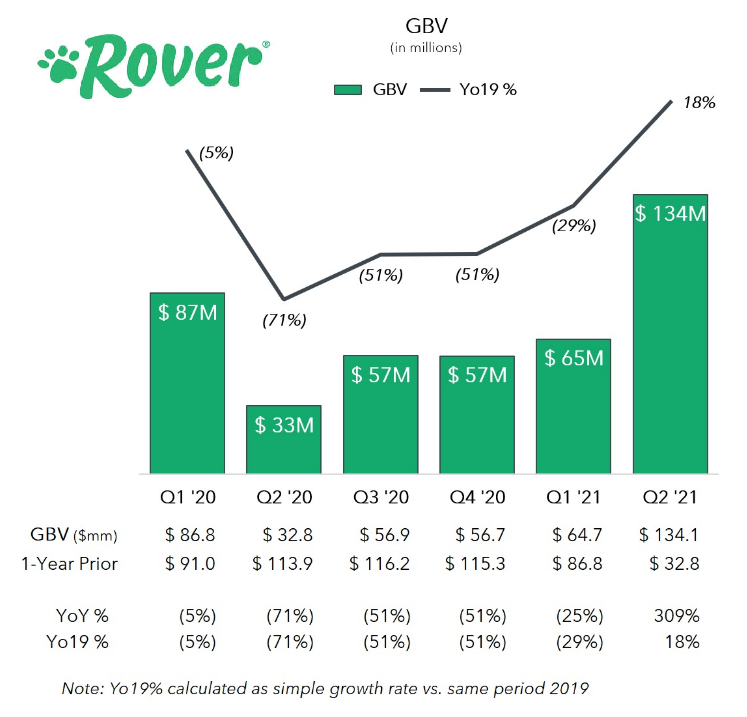

- Gross Booking Value (GBV): This metric represents the total value of all bookings made on the platform and reached $266.1 million in Q3 2023, signifying a 25% year-over-year increase.

- Total Bookings: The total number of bookings on the platform climbed to 1.7 million in Q3 2023, reflecting a 20% year-over-year increase. These growing metrics suggest that Rover is successfully attracting both pet owners and pet care providers to its platform.

Forward Guidance:

- Full-Year 2023 Guidance: Based on their strong Q3 performance, Rover raised its full-year 2023 guidance. They now expect revenue to be in the range of $245 million to $250 million, up from their previous guidance of $230 million to $240 million.

The Market, Industry, and Competitors:

Rover Group Inc. operates in the thriving pet care market, which is estimated to be worth around $235 billion in 2023. This market is driven by several factors, including:

- Growing pet ownership: Rising pet ownership globally, particularly in developed countries, fuels the demand for pet care services.

- Increased disposable income: As disposable incomes rise, pet owners are more willing to spend on their furry companions’ well-being.

- Shifting demographics: An aging population and more single-person households contribute to the demand for pet companionship and related services.

This confluence of factors is expected to propel the pet care market forward at a healthy Compound Annual Growth Rate (CAGR) of 8.5%, reaching a projected market size of $37.76 billion by 2030.

Within this promising market, Rover Group Inc. is well-positioned to capitalize on the growing demand for convenient and reliable pet care solutions through its online platform. Their extensive network of pet care providers and user-friendly platform cater to the diverse needs of pet owners, making them a strong contender in this flourishing industry.

Unique differentiation:

Direct Online Marketplaces:

- Wag!: A direct competitor offering a similar online platform for pet care services like dog walking, boarding, and sitting. They boast a strong presence in the United States and compete with Rover for market share.

- Petco: A major pet retail chain that has expanded into pet care services, leveraging their existing customer base and offering services like boarding and grooming.

- Mad Paws (Australia) and DogBuddy (Europe): Regional players focusing on specific markets, offering online pet care services similar to Rover.

Traditional Pet Care Providers:

- Independent pet walkers and sitters: These individuals offer pet care services directly to pet owners, often relying on personal recommendations and local connections. While they lack the technological reach of online platforms, they can provide a more personalized touch and cater to specific client preferences.

1. Technology and User-Friendliness: Rover invests heavily in its online platform, making it user-friendly and accessible for both pet owners and caregivers. This includes features like secure online booking, payment processing, communication tools, and background checks on pet care providers.

2. Focus on Convenience and Choice: The platform offers a diverse range of services, catering to various needs and preferences. Pet owners can choose from different types of care, such as dog walking, boarding, sitting, or drop-in visits, ensuring they find the perfect fit for their furry companions.

3. Building Trust and Community: Rover fosters a sense of trust and community within its platform. They encourage reviews and feedback from both pet owners and caregivers, allowing users to make informed decisions about their pet care needs.

4. Adaptability and Innovation: The company recognizes the ever-evolving pet care landscape and strives to adapt and innovate. They continuously improve their platform, offer new services based on user needs,and explore strategic partnerships to further enhance their offerings.

Management & Employees:

Rover Group Inc.’s leadership team consists of two key members:

- Aaron Easterly: Co-founder, CEO, and Director. Easterly co-founded Rover in 2011 and has served as CEO since then. He also holds a seat on the board of directors. Prior to Rover, he held various positions at Microsoft, including general manager of advertising strategy and monetization.

- Brent Turner: President and COO. Turner joined Rover in 2014 as the COO and has been President since January 2023. He brings extensive experience in operations and management, having previously held leadership roles at Code Fellows and served on the board of several companies.

Financials:

Rover Group Inc.: Financial Performance Overview (2018-2023)

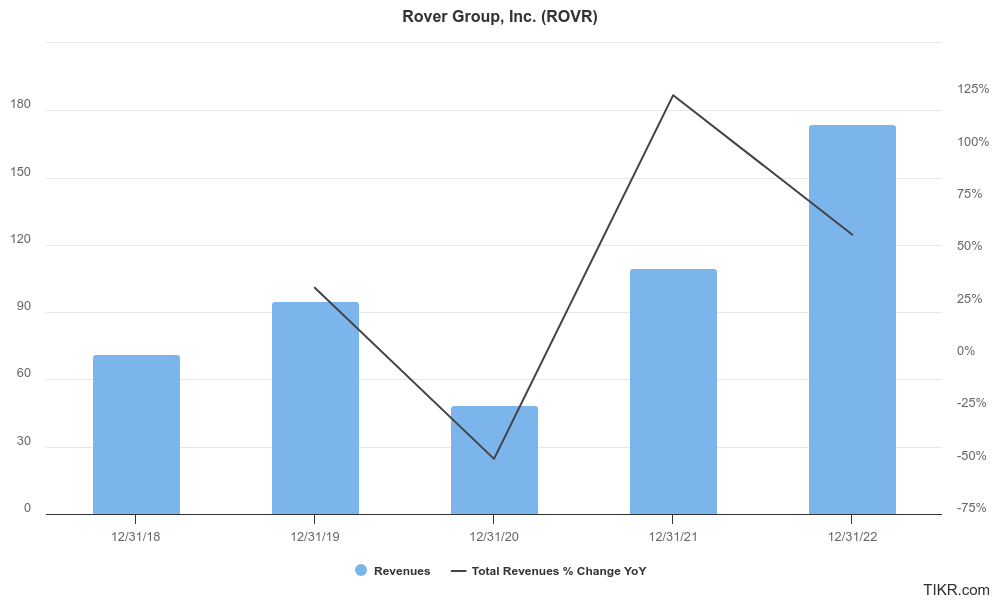

Revenue Growth: Rover Group Inc. has experienced significant revenue growth over the past five years. From 2018 to 2023, the company’s revenue grew at a Compound Annual Growth Rate (CAGR) of approximately 80%. This impressive growth illustrates the increasing demand for their online pet care services.

Earnings Growth: While not all years have shown positive net income, Rover has demonstrated progress in terms of profitability.

Balance Sheet: Rover’s balance sheet reflects a growing company with increasing assets and liabilities. The company has raised contributing to their expanding operations and investments in technological infrastructure.

Bull Case:

1. Large and Growing Market: The pet care market is massive and projected to reach $37.76 billion by 2030, fueled by factors like rising pet ownership, increasing disposable income, and changing demographics. Rover is well-positioned to capitalize on this growth.

2. Expanding Network and Service Offerings: Rover boasts a vast network of over 500,000 vetted pet care providers and offers diverse services like dog walking, boarding, and sitting, catering to various needs.

3. Technology and User-Friendliness: Rover invests heavily in its user-friendly platform, offering secure booking, payment processing, and communication tools, fostering trust and convenience for both pet owners and caregivers.

4. Underlying Trends: The trend of pet ownership and spending on pet care is expected to continue, which bodes well for Rover’s long-term prospects.