Executive Summary:

nCino is a SaaS (Software as a Service) based, financial technology company based in Wilmington, North Carolina. They are a leader in cloud banking, offering a software platform that streamlines tasks for banks and credit unions. Their cloud-based system helps manage loans, accounts, and client onboarding across various banking sectors, from commercial banking to mortgages. Over 1,750 institutions use their platform.

The total revenue of $123.7 million, a 13% increase year-over-year. Earnings per share (EPS) were positive at $1.2 million, which marked a significant turnaround from a net loss in the previous fiscal year.

Stock Overview:

| Ticker | $NCNO | Price | $32.17 | Market Cap | $3.67B |

| 52 Week High | $37.48 | 52 Week Low | $21.26 | Shares outstanding | 114.2M |

Company background:

nCino company’s founders, led by CEO Pierre Naudé, aimed to streamline financial operations for banks and credit unions through cloud-based solutions. This comprehensive platform helps financial institutions improve efficiency and provide a seamless experience for their customers.

nCino’s success is fueled by over $1 billion in funding it has secured throughout the years. This funding has allowed them to continuously develop their cloud-based platform and expand their reach. nCino faces competition from established players in the financial software industry, such as Fiserv, Finastra, and Temenos. Despite the competition, nCino’s focus on cloud-based solutions and its user-friendly platform position it well for continued growth in the modernizing landscape of financial operations.

Recent Earnings:

- Revenue: Total revenue for Q4 2024 was $123.7 million, reflecting a 13% year-over-year increase compared to $109.2 million in Q4 2023.

- Earnings per Share (EPS): nCino achieved positive EPS of $1.2 million in Q4 2024. This marks a significant improvement compared to a net loss in the same quarter of the previous fiscal year.

- Operational Metrics: While specific details on operational metrics like customer acquisition or churn weren’t provided, the overall revenue growth suggests an expanding customer base. nCino reported a 4% increase in Remaining Performance Obligation (RPO) expected to be recognized within the next 24 months.

The Market, Industry, and Competitors:

- Increasing adoption of cloud-based solutions in the banking industry. Banks are realizing the benefits of cloud computing, such as scalability, security, and improved efficiency.

- Focus on automation and streamlining financial operations. Cloud-based platforms like nCino’s can automate many manual tasks, saving banks time and money.

- Expanding product offerings to cater to various banking sectors. Cloud banking platforms are becoming more versatile and can now address the needs of different banking sectors, from commercial banking to retail lending.

Unique differentiation:

- Established Players: Fiserv, Finastra, and Temenos are major corporations with a long history in providing core banking solutions to financial institutions. These companies offer comprehensive platforms that manage various banking functions, including account processing, lending, and payments. While nCino may have an advantage in terms of cloud-native agility, these established players can leverage their vast experience and large customer bases.

- FinTech Startups: Companies like Q2, Mambu, and Alkami Platform are nimbler players specifically focused on cloud-based digital banking solutions. They target a similar market segment as nCino and often have a strong focus on user experience and innovation.

- Cloud-Native Focus: Unlike some established players who adapted existing solutions to the cloud, nCino’s platform was built specifically for the cloud environment. This affords them inherent advantages in scalability, security, and ease of integration with other cloud-based applications.

- Specialization in Cloud Banking: nCino isn’t trying to be a one-stop shop for all core banking functions. Their core strength lies in cloud-based solutions specifically designed for loan origination, account opening, and client onboarding. This deep focus allows them to cater meticulously to the needs of banks and credit unions in these crucial areas.

- User-Friendly Platform: nCino’s platform is known for its intuitive design and ease of use. This focus on user experience simplifies adoption for banks and credit unions, particularly those looking to move away from complex legacy systems.

- Customer Focus: nCino prides itself on a strong customer focus, offering implementation support and ongoing training to ensure successful platform adoption.

Management & Employees:

- Pierre Naudé (Chairman & CEO): A co-founder of nCino, Naudé brings over 35 years of FinTech experience and is the driving force behind the company’s vision and culture.

- Josh Glover (President & Chief Revenue Officer): Leads nCino’s sales strategy and execution, ensuring the company meets its growth objectives.

- Greg Orenstein (Chief Financial Officer): Oversees nCino’s financial operations and strategic planning, guiding the company towards profitability.

Financials:

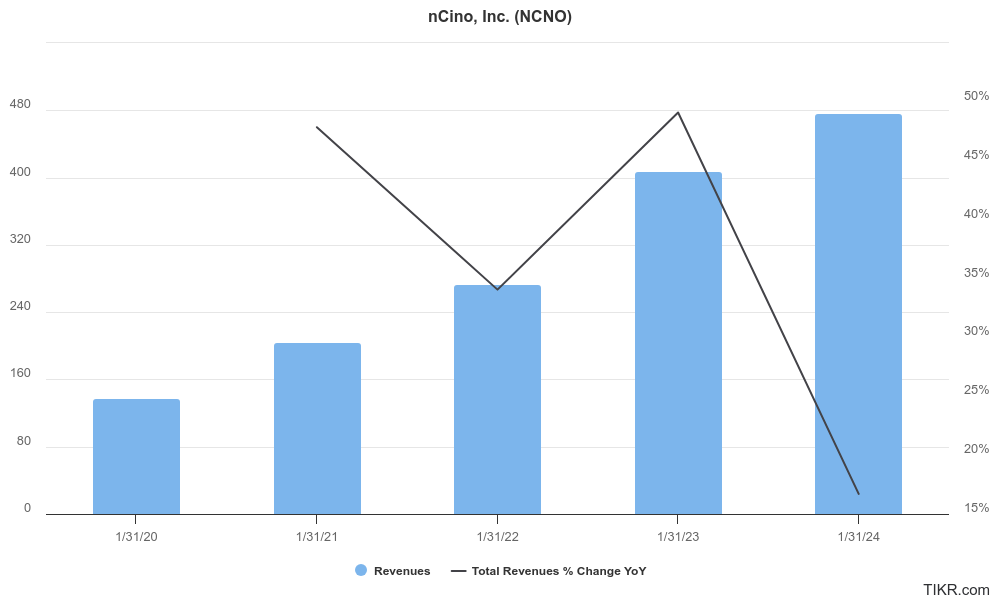

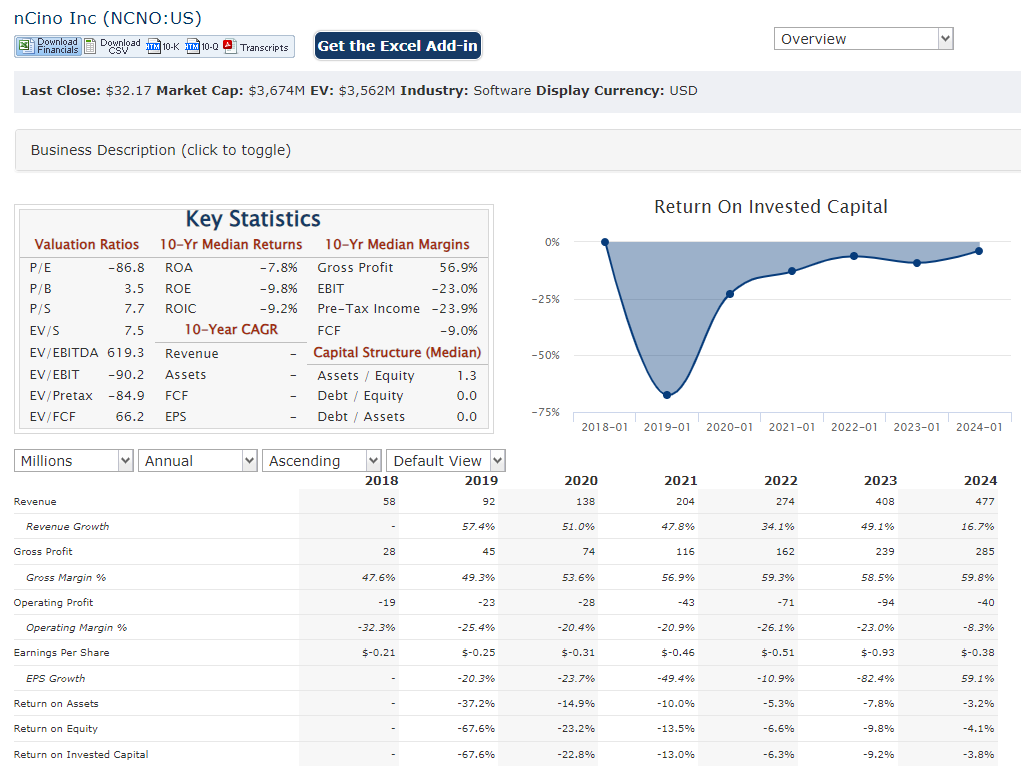

Revenue Growth: Revenue increasing year-over-year, with fiscal year 2024 reaching $476.54 million. This suggests a strong Compound Annual Growth Rate (CAGR) throughout the period.

Earnings Growth: nCino has been steadily moving towards profitability. While they may have reported net losses in earlier years, fiscal year 2024 showed a significant shift with a net income of $58.0 million.

Balance Sheet: Without access to detailed financial statements, it’s difficult to provide a specific breakdown of nCino’s balance sheet. Considering their revenue growth and progress towards profitability, we can expect to see an increase in assets like cash and equivalents alongside investments in research and development to fuel future growth.

Technical Analysis:

The monthly chart shows a strong base formation (cup) and a handle on the weekly chart. But there is a stage 4 decline on the daily chart, with support in the $27 to $29 zone, but stock could head lower.

We will not be buyers of this stock on a technical level until a reversal is confirmed. The RSI and MACD are negative as well.

Bull Case:

User Experience Champion: nCino prioritizes user-friendliness in its platform design.

- Simplified Adoption: Banks and credit unions, particularly those burdened by complex legacy systems, can onboard and integrate nCino’s platform faster, streamlining workflows.

- Increased User Satisfaction: A user-friendly interface fosters higher user adoption and satisfaction within the financial institutions, leading to long-term client retention.

Customer-Centric Approach: nCino goes beyond just offering a product.

- Implementation Support: Dedicated teams assist banks and credit unions during the initial implementation phase, ensuring a smooth transition.

- Ongoing Training: Continuous training programs ensure users maximize the platform’s capabilities, leading to higher efficiency and value extraction.

Innovation Engine: nCino isn’t resting on its laurels. They have a dedicated product development team focused on:

- Platform Enhancements: Continuously improving existing features of the cloud banking platform.

- Product Expansion: Developing new functionalities to address evolving needs of financial institutions and stay ahead of the competition.

Bear Case:

- Established Players: Giants like Fiserv, Finastra, and Temenos offer comprehensive core banking solutions and boast vast experience. They may leverage their brand recognition and large customer bases to challenge nCino’s market share.

- FinTech Startups: Nimble startups like Q2, Mambu, and Alkami Platform specialize in cloud-based digital banking solutions. Their focus on user experience and innovation could attract new clients, particularly those seeking niche functionalities.

Macroeconomic Factors: The health of the financial services industry can significantly impact nCino.

- Reduced IT spending: Banks and credit unions might tighten their budgets, curtailing investments in new technologies like nCino’s platform.

- Increased Risk Aversion: Financial institutions may become more cautious about implementing new solutions during economic uncertainty.