Executive Summary:

Lionsgate Studios Corp. is a Canadian-American film and television production and distribution company. The company’s film division, Lionsgate Films, has released popular franchises such as “The Hunger Games”, “John Wick”, and “Saw”. Lionsgate Television is responsible for hit television series like “Mad Men”, “Weeds”, and “Orange is the New Black”. Lionsgate Studios also owns a majority stake in 3 Arts Entertainment, the production company behind shows like “Parks and Recreation” and “Brooklyn Nine-Nine”.

Lionsgate Studios Corp. reported revenue of $713.8 million, a 3% increase from the same quarter in the previous year. Studio Adjusted OIBDA (Operating Income Before Depreciation and Amortization) was $112.0 million, up 45% compared to $77.4 million in the prior year quarter. The parent company Lions Gate Entertainment Corp. reported an adjusted diluted net income per share of $0.28.

Stock Overview:

| Ticker | $LION | Price | $8.89 | Market Cap | $2.57B |

| 52 Week High | $12.84 | 52 Week Low | $6.13 | Shares outstanding | 288.68M |

Company background:

Lionsgate Studios Corp. is a leading film and television production and distribution company. It was formed in May 2024 after Lionsgate Entertainment Corp. spun off its film and television businesses. Its roots trace back to Lionsgate Entertainment Corp., which was founded in 1997 by Frank Giustra. Lionsgate Studios is headquartered in Santa Monica, California, and is majority-owned by Starz Entertainment.

Lionsgate Studios is involved in the development, production, and distribution of a wide range of entertainment products. Its film division, Lionsgate Films, is responsible for popular franchises like “The Hunger Games,” “John Wick,” and “Saw.” The studio also produces and distributes television series through Lionsgate Television, which is behind hits like “Mad Men,” “Weeds,” and “Orange is the New Black.” Lionsgate Studios owns a majority stake in 3 Arts Entertainment, the production company behind shows like “Parks and Recreation” and “Brooklyn Nine-Nine.”

Lionsgate Studios operates in a competitive landscape, with major players like Disney, Warner Bros., Universal Pictures, and Sony Pictures vying for audience attention and market share. These studios produce and distribute a wide range of films and television shows, often with bigger budgets and more established franchises.

Lionsgate Studios has a diverse portfolio of products, including films, television series, home entertainment offerings, and digital content. The company also extends its film and television properties into various location-based entertainment and live attractions worldwide, such as theme park attractions, escape rooms, exhibitions, and concert tours.

Recent Earnings:

Lionsgate Studios Corp. reported revenue of $713.8 million, a modest 3% increase from the same quarter in the previous year. This growth was primarily driven by the Television Production segment, which saw a significant 63% surge in revenue, fueled by increased episodic deliveries, and licensing of library content. The Motion Picture segment faced headwinds, with revenue declining due to comparisons with strong theatrical releases in the prior year quarter, including “The Hunger Games: The Ballad of Songbirds and Snakes” and “Saw X.”

The Studio Business reported Adjusted OIBDA (Operating Income Before Depreciation and Amortization) of $112.0 million, a substantial 45% increase compared to $77.4 million in the prior year quarter. The parent company Lions Gate Entertainment Corp. reported an adjusted diluted net income per share of $0.28.

The company’s press release emphasized the strong performance of its television business and the continued growth of its library revenue. The trailing-twelve-month library revenue reached a record $954 million, up 22% from the prior year’s quarter, highlighting the value of Lionsgate Studios’ extensive content catalog. The company also pointed to the successful conversion of several mid-budget films to profitability in its motion picture business, indicating a positive trend in that segment despite the overall revenue decline.

The company’s outlook for fiscal 2025 includes an adjusted OIBDA of $300-$320 million for Lionsgate Studios and $200 million for the Starz North American business. With a strong library, a recovering motion picture segment, and a thriving television business, Lionsgate Studios appears well-positioned for future success as an independent entity.

The Market, Industry, and Competitors:

Lionsgate Studios Corp. operates within the global entertainment industry, with a diversified portfolio encompassing film and television production, distribution, and streaming services. The company’s activities include feature film production, support for independent filmmakers, scripted series for television and streaming platforms, documentaries, reality shows, and international distribution partnerships. Lionsgate manages its franchises through sequels, spin-offs, and merchandising, and it provides production, marketing, distribution, and franchise development services. The company generates revenue through theatrical releases, home entertainment, digital media, and television licensing. Lionsgate competes in the dynamic entertainment landscape with a commitment to innovation and audience engagement.

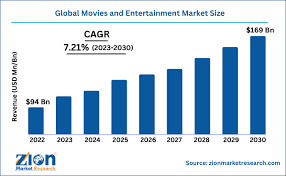

The global movies and entertainment market was valued at approximately USD 94.45 billion in 2022 and is projected to reach USD 169.62 billion by 2030. A compound annual growth rate (CAGR) of roughly 7.21% between 2023 and 2030. Lionsgate Studios’ Motion Picture segment reported $309.2 million in revenue, while the Television Production segment revenue increased 63% to $404.6 million. North America is expected to dominate the movies and entertainment market with the highest CAGR, with the US and Canada leading in growth rate.

Unique differentiation:

Lionsgate Studios Corp. faces stiff competition in the entertainment industry from a variety of established players. Major Hollywood studios like Disney, Warner Bros., Universal Pictures, and Sony Pictures Entertainment are significant rivals, boasting vast resources, extensive distribution networks, and iconic franchises. These companies produce and distribute a wide array of films and television shows, often with larger budgets and broader appeal. Lionsgate Studios competes with independent production companies and emerging digital content creators who are increasingly gaining traction in the evolving media landscape.

Lionsgate Studios also faces competition from streaming giants like Netflix, Amazon Prime Video, and Apple TV+. These platforms have disrupted the traditional entertainment model by producing and distributing original content directly to consumers, bypassing traditional theatrical releases and television broadcasts.

Lionsgate Studios Corp. differentiates itself from larger competitors through a combination of strategic focuses and operational approaches. While they may not have the same financial clout as the “Big Six” studios

- Focus on Genre and Targeted Audiences: Lionsgate has historically excelled in targeting specific demographics with genre films and television series, often focusing on action, horror, and young adult audiences. This allows them to cater to underserved markets and build dedicated fan bases for their franchises, like John Wick, The Hunger Games, and Saw. This targeted approach can be more cost-effective than trying to appeal to everyone.

- Strategic Partnerships and Acquisitions: Lionsgate has a history of smart acquisitions and strategic partnerships. Their ownership stake in companies like 3 Arts Entertainment (known for critically acclaimed television like Parks and Recreation and Brooklyn Nine-Nine) provides a pipeline of high-quality content and creative talent. These partnerships allow them to punch above their weight and compete with larger studios.

- Agile and Adaptable Operations: Lionsgate is often seen as more nimble and adaptable. This allows them to react more quickly to changing market trends and experiment with new distribution models. Their smaller size can be an advantage in a rapidly evolving entertainment landscape.

- Emphasis on Value and Efficiency: Lionsgate often operates with a focus on producing content efficiently and maximizing value. They may not always have the biggest budgets, but they are known for making the most of their resources and finding creative ways to market their films and television shows.

Management & Employees:

Jon Feltheimer: As Chief Executive Officer, Feltheimer has been a driving force behind Lionsgate’s growth and success. He has a long history in the entertainment industry, having held leadership positions at Sony Pictures Entertainment and New World Entertainment before joining Lionsgate. Feltheimer is known for his strategic vision and his ability to identify and develop successful franchises.

Michael Burns: Serving as Vice Chairman, Burns has been instrumental in shaping Lionsgate’s corporate strategy and overseeing key acquisitions. He has a strong background in finance and investment banking, with experience at Prudential Securities and Shearson/American Express. Burns plays a crucial role in the company’s financial decision-making and strategic partnerships.

Brian Goldsmith: As Chief Operating Officer, Goldsmith is responsible for the day-to-day operations of Lionsgate Studios. He oversees various aspects of the business, including production, distribution, and marketing. Goldsmith has a deep understanding of the entertainment industry and a proven track record of success in managing complex projects.

Financials:

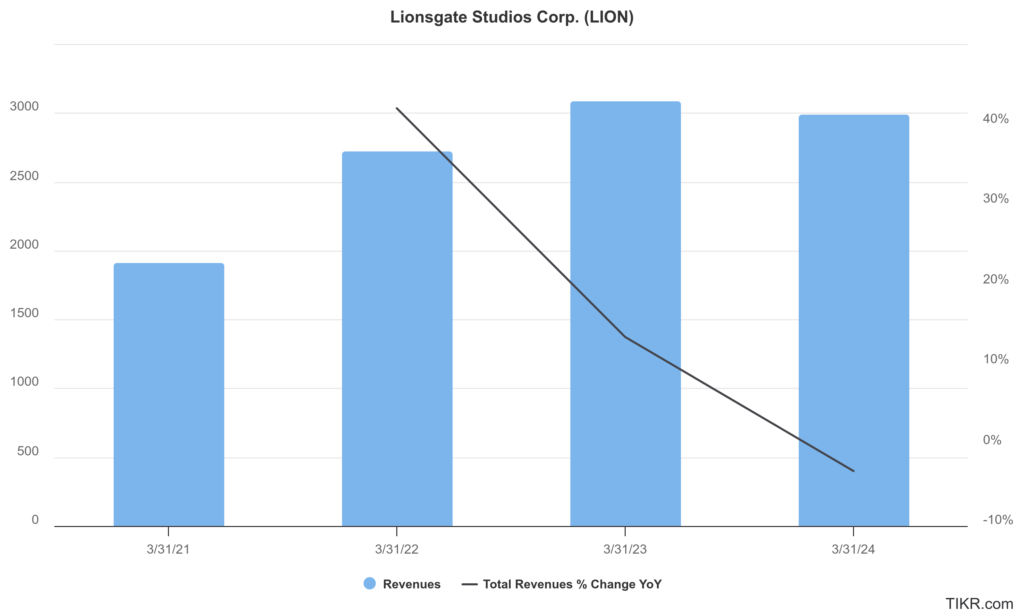

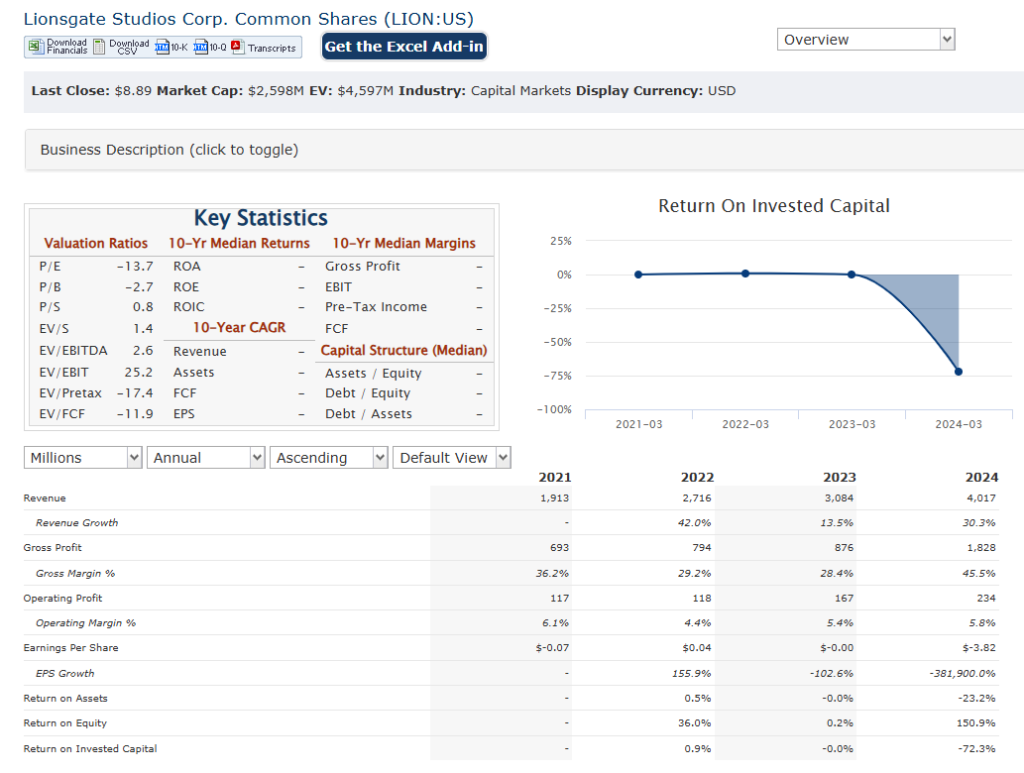

Lionsgate Studios Corp. has reported a total revenue of approximately $970.5 million, reflecting a modest increase compared to previous years. The Motion Picture segment generated $309.2 million, while the Television Production segment saw significant growth, with revenues soaring by 63% to $404.6 million. This growth was largely driven by increased episodic deliveries and licensing of library content. An overall compound annual growth rate (CAGR) in revenue of around 5%, indicating a steady upward trend despite challenges posed by market fluctuations and competition.

Lionsgate reported a net loss attributable to shareholders of $21.9 million for the third quarter of fiscal 2025, which translates to a diluted net loss per share of $0.09. Adjusted net income for the same period was reported at $68.4 million, or $0.28 per share, showcasing the company’s efforts to manage costs and improve profitability in certain segments despite the overall losses. Lionsgate’s earnings have shown a CAGR of approximately -10%, largely influenced by significant one-time charges and restructuring costs that have impacted net income.

The company has maintained a robust library of over 20,000 titles, which generated record library revenue of $954 million in the trailing twelve months—a 22% increase year-over-year. Lionsgate Studios Corp. has faced headwinds in terms of net earnings and profitability, its strategic focus on content creation and distribution has positioned it for potential growth in the evolving entertainment landscape.

Technical Analysis:

The stock is in a base building stage 1 (neutral) on the monthly chart and is on a uptrend after a gap up on the daily chart. It should get to $9.3 – $9.5 range soon. Still, the stock is going to continue to be range bound.

Bull Case:

Strategic Separation from Starz: The upcoming separation of Lionsgate Studios from Starz is expected to unlock value for both businesses. This move will allow Lionsgate Studios to operate with greater focus and agility as a pure-play content company, potentially attracting new investors and strategic partnerships.

Strong Content Library and Franchise Development: Lionsgate boasts a valuable library of over 20,000 film and television titles, providing a stable revenue stream through licensing and distribution. The company is also adept at developing and nurturing successful franchises like John Wick and The Hunger Games, which can generate significant revenue through sequels, spin-offs, and merchandise.

Growth in Television Production: Lionsgate’s television production segment is experiencing strong growth, driven by increased episodic deliveries, licensing of library content, and the company’s rebound from previous industry strikes. This segment is expected to continue its positive momentum, contributing significantly to Lionsgate’s overall revenue and profitability.

Bear Case:

Reliance on Franchise Performance: While franchises are valuable, a significant portion of Lionsgate’s revenue can depend on the success of a few key films or television series. A underperforming franchise installment could negatively impact financial results. The volatility of the box office and changing audience preferences pose a risk.

Challenges in the Motion Picture Segment: The motion picture segment can be volatile and unpredictable. Box office performance is influenced by numerous factors, including competition, marketing, and critical reception. Lionsgate’s ability to consistently deliver successful films is not guaranteed, and theatrical revenue remains an important part of their business.

Integration Challenges Post-Spin-off: While the spin-off from Starz is expected to unlock value, there could be challenges associated with the separation process itself. Integrating the newly independent Lionsgate Studios operations and establishing its own infrastructure could present difficulties and unexpected costs.