Executive Summary:

Capri Holdings Limited is a global fashion luxury group consisting of iconic, founder-led brands Versace, Jimmy Choo, and Michael Kors. The company designs, manufactures, markets, and retails luxury goods, including ready-to-wear, accessories, footwear, and more. Capri Holdings has a global distribution network, including retail stores, department stores, and e-commerce platforms. While Tapestry, the parent company of Coach and Kate Spade, attempted to acquire Capri Holdings in 2023, the deal was ultimately blocked by a federal judge.

Capri Holdings Limited reported adjusted earnings per share (EPS) of $0.65, falling short of analyst expectations of $0.73. Total revenue of $1.08 billion declined 16.4% compared to the prior year.

Stock Overview:

| Ticker | $CPRI | Price | $24.26 | Market Cap | $2.86B |

| 52 Week High | $50.27 | 52 Week Low | $18.70 | Shares outstanding | 117.89M |

Company background:

Capri Holdings Limited is a multinational fashion holding company headquartered in London, United Kingdom. Formerly known as Michael Kors Holdings Limited, the company was founded in 1981 by American designer Michael Kors. It owns and operates several iconic luxury brands, including Versace, Jimmy Choo, and Michael Kors. Capri Holdings designs, manufactures, markets, and retails a wide range of luxury goods, such as ready-to-wear apparel, accessories, footwear, watches, jewelry, and fragrances.

Capri Holdings has a rich history of acquisitions and brand expansion. In 2013, the company acquired Jimmy Choo, a renowned luxury footwear brand. This acquisition significantly expanded Capri Holdings’ presence in the footwear market and added a new dimension to its portfolio. In 2018, the company made another strategic move by acquiring Versace, a legendary Italian fashion house known for its bold designs and high-end craftsmanship.

Capri Holdings faces competition from a range of other luxury fashion companies, including LVMH, Kering, Richemont, and Tapestry. These companies also own and operate a portfolio of luxury brands and compete with Capri Holdings in various product categories and geographic markets. The luxury fashion industry is characterized by intense competition, with companies constantly striving to innovate, expand their brand reach, and cater to the evolving preferences of high-end consumers.

The company’s revenue has steadily increased, driven by strong performances from its brands and a global expansion strategy. Capri Holdings has also demonstrated a commitment to sustainability and corporate social responsibility, implementing initiatives to reduce its environmental impact and support ethical business practices. As the luxury fashion industry continues to evolve, Capri Holdings is well-positioned to capitalize on growth opportunities and maintain its position as a leading player in the global market.

Recent Earnings:

Capri Holdings Limited reported adjusted earnings per share (EPS) of $0.65, falling short of analyst expectations of $0.73. Total revenue of $1.08 billion declined 16.4% compared to the prior year, driven by softening demand for luxury goods globally. Retail sales declined in the high-single digits, while wholesale revenue decreased double-digits due to softer demand in the Americas and EMEA regions.

The company’s revenue performance was weaker than expected due to a combination of factors, including macroeconomic headwinds, increased competition, and changing consumer preferences. The decline in wholesale revenue was particularly significant, reflecting the challenges facing the traditional wholesale channel in the luxury goods market. The impact was less severe, suggesting that the company’s direct-to-consumer strategy is helping to mitigate some of the challenges facing the wholesale channel.

The company continues to invest in its brands, expand its global reach, and enhance its digital capabilities. The company also remains focused on cost-cutting measures and inventory management to improve profitability. The challenging macroeconomic environment and intense competition in the luxury goods market are likely to continue to pose challenges for the company in the near term.

The company expects to continue to face headwinds in the near term, but it remains optimistic about the long-term prospects for its brands. The company expects to continue to invest in its brands and expand its global reach, while also taking steps to improve its profitability. The company’s guidance is subject to several uncertainties, including the ongoing impact of the macroeconomic environment and the evolving competitive landscape.

The Market, Industry, and Competitors:

Capri Holdings operates in the global personal luxury goods market, a sector encompassing high-end fashion, accessories, jewelry, watches, and other luxury items. This market is characterized by high-growth potential, driven by factors such as increasing global wealth, a growing middle class in emerging economies, and a rising demand for luxury goods among younger consumers. The luxury goods market is expected to continue to grow at a steady pace in the coming years, driven by these underlying trends.

A leading global management consulting firm, forecasts that the market volume will reach €540–€580 billion by 2030, implying a compound annual growth rate (CAGR) of 6%–9%. Statista, a leading statistics portal, projects a more moderate growth rate, estimating that the market will reach $418.9 billion by 2028, implying a CAGR of 3.4%. These projections indicate that the personal luxury goods market is expected to continue to grow at a healthy pace in the coming years, providing opportunities for companies like Capri Holdings to expand their businesses and capture market share.

The growth rate of the personal luxury goods market may be influenced by various factors, including macroeconomic conditions, geopolitical events, and consumer preferences. Economic downturns or geopolitical instability could negatively impact consumer spending on luxury goods, while changes in consumer preferences could affect the demand for specific product categories or brands.

Unique differentiation:

Capri Holdings faces competition from a range of other luxury fashion companies, including LVMH, Kering, Richemont, and Tapestry. These companies also own and operate a portfolio of luxury brands and compete with Capri Holdings in various product categories and geographic markets.

LVMH, the world’s largest luxury goods company, owns a diverse portfolio of brands, including Louis Vuitton, Dior, Gucci, and Tiffany & Co. Kering is another major player in the luxury goods market, with brands such as Gucci, Saint Laurent, and Balenciaga. Richemont is a leading player in the luxury watch and jewelry market, with brands such as Cartier, Van Cleef & Arpels, and Piaget. Tapestry, the parent company of Coach and Kate Spade, is a major competitor in the accessible luxury segment of the market.

These companies compete with Capri Holdings in various ways, including product innovation, brand marketing, retail expansion, and digital commerce. The luxury fashion industry is characterized by intense competition, with companies constantly striving to innovate, expand their brand reach, and cater to the evolving preferences of high-end consumers.

Capri Holdings differentiates itself through a multi-brand strategy that leverages distinct brand identities and caters to diverse consumer segments.

- Versace: Positioned as a high-end, aspirational brand known for its bold designs, Italian heritage, and celebrity endorsements.

- Jimmy Choo: Focuses on luxury footwear and accessories, appealing to a sophisticated and glamorous clientele.

- Michael Kors: Offers more accessible luxury with a wider product range, appealing to a broader customer base.

This diversified portfolio allows Capri Holdings to:

- Target different customer segments: From high-end fashion enthusiasts to more budget-conscious consumers.

- Reduce reliance on any single brand: Mitigating the risk associated with any one brand facing challenges.

- Leverage cross-promotional opportunities: Potentially attracting customers across brands within the portfolio.

This multi-brand approach distinguishes Capri Holdings from competitors like LVMH, which often concentrates on building individual brands to extreme heights.

Management & Employees:

John Idol: Chairman and Chief Executive Officer

Krista McDonough: Senior Vice President, General Counsel, and Chief Sustainability Officer

Donatella Versace: Chief Creative Officer of Versace

Financials:

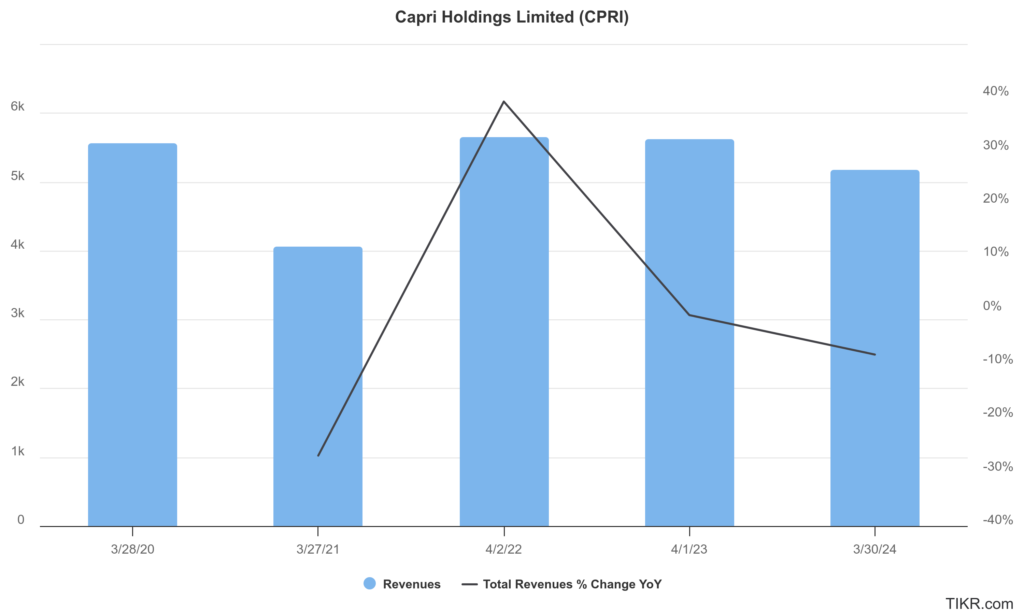

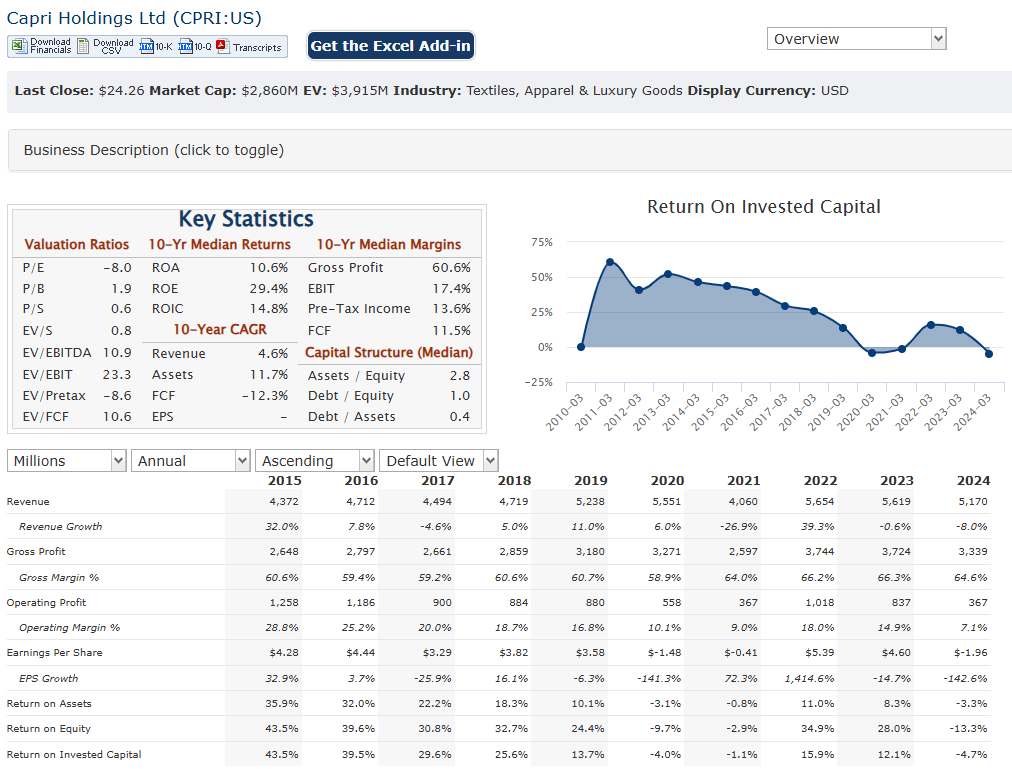

Capri Holdings Limited has reported total revenues of approximately $1.223 billion, which represented an 8.4% decrease from the previous year. This decline followed a trend where revenues peaked in fiscal 2022 at around $1.33 billion, indicating a challenging market environment, particularly influenced by shifts in consumer spending and global economic conditions. The compound annual growth rate (CAGR) for revenue over the last five years stands at approximately 3.5%, reflecting the company’s struggle to maintain consistent growth amid external pressures.

Capri Holdings recorded an EPS of $5.39, but this dropped to $4.60 in fiscal 2023 and further declined to -$1.96 in fiscal 2024. The company’s net income margin also faced pressures, with net margins decreasing from 14.54% in 2022 to just 3.09% in 2024, indicating rising costs and potential inefficiencies that need addressing.

Capri Holding’s net debt stood at approximately $1.524 billion, a slight decrease from $1.578 billion the previous year but higher than the low of $991 million recorded in fiscal 2022. The leverage ratio (Debt/EBITDA) increased to 2.16x in fiscal 2024 from lower levels in previous years, suggesting that while the company is still managing its debt effectively, it is becoming more leveraged as it navigates through current financial challenges.

The company grappling with market fluctuations and operational challenges while trying to sustain growth and profitability. The firm must focus on strategic initiatives to enhance revenue generation and improve earnings stability to recover from recent setbacks and position itself for future growth opportunities.

Technical Analysis:

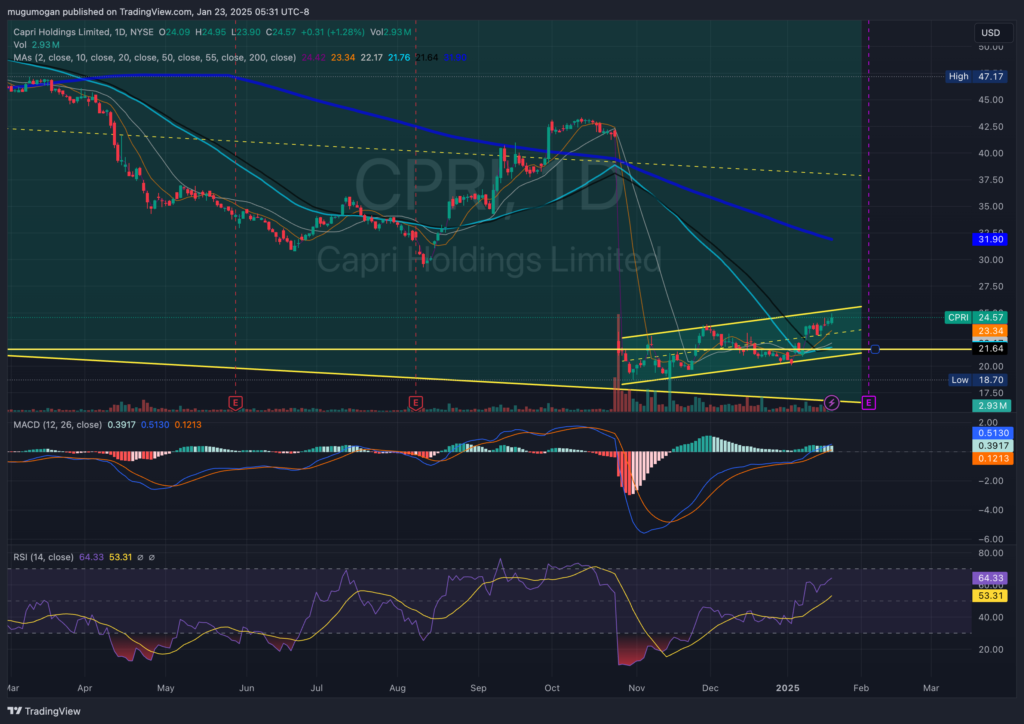

A stage 4 markdown (bearish) on the monthly chart and a stage 3 consolidation (neutral) on the weekly chart. The weekly chart shows a bear flag indicating a move lower to the support at $21 – $22 range. The daily chart is bullish however, at stage 2 but resistance at $30 exists.

Bull Case:

Multi-Brand Strategy: Capri Holdings’ diversified portfolio allows it to target different customer segments, reducing reliance on any single brand and mitigating risk.

Cost-Cutting Measures: The company has implemented cost-cutting measures to improve profitability, which could boost margins in the future.

Digital Transformation: Capri Holdings is investing in its digital capabilities, which could help to drive sales growth and improve customer engagement.

Bear Case:

Economic Uncertainty: Global economic uncertainty, including potential recessions and rising interest rates, could negatively impact consumer spending on luxury goods.

Changing Consumer Preferences: Shifting consumer preferences, such as a preference for experiences over material possessions, could negatively impact demand for luxury goods.

Failed Tapestry Acquisition: The failed acquisition by Tapestry has created uncertainty and may have negatively impacted investor sentiment.