Rocket Lab Corporation is a US-listed aerospace and launch services company that designs, manufactures and launches rockets and satellites. It primarily serves small-satellite launch markets with its “Electron” rocket and is developing the larger “Neutron” vehicle as part of its ambition to be a full-stack space company. It also builds satellites and space systems via its “Photon” satellite bus, and has operations spanning New Zealand, the United States and Europe. With the rise in demand for small-satellite launches, global defence/government contracts and commercial constellations, Rocket Lab positions itself as a “launch + space systems” play rather than just a launch shop. It remains unprofitable as it invests heavily in scale, infrastructure and next-gen launch capability, so the market is betting on future growth and margin improvements rather than current earnings.

2. Most Recent Earnings

For Q3 2025 (for the quarter ended around September 2025) Rocket Lab reported revenue of ≈ US$155 million, up ~48% year-over-year. The company reported a GAAP EPS loss of approximately US$-0.03 per share (versus a deeper expected loss) — the loss narrowed meaningfully from prior periods. For Q4 2025 the company guided revenue in the range of US$170-180 million, with anticipated gross margin improvement (GAAP ~37-39%, non-GAAP ~43-45%). So, the headline: beat consensus, narrowing losses, accelerating growth and positive forward guidance.

3. Company History, Founders, Products, Competitors & HQ

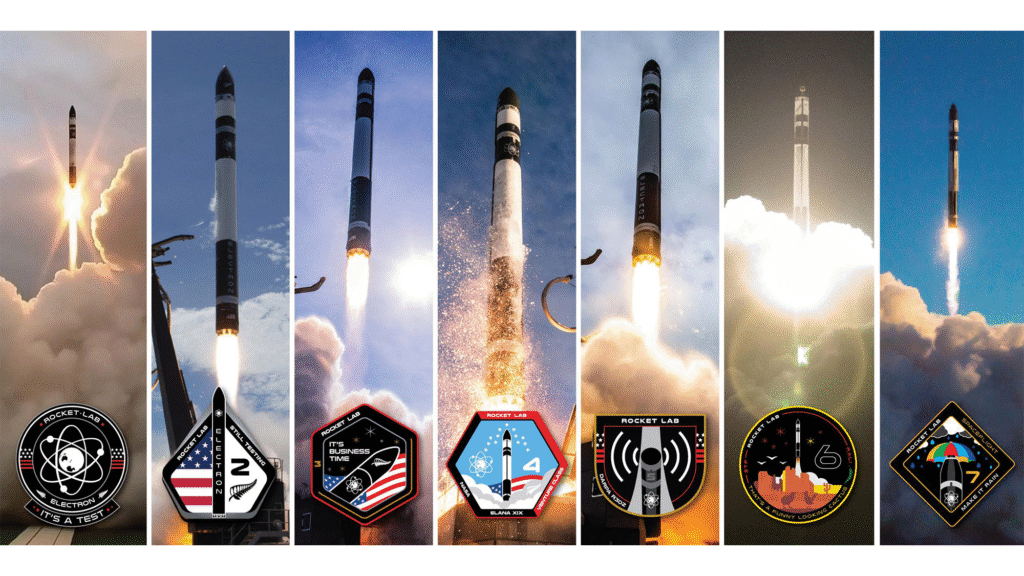

Rocket Lab was founded in 2006 by Peter Beck (who remains CEO) in Auckland, New Zealand. Over time it relocated major manufacturing and launch operations to the US (Long Beach, California) and built launch sites also in New Zealand and Virginia. It has raised capital via various rounds and a public listing (via SPAC in early 2021) to fund its growth. Its product portfolio includes the “Electron” rocket (for small satellites), the upcoming “Neutron” heavy-lift/medium-class launch vehicle, the “Photon” satellite bus/space systems segment and a variety of space services (satellite manufacturing, solar cells via SolAero, etc). Key competitors include SpaceX (especially for launches), Arianespace, ULA and newer players such as Firefly Aerospace and others in the small-sat launch & satellite manufacturing domain. The company’s headquarters is in Long Beach, California, USA, with additional facilities in New Zealand and manufacturing operations in the US.

4. Market & Growth Expectations

Rocket Lab operates in the space launch and space systems market. The broader small-satellite launch market is expected to grow strongly towards 2030 as more commercial constellations, government launches (defence, intelligence) and interplanetary missions scale. For example, some industry estimates forecast the addressable market for launches and associated space services into the US$10-30 billion+ range by 2030 or beyond. Rocket Lab’s specific guidance and backlog suggest conversion of a large backlog (reported ~$1.1 billion) into revenue in coming years. With the Neutron vehicle and mass-producible satellite buses (e.g., “Flatellite”), the growth potential lies in capturing a bigger share of both launches and satellite manufacturing/constellations. That said, forecasting CAGR across the segment is tricky; but if we assume revenue growth of maybe 30-40% annually over the next 5 years (given small-sat ramp and launch frequency growth) that is not unrealistic.

5. Competitors

As noted, competitors include SpaceX (which dominates the overall launch market and has major cost advantage and reusability scale). ULA and Arianespace touch the medium/large-class launch market and government contracts. On the small-sat launch side there’s Firefly, Relativity Space and Rocket Lab’s own peers. In the satellite systems/bus manufacturing side, competitors include satellite bus firms such as Maxar Technologies, Airbus Defence & Space, etc. The key issue: margin, scale, reliability, cadence of launches and the ability to build repeatable production lines. Rocket Lab’s challenge is to scale launch frequency, reduce cost per kilogram, and transition from growth mode to margin/improvement mode in a landscape where competition is intensifying and incumbents (especially SpaceX) are moving fast.

6. Unique Differentiation

Rocket Lab differentiates via a combination of small-sat launch specialization (Electron, tailored for smaller payloads), its vertical integration into satellite manufacturing (Photon buses, solar cells via SolAero) and a visible path to heavier-lift (Neutron) which could enable it to compete for bigger missions and government contracts. Their backlog of 49 launches and ~$1.1 billion contracts gives them a strong forward base. Their ambition to provide “end-to-end space services” (launch + satellite + constellations) in contrast to many peers who only offer one piece, gives them a strategic edge if execution works. Additionally, they appear to be focusing on margin improvement and scalability rather than pure growth for growth’s sake.

7. Management Team

- Peter Beck (CEO & CTO) — Founder, driving the technical vision and strategic direction of the company.

- Adam Spice (CFO) — Manages the financial operations, capital structure, and investor relations as Rocket Lab moves into heavier infrastructure investment.

- (Note: A third name) — While less publicised, one could include Dan McCleary (Head of Launch Business) or similar senior executive responsible for operations/execution, but detailed data is less accessible publicly; therefore I’ll stick with two major leaders to keep it clean.

8. Financial Performance (Last 5 Years)

Over the last 5 years, Rocket Lab has shown strong top-line growth: for example, revenues rose from much smaller levels (e.g., tens of millions in early years) to recent quarters with revenue in the ~$150 million range quarterly and full-year reaching hundreds of millions. For instance, Q4 2024 revenue was ~$132.4 million, up ~78% year-over-year. This suggests a high revenue-CAGR (likely 30-50%+) over multiple years as launch cadence increases and space systems ramp. On the earnings side, the company remains unprofitable, though losses have narrowed (e.g., net loss ~$18 million in Q3 2025) from deeper losses in prior years. Cash flow remains negative or minimal as the company continues investment. On the balance sheet side, Rocket Lab has a solid backlog (~US$1.1 billion) which acts as a forward revenue retailer. The company holds cash or equivalents sufficient for operations but will likely need continued investment/capital as it scales Neutron and builds out manufacturing. The improving gross margins (from 29-30% earlier to ~37-41% non-GAAP in recent quarter) are a positive sign for margin improvement potential. Overall, the pattern is: ramping revenue, improving but still negative earnings, and a structure that bets on future scale to bring profits.

9. Bull Case

- Successful execution of Neutron rocket and entry into larger-payload launch market could open a significantly larger addressable market and materially increase revenue and margin.

- Strong backlog (~US$1.1 billion) and high conversion rate (management expects ~57% to convert within next 12 months) give visibility to growth.

- Margin improvement from scaling launch operations, satellite manufacturing synergy, and higher spacecraft services could shift the company toward profitability and higher earnings multiples.

10. Bear Case

- Execution risk is high: delays, cost overruns, failures in launch or satellites could derail growth and investor confidence (space is hard).

- Intense competition (especially from SpaceX) means price pressure and margin compression; small-sat launch may become commoditised.

- The company is still unprofitable and requires continued investment; any capital raise or dilution could weigh on the stock, and if growth stalls or costs ramp faster than revenues, valuation could compress.

The stock is in a bullish stage 2 markup on the weekly chart but in a stage 4 bearish markdown on the daily chart, with support in the $45 range and should reverse around that range.