Bank of America Corporation is one of the largest and most diversified financial services companies in the United States. It offers a broad range of banking, investing, asset management, and other financial and risk management products and services to individuals, small- and middle-market businesses, institutional clients, and governments. The company operates across consumer banking, global banking, global markets, and wealth and investment management. Its scale, footprint, and diversified revenue streams give it exposure to net interest income, fee income, and capital markets activity. As a systemically important U.S. bank, it is subject to regulatory oversight and capital requirements.

In its third quarter of 2025, Bank of America reported net income of $8.47 billion, or $1.06 per share, marking a ~23% year-over-year increase. Revenue rose ~11% to $28.09 billion, beating analyst expectations of $27.52 billion. The bank achieved a record net interest income (NII) of $15.2 billion, reflecting strength in its interest rate spread and balance sheet growth. It also saw a 43% jump in investment banking fees ($2 billion), driven by resurgence in M&A and underwriting activity. Based on that performance, the bank raised its guidance for Q4 NII to $15.6–15.7 billion.

Bank of America has roots going back to the early 20th century (and predecessor institutions). Through a series of mergers and expansions, the modern Bank of America emerged when NationsBank acquired BankAmerica in 1998, consolidating major banking operations under one roof. Over time, it expanded through acquisitions (notably Merrill Lynch in 2008) to build out its wealth management, advisory, and capital markets services. Today, its headquarters is in Charlotte, North Carolina, with significant operations and investment banking presence in New York City.

Its core business lines include:

- Consumer Banking & Lending: deposits, mortgages, credit cards, consumer loans

- Global Banking / Corporate Banking: lending, advisory, capital raising for corporations and institutions

- Global Markets: trading, underwriting, markets-making

- Wealth & Investment Management: Merrill, U.S. Trust, private banking

Key competitors include other large U.S. money-center banks such as JPMorgan Chase, Citigroup, and Wells Fargo.

4. Market & Industry Dynamics

Bank of America operates in the U.S. banking and financial services market, which is mature but still evolving under regulatory, technological, and macroeconomic dynamics. Key growth drivers include interest rate cycles (which affect net interest margins), loan growth (consumer, business, real estate), capital markets activity (M&A, underwriting, IPOs), and fee-based services (wealth management, advisory).

Going forward toward 2030, analysts expect moderate growth in U.S. financial services tied to macroeconomic expansion, increasing fintech competition, and digital transformation. The compound annual growth rate (CAGR) for banking revenues may be in the low-to-mid single digits, though capital markets and wealth management may see higher growth segments. Regulatory changes, interest rate normalization, and competitive pressures (from fintech, digital challengers) are key risks and wildcards.

5. Competitive Landscape

Bank of America competes principally with large U.S. banks: JPMorgan Chase, Citigroup, and Wells Fargo. Each has overlapping lines (consumer banking, investment banking, wealth management) but differing strengths. JPMorgan is often seen as the gold standard in investment banking and trading; Wells Fargo has strength in consumer banking and mortgage; Citigroup has global footprint strength, especially in corporate and international banking. Regional banks and fintechs also encroach in niche areas (payments, lending, digital banking).

6. Differentiation & Moat

Bank of America’s strengths and differentiators include:

- Scale & diversification: Its broad business mix reduces reliance on any single revenue line (interest, fees, capital markets).

- Strong deposit franchise: Stable, low-cost deposits support its lending and interest margin.

- Integrated platform: The combination of consumer, corporate, markets, and wealth gives potential cross-sell opportunities (e.g. consumers to investment products).

- Technology investment: BofA invests heavily in digital tools, AI, and process automation to reduce costs and improve service.

- Capital discipline & efficiency: It has generally maintained solid capital ratios and cost controls, which give resilience in economic downturns.

These help it compete against more narrowly focused banks or fintechs.

7. Key Management

Here are some of the senior leadership (max 3):

- Brian Moynihan – CEO & Chairman. He has led Bank of America since 2010, guiding its recovery and growth phases, steering strategy, and overseeing operations.

- Paul Donofrio – CFO. Responsible for financial planning, capital allocation, investor relations, and reporting.

- Dean Athanasia – President & COO. Oversees operations and execution across the bank’s major business lines.

8. Financial Performance (Last 5 Years)

Over the past five years, BAC has grown revenue and net income, though the trajectory has had cyclical fluctuations linked to interest rate cycles and macro conditions. In 2024, revenue crossed $192.4 billion, up ~11.9% over 2023.

From 2020–2024, the bank expanded assets: as of mid-2025, total assets reached ~$3.44 trillion, about a ~5–6% YoY gain in latest quarter.

Earnings growth has also been solid, with net income and EPS rising in favorable rate and capital market periods. The bank’s earnings trajectory is more volatile than pure lenders given its exposure to markets. Its balance sheet remains strong, with large liquidity buffers, vast deposits, and diversified assets. As of the latest, its deposit base provides a stable funding source and capital ratios are managed to satisfy regulatory requirements.

One headwind is that when interest rates compress or credit stress rises, margins and credit losses can weigh on profitability. The bank also must reserve capital buffers for stress scenarios.

9. Bull Case

- Continued strength in net interest income if rates remain favorable or banking spreads widen

- Reacceleration in investment banking, capital markets, and fee-based businesses fuels upside beyond core banking

- Efficiency gains from digital/AI investments drive margin expansion

10. Bear Case

- Decline in interest rates or margin compression hurting NII

- Credit deterioration or elevated loan defaults in a macro downturn

- Increased regulatory burden, capital requirements, or competitive disruption from fintechs or non-bank players

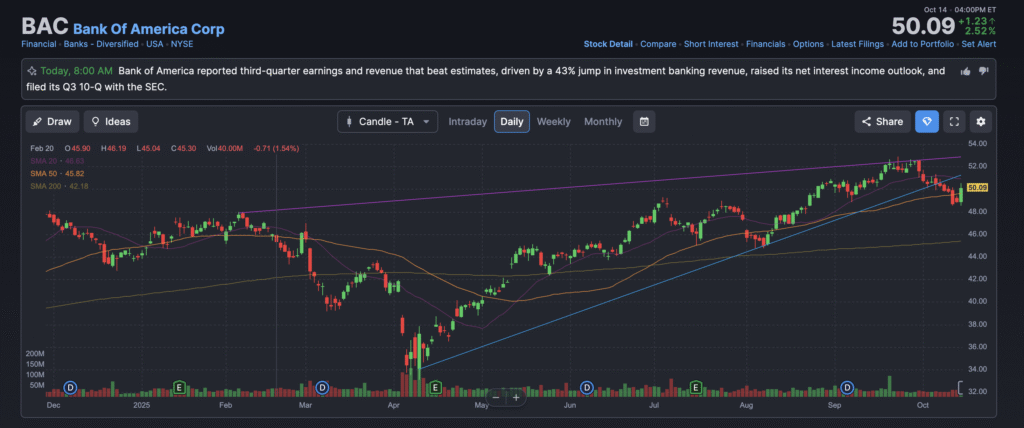

The stock is in a stage 2 bullish markup on the monthly and the weekly charts. The daily chart however is in a stage 3 consolidation but a reversal is in play with a move to $54 being the short term trend with an all time high likely. The stock should get to $54 and then higher to the $60s by year end.