Executive Summary:

CVS Health Corporation is a leading healthcare company that provides a wide range of services, including pharmacy benefit management, retail pharmacy, and healthcare insurance. The company operates through four segments: Pharmacy Services, Retail/LTC, Healthcare Benefits, and Corporate. CVS Health fills more than one of every five prescriptions in the United States.

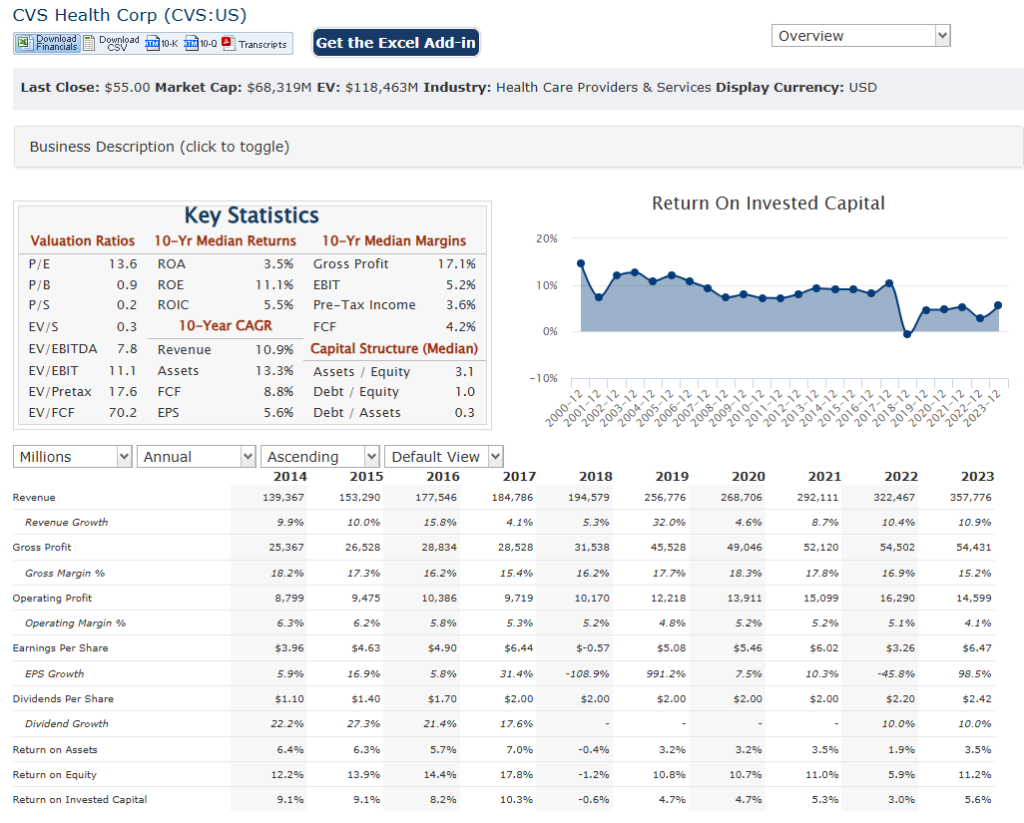

CVS Health Corporation reported an adjusted EPS of $1.09, which fell short of analysts’ expectations of $1.55. Their revenue of $95.4 billion exceeded analysts’ forecasts of $92.7 billion. They aim for 3-5% target margins by 2025 and anticipate earnings decline in the pharmacy segment but improvement in healthcare benefits.

Stock Overview:

| Ticker | $CVS | Price | $55.00 | Market Cap | $69.21B |

| 52 Week High | $80.75 | 52 Week Low | $43.56 | Shares outstanding | 1.26B |

Company background:

CVS Health Corporation, a prominent player in the healthcare industry, traces its roots back to 1963 with the founding of the Consumer Value Stores (CVS) by brothers Stanley and Sidney Goldstein in Lowell, Massachusetts. CVS quickly expanded its offerings to include pharmacy services, recognizing the growing demand for convenient access to prescriptions. This expansion laid the groundwork for the company’s future trajectory as a comprehensive healthcare provider. The company underwent significant growth through acquisitions and mergers over the years, solidifying its position in the market.

CVS Health’s diverse portfolio encompasses a wide range of products and services. Its retail pharmacies offer prescription dispensing, over-the-counter medications, health and beauty products, convenience items, and photo services. Beyond retail, CVS Caremark, the pharmacy benefit management (PBM) division, manages prescription drug benefits for employers, health plans, and government entities. The company’s health insurance arm, acquired through the purchase of Aetna, provides health insurance plans to millions of members.

CVS Health faces stiff competition from other major players in the healthcare landscape. In the retail pharmacy space, Walgreens and Rite Aid are key rivals. The PBM market sees competition from Express Scripts and OptumRx. In the health insurance sector, CVS Health competes with giants like UnitedHealthcare, Anthem, and Cigna. These competitors challenge CVS Health to continually innovate and improve its services to maintain its market share.

Headquartered in Woonsocket, Rhode Island, CVS Health has a vast nationwide presence. Its extensive network of retail pharmacies, coupled with its PBM and health insurance operations, gives the company a significant reach across the United States.

Recent Earnings:

CVS Health Corporation reported a revenue of $95.4 billion, which represented a 6.3% increase compared to the same period in the previous year. This growth was primarily driven by increased revenue in the Healthcare Benefits and Pharmacy & Consumer Wellness segments. The company’s adjusted earnings per share (EPS) of $1.09 fell short of analysts’ expectations of $1.55. This miss was largely attributed to charges to record premium deficiency reserves of approximately $1.1 billion in their Healthcare Benefits segment, reflecting continued utilization pressure and anticipated losses.

Pharmacy script share increased to 27.3%, indicating strong performance in their retail pharmacy business. The company’s CostVantage program, aimed at simplifying drug pricing, saw over 50% client participation, suggesting growing adoption among their pharmacy benefit management clients. Signify Health, a home health services provider acquired by CVS Health, experienced a 37% year-over-year increase in volume, highlighting growth in their healthcare services segment.

The company anticipates an earnings decline in the pharmacy segment due to continued price improvements and increased competition. They expect improvement in the healthcare benefits segment as they address utilization pressures and implement cost-saving initiatives. These expectations suggest a mixed outlook for CVS Health, with challenges in some areas but opportunities for growth in others.

The company also unveiled a multi-year cost savings initiative targeting over $500 million in savings in 2025. These strategic moves signal CVS Health’s commitment to adapting to the evolving healthcare landscape and improving its operational efficiency.

The Market, Industry, and Competitors:

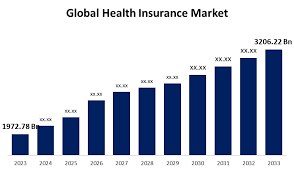

CVS Health Corporation is a diversified healthcare company with a presence in the pharmacy services and retail/long-term care (LTC) segments. The company operates one of the largest Pharmacy Benefit Management (PBM) services in the United States, offering plan design and administration, formulary management, and specialty pharmacy services. CVS Health also has an extensive retail pharmacy network, with nearly 68,000 retail locations under brands like CVS/pharmacy and Longs Drugs. CVS Health operates in the United States, Puerto Rico, and the District of Columbia.

The pharmacy services industry outlook is relatively positive due to expanding healthcare coverage, a growing employed population, and an increasing elderly population seeking drug cost savings. High utilization of prescription drugs and an aging population in the United States, coupled with a 3.7% CAGR through 2030 in the U.S. pharmacy market, could drive top and bottom-line growth through CVS’s diversified revenue streams. CVS could continue to expand its existing wide moat, as the company fills roughly 1 in 4 prescriptions in the United States.

The company’s “Transform Health 2030” strategy focuses on healthy people, a healthy business, a healthy community, and a healthy planet. CVS aims to invest more than $85 billion in inclusive wellness, economic development, and advancement opportunities by 2030.

Unique differentiation:

CVS Health Corporation operates in a highly competitive market, facing challenges from various players across its business segments. In the retail pharmacy space, CVS Health’s main rivals include Walgreens Boots Alliance and Rite Aid. These companies compete for market share by offering similar products and services, such as prescription dispensing, over-the-counter medications, health and beauty products, and convenience items. The competition is intense, with companies constantly striving to attract customers through pricing strategies, loyalty programs, and convenient store locations.

In the pharmacy benefit management (PBM) market, CVS Caremark faces stiff competition from major players like Express Scripts (owned by Cigna) and OptumRx (owned by UnitedHealth Group). These PBMs compete for contracts with employers, health plans, and government entities to manage prescription drug benefits. The PBM market is characterized by complex negotiations, pricing pressures, and the need to demonstrate cost-effectiveness and value to clients. CVS Health competes in the health insurance market through its subsidiary, Aetna.

Integrated Healthcare Model: CVS Health has strategically integrated its various business segments – retail pharmacy, pharmacy benefit management (PBM), and health insurance – to create a comprehensive healthcare ecosystem. This integration allows them to offer a seamless and coordinated experience for patients, from filling prescriptions and managing drug benefits to providing health insurance coverage. This integrated approach is a key differentiator, as it enables CVS Health to address multiple aspects of a patient’s healthcare journey in a coordinated manner.

Extensive Retail Presence: With a vast network of over 9,900 retail pharmacies across the United States, CVS Health has a significant presence in communities nationwide. This widespread reach provides convenient access to healthcare services for millions of Americans. The company’s retail stores serve as a hub for prescription dispensing, over-the-counter medications, health and wellness products, and even in-store clinics (MinuteClinics), making it a one-stop shop for many healthcare needs.

Focus on Convenience and Accessibility: CVS Health has prioritized making healthcare more convenient and accessible for its customers. This is evident in its extensive retail network, its online and mobile platforms for prescription refills and health information, and its MinuteClinics that offer convenient care for minor illnesses and preventive services. By focusing on convenience, CVS Health caters to the evolving needs of consumers who seek easy access to healthcare services.

Management & Employees:

David Joyner: Serves as the President and Chief Executive Officer, leading the company’s overall strategy and operations. He has extensive experience in the healthcare and pharmacy benefit management sectors.

Heidi Capozzi: Holds the position of Executive Vice President and Chief People Officer, responsible for all aspects of human resources, including talent management, compensation, and benefits.

Sree Chaguturu, MD: Serves as the Executive Vice President, President of Health Care Delivery, and Chief Medical Officer. He plays a crucial role in shaping the company’s healthcare delivery strategy and ensuring high-quality patient care.

Tilak Mandadi: Holds the position of Executive Vice President, Ventures and Chief Digital, Data, Analytics and Technology Officer, leading the company’s digital transformation and innovation efforts.

Prem Shah: Holds the position of Executive Vice President and Group President, responsible for overseeing various aspects of the company’s operations.

Len Shankman: Serves as the Executive Vice President and President of Pharmacy and Consumer Wellness, leading the company’s retail pharmacy and consumer health initiatives.

Financials:

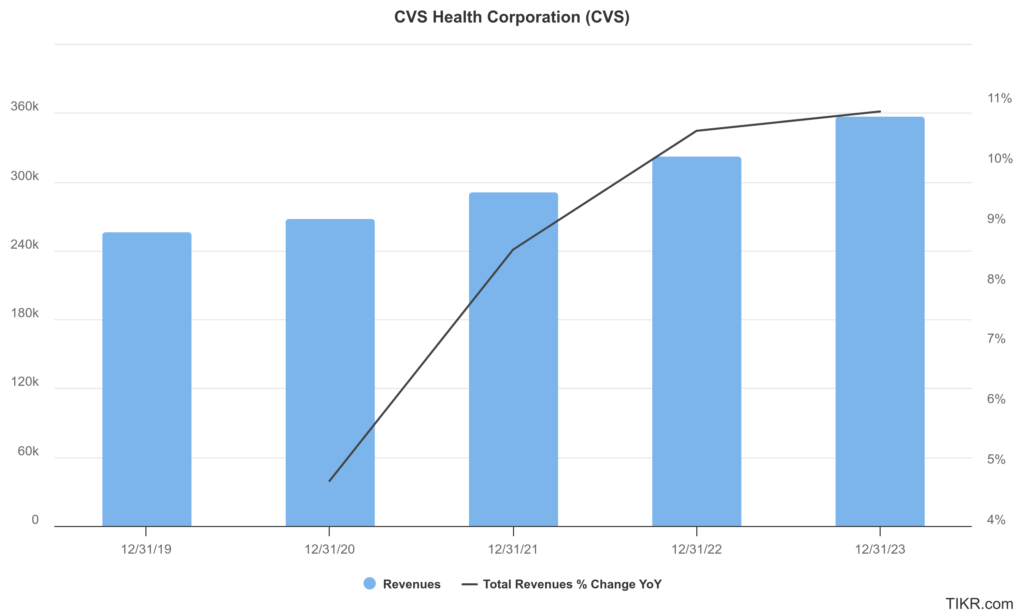

CVS Health Corporation reported a revenue increase of 6.3%, primarily driven by growth in the Health Care Benefits and Pharmacy & Consumer Wellness segments, although this was partially offset by a decline in the Health Services segment. Total revenues reached $95.4 billion. Operating income decreased by 77.5%, primarily due to a decrease in adjusted operating income and restructuring charges of approximately $1.2 billion.

The Health Services segment experienced a 5.9% decrease in total revenues, attributed to the loss of a large client and pharmacy client price improvements, which was partially offset by pharmacy drug mix, contributions from healthcare delivery assets, and growth in specialty pharmacy. The Pharmacy & Consumer Wellness segment saw adjusted operating income increase by 14.9%, driven by increased prescription volume, including vaccinations, improved drug purchasing, pharmacy reimbursement pressure, and decreased front store volume. Prescriptions filled increased by 6.0%, and same-store prescription volume increased by 9.1%. The Health Care Benefits segment reported a revenue increase of 25.5%, driven by growth in the Medicare and Commercial product line.

CVS Health’s total revenues increased to $91.2 billion, a 2.6% increase compared to the prior year. The GAAP diluted EPS decreased from $1.48 to $1.41, and the Adjusted EPS decreased from $2.21 to $1.83, primarily due to a decline in the Health Care Benefits segment’s operating results. The company revised its full-year 2024 GAAP diluted EPS guidance to a range of $4.95 to $5.20 and adjusted EPS guidance to $6.40 to $6.65. The company also revised its full-year 2024 cash flow from operations guidance to approximately $9.0 billion.

CVS Health maintains flexible and ample liquidity, supported by a CFO with between $7 and $11 billion over the forecast period and $7.5 billion.

Technical Analysis:

The stocks is in a stage 4 markdown (bearish) on the monthly and weekly charts, but the daily chart shows a reversal on better momentum. This should carry the stock to the $67 range and then onward to the $75 range. We would be cautious on long term positions yet, but this looks like a good turnaround.

Bull Case:

Aging Population and Rising Healthcare Costs: The aging population and rising healthcare costs are expected to drive increased demand for healthcare services, benefiting companies like CVS Health. Bulls believe that CVS Health is well-positioned to capitalize on these trends, with its diverse business segments and focus on cost management.

Data-Driven Insights: CVS Health’s access to vast amounts of data across its various businesses provides valuable insights into patient behavior and healthcare trends. Bulls believe that the company can leverage these insights to personalize healthcare services, improve health outcomes, and drive innovation, ultimately leading to a competitive edge.

Bear Case:

Reimbursement Pressures: Changes in government regulations and reimbursement policies, particularly for prescription drugs, could negatively impact CVS Health’s revenue and profitability. Pressure to lower drug prices and changes in Medicare or Medicaid reimbursement rates are key concerns for bears.

Debt Burden: CVS Health has taken on significant debt to finance acquisitions, particularly the acquisition of Aetna. While the company is working to pay down this debt, it remains a concern for some investors. Bears worry that a high debt load could limit the company’s financial flexibility and make it more vulnerable to economic downturns.

Consumer Behavior Shifts: Changes in consumer behavior, such as increased adoption of mail-order pharmacies or a shift towards alternative healthcare providers, could negatively impact CVS Health’s retail pharmacy business. Bears are watching for potential disruptions to traditional retail models.