Executive Summary:

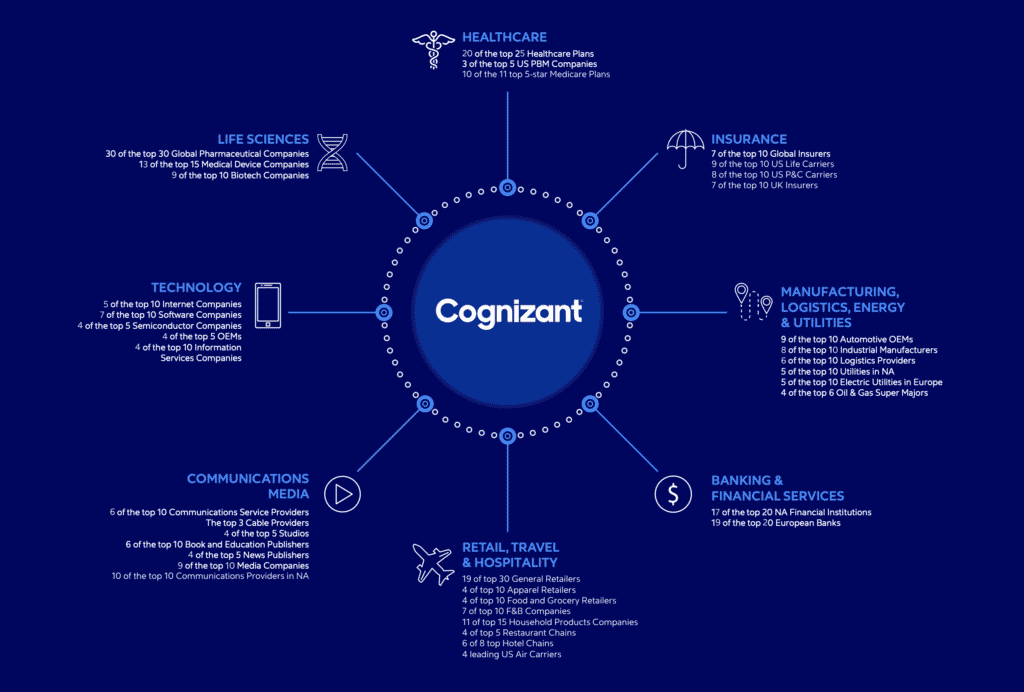

Cognizant Technology Solutions Corporation is a multinational information technology services and consulting company headquartered in Teaneck, New Jersey, U.S. It was founded in 1994 as an in-house technology unit of Dun & Bradstreet and later became an independent company in 1996. Cognizant helps clients modernize technology, reimagine processes, and transform experiences to stay ahead in a fast-changing world. The company serves a wide range of industries, including banking and financial services, healthcare, manufacturing, and retail.

Cognizant Technology Solutions Corporation reported an EPS of $1.13, which missed analysts’ expectations of $1.14. Revenue for the quarter came in at $4.84 billion. The company’s revenue growth of 1.4% year-over-year.

Stock Overview:

| Ticker | $CTSH | Price | $80.06 | Market Cap | $39.7B |

| 52 Week High | $82.41 | 52 Week Low | $63.79 | Shares outstanding | 495.82M |

Company background:

Cognizant Technology Solutions Corporation is a multinational information technology (IT) services and consulting company. Founded in 1994 as an in-house technology unit of Dun & Bradstreet by Kumar Mahadeva, Srini Raju, and Francisco D’Souza, Cognizant became an independent company in 1996. They offer a wide range of IT services, including digital engineering, cloud and infrastructure services, data and AI, and business process services. These services cater to various industries such as healthcare, banking and financial services, manufacturing, and retail.

Cognizant faces competition from several major IT service providers, including industry giants like Tata Consultancy Services (TCS), Infosys, Accenture, and Wipro. These companies compete on factors like service offerings, pricing, geographical reach, and client relationships. Cognizant’s headquarters are located in Teaneck, New Jersey, USA.

Recent Earnings:

Cognizant Technology Solutions Corporation reported revenue for the quarter was $4.84 billion, representing a modest year-over-year growth of 1.4%. While this growth was in line with the company’s guidance, it fell slightly short of analysts’ expectations of $4.85 billion.

Cognizant reported an EPS of $1.13, which missed analysts’ consensus estimate of $1.14. The company’s operating margin for the quarter was 14.6%, up from 14.0% in the previous year.

Cognizant expects revenue to be in the range of $19.7 billion to $19.8 billion, with a year-over-year growth rate of 1.6% to 2.1%. The company also anticipates an EPS in the range of $4.50 to $4.55 for the year. The company remains optimistic about its long-term growth prospects, driven by its focus on digital transformation, cloud services, and artificial intelligence.

The Market, Industry, and Competitors:

Cognizant Technology Solutions Corporation operates primarily in the IT services and consulting market, focusing on several key sectors such as Financial Services, Healthcare, Products and Resources, and Communications, Media, and Technology. The company provides a broad range of services, including digital solutions, application development, systems integration, and business process outsourcing. Cognizant’s expertise in leveraging emerging technologies—like artificial intelligence (AI), cloud computing, and data analytics—positions it well to meet the growing demands of its diverse client base, which includes healthcare providers, financial institutions, and manufacturers.

The company’s strategic investments in AI and cloud services are anticipated to enhance its service offerings and operational efficiencies, making it a key player in the IT landscape. Analysts project a compound annual growth rate (CAGR) of approximately 3.8% – 4.8% for Cognizant through 2030. This growth is supported by the rising demand for specialized IT services in sectors like healthcare and financial services, where regulatory compliance and technological advancements are critical. Cognizant’s focus on delivering tailored solutions is likely to bolster its market position and revenue growth.

Unique differentiation:

Cognizant faces stiff competition from several major IT service providers, including industry giants like Tata Consultancy Services (TCS), Infosys, Accenture, and Wipro. These companies compete on factors like service offerings, pricing, geographical reach, and client relationships.

TCS, often referred to as the largest IT services company globally, boasts a strong presence in various industries and client base. Infosys, another major player, is known for its focus on digital services and innovation. Accenture, a global management consulting and professional services firm, offers a wide range of services, including digital, cloud, and security solutions. Wipro, a leading global information technology, consulting, and business process services company, competes with Cognizant across various service lines.

These competitors, along with others like Capgemini, HCL Technologies, and IBM, pose significant challenges to Cognizant’s growth and market share. Cognizant must continue to invest in digital transformation, cloud services, and emerging technologies, while also focusing on operational efficiency and client satisfaction.

1. Digital Transformation Focus: Cognizant has positioned itself as a leader in digital transformation, leveraging emerging technologies like AI, machine learning, and IoT to help clients innovate and modernize their businesses.

2. Industry Expertise: The company possesses deep industry expertise, particularly in healthcare, financial services, and manufacturing. This allows them to tailor solutions to specific industry challenges and opportunities.

3. Innovation and Agility: Cognizant invests heavily in research and development to stay ahead of technological advancements. This focus on innovation enables the company to offer cutting-edge solutions to clients.

Management & Employees:

Ravi Kumar S.: Currently serving as the CEO of Cognizant, Ravi Kumar S. is a seasoned technology leader with a proven track record of driving growth and innovation.

Surya Gummadi: In his role as EVP and President of Cognizant Americas, Surya Gummadi leads the company’s operations in the Americas region, focusing on driving growth and building strong client relationships.

Rajesh Varrier: As EVP, Global Head of Operations and Chairman and Managing Director of Cognizant India, Rajesh Varrier oversees the company’s global delivery operations and plays a crucial role in driving operational excellence and innovation.

Ganesh Ayyar: As EVP and President of Intuitive Operations and Automation and Industry Solutions, Ganesh Ayyar leads the company’s efforts in automation, AI, and industry-specific solutions, driving innovation and operational efficiency.

Financials:

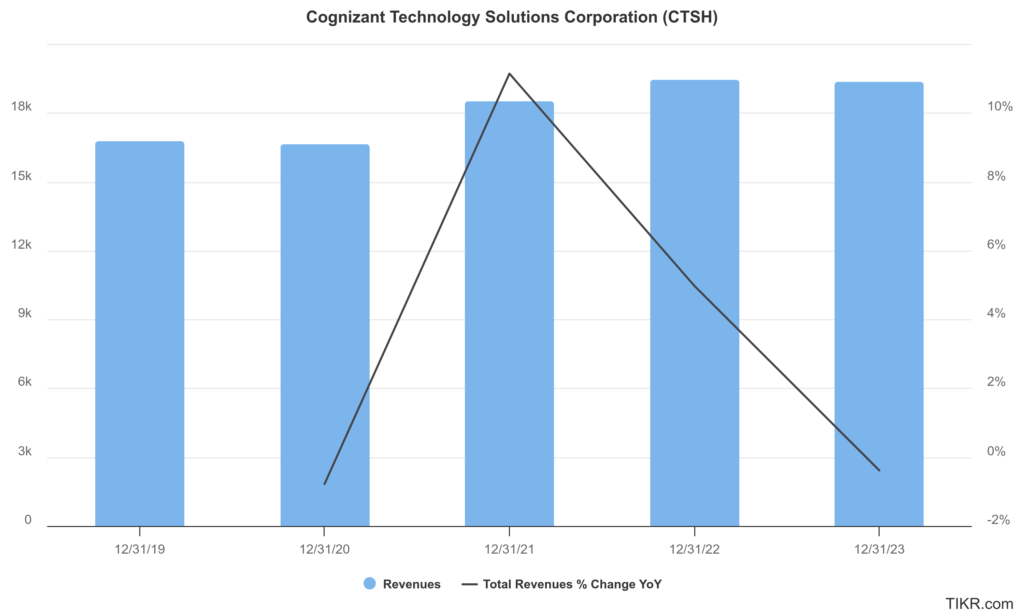

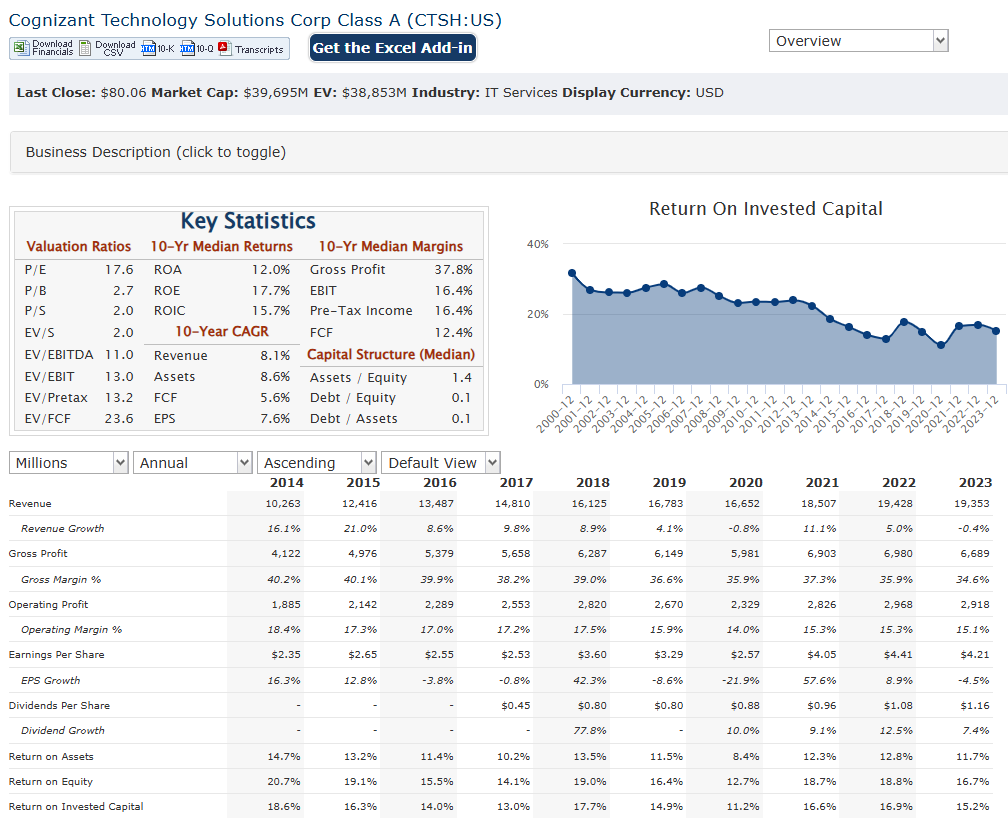

Cognizant Technology Solutions Corporation has reported revenues of approximately $16.8 billion, marking a growth of 4.1% from the previous year. The company faced challenges, particularly during the pandemic, leading to a revenue decline in 2023, where it reported $19.4 billion, slightly down by 0.4% year-over-year. This decline was attributed to macroeconomic pressures and shifting client demands, although it still reflects a broader trend of revenue growth from $16.1 billion in 2018 to nearly $19.4 billion in 2023.

The company’s compound annual growth rate (CAGR) for revenue over this five-year period stands at approximately 3.7%. This growth trajectory was characterized by significant increases in 2021 when revenues surged to $18.5 billion, a notable 11.1% increase from 2020, driven by a strong recovery in IT spending as businesses accelerated digital transformation initiatives.

The net income was reported at $1.8 billion in 2019 but saw a decline to approximately $2.3 billion by 2021 before dropping again to around $2 billion in 2023. The earnings per share (EPS) reflected this trend, with GAAP diluted EPS ranging from $3.29 in 2019 to about $4.21 in 2023. The CAGR for earnings over this period is estimated at around 6%, highlighting periods of robust profitability interspersed with challenges.

With total assets growing consistently over the past five years, reaching around $10 billion by the end of 2023. The company’s operating margin has been under pressure, declining from 14.6% in 2019 to about 13.9% in 2023, reflecting increased operational costs and competitive pressures within the IT services sector. Cognizant has maintained healthy cash flows and returned capital to shareholders through dividends and share repurchases, reinforcing its commitment to shareholder value while navigating an evolving market landscape.

Technical Analysis:

The monthly chart is in a head and shoulders pattern (very bearish) but in stage 2 markup. The weekly chart is still in markup phase 2 (Bullish). The daily chart shows a lot of resistance in the $80s zone, which indicates a move lower to the $74 zone and then likely lower to $64 area.

Bull Case:

1. Global Delivery Model: Cognizant’s global delivery model enables it to provide cost-effective and high-quality services to clients worldwide. This model leverages talent from diverse locations to deliver innovative solutions.

2. Valuation: The company’s valuation, as measured by metrics like price-to-earnings (P/E) ratio and price-to-book (P/B) ratio, may be attractive compared to its peers, especially considering its growth potential.

Bear Case:

1. Intense Competition: The IT services industry is highly competitive, with numerous global players vying for market share. This intense competition can lead to price pressure, margin erosion, and reduced profitability.

2. Economic Slowdown: A global economic slowdown or recession could negatively impact IT spending, particularly in discretionary areas like digital transformation. This could lead to reduced demand for Cognizant’s services and lower revenue growth.

3. Talent Acquisition and Retention: The IT services industry faces challenges in attracting and retaining top talent. A shortage of skilled workers can impact the company’s ability to deliver projects and meet client demands.