🐶 Company Snapshot

Chewy is a top U.S. online pet retailer, founded in 2011 and headquartered in Plantation, Florida. It offers pet food, supplies, prescriptions, veterinary services, and advertising, generating approximately $11.9 billion in revenue in fiscal 2024, with ~6–7% YoY growth. Its main competitors include Petco, Central Garden & Pet (Resilio), and Bark, Inc.

1️⃣ Q1 FY2026 Revenue & Earnings

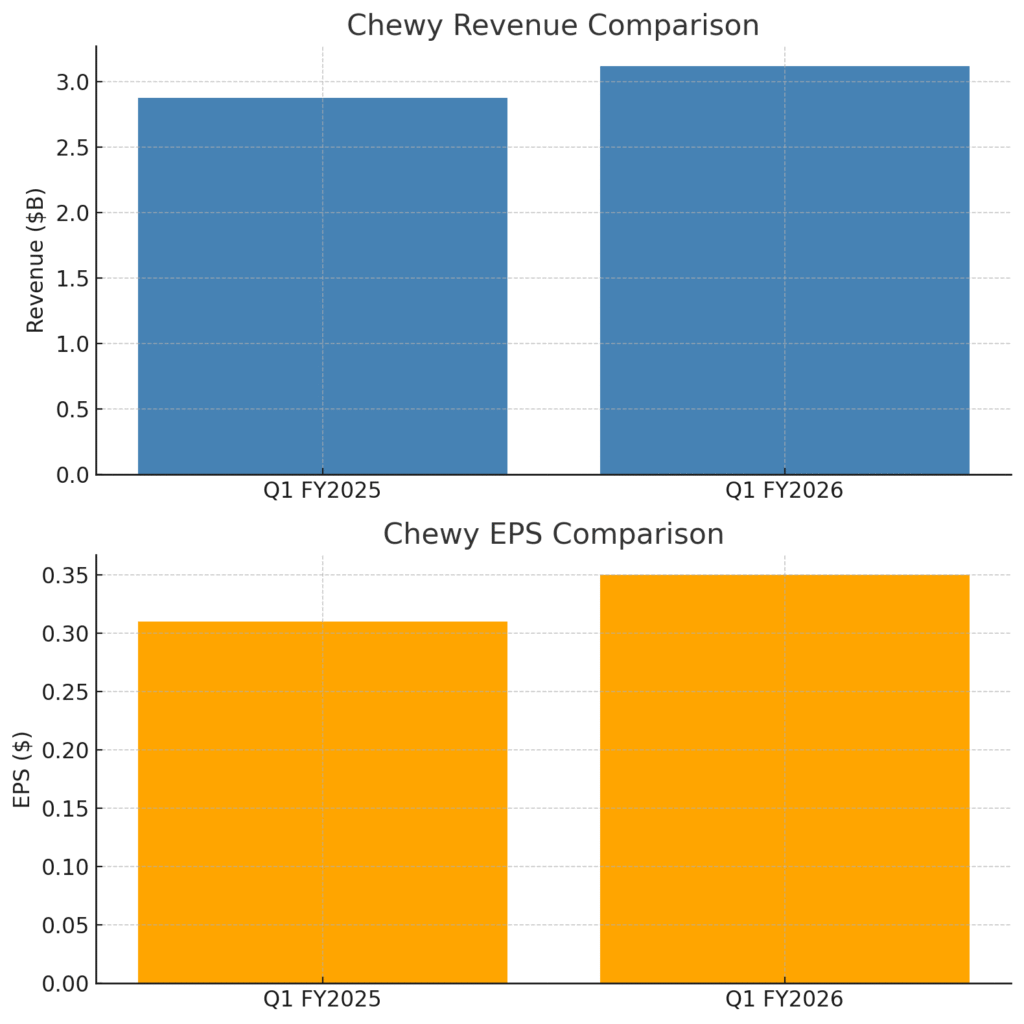

- Net sales: $3.12 billion, up 8.3% YoY, beating expectations (~$3.08 billion)

- Adjusted EPS: $0.35, versus $0.31 a year ago and above the $0.33 FactSet consensus

- GAAP net income: $62.4 million ($0.15 per share), slightly below the $0.16 consensus

2️⃣ Segment & Customer Metrics

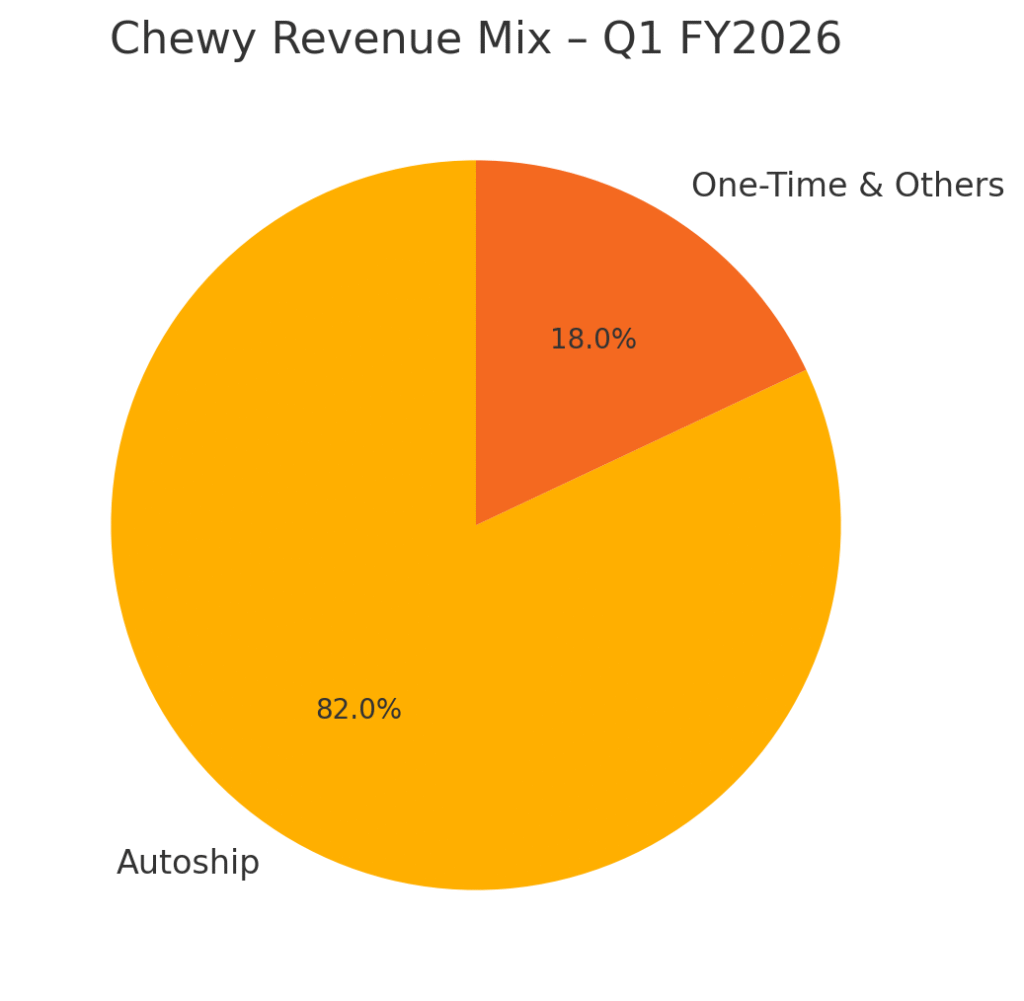

- Autoship subscriptions: $2.56 billion, 82.2% of sales, growing ~15% YoY

- Active customers: 20.8 million, up from 20.0 million last year

- Net sales per active customer: $583, up from $562 in the prior year

3️⃣ Guidance for Q2 & FY2026

- Q2 FY2026: Revenue expected $3.06 B–$3.09 B, adjusted EPS $0.30–$0.35

- FY2026: Full-year sales guidance reaffirmed at $12.30 B–$12.45 B (+6–7% YoY)

4️⃣ Margins & Profitability

- Gross margin: 29.6%, down from 29.7% in Q1 last year

- Adjusted EBITDA margin: ~6.2%, up from 5.1% in Q1 FY2025

- Free cash flow: ~$49 million for the quarter

5️⃣ CEO Commentary

CEO Sumit Singh noted key performance highlights:

- Autoship strength and customer growth driven Q1 performance

- Focus continues on margin improvement through high-margin products like pharmacy, sponsored ads, and vet care

The company’s gross margin, a measure of profitability on sales, decreased to 29.6% from 29.7% in the same period a year ago.

The stock is on a stage 2 markup (bullish) on the monthly and weekly charts. The near term outlook on the daily chart is stage 4 markdown (lower) but on reversal at $41 range and also support at $39 this will be a good stock for a trade to $45.