Executive Summary:

Kyndryl Holdings Inc. is a multinational information technology infrastructure services provider that spun off from IBM in 2021. It assists enterprise clients with designing, building, managing, and modernizing their complex, mission-critical information systems. The company offers a broad range of services across cloud, core enterprise, data and AI, digital workplace, and network and edge computing. Through its Kyndryl Consult division, it also provides advisory and implementation services to guide digital transformation.

Kyndryl Holdings Inc. reported an adjusted Earnings Per Share (EPS) of $0.51, significantly beating analysts’ consensus estimate of $0.41. The reported revenue of $3.74 billion fell slightly below the analysts’ expectation of $3.83 billion, where the reported EPS was -$0.05.

Stock Overview:

| Ticker | $KD | Price | $29.21 | Market Cap | $6.8B |

| 52 Week High | $43.61 | 52 Week Low | $19.24 | Shares outstanding | 232.69M |

Company background:

Kyndryl operates as a global IT infrastructure services provider, offering a broad portfolio of services to help clients design, build, manage, and modernize their mission-critical IT systems. These services are broadly categorized into areas such as Cloud Services, assisting with hybrid cloud strategies and management; Core Enterprise and zCloud, focusing on mainframe modernization and management; Data and AI, enabling data-driven insights and AI adoption; Digital Workplace, enhancing employee productivity through technology; and Network and Edge Computing, managing network infrastructure and edge devices. Additionally, through Kyndryl Consult, the company provides expert advisory and implementation services to support digital transformation initiatives. Kyndryl Bridge serves as an open integration platform to orchestrate and innovate across IT environments.

As the world’s largest IT infrastructure services provider, Kyndryl faces competition from a variety of companies in the IT services and consulting space. Key competitors include major global players such as Accenture, Tata Consultancy Services (TCS), Infosys, Capgemini, DXC Technology, and HCLTech. These companies offer similar or overlapping services in areas like IT consulting, infrastructure management, cloud services, and digital transformation. Kyndryl differentiates itself through its deep expertise in managing complex IT infrastructure, its focus on long-standing enterprise clients, and its strategic partnerships with major technology providers like Microsoft, Google Cloud, and Amazon Web Services. Kyndryl’s global headquarters is located at One Vanderbilt, New York City, in the United States.

Recent Earnings:

Kyndryl Holdings Inc. reported its revenue for the quarter was $3.74 billion, representing a year-over-year decline of 5% (or 3% in constant currency). This decrease is attributed to the company’s ongoing efforts to reduce low-margin contracts and the divestiture of its Securities Industry Services (SIS) platform. Despite the revenue decline, Kyndryl highlighted a 26% year-over-year growth in revenue from its Kyndryl Consult business.

Kyndryl reported a net income of $215 million, or $0.89 per diluted share, a significant improvement compared to the net loss of $12 million, or -$0.05 per diluted share, in the same quarter of the previous year. Adjusted Earnings Per Share (EPS) came in at $0.51, which exceeded analysts’ consensus estimates of $0.41. This positive variance of 24.39% indicates a strong performance in profitability. The adjusted pretax income also saw a substantial increase of 154% year-over-year, reaching $160 million.

Kyndryl’s adjusted EPS of $0.51 was a clear beat against the $0.41 estimate. The reported revenue of $3.74 billion fell slightly short of the analysts’ expectation of $3.83 billion. Kyndryl saw strong growth in total signings, which reached $4.1 billion in the quarter, a 10% year-over-year increase (12% in constant currency). the total signings grew by an impressive 31% to $16.3 billion. The revenue tied to cloud hyperscaler alliances reached $300 million in the quarter.

The company now expects adjusted pretax income of at least $475 million (an increase of at least $310 million year-over-year), an adjusted EBITDA margin of at least 16.7% (a year-over-year increase of at least 200 basis points), and adjusted free cash flow of approximately $350 million. For the fourth quarter of fiscal year 2025, Kyndryl anticipates constant-currency revenue growth of approximately 2%.

The Market, Industry, and Competitors:

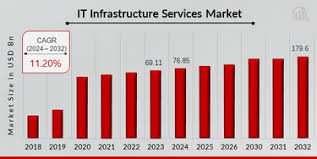

Kyndryl Holdings Inc. operates within the expansive and evolving market of IT infrastructure services. This market encompasses a wide array of services crucial for modern enterprises, including cloud infrastructure management, core enterprise operations (like mainframe services), data and AI solutions, digital workplace services, and network and edge computing. These services are essential for businesses to maintain their IT operations, modernize their infrastructure, and drive digital transformation initiatives. The demand for these services is fueled by the increasing complexity of IT environments, the growing adoption of cloud technologies, the rising need for robust cybersecurity measures, and the continuous drive for operational efficiency and innovation across industries.

A strong Compound Annual Growth Rate (CAGR) for the broader IT services market, with estimates ranging from 9% to over 11% between 2024 and 2030. Factors driving this include the ongoing digital transformation across industries, the increasing reliance on cloud computing, the proliferation of data and the need for advanced analytics, and the expansion of IoT and edge computing. For Kyndryl, this presents a substantial opportunity to leverage its expertise and global presence to capitalize on these growing demands.

One projection estimates annual revenue to reach approximately $17.89 billion by March 2030. The company’s strategic focus on its “three-A” initiatives (Alliances, Advanced Delivery, and Accounts) and its emphasis on higher-margin services like Kyndryl Consult are aimed at improving profitability and positioning it favorably within this growing market landscape.

Unique differentiation:

Kyndryl Holdings Inc. operates in a highly competitive IT infrastructure services market, facing both large multinational corporations and niche service providers. Among its primary competitors are industry giants like Accenture, Tata Consultancy Services (TCS), Infosys, Capgemini, and DXC Technology. These companies offer a broad spectrum of IT services, including consulting, application development, infrastructure management, and cloud services, often competing directly with Kyndryl for large enterprise clients. These competitors have established global footprints, extensive service portfolios, and strong brand recognition, posing a significant challenge to Kyndryl in securing and retaining customers.

In addition to these broad-based IT service providers, Kyndryl also faces competition from companies with specialized expertise in specific areas of IT infrastructure. For instance, in the cloud services domain, it competes with major cloud platform providers like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform (GCP), although Kyndryl also strategically partners with these hyperscalers. In areas like network services and cybersecurity, companies such as HCLTech, Wipro, and specialized security firms present competitive pressure. Furthermore, regional and local IT service providers also vie for market share within specific geographies.

Kyndryl differentiates itself through its deep-rooted expertise in managing complex, mission-critical IT infrastructure, a capability honed during its time as part of IBM. The company also emphasizes its focus on long-term client relationships and its ability to provide tailored solutions across hybrid cloud environments and core enterprise systems. Strategic partnerships with technology leaders like Microsoft, Google Cloud, Amazon Web Services, and others are crucial for Kyndryl to enhance its service offerings and remain competitive in this dynamic market. These alliances allow Kyndryl to integrate cutting-edge technologies and provide comprehensive solutions that address the evolving needs of its enterprise clients.

Heritage and scale as the former managed infrastructure services division of IBM provide it with decades of experience managing some of the world’s most complex IT environments and established relationships with a significant portion of Fortune 500 companies. This deep expertise and vast client network offer a level of trust and reliability that can be difficult for newer or smaller competitors to match.

Freedom and flexibility as an independent entity to forge strategic alliances and partnerships across the entire technology ecosystem. Unlike its time within IBM, Kyndryl can now collaborate with any vendor, including major cloud hyperscalers like AWS, Microsoft Azure, and Google Cloud, as well as niche technology providers. This allows Kyndryl to offer unbiased, tailored solutions that best fit its clients’ specific needs, rather than being tied to a single technology stack. The development of Kyndryl Bridge, an open integration platform, further underscores this vendor-agnostic approach, enabling the orchestration and innovation across diverse IT environments.

High-value services such as its Kyndryl Consult business, which provides expert advisory for digital transformation. This emphasis on higher-margin offerings, combined with its deep technical skills and intellectual property gained from years of operational experience, positions Kyndryl as a partner capable of not just maintaining infrastructure but also driving meaningful business outcomes and modernization for its clients. The company’s significant data lake and AI-powered insights derived from managing vast IT estates also offer a unique advantage in providing proactive and optimized solutions.

Management & Employees:

Martin Schroeter: who serves as the Chairman and Chief Executive Officer. He was appointed the inaugural CEO in January 2021 and became Chairman in November 2021, playing a pivotal role in the company’s spin-off from IBM.

Elly Keinan: Group President, who oversees global operations, practices, and alliances.

Antoine Shagoury, the Chief Technology Officer, who drives the company’s technology vision.

Maria Winans is the Chief Marketing Officer,

Leigh Price is the Global Head of Strategy & Corporate Development

Una Pulizzi heads Global Corporate Affairs.

Financials:

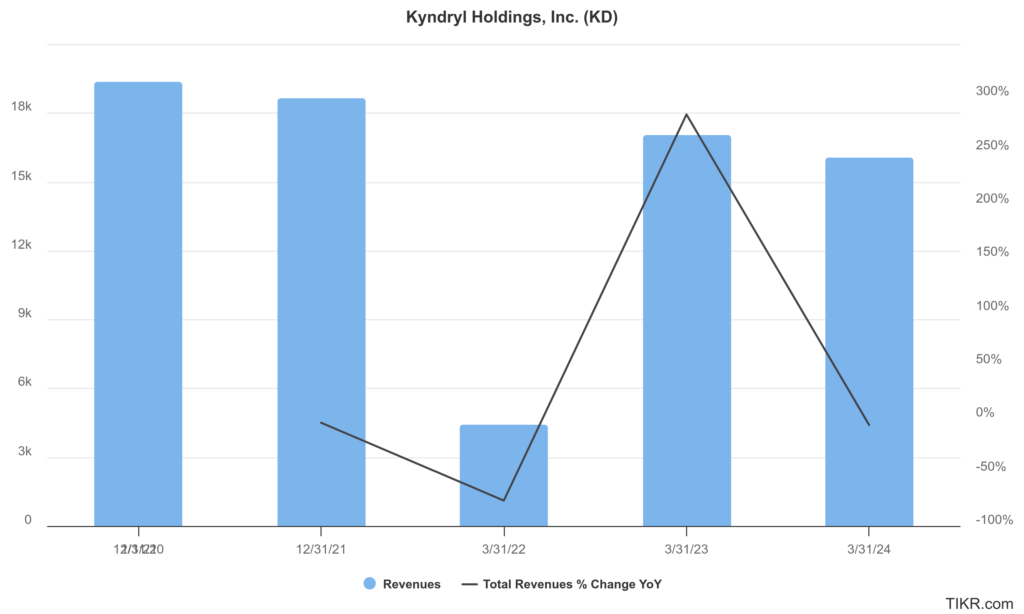

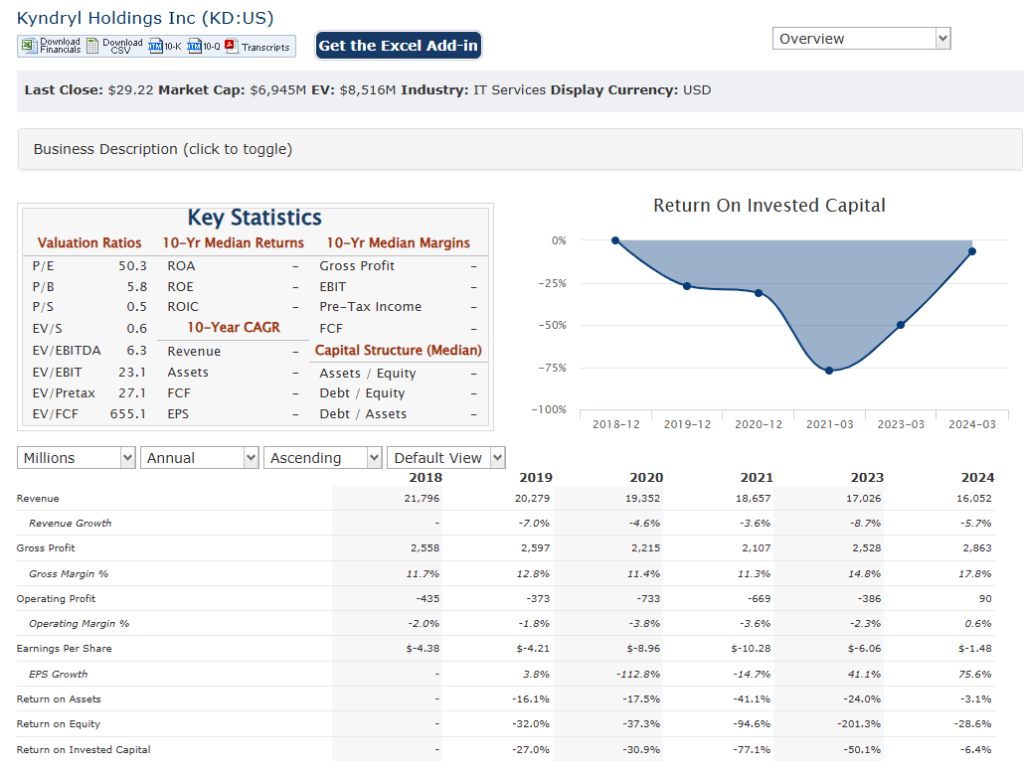

Kyndryl Holdings Inc., revenues have declined at an average annual rate of approximately 6.2%, falling from about $21.8 billion in 2018 to $16.1 billion in fiscal 2024. This decline reflects the company’s strategic efforts to reduce inherited no-margin and low-margin third-party content in its contracts, particularly in the United States and Strategic Markets segments. The revenue contraction was evident in the fiscal 2024 year, with a 6% year-over-year drop to $16.1 billion, and further quarterly declines continuing into 2025.

Earnings grew at an average annual rate of 31.5%, with adjusted pretax income rising from a loss of $217 million in fiscal 2023 to a positive $165 million in fiscal 2024. The adjusted EBITDA margin also improved from 11.6% in 2023 to 14.7% in 2024, driven by operational efficiencies and growth initiatives such as the “three-A” initiatives—Alliances, Advanced Delivery, and Accounts. In the first quarter of fiscal 2025, Kyndryl reported a net income of $11 million and adjusted pretax income of $92 million, a 96% increase year-over-year.

Kyndryl’s cash and equivalents of $1.55 billion, down from $1.85 billion the previous year, while total debt remained relatively stable at approximately $3.24 billion. The company generated positive cash flow from operations of $454 million in fiscal 2024, although free cash flow fluctuated due to workforce rebalancing and other operational costs. The focus on improving margins and cash flow conversion is evident in the company’s outlook for fiscal 2025, which projects adjusted pretax income of at least $435 million and an adjusted EBITDA margin increase to at least 16.2%, alongside expected revenue stabilization and growth in the latter part of the year.

The company’s earnings growth CAGR of around 31.5% contrasts with a revenue CAGR decline of about 6.2% over the last five years. Operational improvements, margin expansion, and cash flow generation are positioning Kyndryl for a return to revenue growth and sustained profitability in the near term, supported by its growth initiatives and contract portfolio optimization.

Technical Analysis:

A broken cup and handle on the long term weekly chart and a stage 4 decline as well, along with a decline (bearish) stage 4 on the daily chart. The near term support is in the $24 range. It should get there soon.

Bull Case:

Transformation and strategic focus on higher-margin services like Kyndryl Consult and its cloud alliances could drive improved profitability. As Kyndryl continues to shed lower-margin contracts and expands its advisory capabilities, this shift could lead to better financial performance and potentially higher earnings per share, making the stock more attractive to investors. The recent increase in full fiscal year 2025 earnings and cash flow outlook supports this narrative.

Stickiness of IT infrastructure services: Kyndryl’s established relationships with a large base of enterprise clients could provide a stable and recurring revenue stream. As businesses rely heavily on their IT infrastructure, they are often hesitant to switch providers, offering Kyndryl a degree of revenue predictability. Successful execution of its transformation initiatives and continued growth in key areas could lead to a re-rating of the stock as the market recognizes its potential for sustainable, profitable growth.

Bear Case:

Highly competitive nature of the IT services market: Kyndryl competes with large, well-established global players with significant resources and brand recognition. Successfully differentiating itself and winning market share against these competitors requires consistent innovation, effective execution, and potentially aggressive pricing strategies, which could impact profitability.

Execution risk associated with its transformation strategy: Successfully shifting towards higher-margin services, building strong cloud partnerships, and streamlining operations is complex. Any missteps or delays in these efforts could hinder the company’s progress, impact its financial performance, and erode investor confidence. Furthermore, macroeconomic headwinds or a slowdown in IT spending could exacerbate these challenges and negatively affect Kyndryl’s business prospects and stock valuation. The need to consistently demonstrate tangible progress in its transformation will be crucial in mitigating this bear case.