Executive Summary:

Spotify Technology S.A. is a leading audio streaming and media services provider that revolutionized the way people consume music and podcasts. Spotify offers a vast library of songs and podcasts, accessible through a user-friendly platform on various devices. The company generates revenue primarily through premium subscriptions, which offer ad-free listening, higher audio quality, and exclusive features.

Spotify Technology S.A. reported a total revenue of €3.98 billion, representing a 19% year-over-year increase. Net income attributable to owners of the parent reached €300 million. Total monthly active users (MAUs) grew 11% year-over-year to 640 million.

Stock Overview:

| Ticker | $SPOT | Price | $479.46 | Market Cap | $93.97B |

| 52 Week High | $506.47 | 52 Week Low | $185.37 | Shares outstanding | 195.76M |

Company background:

Spotify Technology S.A., a multinational media services company, was founded in 2006 by Daniel Ek and Martin Lorentzon. The company’s headquarters are located in Stockholm, Sweden. Spotify has secured investments from prominent firms like DST Global, Sequoia Capital, and Accel Partners.

Spotify’s primary product is a music streaming platform that provides on-demand access to millions of songs and podcasts. It operates on a freemium model, offering a free tier with ad-supported music and a premium subscription tier that removes ads, enables offline listening, and provides higher audio quality.

Spotify faces stiff competition from major players like Apple Music, Amazon Music, and YouTube Music. These companies offer similar services and compete aggressively for market share. Spotify has established itself as a leading platform by focusing on user experience, exclusive content, and strategic partnerships with artists and labels.

Recent Earnings:

Spotify Technology S.A. reported a total revenue reached €3.98 billion, marking a 19% year-over-year increase. The company’s net income attributable to owners of the parent surged to €300 million, or €1.45 per share, a significant improvement from €65 million in the same period of the previous year.

The company’s strong performance can be attributed to several factors, including effective content acquisition and curation, innovative product features, and successful marketing campaigns. Spotify’s focus on podcasting has contributed to user growth and revenue diversification.

Monthly active users (MAUs) increased 11% year-over-year to 640 million, reflecting the company’s expanding user base. Premium subscribers grew 12% year-over-year to 252 million, driven by attractive subscription plans and exclusive content offerings. Spotify’s gross margin reached 31.1%.

Spotify expects total revenue of €4.1 billion and total MAUs of 665 million. The company remains optimistic about its future prospects, driven by its strong market position, innovative products, and expanding user base.

The Market, Industry, and Competitors:

Spotify operates in the highly competitive music streaming market, where it competes with major players like Apple Music, Amazon Music, and YouTube Music. This market is characterized by rapid technological advancements, changing consumer preferences, and increasing demand for high-quality audio content. The industry is driven by factors such as the growing popularity of streaming services, increasing smartphone penetration, and the rise of smart speakers.

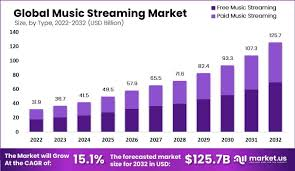

Analysts project significant growth for the music streaming market, with expectations of a Compound Annual Growth Rate (CAGR) of around 10-15% between 2024 and 2030. This growth is fueled by factors such as increasing internet penetration, rising disposable incomes, and the growing popularity of podcasts and audiobooks.

Spotify aims to capture a significant share of this market by expanding its user base, increasing premium subscriptions, and diversifying its revenue streams. The company’s focus on innovative features, exclusive content, and strategic partnerships with artists and labels will be crucial in driving future growth. Spotify’s strong brand recognition, extensive content library, and user-friendly platform position it as a leading player in the music streaming industry.

Unique differentiation:

Spotify operates in the highly competitive music streaming market, facing competition from major players like Apple Music, Amazon Music, YouTube Music, and Tidal. These companies offer similar services, competing aggressively for market share through their vast libraries of songs, user-friendly platforms, and exclusive content offerings.

Apple Music, with its deep integration into the Apple ecosystem and extensive library of songs, is a formidable competitor. Amazon Music, leveraging its massive user base and e-commerce infrastructure, also poses a significant threat. YouTube Music, with its free ad-supported tier and integration with YouTube videos, has attracted a large audience. Tidal, known for its high-fidelity audio quality and exclusive content partnerships, caters to a niche market of audiophiles.

Other notable competitors include Deezer, Pandora, and SoundCloud, each offering unique features and targeting specific segments of the music streaming market. The competitive landscape is constantly evolving, with new entrants and innovative technologies emerging.

Personalized User Experience:

- Algorithmic Recommendations: Spotify’s advanced algorithms analyze user listening habits to deliver highly personalized music and podcast recommendations, enhancing user engagement and discovery.

- Customizable Playlists: Users can create and curate their own playlists, as well as discover curated playlists tailored to their interests, providing a personalized listening experience.

Strong Focus on Podcasting:

- Extensive Podcast Library: Spotify has invested heavily in building a vast library of podcasts, including exclusive content and original shows, attracting a diverse audience and differentiating itself from competitors that primarily focus on music.

- User-Friendly Podcast Platform: Spotify’s user-friendly interface and seamless integration of podcasts into the music listening experience have made it a popular platform for podcast consumption.

Social Features and Community:

- Collaborative Playlists: Users can create and share collaborative playlists with friends and family, fostering a sense of community and social interaction.

- Social Sharing: Users can easily share their favorite music and podcasts on social media platforms, increasing brand visibility and driving user acquisition.

Management & Employees:

Daniel Ek: Founder, CEO, and Chairman of the Board. He oversees the company’s overall strategy and vision.

Gustav Söderström: Co-President and Chief Product & Technology Officer. He leads product development, technology, and research & development.

Alex Norström: Co-President and Chief Business Officer. He oversees the company’s business operations, including advertising, partnerships, and market expansion.

Eve Konstan: General Counsel. She provides legal counsel and oversees legal affairs for the company.

Financials:

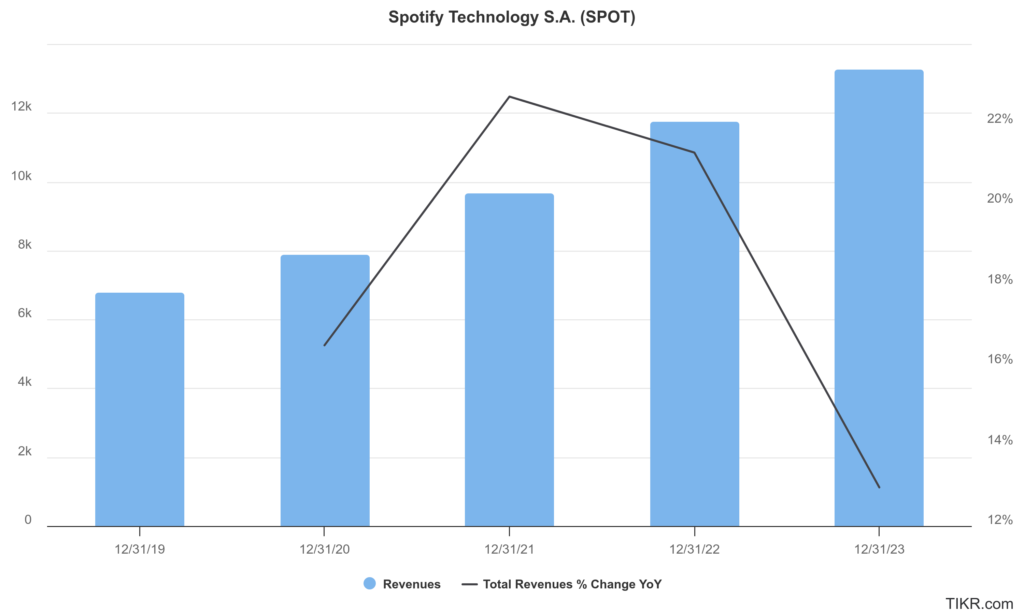

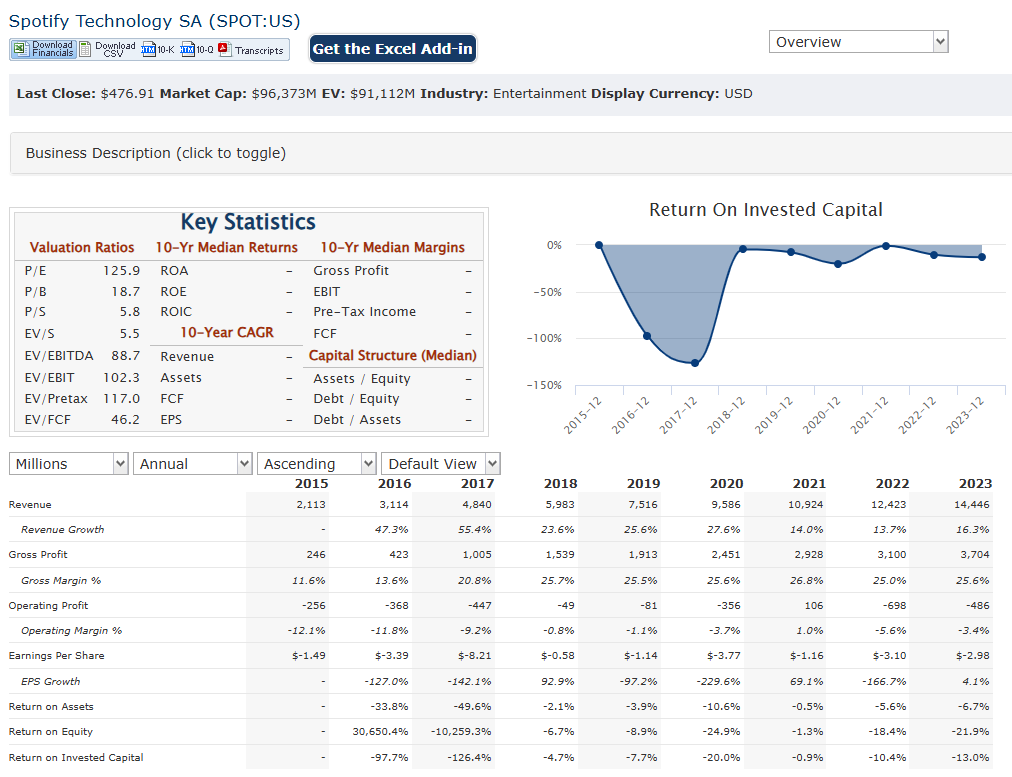

Spotify Technology S.A. has experienced revenue growth, with annual revenues increasing from approximately €7.88 billion in 2020 to €13.25 billion in 2023, representing a compound annual growth rate (CAGR) of about 12.96%. This growth trajectory reflects Spotify’s expanding user base and its successful monetization strategies, particularly through its Premium subscription service, which accounted for about 87% of total revenue in 2023. Spotify continued this trend with quarterly revenues showing a year-over-year growth of approximately 19.83%, indicating robust demand for its services amid increasing competition in the streaming market.

The company reported net losses throughout this period, with net income figures deteriorating from a loss of €581 million in 2020 to a loss of €532 million in 2023. The earnings CAGR over this period is notably negative, highlighting ongoing challenges in achieving sustainable profitability. There have been signs of improvement; for instance, Spotify reported a net income of €65 million in Q3 2023 after several quarters of losses.

Spotify reported total assets of approximately €7.59 billion against total liabilities of about €5.45 billion, resulting in total equity of around €2.14 billion. The company’s current ratio stands at 1.27, indicating a healthy liquidity position to cover short-term obligations. The debt-to-equity ratio is relatively high at approximately 56.52%, suggesting that the company relies on debt financing to support its operations and growth initiatives.

Spotify has demonstrated an increase in user subscriptions and content offerings, but its journey toward profitability remains challenging. The company continues to invest heavily in expanding its platform and enhancing user experience, which may eventually translate into sustainable earnings as it navigates the competitive landscape of digital streaming services.

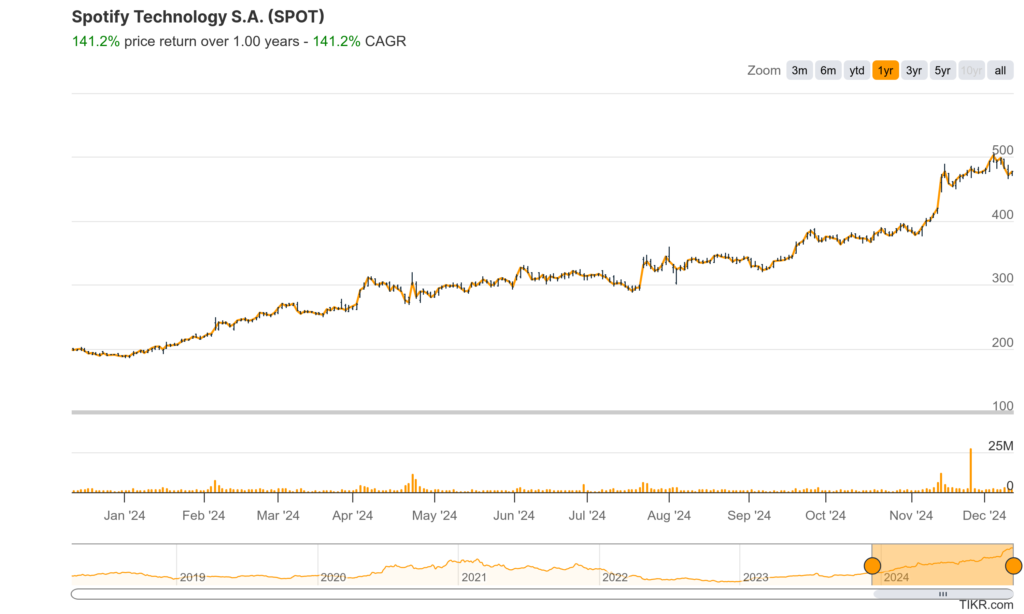

Technical Analysis:

The stock is in a stage 2 markup (bullish) on all 3 timeframes with a strong move in the monthly chart. The near term move should be to the $500 range where it has some resistance, which should see it get back to the support at $474 range and have more support in the $375 range as well.

Bull Case:

Strong Growth Momentum: Spotify has consistently demonstrated robust revenue and user growth, fueled by a growing global subscriber base and expansion into new markets. The company’s focus on content acquisition, product innovation, and strategic partnerships has contributed to this positive trajectory.

Long-Term Growth Potential: The global music streaming market is still in its early stages of growth, with significant potential for expansion. As internet penetration increases and consumer preferences shift towards streaming, Spotify is well-positioned to capitalize on this growth opportunity.

Bear Case:

Rising Content Costs: The cost of acquiring and licensing music rights is increasing, which can impact Spotify’s profitability. As competition intensifies, the company may need to pay higher licensing fees to secure exclusive content and maintain its competitive advantage.

Economic Downturns: Economic downturns can negatively impact consumer spending, leading to lower subscription rates and reduced advertising revenue. This could affect Spotify’s revenue growth and profitability.

Regulatory Risks: Changes in regulatory policies, such as increased taxation or stricter data privacy regulations, could impact Spotify’s operations and financial performance.