Executive Summary:

ASGN Incorporated is a leading provider of IT services and solutions, serving both commercial and government sectors. The company offers various services including IT consulting, creative digital marketing, and permanent placement. ASGN operates through two main segments: Commercial and Federal Government. The Commercial segment primarily serves enterprise clients, while the Federal Government segment provides mission-critical solutions to various government agencies.

ASGN Incorporated reported revenues of $985.0 million, a decrease from $1.07 billion in Q4 2023. Net income for the quarter was $42.4 million, or $0.95 per diluted share, down from $50.3 million, or $1.06 per diluted share, in the same period last year. This EPS of $1.28 for Q4 2024 beat the analyst consensus estimate of $1.23. The reported revenue of $985 million slightly missed the analyst expectation of $1 billion.

Stock Overview:

| Ticker | $ASGN | Price | $68.00 | Market Cap | $2.96B |

| 52 Week High | $106.42 | 52 Week Low | $63.92 | Shares outstanding | 43.6M |

Company background:

ASGN Incorporated, originally founded in 1985 as On Assignment, Inc., has a history spanning nearly four decades in the IT services and solutions industry. The company strategically expanded its offerings and capabilities, leading to its current structure and diverse service portfolio. ASGN’s primary offerings encompass a broad spectrum of IT services. These include IT consulting, which helps clients with strategic technology planning and implementation; creative digital marketing solutions, assisting businesses in enhancing their online presence and customer engagement; and permanent placement services, connecting organizations with skilled IT professionals for long-term roles. The company operates through two main segments: the Commercial segment, serving a wide array of enterprise clients across various industries, and the Federal Government segment, providing specialized IT and mission-critical solutions to various U.S. government agencies.

In the competitive landscape of the IT services industry, ASGN faces competition from a range of companies. Key competitors include large, global IT consulting firms such as Accenture and Infosys (NYSE: INFY), as well as other staffing and professional services providers like Robert Half International Inc. (NYSE: RHI) and Cognizant Technology Solutions. ASGN differentiates itself through its focus on both commercial and government clients, its diverse service portfolio, and its ability to provide specialized solutions.

The corporate headquarters of ASGN Incorporated is located in Calabasas, California, USA. ASGN oversees its various business segments and manages its extensive network of offices and client engagements across the United States and internationally.

Recent Earnings:

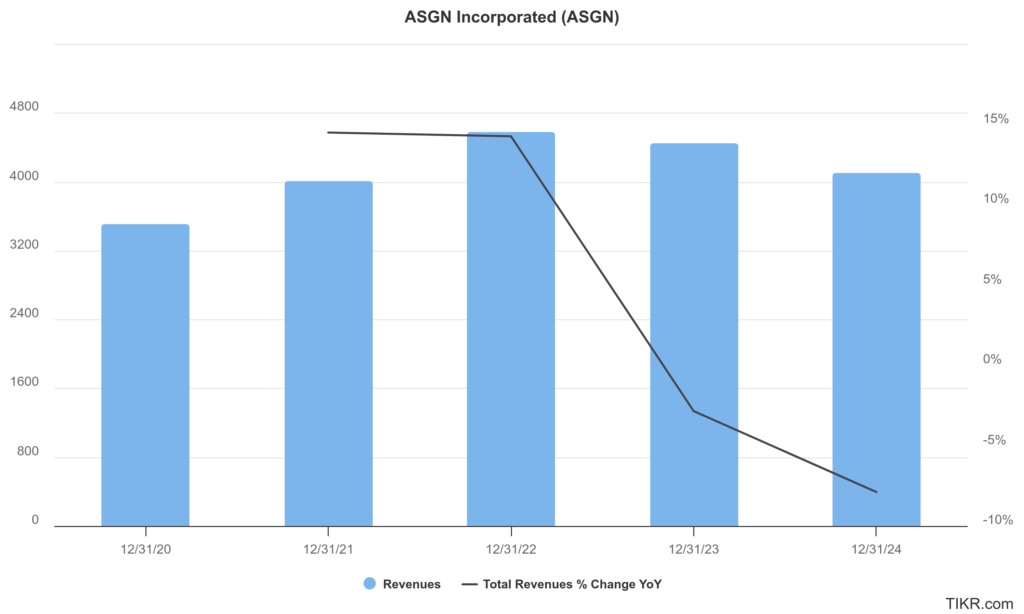

ASGN Incorporated reported revenues of $985.0 million. This represents a decrease compared to the $1.07 billion reported in the fourth quarter of 2023. Analysts had anticipated revenue of approximately $1 billion, meaning ASGN’s reported revenue slightly missed market expectations. For the full year 2024, total revenues were $4.1 billion, also a decrease from the $4.45 billion recorded in 2023, reflecting an overall trend of lower revenue for the fiscal year.

ASGN reported $0.95 per diluted share for the fourth quarter of 2024. This is a decrease from the $1.06 per diluted share reported in the same period of the previous year. The reported EPS of $0.95 for Q4 2024 actually exceeded the analyst consensus estimate of $1.23. The earnings report likely included various operational metrics that provide further insight into the company’s performance. These could include details on the performance of the Commercial and Federal Government segments, gross margins, operating expenses, and backlog.

They often include projections for revenue growth, EPS targets, and other key financial and operational indicators. While the provided information mentions the earnings release date, it does not explicitly detail Investors would be keen to understand the company’s expectations for future performance in light of the reported results and the current economic environment.

The Market, Industry, and Competitors:

ASGN Incorporated operates primarily in the information technology services sector, providing a range of IT solutions and professional staffing services across both commercial and government markets. The company has established itself as a leader in digital transformation, offering services that include technology consulting, creative digital marketing, and mission-critical IT solutions. ASGN’s diverse client base spans various industries, including technology, healthcare, and government, which collectively contribute to its robust revenue stream of approximately $4.5 billion for the fiscal year 2023.

The global IT services market is projected to reach approximately $1.57 trillion by 2027, with a compound annual growth rate (CAGR) of around 12.4% in North America alone. The demand for specialized technology services is expected to drive further expansion, particularly in areas such as cloud computing and artificial intelligence, which are anticipated to grow at CAGRs of 16.7% and 32.9%, respectively. This favorable market environment suggests that ASGN could continue to enhance its market share and financial performance as it capitalizes on these emerging opportunities. The company has been actively expanding its capabilities through targeted acquisitions, such as GovStrive for government IT services and TechNova Solutions for digital transformation.

Unique differentiation:

ASGN Incorporated operates in a highly competitive IT services market, facing a diverse range of competitors. These competitors can be broadly categorized into several groups based on their service offerings and target markets. ASGN competes with industry giants such as Accenture, Tata Consultancy Services, Infosys, and Cognizant Technology Solutions in the large, global IT consulting space. These firms offer a comprehensive suite of IT services, often with a global presence and significant resources, making them direct competitors for larger enterprise clients. They compete on factors like breadth of service portfolio, global reach, industry expertise, and pricing.

Another group of competitors for ASGN includes staffing and professional services companies. These firms specialize in providing IT professionals on a contract or permanent basis, overlapping with ASGN’s staffing and placement services. Key players in this segment include Robert Half International Inc. ManpowerGroup, and Adecco Group. These companies focus on connecting businesses with skilled IT talent, competing on factors such as the size and quality of their talent pool, speed of placement, and client relationships.

ASGN also competes with more specialized IT service providers that focus on specific niches or industry verticals. This can include companies specializing in areas like digital marketing, cloud services, or government IT solutions, depending on the specific services ASGN is offering to a particular client. The competitive landscape is dynamic, with new entrants and evolving service offerings constantly shaping the market.

ASGN Incorporated differentiates itself from its competitors through a few key aspects of its business model and service offerings. One significant differentiator is its dual focus on both the Commercial and Federal Government sectors. While many IT services companies primarily concentrate on one or the other, ASGN has built a strong presence and expertise in both. This provides a diversified revenue stream and allows the company to leverage different market dynamics and opportunities. The specific needs and requirements of commercial enterprises and government agencies often differ significantly, requiring specialized knowledge and security clearances, which ASGN has cultivated.

Another key differentiator lies in its integrated service portfolio. ASGN offers a comprehensive suite of services that spans IT consulting, creative digital marketing, and permanent placement. This allows them to provide end-to-end solutions to clients, addressing a broader range of their technology and talent needs. Unlike competitors that might specialize in just one or two of these areas, ASGN’s ability to offer a more holistic approach can provide convenience and potentially more integrated solutions for its clients.

Furthermore, ASGN’s history and established relationships within both the commercial and government sectors provide a competitive advantage. Having been in operation for several decades, the company has built a strong reputation and trust with its clients. This established track record and deep understanding of the unique challenges and requirements within these sectors can be a significant differentiator, making them a preferred partner for clients seeking experienced and reliable IT solutions providers.

Management & Employees:

Ted Hanson – President and Chief Executive Officer: Ted Hanson has been with ASGN since 2018 and was appointed President and CEO in February 2021. He brings extensive experience in the professional services and technology industries, having held various leadership positions prior to joining ASGN.

Kevin O’Connor – President, Commercial: Kevin O’Connor leads the Commercial segment of ASGN, which serves enterprise clients across various industries. He is responsible for driving the growth and profitability of this key business unit. He has a long tenure within the company and possesses deep expertise in the commercial IT services market.

Scott D. St. John – President, Federal Government: Scott St. John heads the Federal Government segment of ASGN, overseeing the delivery of mission-critical IT solutions to various U.S. government agencies. He has significant experience in the federal contracting space and understands the unique requirements and regulations within this sector.

Financials:

ASGN Incorporated has reported revenues of approximately $4.0 billion, which increased to about $4.1 billion in 2024, reflecting a compound annual growth rate (CAGR) of around 0.6% during this period. The company’s revenue growth has been driven primarily by its commercial segment, which has consistently accounted for a portion of total revenues—approximately 70% in recent years. The demand for IT consulting services has particularly fueled this growth, with consulting revenues contributing to a notable increase in both overall revenue and gross margins.

With net income rising from $200.3 million in 2020 to $175.2 million in 2024. The CAGR for net income over the five-year period stands at approximately -3.1%. Adjusted EBITDA has remained strong, with figures reaching $452 million in 2024, indicating an effective management of costs and an emphasis on high-margin services.

The company has demonstrated robust free cash flow generation, which reached $392.2 million in 2020 and remained strong in subsequent years, allowing for strategic acquisitions without excessive leverage. ASGN’s liquidity position appears solid, supporting its ongoing investments in technology and talent acquisition to enhance service offerings and capture market share.

ASGN is well-positioned to navigate the evolving landscape of IT services and capitalize on emerging trends such as artificial intelligence and cybersecurity. With a focus on higher-value consulting solutions and strategic acquisitions like TopBloc, ASGN aims to strengthen its competitive edge while continuing to deliver value to shareholders and clients alike.

Technical Analysis:

The stock is in a stage 4 decline on the monthly and weekly charts, and is looking weak to break down even on the daily chart unless is reverses course in the $62 – $64 range. The lack of reversal so far in many support levels indicates a breakdown more serious than usual which means the stock is likely to head much lower to $50s.

Bull Case:

Strong Demand for IT Services: The fundamental driver of the bull case is the continued and growing demand for IT services across both commercial and government sectors. As businesses and government agencies increasingly rely on technology for their operations, efficiency, and innovation, the need for IT consulting, digital transformation, and skilled IT professionals will remain robust. ASGN is well-positioned to capitalize on this secular trend.

Focus on High-Growth Areas: ASGN’s service offerings, including digital marketing and cloud services, align with some of the fastest-growing segments within the broader IT services market. Success in these areas can drive higher revenue growth and profitability.

Strategic Acquisitions and Organic Growth: ASGN has a history of growth through both strategic acquisitions and organic expansion. Future well-executed acquisitions could expand the company’s service portfolio, client base, and market share. Organic growth initiatives, such as expanding relationships with existing clients and winning new business, are also crucial for the bull case.

Bear Case:

Client Concentration Risk: While ASGN serves a diverse client base, significant reliance on a few key clients could pose a risk. If a major client reduces spending or terminates a contract, it could have a material negative impact on the company’s financial performance.

Challenges in Talent Acquisition and Retention: The IT industry faces ongoing challenges in attracting and retaining skilled talent. If ASGN struggles to recruit and retain qualified IT professionals, it could impact its ability to deliver services effectively and fulfill client demands, potentially leading to lower revenue and profitability.

Government Spending Cuts or Delays: For the Federal Government segment, changes in government budgets, spending priorities, or delays in contract awards could significantly impact ASGN’s revenue and growth in this area. Political uncertainty and shifts in government policies can also create headwinds.