Executive Summary:

Alight, Inc. is a prominent cloud-based human capital technology and services provider. They specialize in delivering solutions for health, wealth, and wellbeing decisions, serving millions of people and their dependents. Their Alight Worklife® platform utilizes data and analytics to create personalized user experiences for employees. Alight’s services aim to streamline benefits administration and enhance employee engagement through data-driven insights.

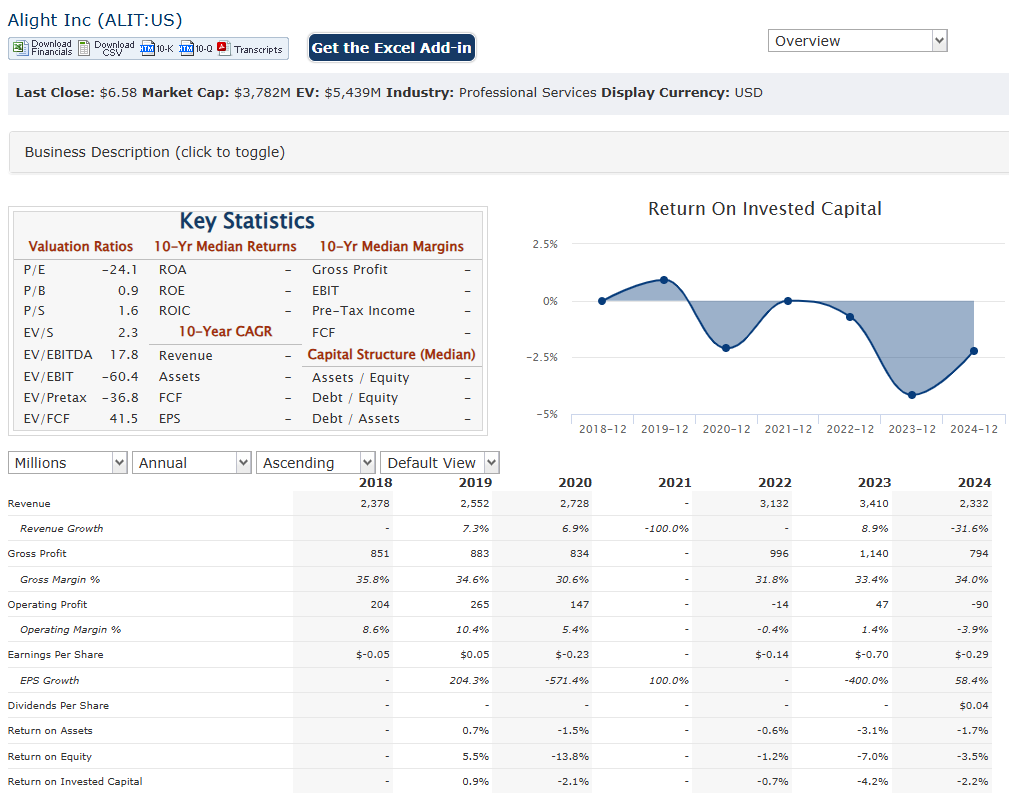

Alight, Inc. released its revenue of $680 million, a slight year-over-year decrease. The adjusted diluted EPS was $0.24. Alight also provided its 2025 outlook, which includes revenue expectations between $2,318 million and $2,388 million, and adjusted diluted EPS of $0.58 to $0.64.

Stock Overview:

| Ticker | $ALIT | Price | $6.58 | Market Cap | $3.57B |

| 52 Week High | $10.38 | 52 Week Low | $6.15 | Shares outstanding | 532.67M |

Company background:

Alight, Inc. is a player in the realm of cloud-based human capital technology and services. The company’s origins trace back to May 2017, when private equity funds affiliated with Blackstone Group L.P. acquired Aon Hewitt’s benefits outsourcing business. This formed the foundation of what is now Alight. Headquartered in Chicago, Illinois, Alight has grown into a provider of comprehensive solutions that address the health, wealth, and well-being needs of a vast clientele.

Alight’s core offering revolves around its Alight Worklife® platform. This platform leverages data and analytics to deliver personalized experiences to employees. It facilitates benefits administration, enhances employee engagement, and provides data-driven insights to support informed decision-making. Alight’s product suite covers a wide range of services, including health benefits administration, retirement solutions, and HR services. Alight has also been going through changes, such as the sale of it’s Payroll & Professional Services business to H.I.G. Capital. This has allowed Alight to focus on it’s core buisness.

In the competitive landscape, Alight faces competition from other major players in the human resources and benefits administration sector. Key competitors include companies like Ceridian, Workday, and other firms specializing in HR technology and outsourcing. Alight distinguishes itself through its focus on providing integrated solutions that cater to the holistic needs of employees, emphasizing the convergence of health, wealth, and wellbeing.

Recent Earnings:

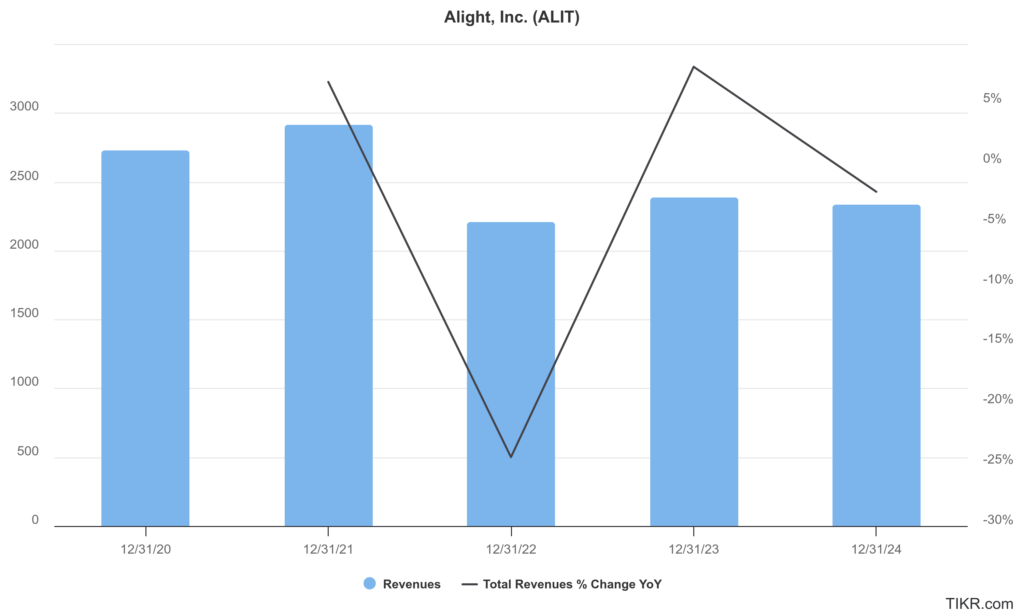

Alight reported revenue of $680 million. This represents a slight year-over-year decrease of 0.3%. There was growth in specific areas, notably in Business Process as a Service (BPaaS) revenue, which increased by 9.8%. For the full year 2024, revenue was $2,332 million, a decrease of 2.3% compared to the prior year.

The adjusted diluted EPS for the fourth quarter was $0.24. The EPS numbers have improved greatly from the previous year.

Alight is focusing on its core buisness, after the sale of its Payroll & Professional Services business. The company’s 2025 outlook indicates expected revenue between $2,318 million and $2,388 million. They also provided adjusted diluted EPS guidance of $0.58 to $0.64.

The Market, Industry, and Competitors:

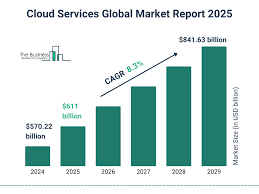

Alight Inc. operates in the human capital management (HCM) and cloud-based business solutions market, providing services such as payroll processing, benefits administration, and workforce management through its proprietary Alight Worklife® platform. The company caters to a global clientele, including 70% of Fortune 100 companies, leveraging advanced technology like AI and data analytics to enhance service delivery. Alight’s business model is characterized by recurring revenue streams, with 80% of its income derived from multi-year contracts, ensuring stability and long-term client relationships. Its strategic focus on Business Process as a Service (BPaaS) has driven growth, with BPaaS revenue increasing by 34% in 2023. The company’s recent divestiture of its payroll outsourcing segment for $1.2 billion allows it to concentrate on its core Employer Solutions segment, which generates the majority of its revenue.

Alight is well-positioned to capitalize on these trends with its integrated digital offerings and partnerships with major platforms like Workday and SAP. Analysts project a compound annual growth rate (CAGR) of approximately 8-10% for the global HCM market during this period. Alight’s strategic initiatives—such as expanding BPaaS offerings and enhancing operational efficiency—are anticipated to drive above-market growth rates, supported by a $3 billion revenue backlog for 2024.

Unique differentiation:

- Workday: Workday is a competitor offering comprehensive cloud-based HCM solutions. They provide a wide range of services, including HR, payroll, and financial management, often overlapping with Alight’s service offerings. Workday is a very strong competitor in the enterprise level HCM market.

- ADP (Automatic Data Processing): ADP is a well-established provider of payroll, HR, and benefits administration services. They have a broad portfolio of solutions catering to businesses of all sizes, and are a very large force in the payroll and benefits administration space.

- Ceridian: Ceridian, with its Dayforce platform, is another major competitor offering cloud-based HCM solutions. They provide a unified platform for HR, payroll, benefits, and workforce management.

These competitors, among others, provide similar services to Alight, creating a dynamic market. Competition is driven by factors such as technology innovation, service quality, and pricing. Alight differentiates itself through its focus on integrated health, wealth, and wellbeing solutions, and also through it’s focus on BPaaS.

- Integrated Health, Wealth, and Wellbeing Focus: Alight emphasizes a holistic approach to employee benefits, aiming to unify the ecosystem across health, wealth, and wellbeing. This integrated strategy sets it apart from competitors that may focus on individual aspects of HR or benefits administration. Their Alight Worklife® platform is designed to provide a personalized experience, addressing the interconnected needs of employees.

- Strategic Shift Towards BPaaS: Alight’s recent strategic moves, including the divestiture of its Payroll & Professional Services business, highlight its focus on Business Process as a Service (BPaaS). This allows Alight to concentrate on its core strengths in technology-enabled benefits administration, a high-growth area. This focus allows them to specialize in a specific area, and become a leader in that area.

Alight’s unique value proposition lies in its ability to provide comprehensive, integrated solutions that address the evolving needs of both employers and employees, with a strong emphasis on technology and data.

Management & Employees:

- Dave Guilmette: Serves as Chief Executive Officer.

- Deepika Duggirala: will be the Chief Technology Officer, effective January 1, 2025.

- Russell P. Fradin: will become the Chairman of the Board of Directors, effective March 1, 2025.

- Other Board members include: Robert Schriesheim, Robert Lopes, Jr., and Mike Hayes.

Financials:

Alight Inc. has reported a total revenue has fluctuated, with notable growth in certain years. For instance, in 2022, Alight reported a total revenue of $3.132 billion, marking a 7.4% increase from 2021. The fourth quarter of 2024 reported $680 million, a decrease from previous periods.

The BPaaS segment has been particularly successful, with a CAGR of 77% over certain periods, contrasting with a more modest 3% CAGR for non-BPaaS revenues. This growth has been supported by strategic investments in technology and the expansion of its client base.

The company has faced declining earnings, with an average annual decrease of approximately 44.8% over recent years. This contrasts sharply with the broader professional services industry, which has seen earnings grow at an annual rate of 10.9%. Alight has reported improved profitability in specific quarters, such as a net profit increase of 134.94% in the fourth quarter of 2024 compared to the same period in the previous year.

Alight’s sale of its Payroll & Professional Services business for $1 billion in upfront gross proceeds, which helped reduce debt and improve financial flexibility. The company has used these proceeds to repay $740 million in debt, reducing its net leverage to 2.8 times, with all debt fixed for the remainder of 2024. Additionally, Alight has enhanced its shareholder value through increased stock repurchases, including a $200 million expansion of its stock repurchase program.

Technical Analysis:

The stock is in a stage 4 decline with no real support obvious right now. We are not going to speculate any support until a reversal. The stock should head lower, but not sure until what point.

Bull Case:

Focus on High-Growth BPaaS: Alight’s strategic shift towards its Business Process as a Service (BPaaS) offerings is a significant positive. This area of the market is expected to see continued growth, and Alight’s specialization could position it as a leader.

Emphasis on Integrated Solutions: The company’s focus on providing integrated health, wealth, and wellbeing solutions gives it a competitive edge. As companies increasingly prioritize holistic employee benefits, Alight’s platform is well-positioned to meet this demand.

Digital Transformation Tailwinds: The ongoing digital transformation of HR and benefits administration creates a favorable environment for Alight. The demand for cloud-based platforms and data-driven solutions is expected to remain strong.

Bear Case:

Economic Uncertainty: Economic downturns can lead to reduced corporate spending on HR and benefits solutions. This could impact Alight’s revenue and profitability.

Client Retention: Since a large portion of Alight’s revenue is recurring, client retention is very important. Any loss of major clients could have a large impact on the companies finacial stability.

Margin Pressures: Even with the focus on BPaaS, there is always the risk of margin pressures. If Alight is unable to control costs, or if competition forces them to lower prices, profitability could be negatively impacted.