Company Overview

On Holding (also called “On”) is a Swiss-based athletic footwear and apparel company focused on designing premium performance running shoes, apparel, and accessories. It aims to marry performance, design, and lifestyle appeal by positioning itself between technical running brands and fashion-forward athletic wear. The company sells through direct-to-consumer (online and branded stores) and wholesale channels across Europe, North America, and Asia. Since going public, it has leveraged strong branding (including tie-ins with Roger Federer) to punch above its size in the performance footwear space. Its strategy emphasizes differentiated product innovation, premium pricing, and global expansion.

Most Recent Earnings (Q2 2025)

On reported its Q2 2025 results on August 12, 2025. The company generated CHF 749.2 million in net sales, beating consensus estimates of ~CHF 703.1 million. The gross profit rose ~35.4% year-over-year to CHF 460.8 million, with a gross margin improving to ~61.5% (versus ~59.9% prior) . However, On posted an adjusted loss of CHF 0.09 per class A share (versus an expected loss of CHF 0.22), meaning the EPS came in better than expected on the downside. The company raised its full-year revenue outlook, guiding net sales at least CHF 2.91 billion (slightly below previous consensus) .

History, Founders, Funding & Products

On was founded in 2010 by Caspar Coppetti, David Allemann, and Oliver Bernhard in Zurich, Switzerland. The founders set out to create a running shoe that combined cushioning and responsiveness, ultimately launching the “Cloud” series which has become a flagship model. Over time, On expanded beyond shoes into performance apparel and lifestyle categories.

In 2021, On completed an initial public offering (IPO) on the New York Stock Exchange (NYSE: ONON). The capital raised has helped fuel global expansion, retail footprint rollouts, marketing, and product development. The company operates with R&D and design teams, contracts manufacturing largely via Asia (notably Vietnam), and a global distribution network.

On’s product lines span categories: running (road, trail), training, outdoor, everyday wear, and more recently tennis. Its Cloud cushioning technology and newer innovations like “LightSpray” (a 3D thermoplastic sprayed midsole approach) are positioned to drive differentiation. Key competitors include Nike (NKE), Adidas, Lululemon (in the apparel/athleisure overlap), Hoka (via Deckers Outdoor), Skechers, and other performance/fashion-adjacent athletic brands. On is headquartered in Zurich, Switzerland, with offices in key markets (e.g. U.S., Europe, Asia) and maintains a presence in major retail hubs.

Market & Industry Dynamics

On operates in the global athletic footwear and performance apparel market, a segment of the broader sporting goods & activewear industry. This market has been growing driven by secular trends: rising health & fitness awareness, athleisure crossover adoption, premiumization, and direct-to-consumer channel shifts.

Estimates for the global athletic footwear & apparel market often project mid-single-digit to low double-digit CAGRover the coming decade, particularly stronger growth in Asia-Pacific, Latin America, and premium/running subsegments. In running specifically, a shift toward premium, lightweight, high-margin models is a growth vector.

By 2030, one might expect the premium running/athletic footwear niche to outpace broader sportswear growth (e.g. 6–9% CAGR vs. ~4–6% for the broader market), especially for brands able to maintain innovation, direct consumer relationships, and global reach. On is targeting to grow faster than the average, pushing into new geographies (Asia, Latin America) and adjacent categories (e.g. tennis, training) as incremental growth drivers.

Competitors

Major competitors to On include:

- Nike (NKE): Large scale, strong brand, broad product range, deep R&D and marketing advantage.

- Deckers Outdoor (via Hoka): More direct competitor in premium running niche; Hoka is a rising brand in cushioning and performance running.

- Adidas / Puma / Under Armour: Compete in footwear/apparel, though typically with broader portfolios (sport, lifestyle).

- Lululemon: Especially as On expands apparel overlap, Lululemon represents a well-entrenched premium athletic apparel player.

- Skechers / New Balance / ASICS / Brooks: In the running and active niche, these brands compete more on technical performance, comfort, or value.

These incumbents enjoy scale, brand recognition, distribution strength, and supply chain advantages.

Differentiation / Moat

On’s key differentiators are:

- Design-performance hybrid positioning — it balances performance capabilities with fashion-forward aesthetics, attracting both runners and lifestyle consumers.

- Innovative cushioning & materials — its Cloud platform and emergent LightSpray technology aim to deliver unique feel, weight, and appearance advantages.

- Premium brand narrative & ambassador strategy — leveraging high-profile figures (Roger Federer) and tight branding to punch above scale.

- Channel mix & efficiency — a blend of DTC and selective wholesale, aiming to preserve margins while scaling reach.

- Margin leverage & branding premium — ability to command higher ASPs (average selling prices) in the premium segment if execution holds.

These can help On resist direct price competition from mass-market players and carve a defensible niche.

Management Team

Here are key management figures (as publicly disclosed):

- David Allemann — Co-Founder and Co-CEO. Oversees overall strategy, branding, and global operations.

- Caspar Coppetti — Co-Founder and Co-CEO (or in those leadership roles). Involved in product, innovation, and design direction.

- Oliver Bernhard — Co-Founder; historically involved in technology, product, and operations.

These founders remain actively involved in the business, which tends to align incentives and preserve the original vision.

Financial Performance & Trends (Last 5 Years)

Over the past 5 years, On has delivered strong top-line growth, often in the 25–40%+ annual range, riding momentum in international expansion and brand strength. During that period, revenue CAGR has been solid, though accelerating growth may have fluctuated as scale increases and market saturation effects emerge.

Net income and EPS performance have been more volatile: At times, On has incurred losses or adjusted losses as investments in marketing, retail expansion, and R&D weigh on margins. Currency effects (notably relating to the Swiss franc) have also introduced volatility. The path toward consistent profitability hinges on operating leverage and margin expansion.

On’s balance sheet has generally looked healthy: moderate debt levels (low leverage relative to equity), solid cash flow from operations (in growth years), and investments in inventory & working capital to support scaling. Its debt-to-equity ratio and leverage are relatively modest compared to many peers. On also appears to maintain decent gross margins (60%+ in recent quarters) reflecting premium pricing, with scope to expand operating margin as fixed costs scale.

However, the transition from high-growth to stable growth often pressures incremental margin gains, and On must navigate cost pressures (materials, logistics, FX) carefully.

Bull Case

- If On executes its innovation roadmap (LightSpray, next-gen cushioning) well, it could disrupt traditional midsole paradigms and capture share from incumbents.

- Premium branding and DTC leverage could allow margin expansion as scale increases, leading to strong free cash flow and profitability.

- Geographic expansion (Asia, Latin America) and category extensions (tennis, training) offer high upside paths beyond core running.

Bear Case

- The premium niche is crowded; competition from Nike, Adidas, Hoka, and others could limit pricing power or force discounting.

- FX fluctuations, especially Swiss franc strength, could erode margins and guidance credibility.

- Execution risks: scaling retail, inventory management, marketing costs, supply chain

disruptions or material cost inflation could offset gains.

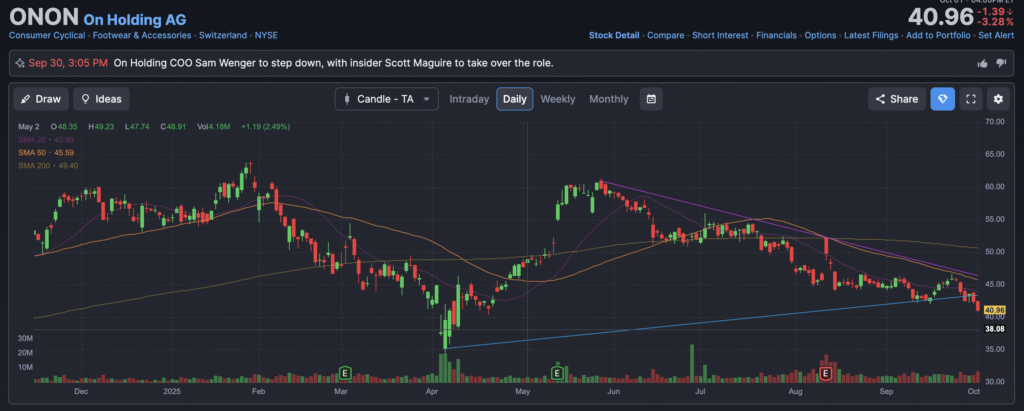

The stock is in a stage 4 markdown on the monthly and weekly charts and has support in the $33 – $40 zone in the near term. We would wait for a reversal. The stock is not at a stage to buy yet.