Executive Summary:

MGM Resorts International is a global entertainment company renowned for its premier casino resorts and hospitality offerings. It owns and operates a diverse portfolio of iconic properties, including the Bellagio, MGM Grand, and Mandalay Bay. MGM Resorts is heavily involved in gaming, entertainment, and hospitality, providing a wide range of experiences for its guests.

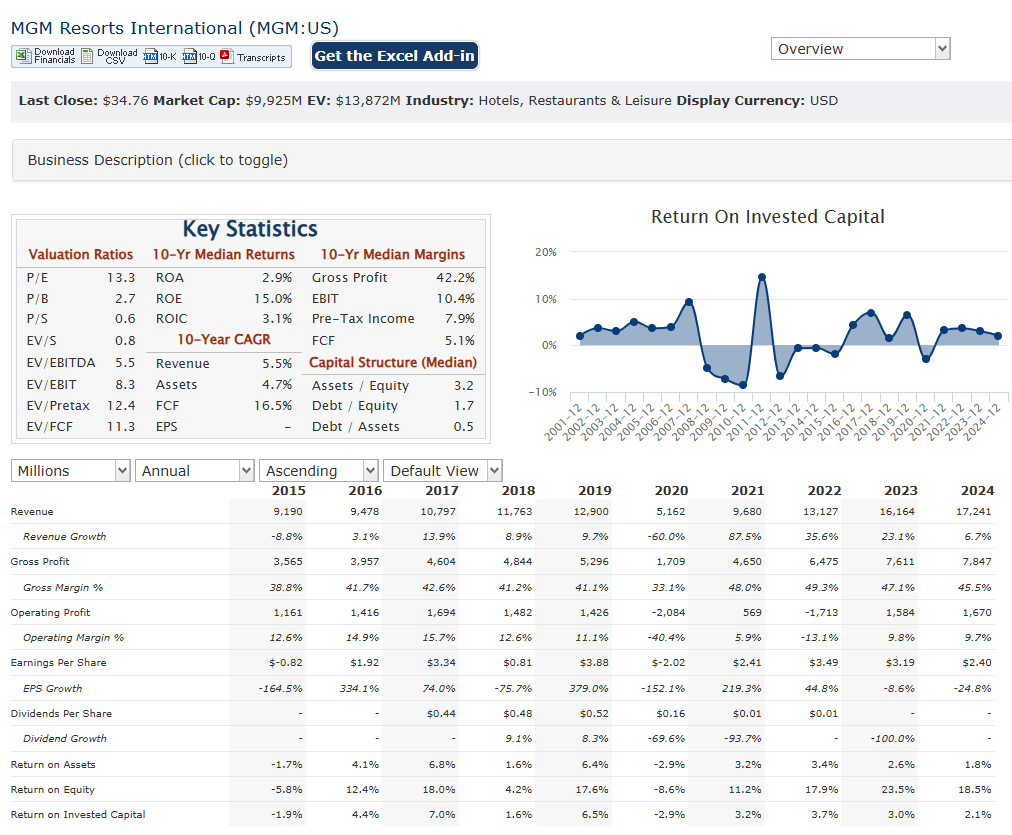

MGM Resorts International reported adjusted earnings per share (EPS) of $0.45, which surpassed analysts’ expectations of roughly $0.39. Revenue for the quarter reached $4.3 billion, also slightly exceeding analyst forecasts of approximately $4.28 billion. MGM Resorts reported record consolidated net revenues of $17.2 billion, demonstrating a 7% increase compared to the previous year.

Stock Overview:

| Ticker | $MGM | Price | $34.76 | Market Cap | $9.93B |

| 52 Week High | $48.25 | 52 Week Low | $31.61 | Shares outstanding | 285.55M |

Company background:

MGM Resorts International has a history rooted in the vision of Kirk Kerkorian, a prominent businessman. Its origins trace back to his acquisition of a controlling stake in Metro-Goldwyn-Mayer (MGM) film studio in 1969. From there, Kerkorian expanded into the casino industry, leading to the development of the original MGM Grand Hotel and Casino. The company’s evolution involved strategic splits and acquisitions, ultimately solidifying its position as a major player in the entertainment and gaming sector.

MGM Resorts International’s “products” encompass a wide range of offerings, primarily centered around its world-class resorts:

- Gaming: Casino operations, including slot machines, table games, and poker.

- Hospitality: Luxury hotel accommodations, fine dining, and spa services.

- Entertainment: Live shows, concerts, and other entertainment events.

- Meetings and Conventions: State-of-the-art facilities for business gatherings.

- Online Gaming and Sports Betting: Through its BetMGM platform.

Key competitors in the gaming and hospitality industry include:

- Caesars Entertainment, Inc.

- Wynn Resorts, Limited.

- Las Vegas Sands Corp.

- PENN Entertainment Inc.

MGM Resorts International is headquartered in Las Vegas, Nevada, the heart of the American gaming industry. This strategic location allows the company to maintain a strong presence in one of the world’s most prominent entertainment destinations.

Recent Earnings:

MGM Resorts reported record full-year 2024 consolidated net revenues of $17.2 billion, representing a 7% increase compared to the previous year. This growth was boosted by a strong performance in MGM China, which saw a 28% increase in net revenues. The fourth quarter of 2024 showed a slight decrease in consolidated net revenues, down 1% compared to the prior-year quarter, reaching $4.3 billion.

The company’s adjusted earnings per share (EPS) was 0.45. For the full year of 2024, the adjusted EPS was 2.59. This surpassed analysts’ expectations, which were around $0.39.

MGM Resorts is looking to capture 150 million in operational EBITDA opportunities in 2025. MGM Digital is targeting 1 billion in top-line revenue. The company focuses on expanding its digital presence and optimizing its operational efficiencies. While there were some drops in Las Vegas Strip resort revenues, the company is seeing positive indicators in domestic operations.

The Market, Industry, and Competitors:

MGM Resorts International operates in the global hospitality and entertainment industry, with a significant presence in Las Vegas, regional U.S. markets, and Macau. The company’s diverse portfolio includes 31 unique hotel and gaming destinations, offering a range of experiences from luxury accommodations to live entertainment and dining options. The hospitality industry, particularly the resort segment, is experiencing substantial growth driven by rising disposable incomes and increased international travel.

The global resort market is projected to grow at a CAGR of 10.2% from 2024 to 2030, driven by the demand for immersive and luxurious travel experiences. The company is focused on expanding its presence in key markets, diversifying its offerings, and enhancing customer engagement through strategic partnerships and digital transformation. The digital segment, particularly BetMGM, represents a significant growth opportunity, with projections for a 15% top-line growth in FY25. As the company continues to navigate industry challenges and capitalize on emerging trends, it is poised for continued expansion and success.

MGM Resorts’ growth strategy involves international expansion, digital transformation, and diversification of offerings. The company is exploring new markets, such as Brazil and the EU, for its digital segment, which could drive future growth. With a strong financial position and a track record of successful acquisitions, the company is well-positioned to pursue growth opportunities in emerging markets. While specific CAGR projections for MGM Resorts are not provided, the company’s strategic initiatives align with the broader industry trends, suggesting potential for robust growth in line with the global resort market’s projected CAGR of 10.2%.

Unique differentiation:

MGM Resorts International operates in a highly competitive landscape within the global gaming and hospitality industry. Key competitors include major players who also own and operate large-scale casino resorts, particularly in Las Vegas and Macau.

- Caesars Entertainment, Inc.: Caesars is a significant competitor, with a broad portfolio of casino resorts across the United States. They compete directly with MGM Resorts in Las Vegas and other regional markets. Like MGM, Caesars offers a wide range of gaming, entertainment, and hospitality services.

- Las Vegas Sands Corp.: Las Vegas Sands is a major competitor, especially in the Asian market, with a strong presence in Macau and Singapore. While their U.S. presence is different than MGM’s, they are a major player in the global gaming market.

- Wynn Resorts, Limited: Wynn Resorts is known for its high-end, luxury casino resorts, competing with MGM Resorts for the premium segment of the market. T

- PENN Entertainment Inc.: PENN Entertainment has a large amount of regional gaming locations in the United States and also has a growing online gaming prescence. This makes them a competitor in both the physical casino and online gaming spaces.

These companies compete across various areas:

- Attracting customers to their resorts.

- Offering competitive gaming and entertainment options.

- Providing high-quality hospitality services.

- The growing online gaming and sports betting markets.

- Iconic Brand Portfolio and Entertainment Focus: MGM Resorts possesses a portfolio of globally recognized and iconic properties, particularly on the Las Vegas Strip, such as the Bellagio and MGM Grand. The company places a significant emphasis on entertainment, hosting world-class shows, concerts, and sporting events. This focus on creating comprehensive entertainment experiences sets them apart.

- Diversification and Omnichannel Strategy: MGM Resorts has strategically diversified its revenue streams, encompassing not only traditional casino gaming but also luxury hospitality, dining, and a growing online presence through BetMGM. They are heavily invested in creating a seamless omnichannel experience. By combining their physical resorts with their digital platforms, they aim to provide a consistent and engaging experience for customers both on and off-property.

- Commitment to Diversity and Sustainability: MGM Resorts has demonstrated a strong commitment to diversity and inclusion, fostering a diverse workforce and inclusive culture. This focus resonates with an increasingly diverse customer base. They also place a high value on sustainability, implementing initiatives to reduce their environmental impact.

Management & Employees:

William J. Hornbuckle: Chief Executive Officer and President.

Paul Salem: Chairman of the Board.

Jyoti Chopra: Senior Vice President and Chief People, Inclusion and Sustainability Officer.

Gary Fritz: President of MGM Resorts International Interactive.

Financials:

MGM Resorts reported a substantial increase in 2024, with consolidated net revenues reaching a record $17.2 billion, marking a 7% increase from the previous year. This growth is indicative of the company’s ability to capitalize on the recovery in travel and leisure activities. The compound annual growth rate (CAGR) for revenue over the past few years has been impacted by the pandemic but is expected to stabilize as the industry continues to normalize.

The company’s earnings per share (EPS) have generally trended upward since the pandemic lows, with some fluctuations. The CAGR for earnings over this period reflects the challenges faced during the pandemic but also highlights the resilience of the company in recovering and growing its profitability.

The company has managed its debt effectively, with leverage ratios improving over time. The debt-to-EBITDA ratio has decreased, indicating better financial stability. MGM Resorts has invested significantly in capital expenditures (CAPEX) to enhance its properties and expand its offerings, which is crucial for maintaining competitiveness in the hospitality sector.

Technical Analysis:

The stock is consolidating stage 3 on the monthly chart, in a stage 4 decline on the weekly chart with support in the $27-$31 zone, and in a stage 4 decline on the daily chart with a reversal support in the $31 zone. This is not a stock for the long term, but a near term reversal in the $31 is likely.

Bull Case:

Growth in Digital and Online Gaming: The expansion of BetMGM, MGM’s online sports betting and iGaming platform, presents a significant growth opportunity. The potential for BetMGM to achieve consistent profitability is a major driver for investor optimism.

Strong Las Vegas Presence and Events: MGM’s portfolio of iconic Las Vegas properties provides a solid foundation for revenue generation. The ability to host major events, such as concerts, sporting events, and conventions, drives significant traffic to its resorts. Operational efficiencies gained in the Las Vegas strip resorts, will also bolster the bottom line.

Expansion Opportunities: MGM is actively pursuing expansion opportunities in new markets, including potential gaming licenses in emerging markets. Successful expansion into these markets could create new revenue streams and enhance the company’s long-term growth prospects.

Bear Case:

Regulatory Risks and Geopolitical Uncertainty: Changes in gaming regulations, particularly in online gaming and sports betting, could negatively impact MGM’s operations. Geopolitical tensions and economic instability in Macau could pose significant risks to MGM China’s performance.

Debt Levels: Large companies such as MGM carry large debt loads. If interest rates remain high, or increase, this could negatively impact the bottom line of the company.

Fluctuations in Macau: The Macau market is subject to volatility, and any downturn in visitation or spending could impact MGM China’s performance.