Executive Summary:

Zscaler Inc. is a leading cybersecurity company specializing in cloud-based security solutions. Their platform secures enterprise networks and data by offering a range of services, including zero-trust network access, cloud security, and web and email security. Zscaler’s cloud-native architecture ensures high performance, scalability, and adaptability to evolving threat landscapes. By leveraging advanced threat detection and prevention techniques, Zscaler helps organizations protect their sensitive information and maintain business continuity in today’s increasingly complex digital environment.

Zscaler Inc. reported an EPS of $3.19, surpassing analysts’ expectations of $2.91. Revenue for the quarter reached $593 million, also exceeding analyst estimates of $574.5 million.

Stock Overview:

| Ticker | $ZS | Price | $201.80 | Market Cap | $30.77B |

| 52 Week High | $259.61 | 52 Week Low | $153.45 | Shares outstanding | 152.49M |

Company background:

Zscaler Inc., a prominent cybersecurity company, was founded in 2007 by Jay Chaudhry. The company’s core business revolves around providing cloud-based security solutions that protect enterprise networks and data. Its suite of products includes zero-trust network access, cloud security, web and email security, and more.

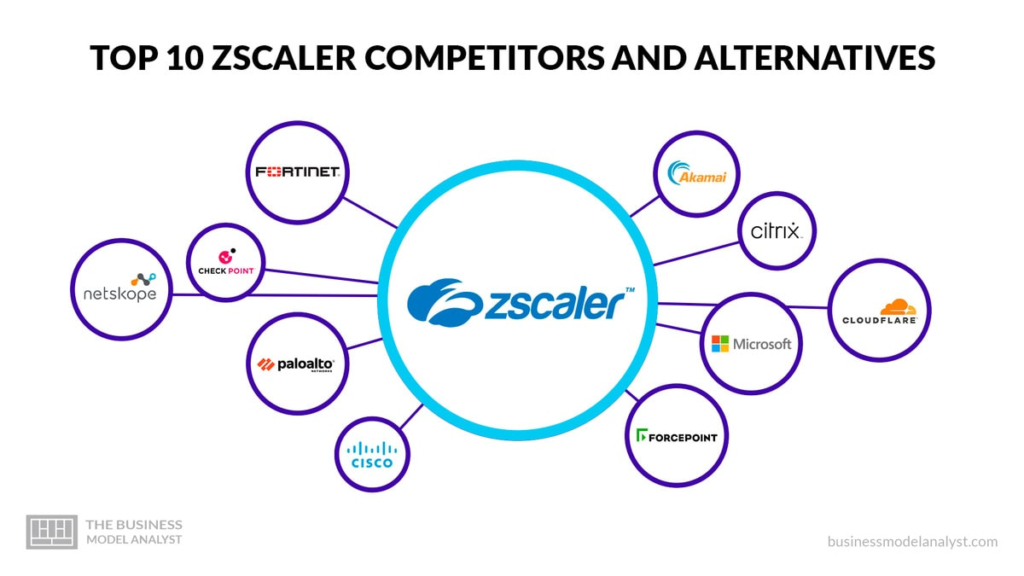

Zscaler’s cloud-native architecture offers several advantages, including high performance, scalability, and adaptability to evolving threat landscapes. Their key competitors in the cybersecurity market include established players like Cisco, Fortinet, and Palo Alto Networks. Zscaler’s focus on cloud-based security and innovative approach has positioned it as a strong contender in the industry. The company is headquartered in San Jose, California, and has a global presence to serve its diverse customer base.

Recent Earnings:

Revenue and Growth:

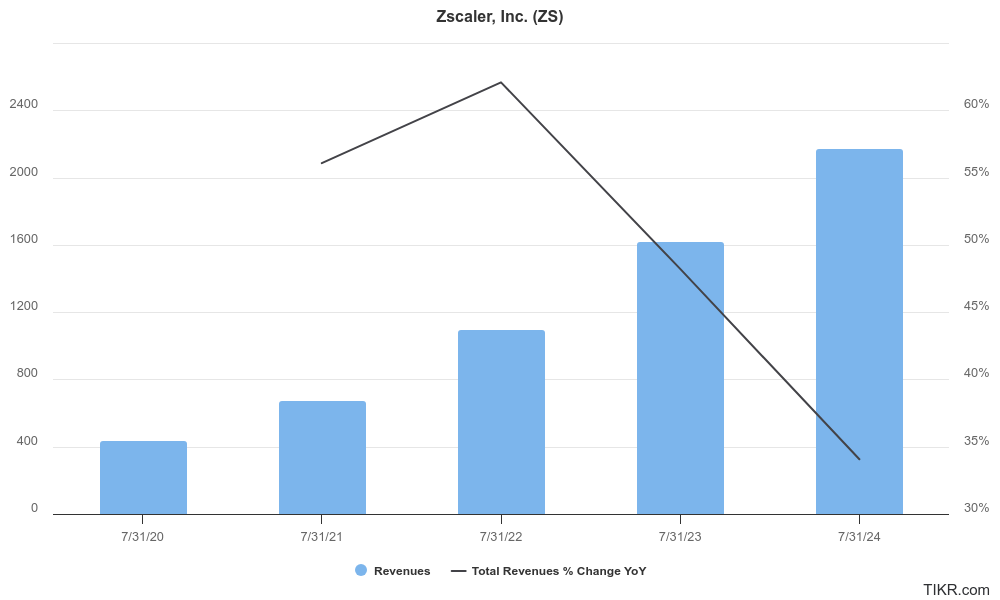

- Revenue: Zscaler reported a quarterly revenue of $593 million, marking a significant 30% year-over-year growth. This impressive growth trajectory reflects the increasing demand for cloud-based security solutions in today’s digital landscape.

Earnings per Share (EPS) and Growth:

- EPS: The company posted an EPS of $3.19, surpassing analysts’ consensus estimate of $2.91. This substantial growth in earnings underscores the company’s ability to translate revenue growth into profitability.

Operational Metrics and Forward Guidance:

- Operational Metrics: Zscaler’s customer acquisition and retention rates, remained healthy, demonstrating the company’s ability to attract and retain customers.

- Forward Guidance: For the first quarter of fiscal year 2025, Zscaler provided guidance with revenue expectations ranging from $575 million to $585 million. This outlook suggests continued growth momentum and a positive outlook for the future.

The Market, Industry, and Competitors:

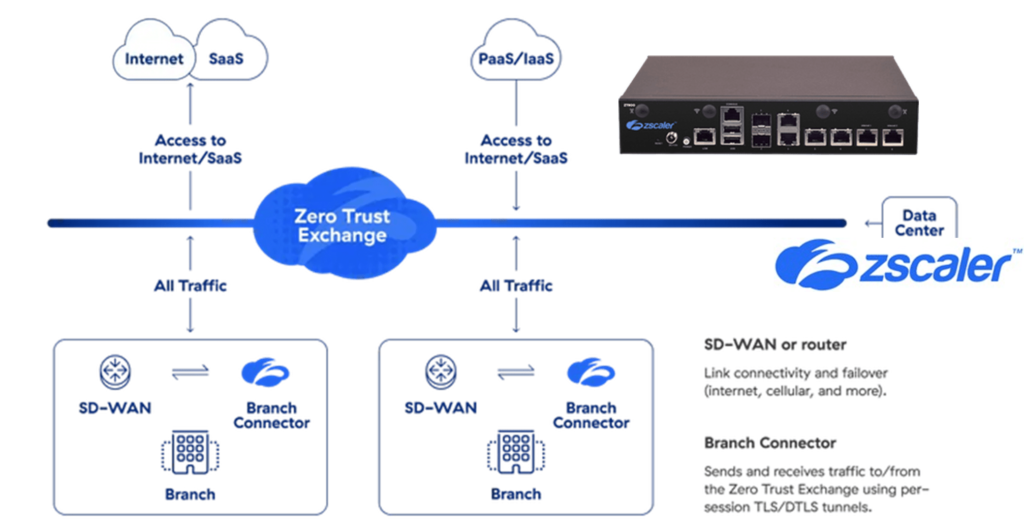

Zscaler Inc. operates in the cloud security market, specifically focusing on Zero Trust security solutions. This market has gained significant traction as organizations increasingly shift towards cloud-based infrastructures and remote work environments. The Zero Trust model, which operates under the principle of “never trust, always verify,” is becoming essential for businesses aiming to protect sensitive data and applications from evolving cyber threats. Zscaler’s platform enables secure access to applications without the need for traditional network security measures, making it particularly attractive to enterprises undergoing digital transformation.

The global cloud security market will grow from approximately $37 billion in 2022 to over $116 billion by 2030, reflecting a compound annual growth rate (CAGR) of about 15%. Zscaler itself has demonstrated impressive growth metrics, reporting a 5-year revenue CAGR of 52.39% and a 3-year CAGR of 44.30% as of October 2023. This strong performance is bolstered by increasing demand for advanced cybersecurity solutions, driven by rising cyber threats and regulatory requirements across various industries.

The company’s innovative approach to cloud security and its ability to scale operations effectively are expected to drive further growth. With a focus on enhancing its Zero Trust Exchange platform and expanding its customer base, Zscaler aims to maintain its leadership position in the rapidly evolving cloud security landscape, contributing to its optimistic outlook.

Unique differentiation:

Cisco Systems: A global technology leader offering a wide range of networking and security solutions. Cisco’s comprehensive product portfolio, including firewalls, intrusion detection systems, and cloud security solutions, directly competes with Zscaler’s offerings.

Palo Alto Networks: A leading cybersecurity company specializing in network security and threat prevention. Palo Alto Networks’ advanced threat prevention capabilities and strong focus on cloud security pose a significant challenge to Zscaler.

Fortinet: A global cybersecurity leader providing a broad range of security solutions, including firewalls, intrusion prevention systems, and wireless security. Fortinet’s strong presence in the enterprise security market and its focus on integrated security solutions position it as a competitor to Zscaler.

Netskope: A cloud security company specializing in protecting enterprises from cloud-based threats. Netskope’s focus on cloud security and data loss prevention aligns with Zscaler’s core offerings.

Microsoft: A global technology giant offering a suite of cloud-based security solutions, including Azure Security Center and Microsoft Defender for Cloud Apps. Microsoft’s strong brand recognition and extensive customer base make it a formidable competitor in the cloud security market.

1. Pure Cloud Architecture:

- Scalability: Zscaler’s cloud-based architecture allows it to scale seamlessly to meet the evolving needs of businesses, regardless of their size or growth rate.

- Performance: By leveraging a global network of data centers, Zscaler delivers high-performance security services with minimal latency.

- Agility: The cloud-native model enables rapid deployment and updates, ensuring that Zscaler’s solutions are always up-to-date with the latest security threats.

2. Zero-Trust Security:

- Granular Access Control: Zscaler’s zero-trust approach eliminates the concept of a traditional network perimeter, ensuring that only authorized users and devices can access resources.

- Continuous Verification: By continuously verifying the identity, device health, and application usage of each user, Zscaler reduces the risk of unauthorized access and data breaches.

- Adaptive Security: Zscaler’s platform adapts to changing user behavior and threat landscapes, providing real-time protection against evolving cyber threats.

3. Advanced Threat Protection:

- Advanced Threat Detection: Zscaler’s advanced threat detection capabilities, including machine learning and artificial intelligence, enable it to identify and block sophisticated attacks.

- Sandboxing: Zscaler’s sandboxing technology isolates and analyzes suspicious files to prevent malware infections.

- URL Filtering: Zscaler’s URL filtering capabilities block access to malicious websites and phishing attacks.

Management & Employees:

Jay Chaudhry: Chairman and CEO, co-founder of Zscaler.

Syam Nair: Chief Technology Officer.

Praniti Lakhwara: Chief Information Officer.

Joyce Kim: Chief Marketing Officer.

Financials:

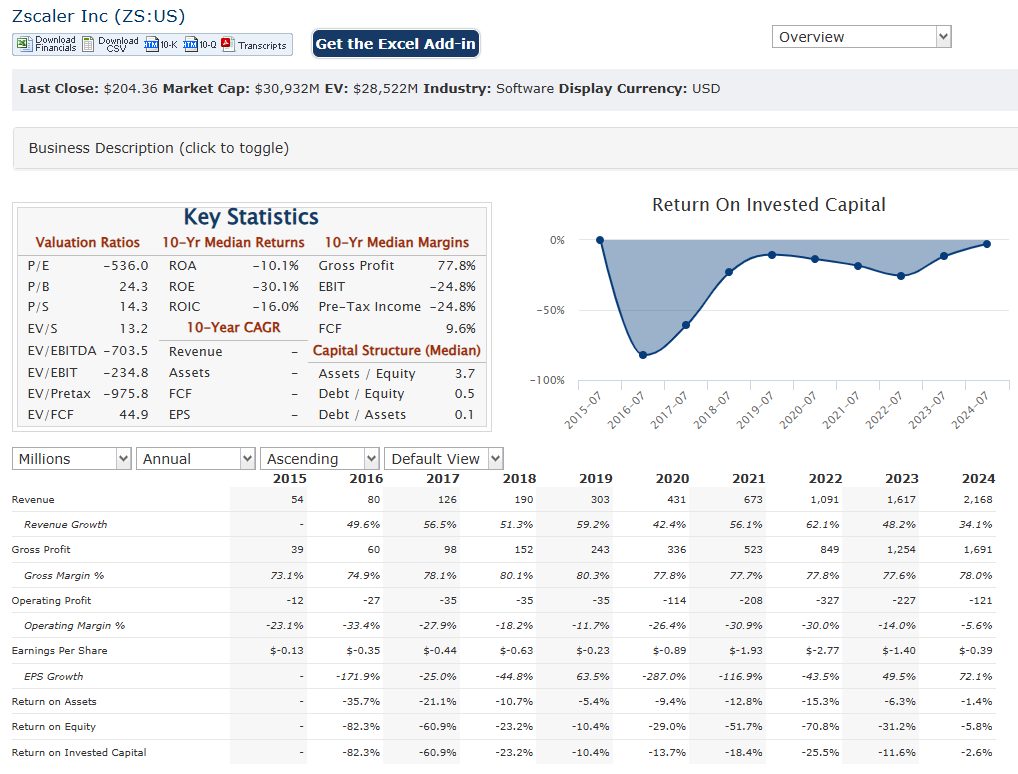

Zscaler Inc. has reported revenues of approximately $2.17 billion, marking a 34% increase from the previous year. This growth trajectory has been consistent, with the company achieving a 5-year revenue compound annual growth rate (CAGR) of 52.39%, highlighting its ability to capitalize on the increasing demand for cloud security solutions, particularly within the Zero Trust framework.

Zscaler transitioned from a GAAP net loss of $202.3 million in fiscal 2023 to a GAAP net loss of $57.7 million in fiscal 2024, indicating a narrowing of losses as operational efficiencies improve. Non-GAAP net income, which provides a clearer picture of profitability by excluding certain expenses, rose to $508.1 million in fiscal 2024, up from $277 million in the prior year.

Zscaler’s healthy cash flows and increasing deferred revenue. The company reported deferred revenue of approximately $1.9 billion, which grew by 32% year-over-year, demonstrating strong customer commitment and future revenue visibility. Zscaler’s cash flow from operations reached $203.6 million, representing 34% of revenue.

The combination of high revenue growth rates, improving earnings metrics, and a solid balance sheet positions Zscaler favorably for continued expansion as it navigates the evolving landscape of cybersecurity threats and opportunities.

Technical Analysis:

The stock is building a small base on the monthly chart and is consolidating in a stage 1 (neutral). The weekly chart is in stage 1 neutral as well, but the daily chart shows some strength to the $224 zone, but lots of resistance at that area, should see it fall again to the $205 area.

Bull Case:

1. Strong Growth Potential in Cybersecurity:

- The cybersecurity market continues to grow rapidly, fueled by increasing digital transformation, remote work, and evolving cyber threats.

- Zscaler’s cloud-native security solutions are well-positioned to capitalize on this growth, offering a comprehensive and scalable approach to security.

2. Attractive Valuation:

- While Zscaler’s stock may be valued at a premium, its strong growth prospects and market leadership position justify a higher valuation.

- As the company continues to execute on its growth strategy, its valuation is likely to expand further.

Bear Case:

1. Valuation Concerns:

- Zscaler’s stock has historically traded at a premium valuation, which some investors may consider to be stretched.

- A potential market correction or a decline in investor sentiment could negatively impact the stock price.

2. Economic Uncertainty:

- Economic downturns can impact corporate spending on technology, including cybersecurity solutions.

- A prolonged economic slowdown could negatively impact Zscaler’s revenue growth.

3. Execution Risks:

- Zscaler’s continued success depends on its ability to execute on its growth strategy, innovate, and adapt to evolving threat landscapes.

- Any missteps in execution or failure to meet expectations could negatively impact the stock price.