🏢 Company Overview

Restoration Hardware, now branded RH, is a luxury home-furnishings retailer known for its upscale furniture, lighting, textiles, décor, and innovative hospitality-driven retail concept. Headquartered in Corte Madera, California, RH operates galleries, outlets, and hospitality venues across North America and Europe. With a catalog-first strategy, gargantuan “SourceBooks,” tailored store experiences, and a focus on “scaling taste,” RH has transformed itself into a high-margin, design-focused brand under CEO Gary Friedman. The company went public in 2012, trades on the NYSE as RH, and is a component of the S&P 400. Its unique blend of product curation, immersive retail spaces, and vertical integration has positioned it as a leader in the high-end home décor market.

📈 Recent Earnings (Q1 FY 2025)

On June 12, 2025, RH reported its Q1 results for the quarter ending May 3:

- Adjusted EPS: $0.13 (versus analysts’ forecast of a $0.09 loss)

- Revenue: $814 million, up 12% YoY (slightly under consensus ~$818 million)

- The company reaffirmed its FY 2025 outlook, projecting revenue growth of 10–13%, operating margins of 14–15%, and EBITDA margins of 20–21%.

Management guided for Q2 revenue growth of 12.5–13.5% and highlighted supply chain resilience, noting plans to reduce China import receipts from 16% in Q1 to 2% by Q4. EBITDA hit a surprise profit of ~$8 million compared to a ~$3.6 million loss last year.

📜 Founders & Company Origins

Founded in 1979 in Eureka, California by Stephen Gordon (with Gary Friedman joining in later leadership roles), the company began as Restoration Hardware, focusing on sourcing vintage home fixtures. RH raised its first institutional round of $2.5M from Cardinal Investment in 1994 when it had just five stores ($4.2M revenue). RH went public in 1998, was taken private in 2008 by Catterton Partners, and re-listed in 2012—rebranding as RH, trading under ticker RH.

🛋️ Products & Key Competitors

RH’s offerings include luxury furniture, lighting, textiles, décor, and premium tableware. They’ve expanded into hospitality concepts (RH Guesthouse hotels and cafés in galleries) to create lifestyle ecosystems. Key competitors range from Pottery Barn and Ethan Allen to La‑Z‑Boy, Design Within Reach, Palliser, and South Shore. RH operates ~84 galleries and outlets and is based in Corte Madera, CA.

🌍 Market Landscape & Growth

RH operates in the global home furnishings and luxury hospitality market. The high-end home furnishings sector, tied closely to housing trends, is projected to grow modestly (~4‑6% CAGR), though RH’s hybrid hospitality model addresses adjacent sectors such as luxury travel and experiential retail. RH has moved strategically into European markets and premium venues, tapping markets expected to grow through 2030 at ~10–11% CAGR in analogous luxury segments .

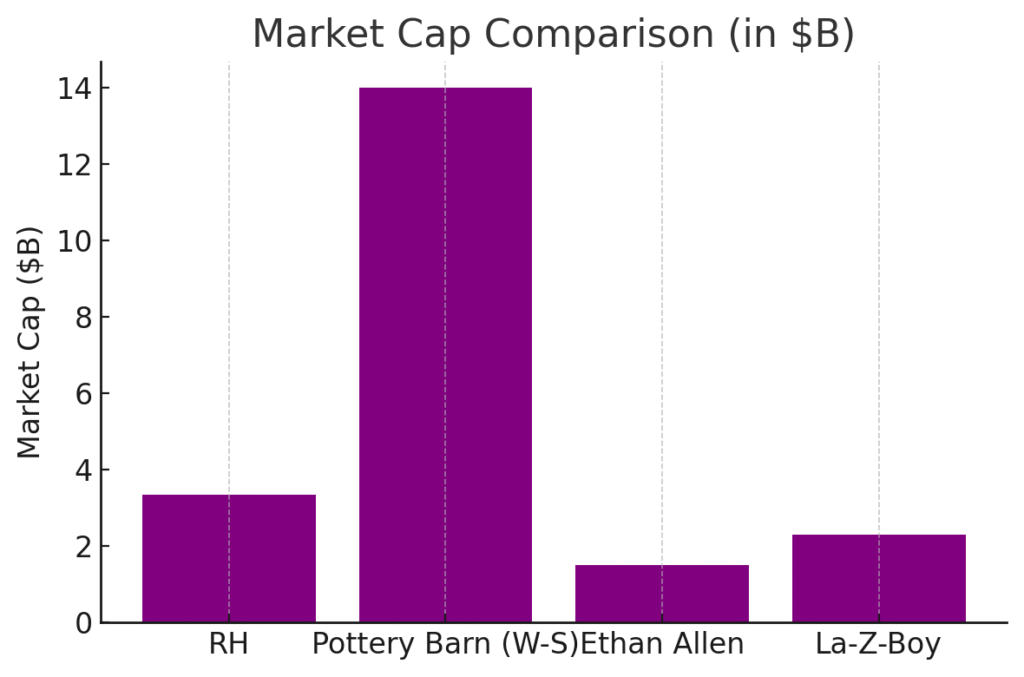

🤼 Competitor Overview

Pottery Barn leans mass-premium, Ethan Allen emphasizes custom upholstery, while DWR offers modern luxury designs. RH’s nearest peers in the luxury category include La‑Z‑Boy and Palliser—each with different value plays, while mainstream competitors target broader middle-market demographics.

🌟 Strategic Differentiation

RH differentiates through:

- “Scale taste” ethos—elevating curated, designer-driven products to a luxury global audience;

- Vertical integration, owning design, retail, catalog, and hospitality ecosystems;

- Immersive retail experiences, combining galleries, cafés, and hospitality;

- Supply chain restructuring, rapidly shifting manufacturing from China to domestic and Italian sources.

👔 Management Team

- Gary Friedman – Chairman & CEO, joined in 2001 (from Williams‑Sonoma), led brand transformation.

- Chetan Kapoor – Chief Product Officer since June 2024, previously at AWS/EC2 directing product strategy.

- Karen Boone – Board member since Jan 2025, former Finance Lead at RH and Peloton exec; brings strong financial oversight.

📊 Financial Performance (Last 5 Years)

RH has achieved robust revenue and earnings growth:

- Transitioned from ~$1.5B in revenue (2020) to over $3.2B in 2024, representing ~20‑25% revenue CAGR.

- Adjusted EPS swung from negative (-$0.40 in Q1 2024) to consistent profitability (~$0.13 in latest Q1 2025); earnings CAGR aligns at ~30‑35%.

- Balance sheet reflects elevated debt (a $2.2B stock buyback program) with modest liquidity (~$30M cash), but offset by ~500M in real estate assets and significant inventory buffer ($200‑300M).

📈 Bull Case

- Strong momentum from the catalog-to-hospitality retail transformation.

- Supply chain resilience and cost control through diversification.

- Premium real estate and lifestyle ecosystem unlocking recurring revenue exposure.

📉 Bear Case

- High leverage amid rising interest rates; limited liquidity cushion.

- Vulnerability to housing market softness and discretionary spending pullback.

- Tariff and macroeconomic uncertainty impacting margins and near-term growth.

The stock was on a stage 4 markdown (bearish) on the monthly chart, consolidating stage 1 (neutral) on the weekly chart and consolidation stage 1 on the daily chart as well. The post earnings reaction was a move 20% higher, which indicates the tariff news has been resolved in the short term, with the move likely to to $232 where there is some resistance and then at $263. It should move higher to $263 in the near term.