Executive Summary:

Nextracker Inc. is a leading global provider of intelligent solar tracker and software solutions. Their products optimize the performance of utility-scale and distributed-generation solar projects by enabling solar panels to follow the sun’s movement. Nextracker’s offerings include the NX Horizon and NX Gemini tracker systems, as well as the TrueCapture software for enhanced energy yield. With operations in numerous countries, they play a significant role in the worldwide growth of solar energy.

Nextracker Inc. reported a strong performance with revenue in the range of $2.8 to $2.9 billion. GAAP diluted EPS is projected to be between $3.11 and $3.31, while adjusted diluted EPS is estimated at $3.75 to $3.95. The company’s record backlog, exceeding $4.5 billion.

Stock Overview:

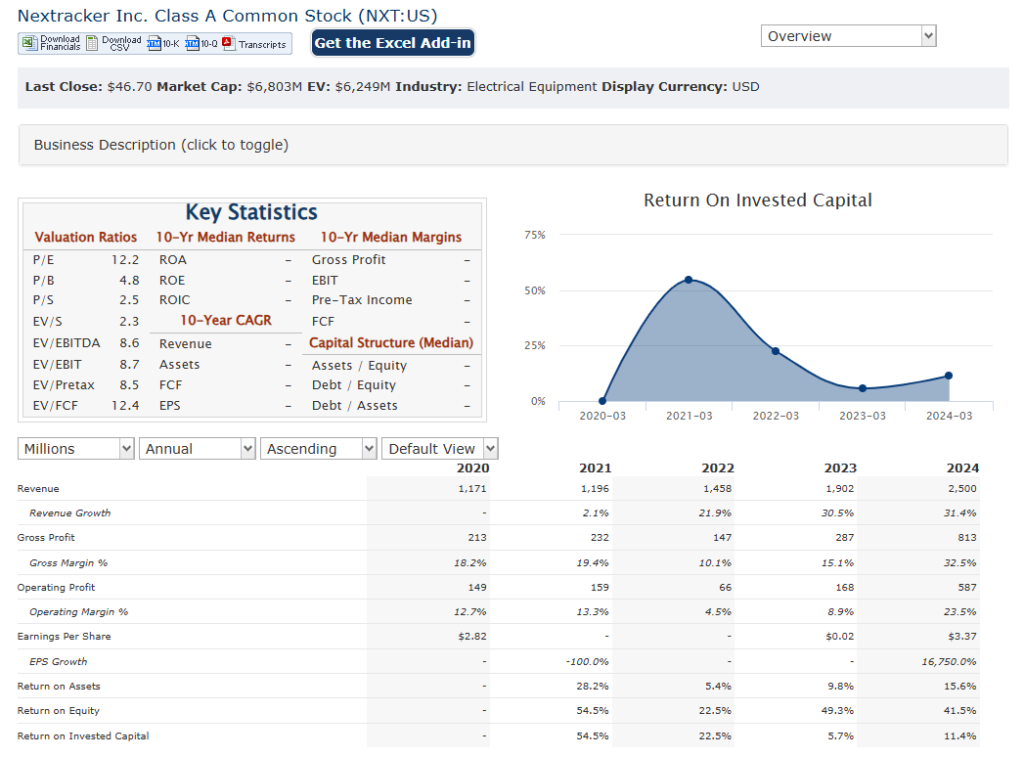

| Ticker | $NXT | Price | $46.12 | Market Cap | $6.72B |

| 52 Week High | $62.31 | 52 Week Low | $30.93 | Shares outstanding | 143.64M |

Company background:

Nextracker Inc. is a leading global provider of intelligent solar tracker and software solutions. Founded in 2013, the company designs, engineers, and manufactures advanced solar tracking technology that optimizes the performance of utility-scale and distributed generation solar projects. Their products enable solar panels to follow the sun’s movement across the sky, significantly increasing energy production compared to traditional fixed-tilt systems. Nextracker’s headquarters are located in Fremont, California.

The company’s flagship products include the NX Horizon and NX Gemini tracker systems. NX Horizon is a one-in-portrait (1P) smart solar tracker system known for its reliability and cost-effectiveness. NX Gemini is a two-in-portrait (2P) tracker designed for projects requiring higher ground coverage. Both systems are compatible with various solar panel technologies. In addition to hardware, Nextracker offers the TrueCapture software, a sophisticated control system that uses machine learning to further enhance energy yield by optimizing the position of individual tracker rows in response to site conditions and weather patterns.

Key competitors in the solar tracker market include companies like Array Technologies and FTC Solar. These companies offer similar tracking solutions and compete with Nextracker for market share. However, Nextracker’s focus on innovation, its comprehensive product portfolio, and its strong track record have solidified its position as a major player in the industry.

Nextracker’s success can be attributed to its commitment to providing high-quality, reliable, and innovative solutions that help drive the adoption of solar energy worldwide. The company continues to invest in research and development to further improve its products and maintain its competitive edge in the rapidly evolving solar market.

Recent Earnings:

Nextracker Inc. reported revenue falling slightly YoY to $679.36 million, but surge in net profit, reaching $115.28 million, a 178.48% increase year-over-year. This growth in profitability was primarily driven by increased bookings for their tracker software and strong demand for their solar tracker systems. The company’s earnings per share (EPS) was $0.79, slightly lower than the same period last year. Nextracker demonstrated substantial growth with a 15.39% increase in revenue to $2.03 billion and a 248.61% jump in net profit to $352.37 million.

The company’s strong performance was attributed to its ability to capitalize on the growing demand for solar energy solutions. With a record backlog exceeding $4.5 billion, indicating a robust pipeline of future projects.

Nextracker expanded its manufacturing and supply chain network to over 70 manufacturing partners operating more than 90 facilities across 19 countries. This expansion increases their production capacity, enabling them to better serve their customers and meet the rising demand for their products. The company also shipped its first 100% U.S. domestic content solar trackers, demonstrating its commitment to localizing its supply chain and supporting domestic manufacturing.

Nextracker provided a positive forward guidance, estimating revenue between $2.8 billion and $2.9 billion for the full fiscal year 2025. Nextracker’s focus on innovation, expanding its manufacturing capabilities, and its strong financial performance position the company well for sustained success in the rapidly growing solar energy sector.

The Market, Industry, and Competitors:

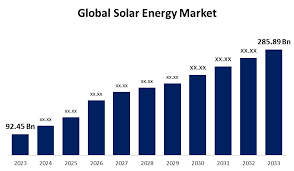

Nextracker operates in the rapidly expanding global solar energy market, specifically within the segment of solar tracker technology. This market is driven by the increasing worldwide demand for renewable energy sources as a means to combat climate change and meet growing energy needs. Solar trackers are crucial components in modern solar power plants, as they significantly enhance energy production by enabling solar panels to follow the sun’s path throughout the day. This leads to higher efficiency and improved returns on investment for solar project developers and operators.

The global solar tracker market size was valued at approximately USD 15.85 billion in 2023 and is projected to reach USD 54.20 billion by 2030. This translates to a robust compound annual growth rate (CAGR) of around 19.2% during the forecast period. The growth is fueled by factors such as decreasing costs of solar energy, supportive government policies and incentives, and technological advancements in tracker systems. As solar energy becomes increasingly competitive with traditional energy sources, the demand for high-efficiency solutions like those offered by Nextracker is expected to surge.

Unique differentiation:

Nextracker operates in a competitive landscape within the solar tracker market. Key competitors include companies like Array Technologies, FTC Solar, and Valmont Industries (through its Convertasol brand). These companies offer similar products and services, designing, manufacturing, and supplying solar tracking systems for utility-scale and commercial solar projects. Competition is based on factors like product performance, reliability, cost-effectiveness, technology innovation, and customer service. Each company strives to differentiate itself through unique features, such as specific tracker designs (e.g., 1P vs. 2P), software capabilities, or specialized installation and maintenance services.

Nextracker also faces indirect competition from companies offering alternative solutions for maximizing solar energy production. This includes companies specializing in fixed-tilt racking systems, although trackers are generally preferred for larger utility-scale projects due to their higher energy yield. The competitive dynamics of the solar tracker market are constantly evolving, with companies investing in research and development to improve their offerings and gain a competitive edge.

Comprehensive Solutions: Nextracker offers a complete suite of products and services, including tracker hardware, software, and support. This integrated approach simplifies project development and ensures compatibility across all components. Their solutions cater to various project needs, from utility-scale plants to distributed generation systems.

Focus on Reliability and Durability: Nextracker’s systems are designed for long-term performance and resilience in diverse environmental conditions. Their trackers are built to withstand harsh weather, including high winds and hail, ensuring reliable operation over the lifespan of a solar project.

Commitment to Sustainability: Nextracker prioritizes sustainability throughout its operations, from product design to manufacturing processes. They actively work to reduce their environmental footprint and contribute to the growth of clean energy.

Management & Employees:

Dan Shugar: As the CEO and Founder of Nextracker, Dan Shugar has been leading the company since its inception. He has a long history in the solar industry, having held senior leadership positions in various solar companies prior to founding Nextracker. His experience and vision have been instrumental in driving the company’s growth and success.

Howard Wenger: Serving as the President of Nextracker, Howard Wenger brings over 35 years of experience in the solar and utility power field. He has held leadership and board positions in several industry-leading companies, contributing his expertise in global product, commercial, and operations management.

Marco Miller: As the Chief Operating Officer (COO) and co-founder, Marco Miller directs global teams from project engineering and supply chain to project management and construction. He has over two decades of experience managing large-scale utility projects in the US and globally.

Mike Mehawich: Also a co-founder, Mike Mehawich serves as the Chief Strategy Officer. He has extensive experience in the solar industry, having spent nearly two decades commercializing solar technologies for global markets.

Financials:

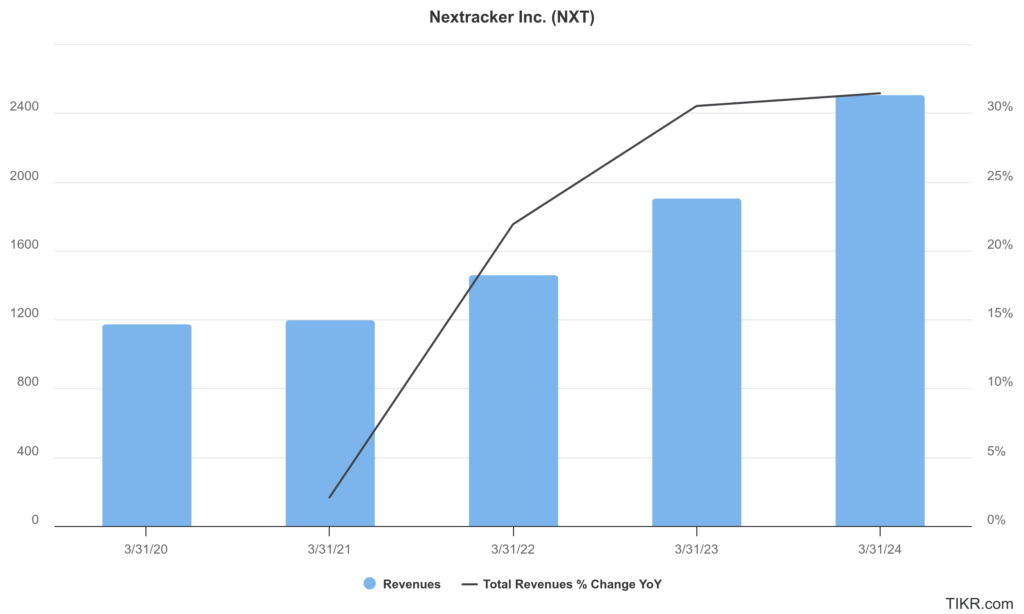

Nextracker Inc., revenue has consistently increased, with a compound annual growth rate (CAGR) of approximately 22.2% per annum. This growth reflects the expanding demand for solar energy solutions and Nextracker’s strategic positioning in the market. Nextracker reported revenue of $1,457.6 million, up from $1,195.6 million in 2021 and $1,171.3 million in 2020.

With Nextracker achieving an average annual earnings growth rate of 51.2%. This rapid expansion in earnings is attributed to the company’s ability to capitalize on the growing solar energy market and improve operational efficiency. Nextracker reported a net profit of $115.28 million, marking a 178.48% YoY increase from $41.4 million in the same period of the previous year.

The company held over $693 million in cash and equivalents, with an operating cash flow of $418 million year-to-date. The company’s return on equity (ROE) is notably high at 40.9%, indicating efficient use of shareholder capital.

Nextracker has reaffirmed its revenue outlook for fiscal year 2025 between $2.8 and $2.9 billion and raised its profit outlook, projecting GAAP net income between $378 and $408 million. The company’s adjusted EBITDA is expected to range from $625 to $665 million for the year.

Technical Analysis:

The stock is on a stage 2 markup (Bullish) on the monthly chart, and starting a consolidation stage 3 (neutral) on the weekly chart. The daily chart is indicating a move lower stage 4 markdown, to the first attempt to reverse at the $44 zone, but could head lower to the $38s

Bull Case:

Record Backlog and Revenue Visibility: Nextracker’s consistently growing backlog, often exceeding billions of dollars, provides strong revenue visibility and suggests future growth. This substantial backlog demonstrates robust demand for their products and services and reduces uncertainty about near-term financial performance.

ESG Investing: The increasing focus on Environmental, Social, and Governance (ESG) factors is driving investment towards sustainable companies. Nextracker’s contribution to the clean energy transition makes it an attractive investment for ESG-focused funds and investors, potentially increasing demand for its stock.

Diversification into Related Areas: While solar trackers are their core business, Nextracker may explore opportunities to diversify into related areas within the renewable energy ecosystem, such as energy storage or other solar technologies, further expanding their market and revenue streams.

Bear Case:

Supply Chain Disruptions: While Nextracker has a diversified supply chain, global supply chain disruptions, including material shortages, logistical challenges, or geopolitical events, could impact their ability to meet demand and fulfill orders, potentially leading to delays and lost revenue. Rising raw material costs could also squeeze margins.

Technological Obsolescence: The solar industry is constantly evolving. Rapid advancements in solar technology, such as improved panel efficiency or the emergence of new tracking systems, could make Nextracker’s current products less competitive or even obsolete in the future. Continuous R&D is essential, but there’s no guarantee of success.

Project Delays and Cancellations: Solar projects can be complex and subject to delays or cancellations due to various factors, including permitting issues, financing challenges, or changes in project economics. Such delays or cancellations can directly impact Nextracker’s revenue and cash flow.