Executive Summary:

The Boeing Company is a leading global aerospace corporation that designs, manufactures, and services commercial airplanes, defense products, and space systems. The company is organized into three primary divisions: Commercial Airplanes, Defense, Space & Security, and Global Services. Boeing plays a crucial role in connecting people and nations through its commercial aircraft and supports global security with its defense and space capabilities.

Boeing reported a revenue of $15.2 billion, which was lower than the analysts’ expectation of $17.04 billion. The reported EPS was a loss of $5.90, worse than the expected loss of $1.74.

Stock Overview:

| Ticker | $BA | Price | $185.44 | Market Cap | $139.09B |

| 52 Week High | $208.10 | 52 Week Low | $137.03 | Shares outstanding | 750.07M |

Company background:

The Boeing Company, a global aerospace giant, traces its roots back to 1916 when William Boeing founded the Pacific Aero Products Co. in Seattle, Washington. Initially focused on building seaplanes, the company quickly evolved, playing a pivotal role in the burgeoning aviation industry. Boeing’s early success stemmed from government contracts during World War I and its pioneering efforts in commercial air travel in the subsequent decades.

Boeing’s product portfolio is diverse and encompasses a wide range of aircraft and related services. Its Commercial Airplanes division is renowned for iconic jetliners like the 737, 787 Dreamliner, and 777. These aircraft serve airlines worldwide, facilitating global connectivity. Beyond commercial aviation, Boeing’s Defense, Space & Security segment provides military aircraft, missiles, space launch vehicles, and satellite systems. This division supports national defense and exploration efforts. Boeing Global Services offers aftermarket support, including maintenance, repair, and training, ensuring the continued operation of Boeing-made products.

The aerospace industry is highly competitive, with Boeing facing stiff rivalry from several key players. Airbus, headquartered in Toulouse, France, is its primary competitor in the commercial aircraft market. Airbus offers a similarly comprehensive range of airliners, creating a duopoly that shapes the industry. In the defense sector, Boeing competes with companies like Lockheed Martin, Northrop Grumman, and Raytheon Technologies, all of which are major contractors for governments worldwide. These companies vie for lucrative defense contracts, driving innovation and technological advancements.

Boeing’s corporate headquarters are located in Chicago, Illinois. This strategic location provides access to a diverse talent pool and positions the company at the heart of the American business landscape. Boeing manages its global operations, overseeing manufacturing facilities, engineering centers, and sales offices across the world.

Recent Earnings:

Boeing reported a revenue of $15.2 billion, which was lower than the analysts’ expectation of $17.04 billion, representing a decline compared to the same period in the previous year. This revenue shortfall was primarily attributed to the impacts of the IAM work stoppage and agreement, which significantly hampered commercial airplane deliveries.

The reported earnings per share (EPS) was a loss of $5.90, worse than the expected loss of $1.74. This substantial miss was primarily driven by the same factors affecting revenue, compounded by charges for certain defense programs and costs associated with workforce reductions announced earlier in the year.

The IAM work stoppage had a more impact than initially projected, and the defense program charges further weighed on profitability. These misses underscore the operational hurdles Boeing continues to face as it strives to stabilize its production and improve execution.

Boeing delivered 57 commercial airplanes during the fourth quarter, a significant decrease compared to the same period in the previous year due to the work stoppage. However, the company’s total backlog grew to $521 billion, including over 5,500 commercial airplanes, indicating strong demand for its products.

Boeing’s ongoing uncertainties related to production ramp-up, supply chain challenges, and the pace of recovery in the commercial aviation market. However, the company emphasized its focus on stabilizing operations, improving production efficiency, and strengthening its safety and quality processes. Boeing is also working to address challenges in its defense business and streamline its portfolio to focus on core competencies.

The Market, Industry, and Competitors:

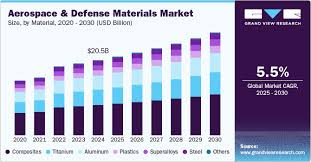

The Boeing Company operates primarily in the aerospace and defense markets, which encompass commercial aviation, military aircraft, space systems, and various support services. The commercial aviation sector is expected to see significant growth driven by increasing passenger traffic and the need for fleet modernization. Boeing’s forecasts indicate that the global market for commercial aircraft will recover and expand, with a notable push towards more fuel-efficient and environmentally friendly models as airlines adapt to changing consumer preferences and regulatory pressures. Boeing anticipates its services market, which includes maintenance, repair, and training, will be valued at approximately $4.4 trillion over the next two decades, highlighting the vital role of aftermarket services in sustaining revenue streams.

The overall aviation market is estimated to reach around $395.76 billion by 2030, reflecting a compound annual growth rate (CAGR) of approximately 2.87% from 2025. Specific segments within the industry are expected to experience even higher growth rates; for instance, the aircraft platforms market is forecasted to grow at a CAGR of 4.2%, reaching $301.19 billion by 2030. Factors contributing to this growth include rising defense expenditures amid geopolitical tensions, advancements in technology, and an increasing focus on sustainability within aviation practices.

Unique differentiation:

The Boeing Company operates in a highly competitive market, facing stiff rivalry from several key players across its various business segments. In the commercial aircraft market, Boeing’s primary competitor is Airbus, a European aerospace giant. Airbus offers a comprehensive range of airliners that directly compete with Boeing’s 737, 787, and 777 families. This duopoly has shaped the commercial aviation landscape, with both companies vying for market share and driving innovation in aircraft design and technology.

Boeing faces competition from several major players, including Lockheed Martin, Northrop Grumman, and Raytheon Technologies. These companies compete for government contracts in areas such as military aircraft, missiles, and space systems. The defense market is characterized by intense competition, with companies constantly striving to develop cutting-edge technologies and meet evolving military requirements.

Boeing also encounters competition in other areas, such as space exploration and satellite systems. In this domain, rivals like SpaceX and Blue Origin are emerging as significant players, challenging Boeing’s traditional dominance in the space sector.

A Legacy of Engineering Excellence: Boeing has a long and storied history of pioneering advancements in aviation. This legacy, coupled with its vast engineering expertise, allows the company to tackle complex aerospace challenges and develop innovative solutions.

Strong Defense and Space Presence: Boeing is a major defense contractor and has a significant presence in the space sector. This provides a stable revenue stream and positions the company to capitalize on growing government spending in these areas.

Focus on Technology and Innovation: Boeing invests heavily in research and development to stay at the forefront of aerospace technology. This commitment to innovation enables the company to develop cutting-edge products and maintain a competitive edge.

Management & Employees:

David L. Calhoun: Serves as the President and Chief Executive Officer, providing overall leadership and strategic direction for the company.

Susan Doniz: Serves as the Chief Information Officer and Senior Vice President of Information Technology and Data Analytics, leading Boeing’s digital transformation efforts and managing its IT infrastructure.

Michael Delaney: Is the Chief Aerospace Safety Officer and Senior Vice President of Global Aerospace Safety, responsible for ensuring the safety and quality of Boeing’s products and services.

Financials:

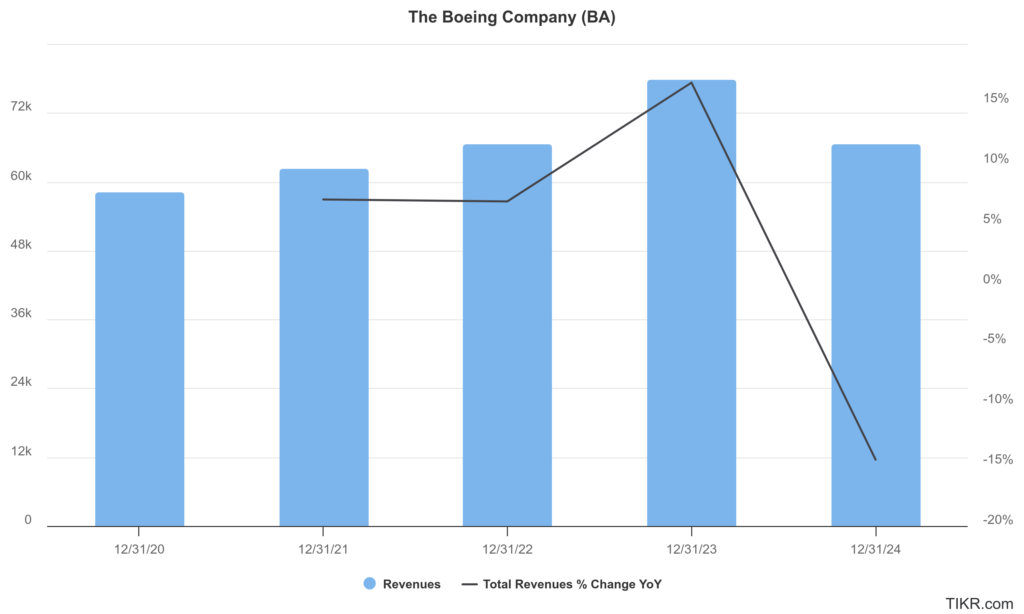

The Boeing Company has recorded a substantial loss due to the grounding of its 737 Max aircraft and the effects of the COVID-19 pandemic, resulting in an annual loss of $11.87 billion. They reported a total annual deficit of $11.83 billion in 2024, marking its sixth consecutive year of losses. Revenue during this period fluctuated, with total revenues reaching approximately $66.5 billion in 2024, down from $77.8 billion in 2023, reflecting a year-over-year decline of about 14.4%.

The company’s commercial airplanes segment, which is crucial for revenue generation, reported revenue of $22.86 billion in 2024, down from $33.9 billion in 2023. This decline can be attributed to lower deliveries and pre-tax charges related to ongoing production challenges, particularly with the 777X and 767 programs.

Boeing’s situation remains similarly bleak, with a reported GAAP loss per share of ($5.46) in Q4 2024 and an adjusted loss per share of ($5.90). This continues a trend of negative earnings that has persisted since 2019, with the company experiencing significant charges across various programs. The company’s balance sheet also shows considerable strain; as of early 2025, Boeing had total assets of approximately $134.5 billion against total liabilities of around $151.5 billion, resulting in a negative equity position of approximately $17 billion.

They have initiated production restarts for key aircraft models and are focusing on enhancing internal processes to restore trust among stakeholders. Achieving positive revenue and earnings growth will depend on the successful execution of these strategies and overcoming the legacy issues that have plagued.

Technical Analysis:

While the fundamentals look bad, the monthly and weekly charts are in a stage 4 markdown (bearish) and the stock is reversing on the daily timeframe (stage 2 markup). The stock has enough resistance in the $198 zone, which it should get to in the near term, which is almost 7-9% increase from its current position.

Bull Case:

Commercial Airplanes Recovery: The commercial aviation market is expected to experience strong growth in the coming years, driven by rising passenger traffic and fleet modernization. Boeing, with its established product portfolio and global presence, is well-positioned to capitalize on this growth. As the company addresses its production challenges and ramps up deliveries, particularly of the 737 MAX and 787 Dreamliner, it can significantly boost its revenue and profitability.

Strong Order Book: Boeing has a substantial backlog of commercial aircraft orders, providing a solid foundation for future revenue. This backlog demonstrates continued demand for its products and offers a buffer against short-term market fluctuations. As the company fulfills these orders, it can generate significant cash flow and drive shareholder value.

Defense and Space Opportunities: Boeing’s defense and space business segments offer diversification and growth potential. Increased government spending on defense and space exploration, coupled with Boeing’s expertise in these areas, can lead to lucrative contracts and long-term revenue streams.

Bear Case:

Production Issues and Delays: Boeing has faced persistent production challenges, including supply chain disruptions and quality control issues. These problems have led to delays in aircraft deliveries, increased costs, and reputational damage. Further delays or setbacks in production could further erode investor confidence and impact financial performance.

Safety Concerns and Regulatory Scrutiny: The 737 MAX crashes and subsequent safety concerns have raised questions about Boeing’s safety culture and engineering practices. Increased regulatory scrutiny and potential further incidents could lead to additional costs, delays, and damage to the company’s reputation.

Defense Program Issues: Boeing has faced challenges in its defense business, including cost overruns and program delays. These issues can lead to losses on defense contracts and further strain the company’s financials.