Executive Summary:

Stellantis N.V. is a multinational automotive corporation formed in 2021 through the merger of Fiat Chrysler Automobiles (FCA) and the PSA Group. Stellantis is headquartered in Hoofddorp, Netherlands. Stellantis owns and operates 14 automotive brands, including Jeep, Alfa Romeo, Chrysler, and Maserati. Stellantis is committed to developing and manufacturing cutting-edge technology and sustainable mobility solutions.

Stellantis N.V. achieved net revenues of €189.5 billion, a 6% increase compared to 2022. Net profit grew by 11% to reach €18.6 billion. Stellantis reported industrial free cash flows of €12.9 billion, representing a 19% increase year-over-year.

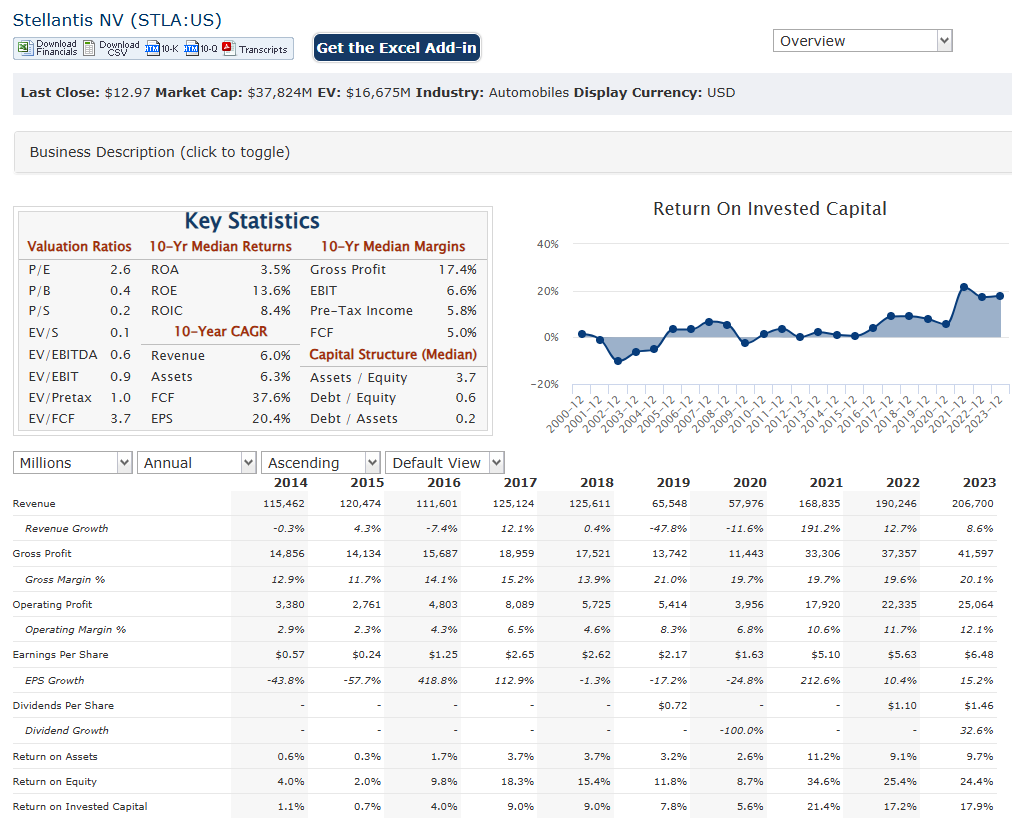

Stock Overview:

| Ticker | $STLA | Price | $12.97 | Market Cap | $38.45B |

| 52 Week High | $29.51 | 52 Week Low | $12.12 | Shares outstanding | 2.88B |

Company background:

Stellantis N.V. is a relatively young automotive giant, formed in January 2021 through a 50/50 merger between Fiat Chrysler Automobiles (FCA) and the PSA Group. FCA itself was the product of a merger between the Italian Fiat and the American Chrysler Corporation, while PSA encompassed French brands like Peugeot and Citroën. Stellantis inherited a legacy of founders like Giovanni Agnelli (Fiat) and Armand Peugeot (Peugeot) rather than having founders of its own.

Stellantis boasts a diverse portfolio of automotive brands, catering to a wide range of consumer needs and preferences. Their brand portfolio includes Jeep, Ram, Dodge, Chrysler, Fiat, Alfa Romeo, Maserati, Peugeot, Citroën, DS Automobiles, Opel, and Vauxhall. This broad range allows Stellantis to compete in various market segments, from mass-market vehicles to luxury and performance cars, as well as commercial vehicles. Their product lineup ranges from the Jeep Wrangler and Ram pickup trucks to the Maserati MC20 supercar and a growing number of electric vehicles.

Stellantis faces intense competition in the global automotive market. Key competitors include other major automakers like Toyota, Volkswagen Group, General Motors, Ford, Hyundai-Kia, and Renault-Nissan-Mitsubishi. These companies compete across various segments, vying for market share with innovative technologies, compelling designs, and competitive pricing. The rise of electric vehicles has also introduced new players and intensified the competition, with companies like Tesla making significant inroads.

Stellantis N.V. is headquartered in Hoofddorp, Netherlands. This location was chosen as a neutral ground for the newly merged company, reflecting the equal partnership between FCA and PSA. While the corporate headquarters are in the Netherlands, reflecting the global nature of its operations and the diverse origins of its brands.

Recent Earnings:

Stellantis N.V. reported net revenues of €189.5 billion, a 6% increase compared to 2022. This growth was driven by a 7% increase in consolidated shipment volumes, indicating healthy demand for Stellantis’ diverse portfolio of vehicles. Net profit also saw a significant jump, rising 11% to reach €18.6 billion.

Stellantis achieved an adjusted operating income (AOI) of €24.3 billion, representing a 1% increase year-over-year. The AOI margin slightly decreased to 12.8% from 13.0% in 2022. This slight dip could be attributed to various factors, including increased investments in research and development, particularly in electrification and software technologies, as well as inflationary pressures on input costs. Stellantis generated robust industrial free cash flows of €12.9 billion, a 19% increase compared to the previous year.

The company reported a 27% increase in global sales of low-emission vehicles (LEV), which include battery electric vehicles (BEV) and plug-in hybrid electric vehicles (PHEV). Stellantis achieved the #1 position in PHEV sales and #2 in overall LEV sales in the U.S. market. Stellantis increased its global BEV sales by 21% in 2023, indicating a positive trajectory in its transition towards electric mobility.

The company aims to achieve carbon net zero emissions by 2038, a goal that requires significant investments in sustainable technologies and operations. Stellantis also plans to continue returning value to shareholders through dividends and share buybacks. The company returned €6.6 billion to shareholders, a 53% increase compared to the previous year.

The Market, Industry, and Competitors:

Stellantis NV, formed in early 2021 through the merger of Fiat Chrysler Automobiles (FCA) and the PSA Group, has become the world’s sixth-largest global manufacturer, boasting 14 brands that span from ultra-compact cars to luxury sports cars. Stellantis is involved in designing, manufacturing, distributing, and selling vehicles.

Under its “Dare Forward 2030” long-term plan, Stellantis aims to double its net revenues to €300 billion by 2030. A key driver will be increasing battery electric vehicle (BEV) sales to over 50% of global revenues, compared to 3% in 2021. The company is planning to have more than 75 BEV models by 2030 and is aiming for 100% BEV sales in Europe and 50% in the United States, targeting over 5 million global BEV sales annually. Stellantis also expects strong growth in software and services, projecting them to represent 20% of total revenues by 2030. The company is targeting more than 25% of net revenues from outside North America and Enlarged Europe, up from 15% in 2021.

Unique differentiation:

Stellantis faces a wide range of competitors in the global automotive market, varying by segment and region. In the mass-market passenger car and light commercial vehicle segments, key competitors include giants like Toyota, Volkswagen Group, Hyundai-Kia, and Renault-Nissan-Mitsubishi. These companies offer a diverse range of vehicles, from compact cars and SUVs to pickup trucks and vans, competing on factors like price, fuel efficiency, and brand reputation. In the North American market, Stellantis faces strong competition from domestic automakers like Ford and General Motors, particularly in the lucrative truck and SUV segments.

In the premium and luxury segments, Stellantis competes with established players like BMW, Mercedes-Benz, Audi, and Lexus. These brands are known for their high-quality vehicles, advanced technology, and prestigious brand image. Stellantis aims to capture market share in these segments with its Alfa Romeo and Maserati brands, focusing on performance, Italian design, and exclusivity. The rise of electric vehicles has intensified competition, with new entrants like Tesla making significant inroads and traditional automakers accelerating their EV development. Stellantis is investing heavily in electrification and plans to launch numerous electric models across its brands to compete in this rapidly growing segment.

Diverse Brand Portfolio: Stellantis boasts an extensive portfolio of 14 iconic and well-established brands, covering a wide spectrum of market segments from mass-market to luxury and performance. This diverse portfolio allows Stellantis to cater to a broad range of customer preferences and compete effectively in various market niches.

Global Presence: Stellantis has a significant presence in key automotive markets worldwide, including North America, Europe, and emerging markets. This global footprint provides Stellantis with economies of scale and allows it to leverage its resources and expertise across different regions.

Multi-Energy Approach: Stellantis is pursuing a multi-energy strategy, investing in various powertrain technologies, including internal combustion engines, hybrid systems, and electric vehicles. This approach provides flexibility and allows Stellantis to adapt to evolving market demands and regulatory requirements.

Management & Employees:

John Elkann: Chairman of the Board of Directors. Elkann brings extensive experience from his leadership roles at Fiat and Exor, the Agnelli family’s investment company.

Robert Peugeot: Vice Chairman of the Board of Directors. Peugeot represents the Peugeot family’s interests and has a long history with the PSA Group.

Olivier Francois: Chief Marketing Officer and Brand CEO for Fiat and Abarth. Francois leads Stellantis’ global marketing efforts and oversees the Fiat and Abarth brands.

Xavier Chéreau: Chief Human Resources and Transformation Officer. Chéreau is responsible for human resources, organizational transformation, and other corporate functions.

Ned Curic: Chief Engineering and Technology Officer. Curic leads Stellantis’ engineering and technology development, focusing on future mobility solutions.

Financials:

Stellantis N.V. has reported net revenues of €85.0 billion, a 14% decrease compared to the first half of 2023, which they attribute primarily to declines in volume and mix. Net profit for the same period was €5.6 billion, a 48% decrease compared to the previous year, influenced by lower volume and mix, foreign exchange headwinds, and restructuring costs. The adjusted operating income (AOI) was €8.5 billion, with an AOI margin of 10%, reflecting cost reductions in direct materials, workforce, and logistics that helped mitigate the revenue decline.

Stellantis is expected to reach €169.55 billion in 2025, a 4.52% increase from €162.22 billion in sales recorded in 2024. Stellantis has set a target to increase net revenues from €152 billion in 2021 to €300 billion by 2030. Fitch Ratings forecasts Stellantis’ EBIT margin to be at 6.2% and 7.7% in 2024 and 2025, respectively, due to a failure to reduce inventory and continued pricing pressure.

Net debt was reported as -€17.950 million in 2021 and -€23.603 million in 2022. Forecasts suggest net debt of -€21.036 million in 2023, -€14.023 million in 2024, -€17.241 million in 2025, and -€20.092 million in 2026. The estimates for key ratios such as EBITDA margin, EBIT margin, and net margin have varied, with fluctuations expected in the coming years. For example, the net margin was 9.42% in 2021, 9.35% in 2022 and is expected to be 9.83% in 2023, but is then predicted to drop to 4.05% in 2024.

Technical Analysis:

The monthly chart is in stage 4 (bearish) markdown, and the weekly chart is starting a consolidation (stage 1) with a retest in the $11.7 – $12.4 range. The daily chart is range bound and only a move higher than $15.14 would be a signal to take a position, but the medium term outlook is not very positive.

Bull Case:

Electrification Progress: Stellantis is making significant strides in its electrification strategy, with increasing sales of low emission vehicles (LEV) and a growing portfolio of electric models across its brands. Success in the EV market is crucial for long-term growth in the automotive industry, and Stellantis’ progress here is a key element of the bull case.

Synergies from the Merger: The merger that created Stellantis has generated significant cost synergies, improving efficiency and profitability. Investors may anticipate further synergies as the company continues to integrate its operations.

Bear Case:

Technological Disruption: The automotive industry is undergoing a rapid transformation, with the rise of electric vehicles, autonomous driving, and connected car technologies. Stellantis needs to adapt quickly to these changes and invest heavily in new technologies to remain competitive. Failure to do so could lead to market share loss.

Dependence on ICE Vehicles: While Stellantis is making progress in electrification, a significant portion of its revenue still comes from internal combustion engine (ICE) vehicles. Regulatory changes and shifting consumer preferences towards EVs could pose a challenge to Stellantis’ long-term growth if it cannot successfully transition to electric mobility.

Brand Perception: Some of Stellantis’ brands may face challenges in maintaining their brand image and attracting younger generations of consumers. Negative brand perception or failure to resonate with evolving consumer preferences could impact sales and profitability.

Execution Risks: Successfully executing the company’s strategic plan, particularly its ambitious electrification and technology initiatives, is crucial for its future success. Any setbacks or delays in these plans could negatively impact investor sentiment and the stock price.