Executive Summary:

CRISPR Therapeutics AG is a leading gene editing company focused on developing transformative therapies for serious diseases using the CRISPR/Cas9 platform. CRISPR Therapeutics aims to revolutionize medicine by precisely editing genes to treat a wide range of conditions, including genetic diseases, cancer, and autoimmune disorders. the company achieved a major milestone with the FDA approval of its first CRISPR-based therapy, exagamglogene autotemcel (exa-cel), for the treatment of sickle cell disease and beta-thalassemia.

CRISPR Therapeutics AG announced a total revenue of $170 million, primarily driven by collaborations and licensing agreements. Research and development expenses were $101.555 million, reflecting continued investment in its pipeline of gene editing therapies.

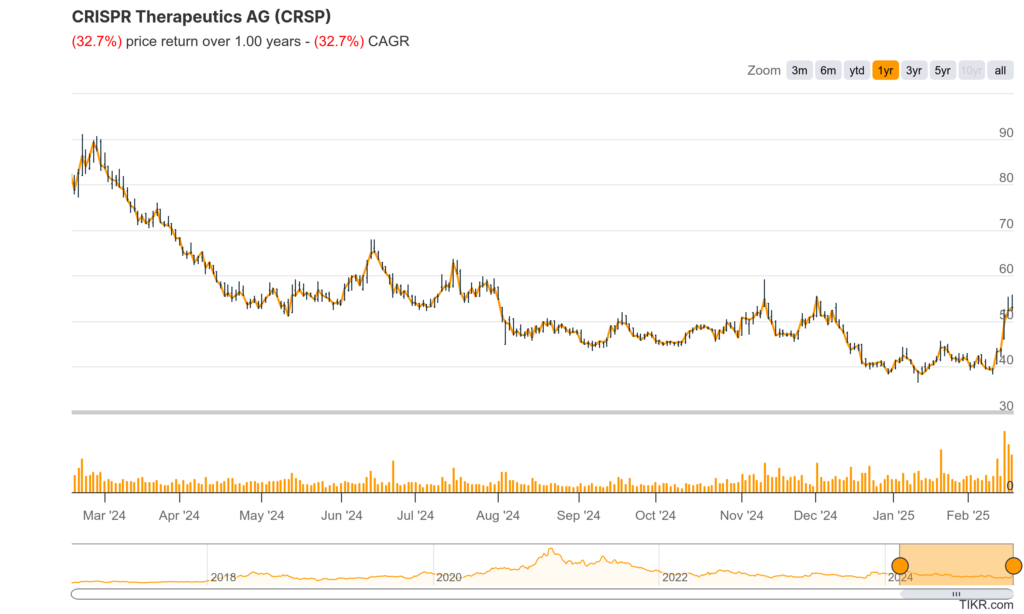

Stock Overview:

| Ticker | $CRSP | Price | $53.02 | Market Cap | $4.55B |

| 52 Week High | $91.10 | 52 Week Low | $36.52 | Shares outstanding | 85.77M |

Company background:

CRISPR Therapeutics AG is a pioneering gene editing company focused on developing transformative therapies for serious human diseases. Founded in 2013, the company is headquartered in Zug, Switzerland, with research and development operations in Boston, Massachusetts. CRISPR Therapeutics was co-founded by Emmanuelle Charpentier, Shaun Foy, and Rodger Novak. Charpentier, along with Jennifer Doudna, was awarded the Nobel Prize in Chemistry in 2020 for their groundbreaking work on the development of the CRISPR/Cas9 gene editing technology. This revolutionary platform allows for precise modifications to DNA sequences, offering the potential to cure genetic diseases and revolutionize medicine.

The company’s lead product, exagamglogene autotemcel (exa-cel), is a CRISPR-based gene editing therapy for the treatment of sickle cell disease and beta-thalassemia. Exa-cel has received regulatory approval in several countries, marking a major milestone for CRISPR Therapeutics and the gene editing field. In addition to exa-cel, the company is developing a pipeline of innovative therapies targeting various diseases, including cancer, autoimmune disorders, and other genetic conditions.

CRISPR Therapeutics faces competition from other gene editing companies, such as Vertex Pharmaceuticals, Editas Medicine, and Intellia Therapeutics, all of which are developing CRISPR-based therapies. CRISPR Therapeutics has established itself as a leader in the field, with its strong intellectual property portfolio, experienced management team, and promising clinical trial results. The company’s headquarters in Zug, Switzerland, provides a strategic base for its global operations, while its research and development facilities in Boston foster collaboration and innovation.

CRISPR Therapeutics is committed to transforming the lives of patients with serious diseases through its innovative gene editing therapies. The company’s focus on precision, safety, and efficacy has positioned it at the forefront of the gene editing revolution. With its continued advancements in CRISPR technology and its dedication to developing life-changing treatments.

Recent Earnings:

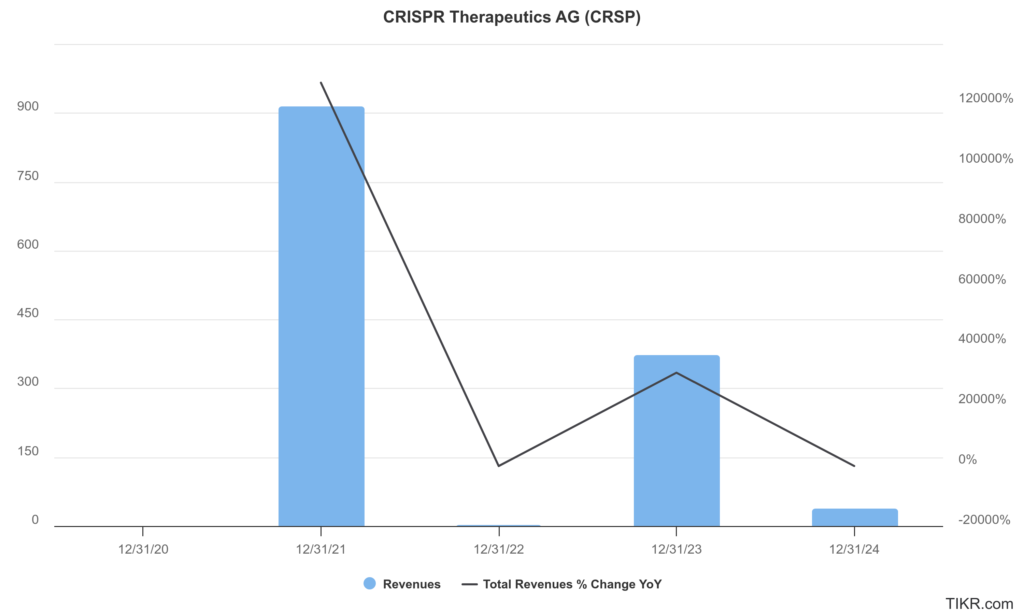

CRISPR Therapeutics AG reported total revenues of $37.3 million, a significant decrease from the $371.2 million reported in 2023. CRISPR Therapeutics exceeded revenue expectations, with $35.7 million compared to the anticipated $7.3 million.

The company reported a net loss of $37.3 million for the fourth quarter of 2024, compared to a net income of $89.3 million for the same period in 2023. This reflects the reduced revenue and ongoing investments in research and development. CRISPR Therapeutics emphasized its strong financial position, with approximately $1.9 billion in cash, cash equivalents, and marketable securities as of December 31, 2024. This substantial cash reserve provides the company with the resources to continue advancing its pipeline of gene editing therapies.

CRISPR Therapeutics highlighted the continued progress of its lead candidate, exagamglogene autotemcel (exa-cel), which is now approved for the treatment of sickle cell disease and beta-thalassemia in several regions. The company is focused on the ongoing launch of exa-cel, with increasing momentum and growing patient demand. CRISPR Therapeutics continues to advance its in vivo programs targeting various diseases, including cardiovascular disease and other genetic conditions.

The company is focused on expanding the availability of exa-cel to patients in need, while also continuing to invest in its next-generation gene editing technologies and advancing its in vivo programs. CRISPR Therapeutics is well-positioned to continue its leadership in the gene editing field and potentially transform the treatment of serious diseases.

The Market, Industry, and Competitors:

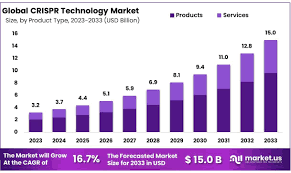

CRISPR Therapeutics AG operates within the rapidly evolving CRISPR gene editing market, which is a subset of the broader biotechnology sector. This market encompasses various applications, including therapeutic interventions for genetic disorders, oncology, and personalized medicine. The global CRISPR genomic cure market is projected to grow significantly, with expectations to reach approximately $11.71 billion by 2030, up from $3.18 billion in 2023, reflecting a robust compound annual growth rate (CAGR) of 20.5% during this period. The increasing prevalence of chronic diseases, advancements in gene-editing technologies, and supportive government initiatives are key drivers behind this growth.

The broader CRISPR technology market is also on an upward trajectory, with a valuation of around $4.25 billion in 2023 and an anticipated CAGR of 16.02%, potentially reaching nearly $9.30 billion by 2030. This growth is fueled by rising investments in biotechnology and the urgent need for innovative treatments for genetic disorders and cancers. CRISPR Therapeutics AG’s focus on developing transformative gene-based medicines positions it well within this expanding market, particularly as it advances its pipeline of therapies targeting serious conditions like sickle cell disease and various cancers.

Unique differentiation:

CRISPR Therapeutics operates in a competitive landscape within the gene editing field. Several companies are developing CRISPR-based therapies and other gene editing technologies, vying for a share of this promising market.

- Vertex Pharmaceuticals: While technically a partner on exa-cel, Vertex also has its own gene editing programs and significant resources. Their collaboration on exa-cel demonstrates their expertise in the field and their potential to become a major player in gene editing therapies.

- Editas Medicine: Editas Medicine is another prominent gene editing company focused on developing CRISPR-based therapies for various diseases. They have a diverse pipeline of candidates targeting different indications, including inherited blood disorders, eye diseases, and cancer.

- Intellia Therapeutics: Intellia Therapeutics is a clinical-stage gene editing company developing CRISPR-based therapies for genetic diseases. They are advancing programs targeting various conditions, including transthyretin amyloidosis (ATTR) and hereditary angioedema (HAE).

- Beam Therapeutics: Beam Therapeutics is a gene editing company utilizing base editing technology, a variation of CRISPR, to develop therapies for genetic diseases. Their approach focuses on precisely modifying single base pairs in DNA, offering potential advantages in certain applications.

These companies, along with others in the field, are engaged in ongoing research and development efforts, advancing their respective gene editing technologies and therapeutic programs. The competitive landscape is dynamic, with companies continuously innovating and seeking to differentiate themselves through their unique approaches, target diseases, and clinical trial results.

Pioneering Technology: CRISPR Therapeutics was co-founded by Emmanuelle Charpentier, one of the inventors of the CRISPR/Cas9 technology. This gives the company a deep understanding of the technology and a strong foundation for developing innovative therapies.

First Approved CRISPR Therapy: CRISPR Therapeutics achieved a significant milestone with the FDA approval of exagamglogene autotemcel (exa-cel) for sickle cell disease and beta-thalassemia. This marks the first approval of a CRISPR-based therapy, giving CRISPR Therapeutics a first-mover advantage and validating its platform.

Focus on Serious Diseases: CRISPR Therapeutics is focused on developing therapies for serious and life-threatening diseases with significant unmet medical needs. This focus allows the company to prioritize its resources and expertise on areas where it can have the greatest impact.

Diverse Pipeline: CRISPR Therapeutics has a diverse pipeline of therapeutic programs targeting various diseases, including cancer, cardiovascular disease, and other genetic conditions. This broad approach increases the company’s chances of success and allows it to explore the full potential of CRISPR technology.

Management & Employees:

Samarth Kulkarni, Ph.D. serves as the Chief Executive Officer and Chairman of the Board. He has been with CRISPR Therapeutics since 2015, initially as the Chief Business Officer, and has played a crucial role in the company’s growth and development. Dr. Kulkarni has a strong background in strategy and operations in the biotech industry, with previous experience at McKinsey & Company.

Julianne Bruno, M.B.A. is the Chief Operating Officer. She brings extensive experience in operational leadership and has been instrumental in building and scaling CRISPR Therapeutics’ operations.

Naimish Patel, M.D. is the Chief Medical Officer. He leads the clinical development and regulatory strategy for CRISPR Therapeutics’ therapeutic programs.

Jon Terrett, Ph.D. is the Head of Research. He leads the company’s research and development efforts, focusing on advancing its gene editing technologies and therapeutic programs.

Financials:

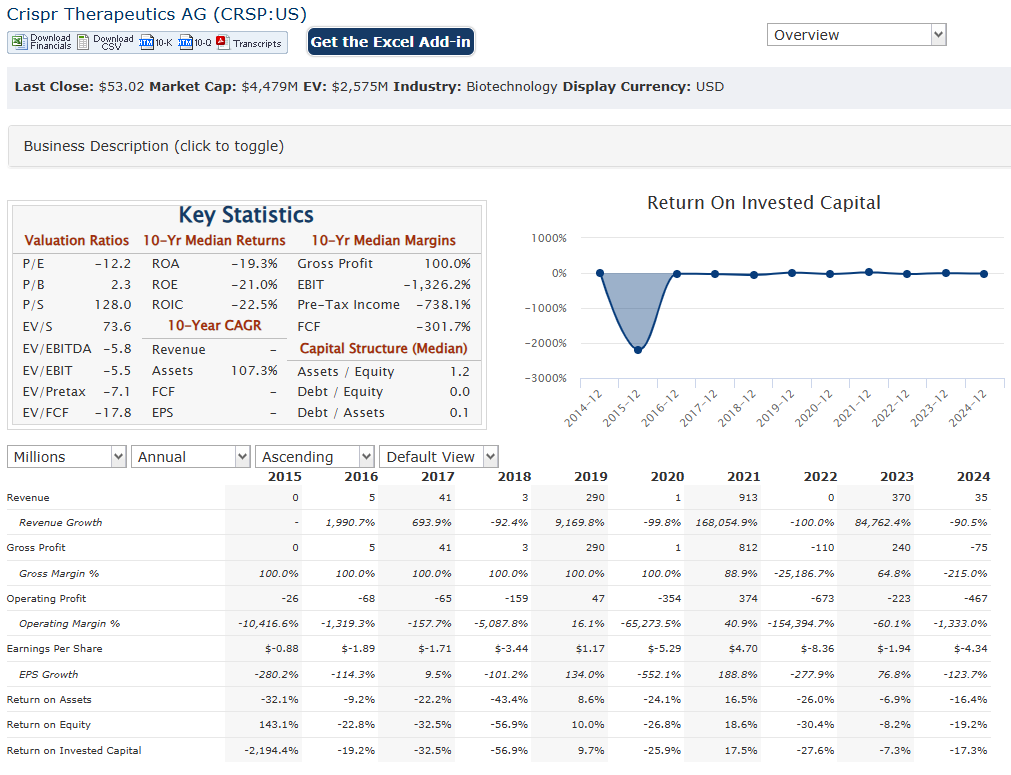

CRISPR Therapeutics AG has reported a substantial increase in revenue driven by collaborations and advancements in its gene-editing technologies, with total revenue reaching approximately $370 million. CRISPR Therapeutics recorded a total revenue of $37.3 million, reflecting a compound annual growth rate (CAGR) of approximately -50% over the five years. This downturn highlights the volatility inherent in the biotechnology sector, particularly for companies reliant on breakthrough therapies.

The net loss for CRISPR Therapeutics reached $366.3 million in 2024, following a net income of $89.3 million in 2023, which was primarily attributed to collaboration revenues. The CAGR of approximately -70% in earnings, indicating the operational costs associated with research and development that outpaced revenue generation. The company’s focus on innovation and pipeline expansion has led to increased expenditures, particularly in R&D, which totaled around $320 million in 2024.

CRISPR Therapeutics has maintained a strong cash position, with cash and cash equivalents amounting to $298 million at the end of 2024. This is down from $389 million at the end of 2023 but is complemented by marketable securities totaling approximately $1.6 billion. The company’s total assets stood at about $2.24 billion, with shareholders’ equity reaching $1.93 billion, indicating a solid financial foundation despite ongoing operational losses. The working capital remains robust at around $1.85 billion, suggesting that CRISPR Therapeutics is well-positioned to fund its future growth initiatives and navigate potential market challenges effectively.

The company aims to capitalize on its innovative gene-editing platform to drive future growth and potentially return to profitability as its pipeline progresses through clinical stages.

Technical Analysis:

The stock is in a stage 1 consolidation (neutral) on the monthly and weekly charts. The daily chart shows a reversal, but the move back down indicates a test of the $44-$48 zone, where there is some support. The stock should reverse again at that point.

Bull Case:

Commercial Success of exa-cel: The approval and successful commercial launch of exa-cel for sickle cell disease and beta-thalassemia is a major win for CRISPR Therapeutics. A smooth rollout, strong patient uptake, and positive real-world data could drive substantial revenue growth and validate the CRISPR platform. This is arguably the most significant near-term catalyst.

Expanding Indications for exa-cel: CRISPR Therapeutics is exploring exa-cel in other indications, such as transfusion-dependent beta-thalassemia. Expanding the eligible patient population could significantly increase the market opportunity and further boost revenue.

Platform Validation and Technological Advancements: The success of exa-cel serves as validation for the CRISPR/Cas9 gene editing platform. Continued advancements in CRISPR technology, including improved delivery methods and reduced off-target effects, could further enhance the potential of gene editing therapies and benefit CRISPR Therapeutics.

Bear Case:

Clinical Trial Failures: Drug development is inherently risky. Clinical trials for CRISPR Therapeutics’ other programs may fail to meet their endpoints or encounter safety issues, leading to setbacks and potentially impacting the stock price.

Off-Target Effects and Safety Concerns: CRISPR technology, while promising, is not without risks. Off-target editing, where the CRISPR system modifies unintended DNA sequences, could lead to adverse effects. Safety concerns could delay or halt clinical trials and impact the commercial viability of CRISPR-based therapies.

Intellectual Property Disputes: The intellectual property landscape in the gene editing field is complex. CRISPR Therapeutics could face legal challenges or disputes over its patents, potentially impacting its ability to develop and commercialize its therapies.