Executive Summary:

Moderna, Inc. is a biotechnology company pioneering mRNA technology. They develop and manufacture mRNA-based therapeutics and vaccines. Their innovative platform enables rapid response to emerging health threats, as demonstrated by their COVID-19 vaccine. Moderna’s pipeline includes a variety of treatments and vaccines targeting infectious diseases, rare diseases, and cancer.

Moderna Inc. reported earnings per share (EPS) of $0.03, an improvement from the loss per share of $(9.53) in the same quarter of the previous year. Revenue for the quarter reached $1.9 billion. The company’s year-to-date product sales of $2.2 billion and the reiterated 2024 expected product sales of $3.0 to $3.5 billion indicate a positive outlook.

Stock Overview:

| Ticker | $MRNA | Price | $41.63 | Market Cap | $16.02B |

| 52 Week High | $170.47 | 52 Week Low | $35.80 | Shares outstanding | 384.82M |

Company background:

Moderna, Inc., a pioneering biotechnology company, was founded in 2010 by a team of scientists led by Derrick Rossi and Noubar Afeyan. The company is dedicated to leveraging messenger RNA (mRNA) technology to develop transformative therapeutics and vaccines. Since its inception, Moderna has secured substantial funding through various rounds of venture capital and public offerings, enabling it to invest heavily in research and development.

Moderna’s primary focus lies in developing mRNA-based medicines, which instruct the body’s cells to produce specific proteins that can combat diseases. This innovative approach has led to the development of a diverse pipeline of products, including vaccines for infectious diseases like COVID-19 and RSV, as well as therapeutic candidates targeting cancer and rare diseases. The company’s mRNA platform offers the potential for rapid development and customization of treatments, making it a powerful tool in addressing unmet medical needs.

Moderna operates in a highly competitive landscape with key players such as Pfizer, BioNTech, and CureVac. These companies are also actively involved in mRNA research and development, vying for market leadership in this emerging field. Moderna’s strong scientific foundation, robust pipeline, and strategic partnerships position it as a significant player in the biotechnology industry. The company’s headquarters are located in Cambridge, Massachusetts, USA.

Recent Earnings:

Moderna, Inc. reported earnings per share (EPS) of $0.03, an improvement from the loss per share of $(9.53) in the same quarter of the previous year. Revenue for the quarter reached $1.9 billion, slightly below analyst expectations. While the company’s year-to-date product sales of $2.2 billion and the reiterated 2024 expected product sales of $3.0 to $3.5 billion indicate a positive outlook, the market’s reaction to the earnings report was mixed, reflecting concerns about the sustainability of future revenue growth.

The company initiated dosing in two pivotal Phase 3 trials to assess the efficacy of investigational mRNA vaccines against norovirus and influenza. Moderna expanded its Executive Committee to strengthen its leadership team.

The company reiterated its 2024 expected net product sales of $3.0 to $3.5 billion from its respiratory franchise. The company faces challenges in transitioning from the pandemic-era revenue surge, its robust pipeline, innovative technology, and strong financial position position it for long-term growth.

The Market, Industry, and Competitors:

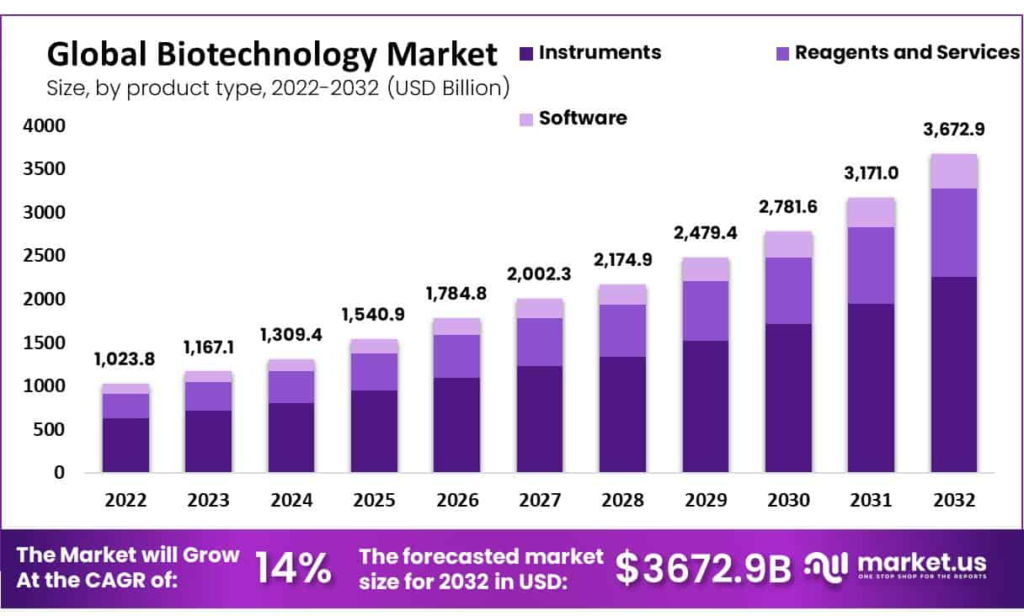

Moderna Inc. operates within the biotechnology sector, focusing on the development of mRNA-based therapeutics and vaccines. The company is renowned for its innovative approach to combating infectious diseases, cancer, autoimmune disorders, and cardiovascular diseases. Moderna’s product sales constituted approximately 97.4% of its revenue, with a diverse portfolio that includes 41 products in various stages of clinical development. Its sales are distributed across the United States (27.7%), Europe (19.8%), and other regions (52.5%). The global market for mRNA therapeutics is experiencing significant growth, driven by increasing demand for personalized medicine and the rising prevalence of chronic diseases.

The mRNA therapeutics market is projected to reach approximately $31.3 billion, growing at a compound annual growth rate (CAGR) of 14.05% from 2024 to 2030. This growth is fueled by advancements in mRNA technology and its applications in various therapeutic areas, including oncology and rare genetic diseases. The hospitals and clinics segment is expected to dominate this market, contributing significantly to its expansion due to the increasing number of patients seeking treatment. Moderna’s strategic focus on expanding its pipeline, particularly in respiratory vaccines and oncology therapeutics, positions it well to capitalize on these market opportunities as it continues to innovate and adapt in a rapidly evolving healthcare landscape.

Unique differentiation:

BioNTech: A German biotechnology company that collaborated with Pfizer to develop one of the leading COVID-19 vaccines. BioNTech is also advancing its mRNA technology for other diseases, making it a direct competitor to Moderna.

CureVac: Another German biotechnology company focused on mRNA-based therapeutics. CureVac has been developing its own mRNA-based COVID-19 vaccine and other therapeutic candidates, positioning itself as a significant player in the mRNA space.

Other notable competitors:

- Pfizer: A global pharmaceutical giant with a strong research and development pipeline, including mRNA-based therapies.

- Merck: A leading pharmaceutical company with a focus on innovative medicines, including vaccines and oncology treatments.

- Johnson & Johnson: A diversified healthcare company with a strong presence in vaccines and other therapeutic areas.

1. Robust Intellectual Property Portfolio:

- Strong Patent Estate: Moderna possesses a robust patent portfolio covering various aspects of mRNA technology, including mRNA design, lipid nanoparticle delivery systems, and specific therapeutic applications.

- Competitive Advantage: This strong IP position provides Moderna with a significant competitive advantage, protecting its innovations and hindering potential competitors.

2. Advanced Manufacturing Capabilities:

- In-House Manufacturing: Moderna has invested in state-of-the-art manufacturing facilities, enabling it to control the entire production process, from mRNA design to final product.

- Scalability: This in-house capability allows for rapid scale-up of production, ensuring timely supply of its products.

3. Diverse Pipeline and Strategic Partnerships:

- Broad Pipeline: Moderna’s diverse pipeline includes a wide range of mRNA-based therapeutics and vaccines targeting various diseases, including infectious diseases, cancer, and rare diseases.

- Strategic Collaborations: The company has formed strategic partnerships with other pharmaceutical companies to accelerate development and expand its market reach.

Management & Employees:

Stéphane Bancel: CEO

Stephen Hoge, MD: President

Kate Cronin: Chief Brand Officer

Jackie Miller, MD: Chief Medical Officer

Financials:

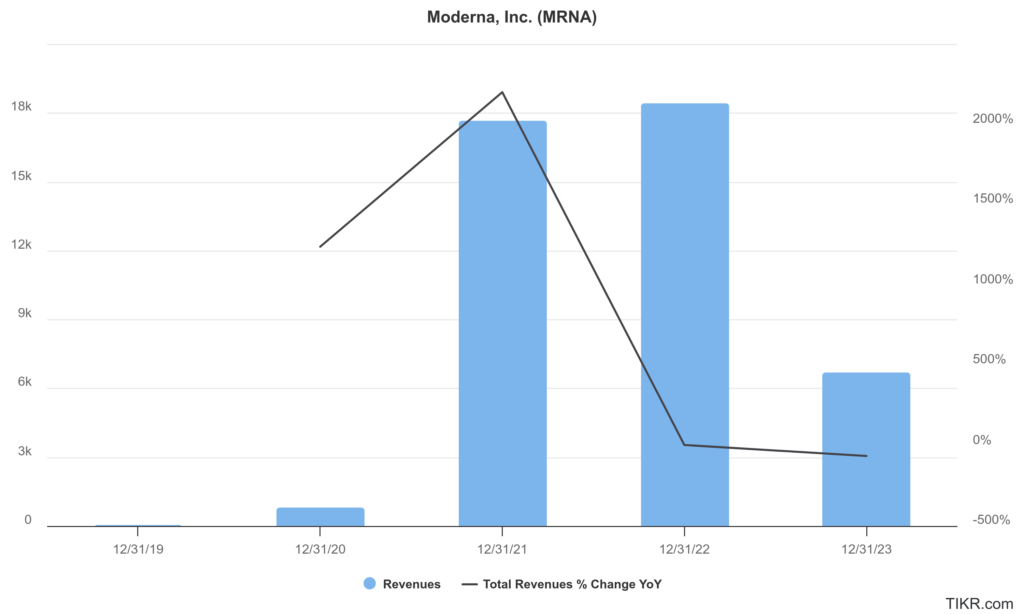

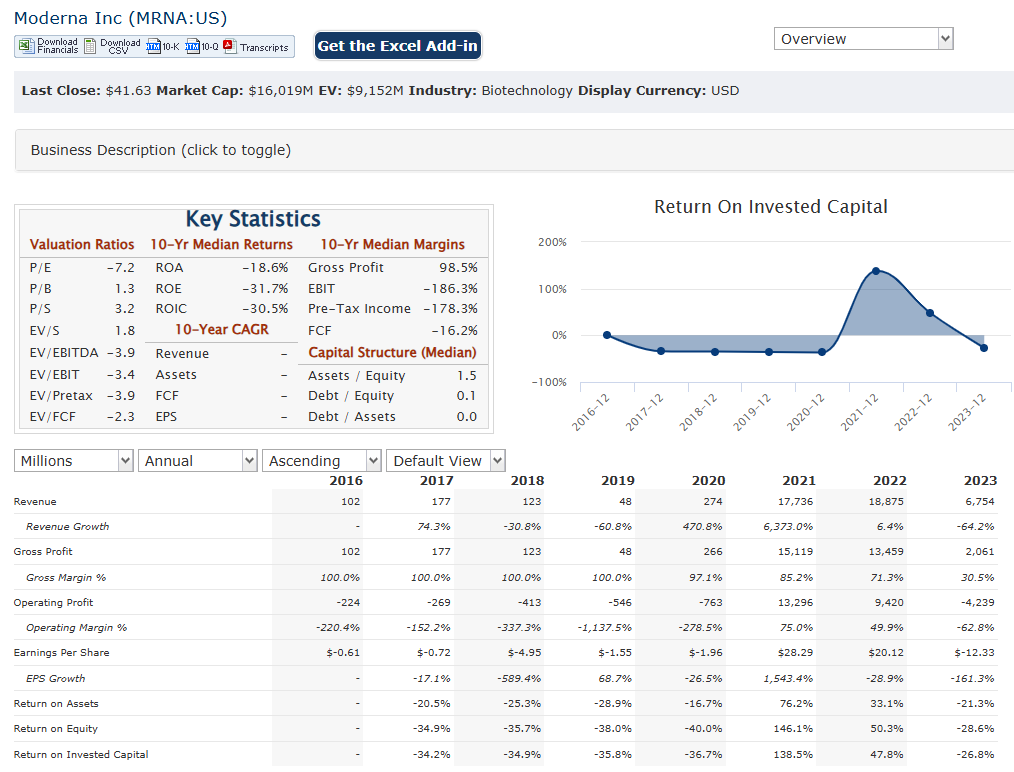

The company reported a modest revenue of $60 million, which surged to $803 million in 2020 as the pandemic began to impact global health. The following year, 2021, marked a dramatic increase in revenue to $18.471 billion, reflecting a staggering 2,200% growth compared to 2020. This surge was largely due to the widespread distribution of its COVID-19 vaccine, Spikevax. In 2022, revenue slightly declined to $19.263 billion, representing a 4.29% increase from 2021 as demand began to stabilize. The most recent financial year, 2023, saw a drop in revenue to $6.848 billion, a 64.45% decline from the previous year as the market adjusted to lower vaccine demand.

The compound annual growth rate (CAGR) for Moderna’s revenue over the last five years (2018-2023) stands at approximately 212%, illustrating the explosive growth driven by its COVID-19 vaccine during this period. Moderna’s net income followed a similar trajectory, peaking at approximately $12.2 billion in 2021. In 2023, Moderna reported a net loss of around $3 billion, reflecting the challenges of sustaining profitability in a post-pandemic market.

The company reported cash and investments totaling approximately $9.2 billion, down from $10.8 billion earlier that year. This decrease is attributed to ongoing research and development expenses as well as operational costs associated with launching new products and maintaining its pipeline of mRNA-based therapies and vaccines. The company’s total assets were reported at about $15.8 billion, with liabilities totaling around $4.5 billion, indicating a strong asset base relative to its obligations.

Moderna’s financial performance has been volatile due to external market conditions and shifts in vaccine demand, but it remains well-capitalized for future growth opportunities within the biotechnology sector. The company continues to invest heavily in R&D and expand its product offerings beyond COVID-19 vaccines, aiming for sustainable growth as it navigates the evolving landscape of infectious diseases and other therapeutic areas.

Technical Analysis:

The stock is on a stage 4 markdown (bearish) on the monthly and weekly charts. It is also retesting a base in the $34 zone on the daily chart and is attempting a reverse. We would not be buyers in this stock at this point yet.

Bull Case:

1. Pioneering mRNA Technology:

- Diverse Applications: Moderna’s mRNA platform is highly versatile, enabling the development of a wide range of therapeutics and vaccines for various diseases.

- Rapid Development: This technology allows for rapid development and customization of treatments, making it a powerful tool in addressing unmet medical needs.

2. Strong Product Pipeline:

- Promising Candidates: Moderna has a robust pipeline of mRNA-based products in various stages of clinical development, including vaccines for infectious diseases, cancer therapies, and rare disease treatments.

- Commercial Success: The successful commercialization of its COVID-19 vaccine has demonstrated the potential of its platform and provides a strong foundation for future growth.

Bear Case:

1. Post-Pandemic Revenue Decline:

- Decreasing Vaccine Demand: As the global health landscape evolves and the pandemic subsides, demand for COVID-19 vaccines is expected to decrease significantly.

- Revenue Impact: This decline in vaccine sales could have a substantial impact on Moderna’s revenue and profitability.

2. Clinical Trial Risks:

- Uncertain Outcomes: Clinical trials are inherently risky, and there is no guarantee that Moderna’s pipeline candidates will successfully progress through development and regulatory approval.

- Potential Failures: Failure of clinical trials could lead to significant setbacks and loss of investor confidence.

3. Manufacturing Challenges:

- Complex Processes: Manufacturing mRNA-based therapies is a complex process that requires specialized expertise and facilities.

- Scaling Challenges: Scaling up production to meet global demand can be challenging and may lead to quality control issues or supply shortages.