Company Overview

Charles Schwab Corporation is a U.S.-based financial services firm that provides a full range of wealth management, brokerage, banking, and advisory services to individual and institutional clients. It operates an integrated platform that combines trading, investment advice, wealth management, custody, and banking under one roof. Over its history, Schwab has aimed to democratize investing by reducing costs and expanding access to financial services. It generates revenue from net interest income, trading & commissions, advisory fees, and asset management fees. The firm’s scale, brand, and diversified revenue streams place it among the major players in American retail and institutional financial services.

Recent Earnings (Most Recent Quarter)

In the third quarter of 2025, Charles Schwab reported record profits. Its adjusted EPS came in at $1.31, beating consensus estimates ( ~$1.25 ) with solid margins. Net revenue for the quarter rose ~27% year-over-year to $6.14 billion, driven by strength in trading revenues and growth in client assets. Schwab also added $137.5 billion in net new core assets, and total client assets rose to $11.59 trillion. For the forward outlook, management signaled confidence in continued growth across trading, net interest margins, and advisory/asset management lines, while maintaining a strong capital return posture (e.g. buybacks) underpinned by solid balance sheet flexibility.

In the prior second quarter (Q2 2025), Schwab posted adjusted EPS of $1.14, up ~56% YoY, and revenue of $5.85 billion, exceeding estimates of ~$5.7 billion.

Origins, Business, and Competitive Landscape

Charles Schwab traces its roots to 1971, founded by Charles “Chuck” Schwab (the person). The firm began as a discount brokerage, seeking to undercut traditional brokers’ commissions and open investing to a wider base. Over time, Schwab expanded into banking, advisory, asset management, and custody services. Through both organic growth and acquisitions (most notably the 2020 acquisition of TD Ameritrade), the company broadened its client base, technology, and scale.

Its product offerings now include retail brokerage (self-directed trading), managed investing (robo + advisor-led), wealth advisory services, banking (deposits, lending), custody services for independent advisors, and trading & execution platforms. Its scale gives it cost advantages and cross-sell opportunities. Headquarters is in Westlake, Texas (after relocating some operations in recent years).

Key competitors include Fidelity Investments, Interactive Brokers, Vanguard (in passive/ETF space), and in the advisory/wealth management domain, firms like Goldman Sachs, Morgan Stanley, and UBS (for high-net-worth clients).

Market & Industry Context

Schwab operates in the retail and institutional financial services space, with exposure to capital markets, asset management, wealth management, and banking. The broader U.S. wealth management / brokerage industry has been migrating toward lower fees, passive products, digital platforms, and greater integration of technology (robo, analytics). The trend of increasing assets flowing to managed solutions and ETFs bolsters advisory / asset management growth potential.

Analysts expect continued expansion of client assets and fee-based revenue over time. Some forecasts for the wealth management / brokerage industry suggest mid-single digit to low double-digit CAGR over the next decade driven by increasing wealth, longevity of capital markets, and higher adoption of advisory services (versus pure trading). Because Schwab is diversified across interest income, trading, and advisory, it is relatively well positioned to benefit from multiple tailwinds.

By 2030, the market could see a shift in share toward more integrated platforms (broker + banking + advice) and more competition from fintech entrants, putting pressure on execution, margin, and fees.

Competitive Landscape (More Detail)

Among direct peers, Fidelity is a formidable rival in low-cost investing, mutual funds, and advisory, leveraging brand strength and integrated offerings. Interactive Brokers competes strongly on trading sophistication, low costs, international reach, and appeal to more active or professional traders. In the asset management / wealth advisory domain, giants like BlackRock, Vanguard, and Goldman Sachs compete for institutional and high-net-worth money. Finally, fintech platforms (e.g. robo advisors, wealthtech startups) pose potential disruption in lower-margin segments.

Differentiation of Schwab

- Integrated platform: Schwab offers brokerage, banking, advisory, and custody under one umbrella, allowing cross-selling and sticky client relationships.

- Scale and cost advantage: Its large asset base gives it economies of scale in operations, distribution, and product development.

- Brand and trust: Schwab is a well-recognized, low-risk brand in U.S. retail finance, which is valuable in wealth/investment business.

- Capital return flexibility: Strong balance sheet allows aggressive share buybacks, dividend support, and strategic investments.

- Diversified revenue mix: Unlike pure brokerages, Schwab earns from interest spreads, fees, and trading — less reliant on any single stream.

Key Management

- Rick Wurster — CEO (succeeded Walt Bettinger). He has stewardship over Schwab’s strategic vision, capital allocation, and execution of integration and growth plans (he was formerly President).

- Michael Verdeschi — CFO. He oversees financial strategy, capital management, and investor relations.

- (Optionally) [Third executive] — For example, the head of asset management or wealth solutions (exact name may vary). The leadership team emphasizes consistency, capital discipline, and balancing growth vs returns.

Financial Performance (Last 5 Years)

Over the past five years, Schwab has delivered strong revenue growth, aided by rising client assets, acquisitions (notably TD Ameritrade), and expanding advisory/asset management revenues. From ~2019 to ~2024–2025, revenue trended upward, with recent TTM revenue around $21.62 billion (versus ~$19.61 billion in FY 2024) . The compounded growth rate is solid but also partly driven by scale and market appreciation.

Earnings (net income) have also grown, though more cyclically, influenced by net interest income spreads, market volatility and trading volumes. Schwab’s net income in recent years has increased, giving it more flexibility to return capital and absorb shocks. The firm has emphasized margin expansion and operational efficiency.

On the balance sheet, Schwab maintains a robust capital base, liquidity buffer, and conservative risk profile. Its deposits and borrowing mix supports its lending and interest-spread business. It also supports large share repurchases and dividends while retaining capital for growth investments. Over the period, Schwab has managed to keep leverage moderate and maintain credit strength.

Overall, Schwab’s financial trajectory shows both growth and resilience, with balance sheet strength enabling flexibility in capital allocation and scaling.

Bull Case

- Strong secular tailwinds in advisory, wealth management, and passive investing favor Schwab’s diversified model

- Its scale, brand, and capital flexibility allow Schwab to out-invest smaller rivals and defend margins

- Continued capital return (via buybacks/dividends) and operating leverage could drive returns for shareholders

Bear Case

- Rising rates compress net interest margins or increase funding costs

- Increased competition from fintech platforms, zero-commission brokers, or disruptive entrants may erode trading margins or advisory share

- Regulatory or macro shocks (market crashes, recessions) could sharply reduce trading revenues and client inflows

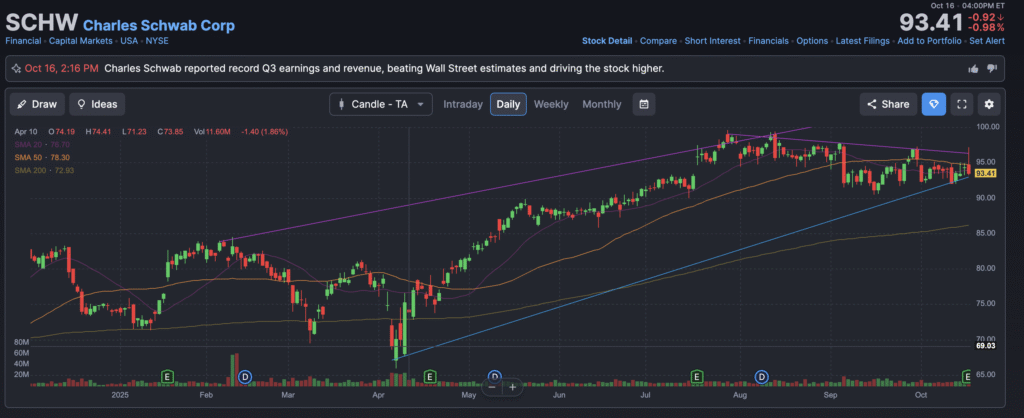

The stock is in a bullish stage 2 on the monthly and weekly charts. The daily chart is in stage 4 bearish markdown and should get to the $86 zone for a reversal. We would wait for an entry.