Executive Summary:

United Rentals Inc., a leading equipment rental company, boasts the largest rental fleet globally. The company caters to diverse customer segments, including construction, industrial, utilities, municipalities, and homeowners. United Rentals offers a wide range of equipment for rent, encompassing general and aerial rentals, specialty equipment like trench safety solutions, and various tools and light equipment.

United Rentals Inc. reported an net income of $708 million and adjusted earnings per share (EPS) of $11.80, surpassing analyst estimates. Revenue for the quarter reached $4.0 billion.

Stock Overview:

| Ticker | $URI | Price | $858.92 | Market Cap | $56.36B |

| 52 Week High | $896.98 | 52 Week Low | $491.60 | Shares outstanding | 65.62M |

Company background:

United Rentals Inc., a leading equipment rental company, was founded on August 14, 1997. The company offers a wide range of equipment for rent, including construction equipment, general tools, and specialty items like aerial work platforms and trench safety equipment. United Rentals operates through a vast network of rental locations across North America, Europe, Australia, and New Zealand, catering to diverse customer segments such as construction companies, industrial facilities, utilities, municipalities, and homeowners.

United Rentals faces competition from various players in the equipment rental industry. Key competitors include H&E Equipment Services, American Equipment Co., Herc Rentals, and Maxim Crane Works. These companies offer similar products and services, competing for market share based on factors like fleet size, geographic reach, customer service, and pricing. United Rentals is headquartered in Stamford, Connecticut, USA.

Recent Earnings:

United Rentals Inc. reported a net income of $708 million and adjusted earnings per share (EPS) of $11.80, exceeding analyst estimates. Revenue for the quarter reached $4.0 billion, slightly below analyst projections.

United Rentals reported total revenue of $3.992 billion, including rental revenue of $3.463 billion. Net income for the quarter increased 0.7% year-over-year to a third-quarter record of $708 million. GAAP diluted earnings per share were $10.70, and adjusted EPS was $11.80. Adjusted EBITDA reached $1.904 billion, with a margin of 47.7%. Year-over-year, fleet productivity increased 3.5%.

The company expects total revenue between $15.10 billion and $15.30 billion, adjusted EBITDA between $7.115 billion and $7.215 billion, and net rental capital expenditures after gross purchases between $2.05 billion and $2.25 billion. The company also anticipates net cash provided by operating activities between $4.40 billion and $4.80 billion.

The Market, Industry, and Competitors:

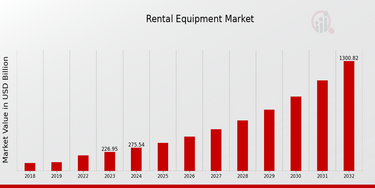

United Rentals Inc. operates primarily within the equipment rental industry, which is a significant segment of the broader construction and industrial sectors. As the largest equipment rental company globally, United Rentals holds approximately 15-16% market share in North America, where it provides a diverse range of equipment for general industrial, commercial construction, and residential construction markets. The company has expanded its offerings through both organic growth and numerous acquisitions, establishing a fleet valued at around $21 billion and a network of over 1,400 locations across the United States, Canada, and select international markets such as Europe and Australia.

The global construction equipment rental market is expected to reach approximately $280 billion, reflecting a compound annual growth rate (CAGR) of about 5.3% from 2023 to 2030. For United Rentals, analysts anticipate a revenue CAGR of around 6.8%, driven by increasing penetration of rental services in North America and a growing preference for renting over purchasing equipment among customers. This growth is supported by trends favoring flexible rental solutions in response to fluctuating demand in construction and industrial activities, positioning United Rentals to capitalize on these market dynamics effectively.

Unique differentiation:

United Rentals faces competition from various players in the equipment rental industry. Key competitors include H&E Equipment Services, American Equipment Co., Herc Rentals, and Maxim Crane Works. These companies offer similar products and services, competing for market share based on factors like fleet size, geographic reach, customer service, and pricing.

H&E Equipment Services, for instance, is a significant player in the construction and industrial equipment rental market, with a strong presence in the United States. American Equipment Co. is another major competitor, offering a wide range of equipment for rent, including aerial work platforms, earthmoving equipment, and general tools. Herc Rentals is a well-established company with a strong focus on construction and industrial equipment rental. Maxim Crane Works specializes in crane rental and rigging services, catering to the construction and infrastructure sectors.

United Rentals’ strong brand recognition, extensive fleet, and focus on customer service provide a competitive advantage.

1. Extensive Fleet and Network:

- Largest Fleet: United Rentals boasts the world’s largest equipment rental fleet, offering a diverse range of equipment to cater to various customer needs.

- Wide Network: The company’s extensive network of rental locations across North America, Europe, Australia, and New Zealand ensures convenient access for customers.

2. Strong Financial Performance:

- Consistent Growth: United Rentals has a track record of consistent growth and profitability, driven by strategic acquisitions, organic growth, and operational excellence.

- Financial Stability: The company’s strong financial position enables it to invest in its business, expand its fleet, and weather economic downturns.

Management & Employees:

Matthew J. Flannery: As the President and CEO, Flannery oversees the overall strategy and operations of United Rentals.

Michael D. Durand: As the Executive Vice President and Chief Operating Officer, Durand oversees the company’s operational activities, including fleet management, maintenance, and customer service.

Craig A. Pintoff: As the Executive Vice President and Chief Administrative Officer, Pintoff is responsible for various administrative functions, including human resources, information technology, and real estate.

Financials:

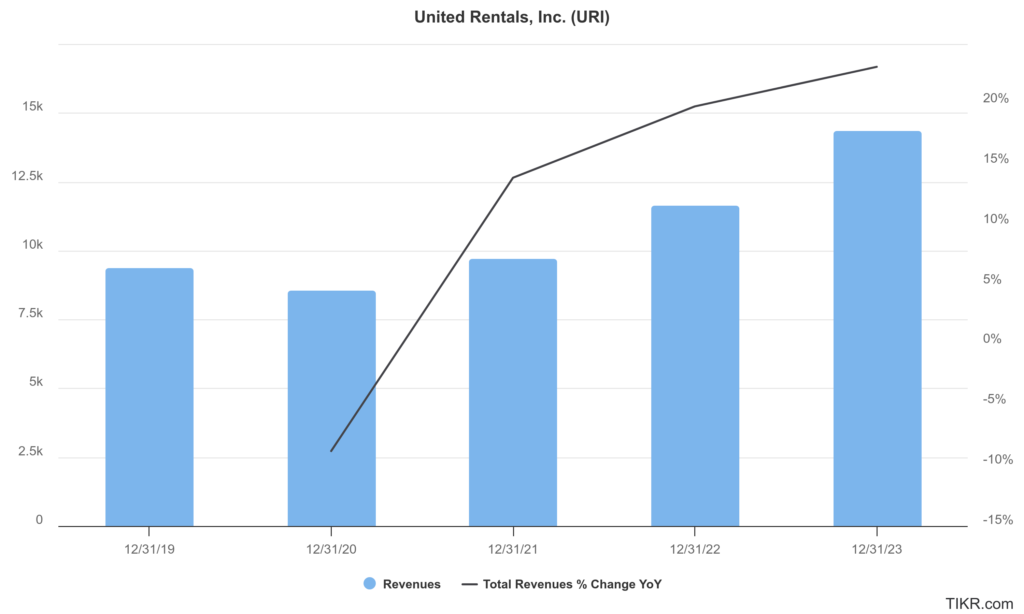

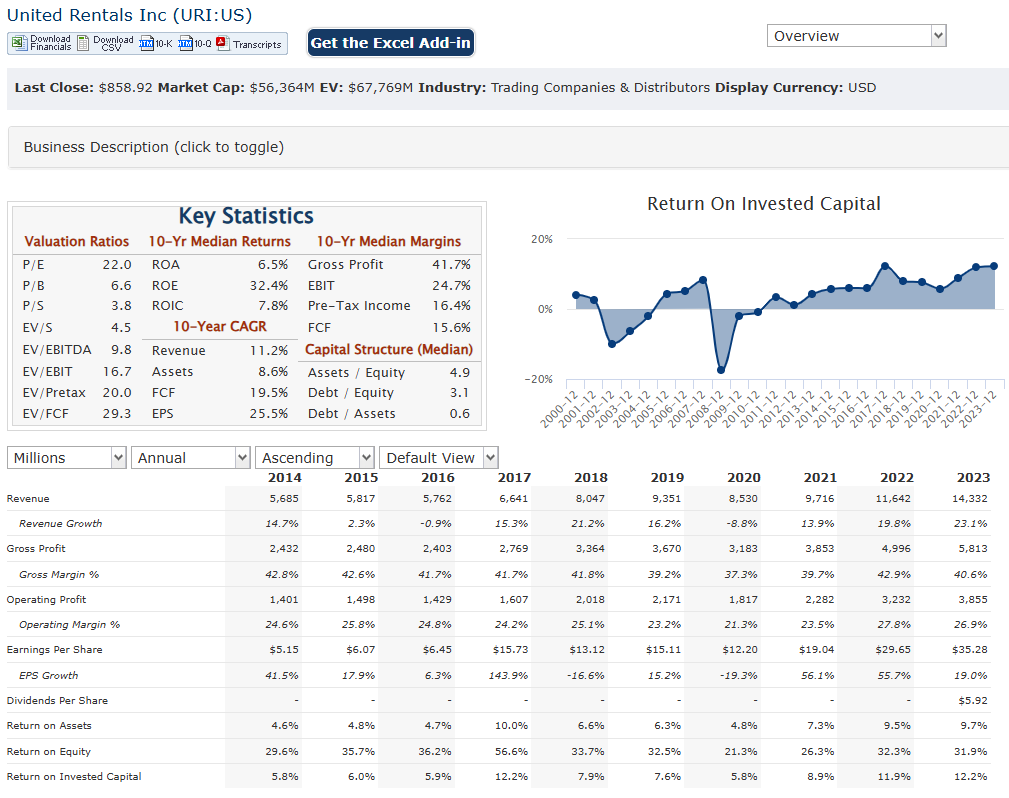

United Rentals Inc. has reported total revenues of approximately $8.945 billion, which increased steadily to around $14.332 billion by 2023. This growth trajectory reflects a compound annual growth rate (CAGR) of approximately 10.5% over the five years. The company’s ability to capitalize on strong demand in both construction and industrial markets, coupled with strategic acquisitions such as Ahern Rentals in late 2022.

Earnings performance has also been impressive, with net income rising from about $1.745 billion in 2022 to approximately $1.886 billion in 2023, indicating a year-over-year growth of about 8%. Over the five years leading up to 2023, United Rentals achieved a CAGR of around 11% in net income, driven by operational efficiencies and enhanced fleet utilization. The company’s diluted earnings per share (EPS) reflected this growth, increasing from $25.30 in 2022 to $28.25 in 2023.

United Rentals has maintained a strong financial position, with total stockholders’ equity growing from approximately $7.4 billion in 2019 to about $8.6 billion in 2023. The company’s leverage ratio remains within a manageable range, allowing for continued investment in fleet expansion and capital expenditures, which were projected at around $1.934 billion for net rental capital expenditures in 2023. The company reported cash flows from operating activities of approximately $4.704 billion, underscoring its ability to generate substantial cash flow to support ongoing operations and shareholder returns.

Technical Analysis:

The stock is on a stage 2 markup on the monthly chart (Bullish) and stage 3 consolidation (neutral) on the weekly chart. The daily chart is in stage 4 markdown (Bearish) and the stock should get to the $760 – $780 range in the short to medium term. The stock is a good buy for the long term in the $720 range.

Bull Case:

1. Pricing Power and Profit Margins:

- Pricing Flexibility: URI’s strong market position allows it to exercise pricing power and pass on cost increases to customers.

- High Profit Margins: The company’s efficient operations and scale enable it to maintain high profit margins.

2. Strategic Acquisitions and Growth Initiatives:

- Consolidation Opportunities: URI can capitalize on consolidation opportunities in the fragmented equipment rental industry through strategic acquisitions.

- Technology Investments: The company’s investments in technology can enhance operational efficiency, improve customer experience, and drive growth.

Bear Case:

1. Cyclical Nature of the Industry:

- Economic Downturns: A downturn in the economy, particularly in construction and industrial sectors, can significantly impact demand for rental equipment.

- Interest Rate Sensitivity: Rising interest rates can increase the cost of debt, impacting the company’s financial performance.

2. Operational Risks:

- Fleet Management Challenges: Managing a large and diverse fleet can be complex and costly, requiring significant investment in maintenance and replacement.

- Supply Chain Disruptions: Disruptions in the supply chain, such as component shortages or transportation delays, can impact the availability of equipment and increase costs.

3. Regulatory Risks:

- Environmental Regulations: Increasingly stringent environmental regulations can increase compliance costs and impact operations.

- Labor Regulations: Changes in labor laws and regulations can affect labor costs and employee relations.