Nasdaq, Inc. operates one of the world’s most recognized stock exchanges and a leading provider of financial technology and market infrastructure solutions. Founded in 1971, it has evolved from a purely electronic stock market into a diversified technology-driven enterprise spanning market services, data analytics, corporate platforms, and anti-financial crime technology. Headquartered in New York City, Nasdaq generated roughly $5.9 billion in revenue in 2024, reflecting high-single-digit growth. Its top competitors include Intercontinental Exchange (ICE), CME Group (CME), and London Stock Exchange Group (LSEG).

Nasdaq reported its Q3 2025 results today (October 21, 2025) before the open. It posted an adjusted profit of $0.88 per share, beating analysts’ expectations of around $0.85. Its total net revenue was $1.32 billion, up ~15% year-over-year, driven by higher trading volumes and strong demand for its financial technology and compliance solutions. The company’s market services revenue climbed ~14% to about $303 million, and its fintech/solutions business grew ~23.2% to around $457 million. Management gave positive commentary about continued diversification into recurring revenue streams and noted a strong IPO environment.

Nasdaq’s roots trace back to 1971, when it became the world’s first electronic stock market. It was founded by the National Association of Securities Dealers (NASD) to facilitate automated trading. The company went public in 2002 and has since transformed under the leadership of figures like Adena Friedman, who became CEO in 2017 and drove Nasdaq’s evolution into a global financial technology provider. Over the years, Nasdaq has expanded through acquisitions such as Verafin (anti-financial crime software), eVestment (data analytics), and Adenza (regulatory technology). Its business today spans four main segments: Market Platforms, Capital Access Platforms, Financial Technology, and Data & Analytics. Headquartered at 151 W 42nd Street in New York City, Nasdaq employs over 7,800 people globally.

The company competes in multiple markets—exchange operations, financial data, regulatory technology, and anti-money-laundering software. Its core exchange business faces rivals like CME Group and Intercontinental Exchange, while its analytics and fintech arms compete with Bloomberg, Refinitiv, and Moody’s Analytics. However, Nasdaq’s multi-segment structure provides diversification beyond transaction-based revenue, aligning it with long-term trends in automation, compliance, and digital transformation of financial infrastructure.

Nasdaq’s addressable market is massive and expanding. The global financial technology and market infrastructure sector is projected to grow at a compound annual growth rate (CAGR) of about 8–10% through 2030, reaching over $250 billion in annual revenue opportunity. Within that, the regulatory technology (RegTech) market—where Nasdaq has been active since the Verafin acquisition—is expected to grow even faster, at 15–17% CAGR, driven by global anti-financial crime compliance spending. Nasdaq’s ability to cross-sell technology, analytics, and data products positions it well for long-term double-digit growth in recurring revenues.

Competitors like ICE and CME Group continue to post strong results, but Nasdaq’s strategy is distinct—it has steadily increased recurring revenues, which now account for more than 75% of total sales, compared to roughly 30% a decade ago. ICE leans heavily on its energy and commodities clearing, and CME dominates in derivatives, while Nasdaq’s core strength lies in technology solutions for exchanges and corporates worldwide. This pivot from market services to SaaS-based technology platforms is its defining competitive edge.Nasdaq’s unique differentiation lies in its blend of exchange credibility and technology innovation. Unlike traditional exchange peers, Nasdaq is positioning itself as a fintech infrastructure provider, helping other exchanges, banks, and corporates build digital market systems and compliance tools. Its anti-financial crime and data intelligence solutions generate sticky, subscription-based revenue, giving Nasdaq a more resilient business model than transaction-driven peers.

Adena Friedman, President and Chief Executive Officer, has led Nasdaq since 2017, emphasizing digital transformation and expanding technology-driven revenue streams. Ann Dennison, Chief Financial Officer since 2021, brings more than two decades of experience in finance and accounting, ensuring strong fiscal discipline and balance sheet management. Tal Cohen, President of Market Platforms, oversees the global trading, clearing, and exchange operations, driving innovation in market structure and liquidity. Together, this leadership team has reshaped Nasdaq into a high-margin, technology-first enterprise.

Over the last five years, Nasdaq’s financial performance has shown consistent growth. Revenues increased from $3.9 billion in 2019 to $5.9 billion in 2024, representing a 5-year CAGR of roughly 8.6%. Adjusted EPS has risen from $2.44 in 2019 to $3.45 in 2024, a CAGR of 7.2%. Its balance sheet remains healthy, with total assets over $23 billion and a debt-to-equity ratio below 1.2. The acquisition of Adenza for $10.5 billion in 2023 increased leverage temporarily, but free cash flow and EBITDA growth have supported ongoing deleveraging efforts.

Nasdaq’s bull case centers on three factors: accelerating adoption of its SaaS-based financial crime and regulatory technology platforms, continued global market expansion, and growing recurring revenue that cushions cyclicality from trading volumes. Investors bullish on Nasdaq see it as a hybrid of fintech and infrastructure—positioned for durable, compounding earnings.

Conversely, the bear case highlights risks such as cyclicality in capital markets activity, competitive pressure from ICE and CME, and integration challenges from large acquisitions like Adenza. Higher interest rates could also dampen IPO activity, affecting Nasdaq’s listings revenue, though its diversified model mitigates the impact.

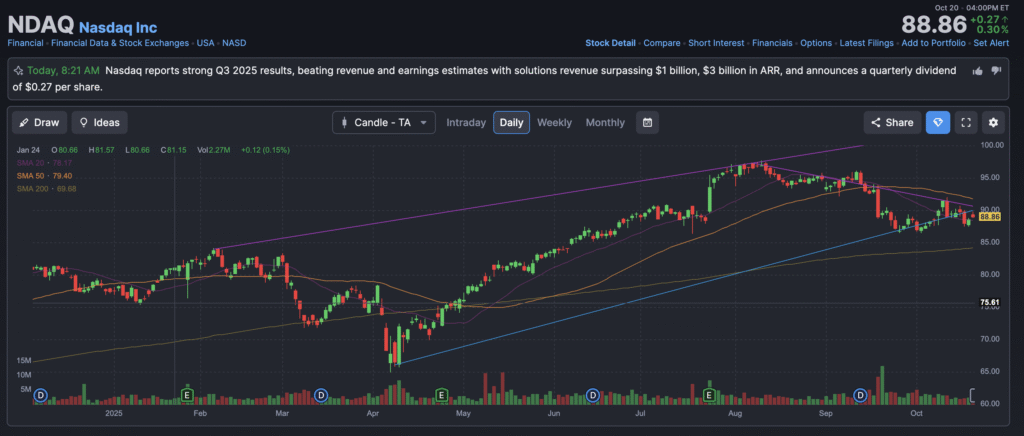

The stock is in a stage 4 decline on the monthly chart, but consolidating stage 1 on the weekly and daily charts. The near term move is back to the resistance at $90 after good earnings.