Executive Summary:

Snowflake Inc. is a cloud-based data warehousing and analytics company that provides customers with a single platform for all their data needs. The company’s platform allows businesses to store, process, and analyze data from various sources, including databases, applications, and the Internet of things. Snowflake’s technology is designed to be scalable, secure, and cost-effective, making it a popular choice for businesses of all sizes. Snowflake’s innovative approach to data management has positioned it as a leader in the evolving data analytics landscape.

Snowflake Inc. reported its revenue for the quarter was $942.1 million, representing 28% year-over-year growth and exceeding analyst expectations of $900.3 million. Product revenue for the quarter was $900.3 million, representing 29% year-over-year growth. The company also reported a net loss of $327.9 million.

Stock Overview:

| Ticker | $SNOW | Price | $162.00 | Market Cap | $53.48B |

| 52 Week High | $237.72 | 52 Week Low | $107.13 | Shares outstanding | 330.1M |

Company background:

Snowflake Inc. is a cloud-based data warehousing and analytics company that provides customers with a single platform for all their data needs. Founded in 2012 by Benoit Dageville, Thierry Cruanes, and Marcin Zukowski, the company’s innovative architecture separates data storage from data processing, allowing businesses to scale their data operations independently. This unique approach has garnered significant attention and investment, with Snowflake securing substantial funding from prominent venture capital firms such as Sequoia Capital, Redpoint Ventures, and Altimeter Capital.

Snowflake’s flagship product is its Data Cloud, a platform that enables organizations to store, process, analyze, and share data from various sources, including databases, applications, and the internet of things. The Data Cloud is designed to be highly scalable, secure, and cost-effective, making it a popular choice for businesses of all sizes. Key features of the platform include data warehousing, data lake capabilities, data sharing, and a wide range of data services.

Snowflake faces competition from several major players in the data warehousing and analytics market. These competitors include Amazon Web Services (AWS) with its Redshift and S3 services, Microsoft Azure with its Synapse Analytics and Data Lake Storage, and Google Cloud Platform with its BigQuery and Cloud Storage. Other notable competitors include Databricks, Cloudera, and Teradata.

Snowflake is headquartered in Bozeman, Montana, with offices worldwide. The company has experienced rapid growth in recent years, driven by the increasing demand for cloud-based data solutions and its innovative approach to data management. Snowflake’s success has positioned it as a leader in the evolving data analytics landscape.

Recent Earnings:

Snowflake Inc. reported its revenue for the quarter was $942.1 million, representing 28% year-over-year growth and exceeding analyst expectations of $900.3 million. Product revenue for the quarter was $900.3 million, representing 29% year-over-year growth. The company also reported a net loss of $327.9 million. The company’s remaining performance obligations (RPO), a key metric that indicates future revenue, were $5.7 billion at the end of the quarter, representing 55% year-over-year growth.

Snowflake’s net revenue retention rate remained strong at 127%, indicating that existing customers are increasing their spending on the Snowflake platform. The company also reported a significant increase in its customer base, with 542 customers generating more than $1 million in trailing 12-month product revenue, representing 25% year-over-year growth. Snowflake now has 754 Forbes Global 2000 customers, representing 8% year-over-year growth.

Snowflake raised its product revenue guidance to approximately $3.43 billion, up from its prior forecast of $3.36 billion. This revised guidance reflects the company’s strong third-quarter performance and continued momentum in the business.

The Market, Industry, and Competitors:

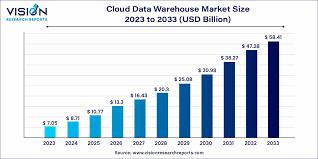

Snowflake operates in the rapidly growing cloud data warehousing and analytics market. This market is driven by several key factors, including the increasing volume of data generated by businesses, the rise of cloud computing, and the growing demand for data-driven insights to improve decision-making. The cloud data warehousing market is driven by the migration of traditional on-premises data warehouses to the cloud and the increasing adoption of cloud-native applications and data platforms.

The global data and analytics market will reach $300 billion by 2025, growing at a compound annual growth rate (CAGR) of 11.3% from 2020 to 2025. This growth is driven by the increasing importance of data in the digital economy. Snowflake is well-positioned to capitalize on this growth, given its innovative technology, strong customer base, and expanding product portfolio.

The company aims to maintain its position as a leader in the cloud data warehousing market and continue to expand its customer base and revenue streams. Snowflake’s long-term growth strategy is focused on several key areas, including expanding its product offerings, investing in research and development, and expanding its global reach. The company is also focused on developing new partnerships and integrations with other technology providers to enhance its platform and expand its market reach.

Unique differentiation:

- Cloud Giants:

- Amazon Web Services (AWS): A dominant force in cloud computing, AWS offers strong competition with its Redshift data warehouse and S3 data lake storage services. Leveraging its extensive cloud infrastructure and broad customer base, AWS presents a significant challenge to Snowflake.

- Microsoft Azure: Azure Synapse Analytics and Azure Data Lake Storage provide robust alternatives to Snowflake, particularly for customers deeply invested in the Microsoft ecosystem. Azure’s strong enterprise focus and integration with other Microsoft products make it a formidable competitor.

- Google Cloud Platform (GCP): GCP offers BigQuery, a powerful serverless data warehousing service known for its performance and cost-effectiveness. Google’s focus on data analytics and machine learning provides a strong foundation for its competitive offerings.

- Specialized Competitors:

- Databricks: A leading player in the data lakehouse space, Databricks offers a unified platform for data engineering, data science, and machine learning. Its strong focus on data engineering and open-source technologies presents a compelling alternative for certain use cases.

- Cloudera: A veteran in the big data space, Cloudera offers a comprehensive data platform that includes data warehousing, data lake, and data analytics capabilities. Cloudera’s strong enterprise focus and partnerships provide a solid foundation for its competitive position.

These competitors offer a range of features and capabilities, and the competitive landscape is constantly evolving. Snowflake must continuously innovate and differentiate its offerings to maintain its competitive edge in this dynamic market.

Scalability and Flexibility: Snowflake’s architecture decouples storage and compute, allowing for independent scaling of both. This provides unparalleled flexibility and cost-effectiveness for businesses with varying data volumes and processing needs.

Data Sharing Marketplace: Snowflake’s Data Sharing Marketplace enables organizations to securely and easily share data with other companies, partners, and even customers. This fosters new data-driven collaborations and creates unique revenue opportunities.

Multi-cloud Support: Snowflake operates across all major cloud providers (AWS, Azure, GCP), offering customers flexibility and avoiding vendor lock-in.

Management & Employees:

Sridhar Ramaswamy: Chief Executive Officer and Director

Benoit Dageville: Co-Founder and President of Products

Denise Persson: Chief Marketing Officer

Christian Kleinerman: EVP, Product

Mike Speiser: Director

Financials:

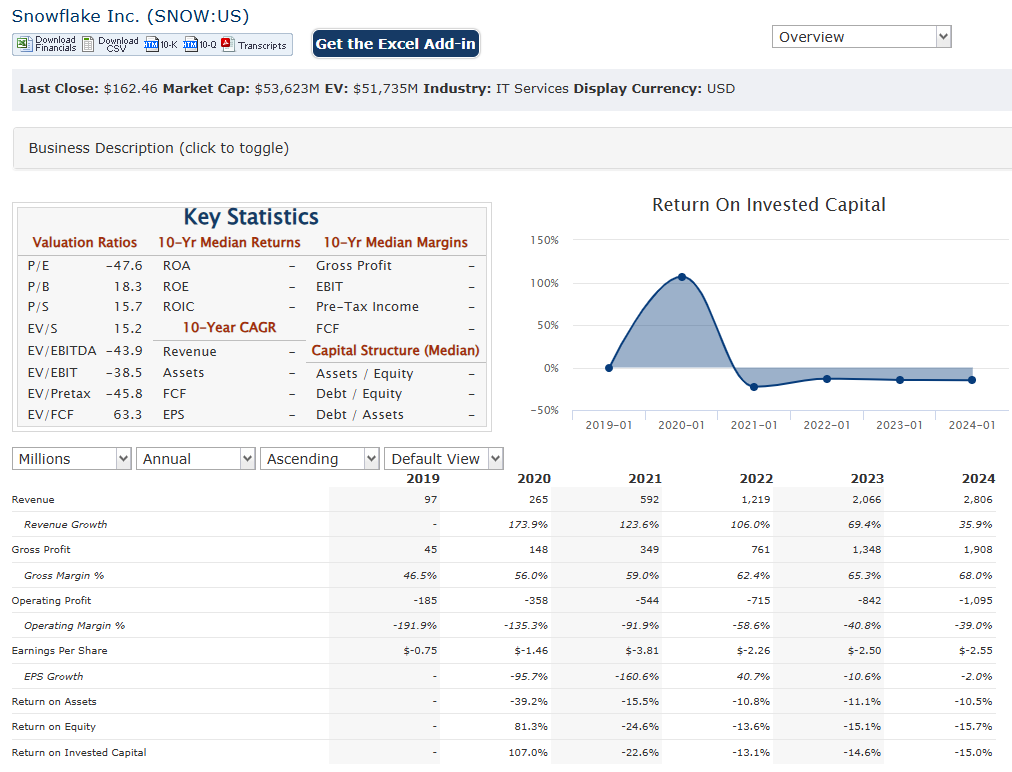

Snowflake Inc. has reported product revenue of approximately $900 million, reflecting a 29% year-over-year growth and total revenue for the fiscal year projected at about $3.43 billion, also up 29% from the previous year. The company’s five-year revenue CAGR stands impressively at 67.96%, indicating sustained expansion and market penetration in the cloud data warehousing sector.

The company has not yet achieved consistent profitability, with net losses reported in recent quarters. For instance, in the third quarter of fiscal 2025, Snowflake recorded a net loss of approximately $365.5 million. There has been a notable increase in net revenue retention rate, which reached 127%, showcasing the company’s ability to effectively retain and expand its customer base. The earnings per share (EPS) have fluctuated, with estimates for the current year around $0.14, indicating challenges in translating revenue growth into profit.

The remaining performance obligations (RPO), which indicate future revenue from existing contracts, stood at $5.7 billion—up 55% year-over-year. Snowflake’s market capitalization has reached approximately $80 billion, further emphasizing investor confidence despite ongoing operational losses.

The company is in rapid growth mode focusing on expanding its market presence while grappling with profitability challenges. The impressive revenue growth and high retention rates signal strong operational execution and customer satisfaction, positioning Snowflake as a formidable player in the cloud data industry.

Technical Analysis:

An early bull flag on the monthly chart and similar on the weekly chart is a good sign. The daily chart is showing a bottom at $151 and reversal on the gains, but a lot of resistance at $170. The long term (1+ year) outlook is more promising based on the chart, with buying signals at the $135 – $140 gap.

Bull Case:

First-mover advantage and strong market position: Snowflake is a pioneer in the cloud data warehousing and analytics space, having established a strong market position with its innovative architecture and data sharing capabilities. This first-mover advantage gives the company a significant head start over competitors.

Rapid growth and strong financials: Snowflake has consistently demonstrated strong revenue growth and a rapidly expanding customer base. The company’s financials have been impressive, with high revenue growth rates and increasing profitability. This strong financial performance provides a solid foundation for future growth.

Bear Case:

High Valuation: Snowflake’s stock has historically traded at a premium valuation, reflecting high growth expectations. If the company fails to meet these expectations, the stock price could experience significant downward pressure.

Profitability Challenges: Snowflake has yet to achieve consistent profitability, with ongoing operating losses. This raises concerns about the company’s ability to generate sustainable profits as it scales its operations.