Texas Instruments Incorporated (NASDAQ: TXN) is a global semiconductor company headquartered in Dallas, Texas, primarily known for its design and manufacture of analog and embedded processing chips. It serves a broad array of customers in industrial, automotive, personal electronics, communications, and other markets. With a long history dating back to its predecessor business founded in 1930 and reorganised into TI in 1951, the company has built a large manufacturing footprint and a diversified product line. TI emphasizes direct customer relationships — in recent years about 80% of its revenue is transacted directly with customers. Although it does not compete at the bleeding edge of logic or AI-accelerator chips, it occupies a strong niche in analog chips which are pervasive across many electronic systems. TI also has a significant shareholder-return history via dividends and share repurchases.

In its most recently reported quarter (Q2 FY2025, ended June 30, 2025), Texas Instruments posted revenue of $4.45 billion, net income of $1.30 billion, and EPS of $1.41, beating consensus estimates of about $1.32 EPS and ~$4.36 billion revenue. That represented approximately 16% year-over-year revenue growth. For guidance, TI expects Q3 revenue in the range of $4.45 billion to $4.80 billion and EPS between $1.36 and $1.60. The strength was driven by an industrial recovery, though management cautioned that some of the demand may reflect customer inventory pull-forward and that broader macro and tariff risks remain.

Company Background & Business Model

Texas Instruments traces its roots back to Geophysical Service Incorporated founded in 1930; the company reorganised and adopted the Texas Instruments name in 1951 by founders including Cecil H. Green, J. Erik Jonsson, Eugene McDermott, and Patrick E. Haggerty. Over decades TI evolved from early transistor and geophysical equipment work into one of the leading analog chip vendors globally. The firm is headquartered in Dallas, Texas. TI has developed a broad portfolio of analog and embedded processing products (including analog signal chain, power management, microcontrollers, digital signal processors). The company’s business model emphasises: owning its own manufacturing (fabs), maintaining control over process and packaging technology, transacting directly with customers, and focusing on long-lived analog/embedded products rather than ultra-fast logic cycles. Funding has largely come through internal cash flows rather than external venture rounds; TI is publicly traded and has ample capital deployment in manufacturing expansion and shareholder returns. Key competitors include companies such as Analog Devices, Inc. (ADI), Infineon Technologies AG, and Microchip Technology.

Market and Growth Prospects

TI operates primarily in the analog and embedded processing semiconductor markets, focusing on industrial, automotive, personal electronics, communications infrastructure, and other segments. The analog market in particular is relatively large and somewhat less cyclical than logic/AI semiconductors, yet still subject to industrial cycles. The global analog semiconductor market is expected to grow steadily through 2030, with industry estimates projecting mid-single digit to low double digit compound annual growth rate (CAGR) for many analog segments driven by electrification of vehicles, industrial automation (Industry 4.0), Internet of Things (IoT), and renewable energy systems. TI’s industrial end market, which represents a significant portion of revenue, is less exposed to the more volatile handset/PC cycle and may benefit from secular trends such as automotive electrification and factory digitisation. TI has noted that more than 80% of its revenue is direct-customer transactions, which may support margin and control. If we assume a conservative 6-8% annual growth for TI over the next 5 years, by 2030 TI’s revenues could be meaningfully higher than current ($17 billion peak) levels, though likely below the ultra-fast growth enjoyed by AI logic players.

Competitors

In the analog/embedded space, TI faces meaningful competition from Analog Devices, Infineon, Microchip Technology, and to some extent STMicroelectronics and NXP Semiconductors in certain product niches. Analog Devices, for example, has strong signal processing and high-speed analog solutions; Infineon has a strong automotive and power electronics portfolio; Microchip competes in microcontrollers and analog IP. While TI boasts broad portfolio and vertical integration, each competitor has strengths in certain sub-markets. The competition exerts margin pressure and requires continuous investment in manufacturing and process technology just to maintain parity.

Differentiation

TI’s unique differentiation lies in its combination of broad analog/embedded portfolio, in-house manufacturing (including ownership of wafer fabs and packaging/manufacturing capability), direct-customer sales model, and long-lived products with high content per system rather than chasing ultra-cut-throat logic performance. TI emphasises manufacturing and technology control to provide supply reliability and cost advantages. This gives it a competitive moat in markets where reliability, longevity, and customer support matter (e.g., industrial/automotive) more than bleeding-edge chip performance. Additionally, its strong shareholder-return discipline (dividends + buybacks) supports investor appeal.

Management Team

- Haviv Ilan – President and CEO of Texas Instruments. He leads the company’s strategy and operations, including its manufacturing expansion and analog growth focus.

- Rafael Lizardi – Chief Financial Officer, responsible for finance, investor relations, and capital allocation (dividends, buybacks, capex).

- Ahmad Bahai – Chief Technology Officer, overseeing TI’s technological roadmap, process technology, and packaging/manufacturing strategy.

Financial Performance (Last 5 Years)

Over the past five years, TI’s revenue and earnings have exhibited significant cyclical swings. For example, annual revenue in 2022 was ~$20.0 billion, up from ~$18.3 billion in 2021 (approx +9%). In 2023 revenue declined to about $17.52 billion (-12.5%). Then in 2024 the drop continued to ~$15.64 billion (-10.7%) according to some sources. On the net income side, TI posted ~$8.71 billion in 2022 (up ~12.6% from 2021) and ~$6.48 billion in 2023 (-25.6%). The earnings decline reflected the downturn in demand especially in industrial/automotive end markets and excess inventory issues. TI’s free cash flow also suffered in recent years, drawing activist investor attention. On the balance sheet side, TI has maintained a strong cash position and modest net debt relative to peers; its manufacturing-owning model gives good asset base and long-lived investment. From a longer-term viewpoint, if one looks from 2019 forward, the five-year revenue CAGR is modest given the downturns, probably in the low single-digit range. Earnings CAGR likewise has been muted by the recent decline. However, TI’s return of capital (dividends + buybacks) has remained robust, and its capital expenditure is aimed at increasing wafer size and manufacturing efficiency (300 mm wafers), which may support future margin expansion.

Bull Case

- TI’s focus on analog and embedded chips positions it well for secular growth in industrial automation, automotive electrification, IoT and other non-consumer cyclical markets.

- Its manufacturing ownership and control of process and packaging technology can offer supply chain advantage and operational leverage as demand recovers.

- The company’s shareholder-return policies (dividends, buybacks) offer investor-friendly cash flow even during cyclical downturns, potentially enhancing total return.

Bear Case

- TI remains exposed to cyclical demand in industrial and automotive markets; if inventory correction drags on or broader macro/economic weakness manifests, revenues risk further decline.

- Guidance remains cautious and the analog market is less glamorous/fast growing compared to AI-accelerated logic/GPUs, which may limit multiple expansion and investor excitement.

- The company’s heavy capital expenditure (fab expansions, wafer transitions) requires disciplined execution and timing; mistakes or delays could impair returns or margin upside.

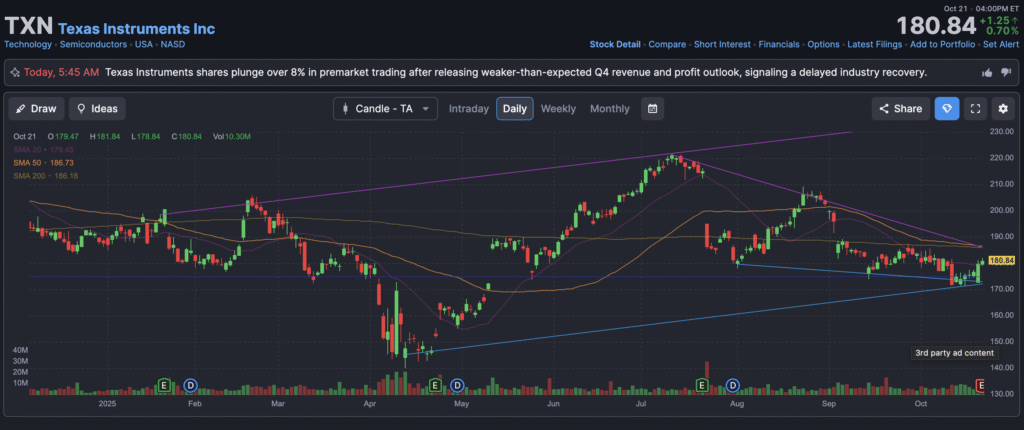

The stock is in a stage 2 bullish markup on the monthly chart, consolidation stage 3 on the weekly chart and stage 4 bearish markdown on the daily chart. The near term support is in the $169 zone, but the $153 zone, which should be an area of interest for a reversal. Not a buy in the near term.