Executive Summary:

Block, Inc., formerly known as Square, Inc., is a financial technology company that provides payment processing and point-of-sale (POS) solutions for merchants. Their flagship product, Square, allows businesses to accept card payments and manage operations through a mobile app and card reader. Block also offers Cash App, a peer-to-peer payment and financial services app for consumers. The company has expanded its services to include loans, payroll, and other financial tools for businesses and individuals.

Block Inc. reported an EPS of $0.88, beating analysts’ expectations of $0.88. Revenue for the quarter came in at $5.98 billion, slightly below the consensus estimate of $6.24 billion.

Stock Overview:

| Ticker | $SQ | Price | $95.04 | Market Cap | $58.9B |

| 52 Week High | $99.26 | 52 Week Low | $55.00 | Shares outstanding | 559.74M |

Company background:

Block, Inc., formerly known as Square, Inc., is a prominent financial technology company founded in 2009 by visionary entrepreneurs Jack Dorsey and Jim McKelvey. The company emerged from a desire to simplify payment processing for small businesses, particularly those underserved by traditional banking systems.

Block’s initial product, Square, revolutionized the point-of-sale (POS) industry by providing a user-friendly mobile app and card reader that enabled merchants to accept card payments seamlessly. As the company grew, it expanded its product offerings to include a range of financial services, such as loans, payroll, and banking solutions.

One of Block’s ventures is Cash App, a peer-to-peer payment and financial services app that has gained immense popularity. Cash App allows users to send and receive money, invest in stocks and Bitcoin, and even apply for loans.

Block’s key competitors in the fintech space include PayPal, Stripe, and Apple Pay. While PayPal remains a dominant force in online payments, Block has carved out a niche by focusing on small businesses and providing a more intuitive and user-friendly experience. Stripe, on the other hand, caters to larger businesses and offers a broader range of payment processing solutions. Apple Pay, while primarily a mobile payment service, competes with Block in the digital wallet space.

Block, Inc. is headquartered in San Francisco, California, and has offices in various locations across the United States and internationally. The company’s innovative approach to financial technology has garnered significant attention and has positioned it as a major player in the industry.

Recent Earnings:

Block, Inc. reported revenue for the quarter was $5.98 billion, a 60% year-over-year increase. It fell slightly short of analysts’ expectations of $6.24 billion.

The company’s earnings per share (EPS) for the quarter was $0.88. This indicates that Block was able to manage its costs effectively and deliver on its profitability targets.

Block’s Gross Payment Volume (GPV) continued to grow, driven by strong performance from both Square and Cash App. The company also highlighted the continued adoption of its ecosystem of products and services, including Afterpay and Tidal.

Block reaffirmed its previous guidance, expecting revenue growth of 40-45% and adjusted EBITDA margin of 20-22%. The company remains optimistic about its long-term growth prospects, driven by continued innovation and expansion of its product offerings.

While the revenue growth was impressive, the slight miss on analyst expectations and the mixed investor reaction to the earnings report suggest that the company may face some challenges shortly.

The Market, Industry, and Competitors:

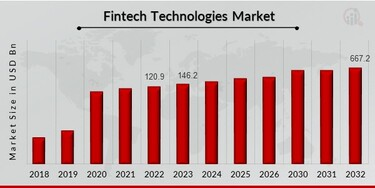

Block Inc. operates in the rapidly evolving financial technology sector, primarily focusing on digital payments and financial services. The company is structured around two main segments: Square, which provides comprehensive payment solutions and business management tools for merchants, and Cash App, a consumer-focused platform that facilitates peer-to-peer payments, banking services, and investments in stocks and cryptocurrencies. Block has diversified its offerings, including ventures into music streaming with TIDAL and cryptocurrency through its TBD platform, which aims to enhance access to Bitcoin and other blockchain technologies. Block reported revenues of $21.9 billion, marking a 25% increase from the previous year, with Bitcoin transactions contributing notably to its revenue stream.

Block Inc. is expected to experience substantial growth driven by the increasing adoption of digital payment solutions and ongoing innovations in financial technology. Analysts project a compound annual growth rate (CAGR) of approximately 20% for the company over the next several years as it expands its market presence both domestically and internationally. The Cash App segment is anticipated to continue its trajectory of growth, bolstered by enhancements in user engagement and the introduction of new financial products. Block’s strategic investments in cryptocurrency infrastructure are likely to position it favorably as digital currencies gain wider acceptance among consumers and businesses alike.

Unique differentiation:

Block Inc. faces competition from various players across different segments of the fintech industry. In the payment processing and point-of-sale (POS) solutions market, key competitors include Stripe and Adyen. These companies offer robust payment infrastructure and processing solutions, particularly for online and mobile businesses.

In the peer-to-peer payment and financial services space, PayPal remains a major competitor. PayPal’s extensive network, brand recognition, and diverse range of services pose a significant challenge to Block’s Cash App. Additionally, traditional financial institutions and emerging fintech startups continue to innovate and compete in this space.

While Block has established a strong position in the market, it must continually adapt to evolving industry trends and customer needs to maintain its competitive edge. By investing in technology, expanding its product offerings, and strengthening its partnerships, Block aims to solidify its leadership position in the fintech industry.

1. Integrated Ecosystem:

- Block offers a comprehensive suite of financial products and services, including payment processing, peer-to-peer payments, banking, and lending. This integrated ecosystem allows businesses and individuals to manage their finances efficiently within a single platform.

2. Focus on Small Businesses:

- Block has a strong focus on serving small and medium-sized businesses, providing them with user-friendly tools and solutions to manage their operations. This customer-centric approach has helped Block build a loyal customer base.

3. Strategic Acquisitions:

- Block has strategically acquired companies to expand its product offerings and market reach. This has helped the company diversify its revenue streams and strengthen its competitive position.

Management & Employees:

Jack Dorsey: Known for his role as co-founder of Twitter, Dorsey serves as the Chairman and CEO of Block Inc. He is a visionary leader who has been instrumental in shaping the company’s strategic direction.

Brian Grassadonia: Serving as the CEO of Cash App, Grassadonia is responsible for driving the growth and development of this popular peer-to-peer payment and financial services app.

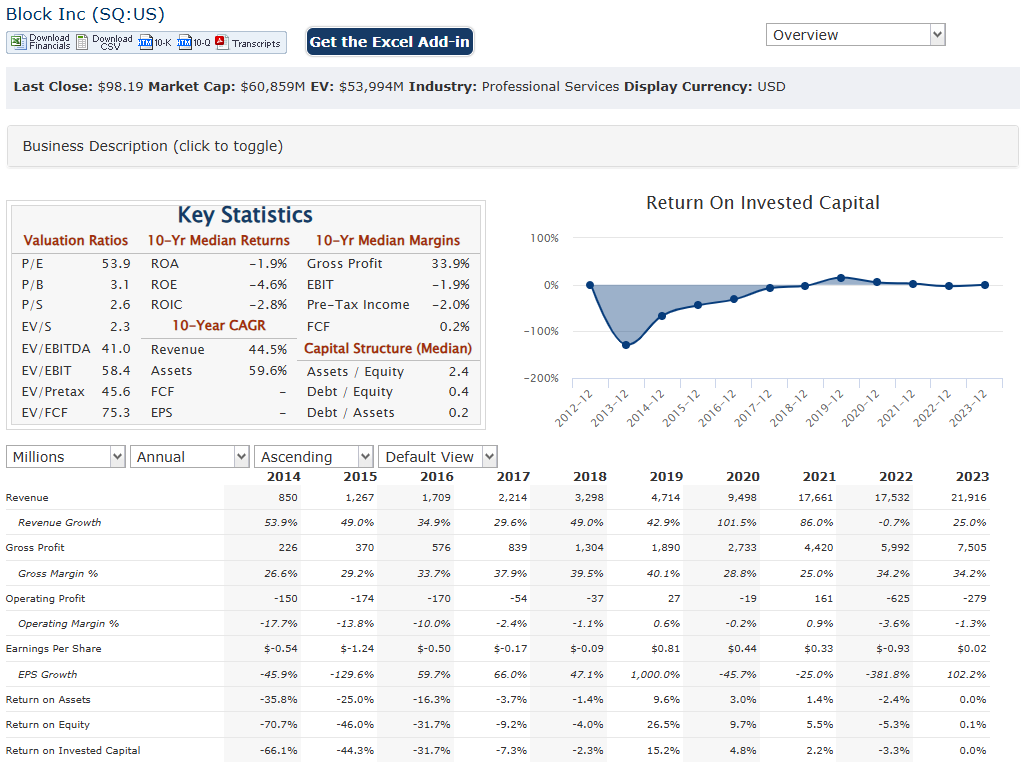

Financials:

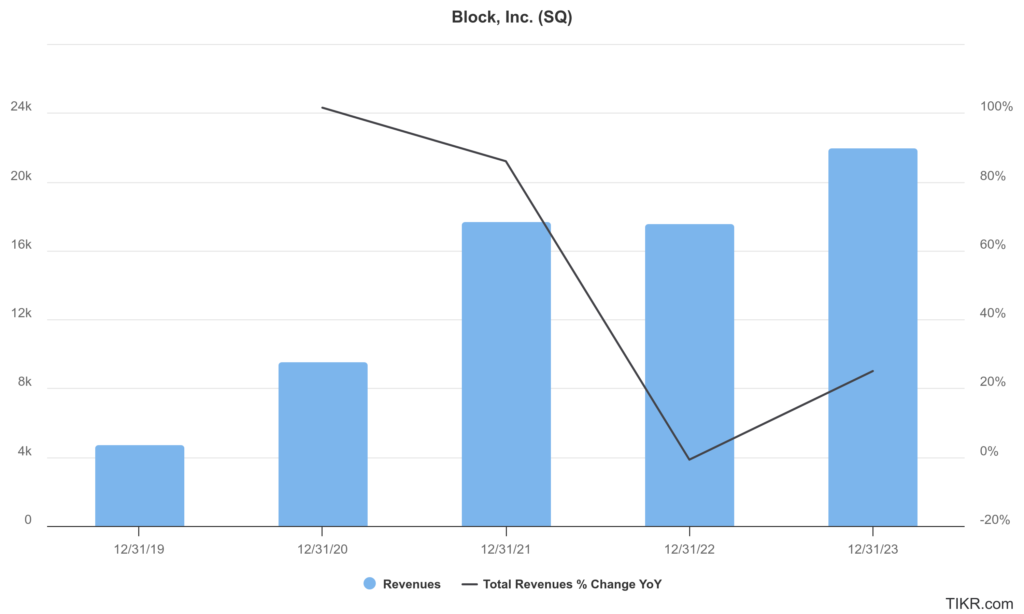

Block Inc. has reported revenues of approximately $4.7 billion, which surged to $21.9 billion in 2023, reflecting an impressive CAGR of around 70% over this period. The growth trajectory was particularly notable in 2021, when revenue skyrocketed by nearly 86% compared to 2020, driven by increased adoption of digital payment solutions and the expansion of its Cash App services. The company faced a slight decline in revenue in 2022, with a decrease of 0.73%, before rebounding with a 25% increase in 2023.

The company transitioned from a net loss of approximately $49 million in 2020 to a net income of about $1.5 billion in 2021, showcasing a remarkable turnaround. Block reported a return to profitability with a net income of approximately $661 million for the first half of the year, indicating a recovery and renewed focus on operational efficiency.

The company reported total liabilities and stockholders’ equity amounting to approximately $37.5 billion. This reflects an increase from $34 billion in the previous year, indicating that while Block is investing heavily in its growth strategy, it is also managing its liabilities effectively. The company’s liquidity position remains strong, supported by healthy cash flows from operations and strategic investments in technology and infrastructure aimed at enhancing its service offerings.

Block Inc.’s financial performance over the last five years illustrates its resilience and adaptability within the competitive fintech landscape. With continued innovation and expansion into new markets, the company is well-positioned for future growth as digital payment solutions become increasingly integral to consumer behavior and business operations globally.

Technical Analysis:

The stock is on a stage 1 consolidation phase (neutral) on the monthly chart and is building a strong base, and in an early stage 2 on the weekly chart. The daily chart is on a stage 3 consolidation with a near term move lower to the $87 range. We would wait for a move much lower to th $72 range for a medium term position.

Bull Case:

1. Strong Financial Performance:

- Consistent Revenue Growth: Block has consistently demonstrated strong revenue growth, driven by the adoption of its products and services.

- Improving Profitability: The company has made significant strides in improving its profitability margins.

- Strong Cash Flow: Block generates substantial cash flow, which can be used for investments, acquisitions, or shareholder returns.

2. Crypto and Bitcoin Exposure:

- Bitcoin Adoption: Block’s early adoption of Bitcoin and its continued investment in cryptocurrency infrastructure positions it to benefit from the growth of the cryptocurrency market.

- Potential for Disruption: Bitcoin and other cryptocurrencies have the potential to disrupt traditional financial systems, creating new opportunities for Block.

3. Valuation:

- Attractive Valuation: While Block’s stock price has been volatile, the company’s valuation may be attractive compared to its growth potential and future earnings.

Bear Case:

12. Regulatory Risks:

- Changing Regulatory Landscape: The fintech industry is subject to evolving regulations, which could increase compliance costs and limit growth opportunities.

- Cryptocurrency Regulations: Increased regulatory scrutiny on cryptocurrency could impact Block’s Bitcoin business and other crypto-related initiatives.

2. Economic Uncertainty:

- Economic Downturn: A downturn in the economy could negatively impact consumer spending and business activity, reducing demand for Block’s products and services.

- Interest Rate Risk: Rising interest rates could increase the cost of borrowing and impact the company’s financial performance.

3. Execution Risk:

- Expanding Product Offerings: The company’s expansion into new products and services, such as Afterpay and Tidal, carries execution risk.

- Integration Challenges: Successfully integrating acquisitions and new products can be challenging and may impact financial performance.