Executive Summary:

Global Payments Inc. is a multinational financial technology company that provides payment technology and services to merchants, issuers, and consumers worldwide. It facilitates payments through credit cards, debit cards, and digital and contactless methods. Global Payments’ solutions include payment processing, point-of-sale systems, and software for managing payment operations.

Global Payments Inc. posted GAAP diluted earnings per share (EPS) of $1.24, down 11% year-over-year, and adjusted EPS of $3.08, up 12% year-over-year. GAAP revenue for the quarter was $2.60 billion, an increase of 5%, while adjusted net revenue was $2.36 billion, up 6%.

Stock Overview:

| Ticker | $GPN | Price | $115.20 | Market Cap | $29.32B |

| 52 Week High | $141.78 | 52 Week Low | $91.60 | Shares outstanding | 254.5M |

Company background:

Global Payments Inc. is a multinational financial technology company that provides payment technology and services to merchants, issuers, and consumers worldwide. It was founded in 1998 and is headquartered in Atlanta, Georgia, United States.

Global Payments offers a wide range of products and services, including payment processing, point-of-sale solutions, software for managing payment operations, and digital payment solutions. It operates in over 100 countries and serves millions of merchants and financial institutions. The company’s key competitors include Fiserv, Adyen, and Worldpay.

It is a Fortune 500 company and plays a significant role in the global payments industry. The company is committed to providing innovative payment solutions to its clients and helping them succeed in the digital age.

Recent Earnings:

Global Payments Inc. reported its third-quarter, the GAAP diluted earnings per share (EPS) of $1.24, down 11% year-over-year, and adjusted EPS of $3.08, up 12% year-over-year. GAAP revenue for the quarter was $2.60 billion, an increase of 5%, while adjusted net revenue was $2.36 billion, up 6%.

Global Payments’ adjusted net revenue growth was primarily driven by strong performance in its merchant solutions segment, which benefited from increased transaction volumes and pricing. The company’s adjusted operating margin expanded 40 basis points to 46.1% due to operational efficiencies and cost control measures.

The company expects adjusted net revenue growth of 6-7% and adjusted EPS in the range of $12.60 to $12.80. Global Payments also announced a $600 million accelerated share repurchase plan, reflecting its confidence in its long-term growth prospects.

The Market, Industry, and Competitors:

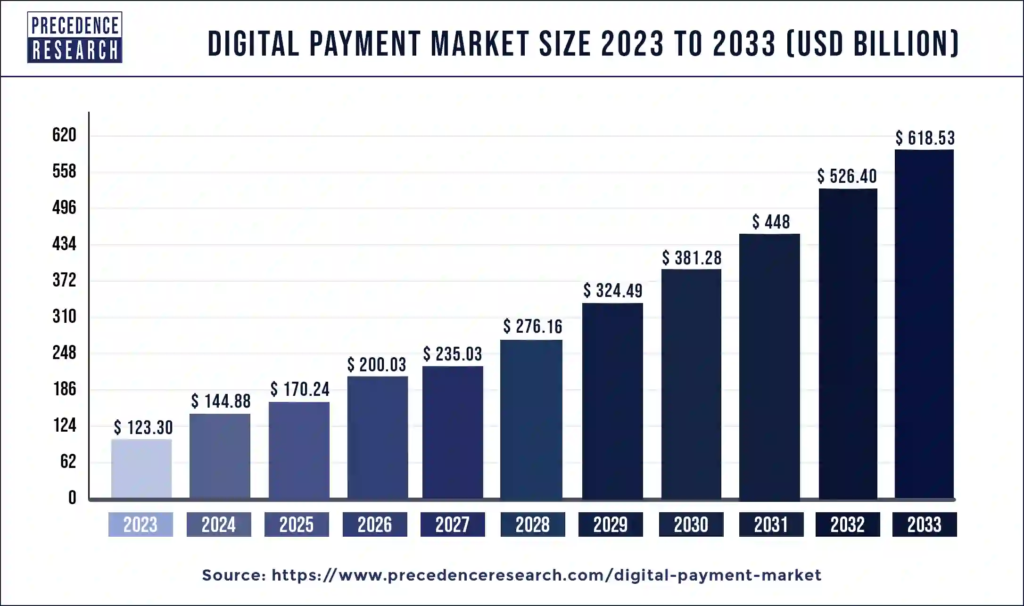

Global Payments Inc. operates within the expansive and rapidly evolving payment processing solutions market. As of 2022, this market was valued at approximately $58.5 billion and is expected to reach around $161.9 billion by 2030, reflecting a compound annual growth rate (CAGR) of 13.6% from 2022 to 2030. The surge in e-commerce transactions, and the overall shift towards digital payment methods among consumers and businesses alike. Regions such as the U.S. and China are leading this transformation, with China anticipated to grow at an impressive 18.6% CAGR, reaching a market size of $38.4 billion by 2030.

The broader digital payment market is also on an upward trajectory, with expectations to grow from $96.07 billion in 2023 to $381.30 billion by 2030, achieving a CAGR of 21.1% during this period. This growth is fueled by technological advancements, increased internet penetration, and changing consumer preferences for cashless transactions. The landscape is becoming increasingly competitive, with major players like PayPal, Stripe, and Global Payments Inc. continuously innovating to enhance their offerings and capture greater market share in this dynamic environment.

Unique differentiation:

Fiserv: A leading global provider of financial services technology solutions, Fiserv offers a wide range of products and services, including payment processing, digital banking, and risk management solutions.

Adyen: A Dutch multinational financial technology company that provides payment processing services for businesses. Adyen is known for its innovative technology and focus on cross-border payments.

Worldpay: A global payment processor that provides a range of payment solutions, including card payments, mobile payments, and online payments.

Stripe: A technology company that builds economic infrastructure for the internet. Stripe provides a suite of payment and financial tools for businesses, including payment processing, fraud prevention, and invoicing.

Comprehensive Product Suite:

- Diverse Offerings: Global Payments provides a comprehensive suite of payment solutions, including credit, debit, and prepaid card processing, point-of-sale systems, mobile payments, and more.

- End-to-End Solutions: The company offers end-to-end payment solutions, simplifying complex payment workflows and reducing operational costs for businesses.

Innovation and Technology:

- Continuous Innovation: Global Payments invests heavily in research and development to stay ahead of industry trends and introduce innovative payment technologies.

- Strategic Partnerships: The company collaborates with leading technology providers to enhance its offerings and deliver cutting-edge solutions.

Management & Employees:

Cameron Bready: Chief Executive Officer and Member of the Board of Directors

Robert Cortopassi: President and Chief Operating Officer

Cameron Bready: Chief Executive Officer and Member of the Board of Directors

Chris Ancona: Vice President of Finance.

Financials:

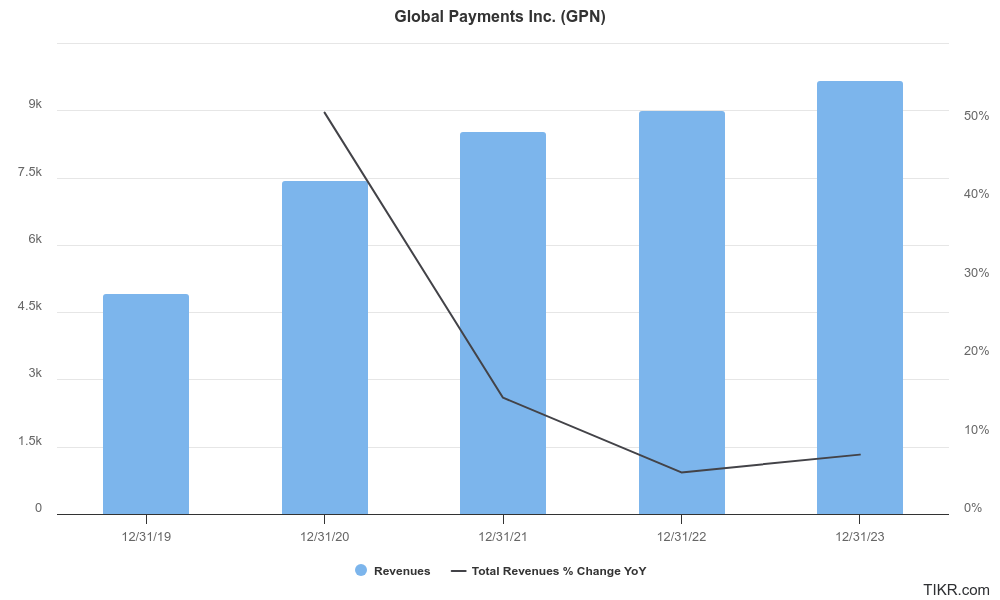

Global Payments Inc. has reported GAAP revenues of $9.65 billion, an increase from $8.98 billion in 2022, reflecting a growth rate of approximately 7.6%. Adjusted net revenues also rose to $8.67 billion, up from $8.09 billion in the previous year, translating to a 7% increase. Global Payments’ ability to adapt to changing market conditions and consumer behaviors, particularly as digital payment solutions continue to gain traction.

Earnings growth has similarly been robust, with diluted earnings per share (EPS) increasing from $0.40 in 2022 to $3.77 in 2023, marking a significant improvement. Adjusted EPS also saw a noteworthy rise of 12%, reaching $10.42, compared to $9.32 in 2022. The company’s ability to enhance its profitability is further evidenced by its adjusted operating margin, which expanded by 90 basis points to 44.6% in 2023.

Global Payments maintains a solid financial position, with total current assets reported at approximately $7.9 billion and total liabilities around $27.1 billion as of early 2024. This includes long-term debt of about $15.2 billion, indicating a manageable debt load relative to its asset base. The company’s liquidity is bolstered by cash and short-term investments totaling roughly $2.9 billion, providing it with ample resources to invest in growth opportunities and navigate potential economic uncertainties.

Global Payments is optimistic about its growth trajectory, projecting adjusted net revenue for 2024 between $9.17 billion and $9.30 billion, which suggests continued growth of 6% to 7% year-over-year. The company also expects adjusted EPS to rise by 11% to 12%, reflecting its commitment to enhancing shareholder value while capitalizing on the ongoing shift towards digital payments globally.

Technical Analysis:

The stock is on a stage 2 markup (bullish) on the monthly timeframe, consolidating stage 3 (neutral) on the weekly timeframe and stage 2 markup as well on the daily timeframe. There is a lot of resistance in the $118 – $122 zone, so this should consolidate in the near term to $113 range before it heads to the $118 zone.

Bull Case:

Strong Growth Potential:

- Digital Payments Boom: The ongoing shift towards digital and contactless payments presents significant growth opportunities for the company.

- Global Expansion: Global Payments’ strong international presence and focus on emerging markets can drive future growth.

- Acquisitions and Partnerships: Strategic acquisitions and partnerships can accelerate growth and enhance market position.

Diversified Revenue Streams:

- Multiple Business Segments: The company’s diverse revenue streams, including merchant solutions, issuer solutions, and other services, reduce reliance on a single segment.

- Recurring Revenue: A significant portion of revenue is recurring, providing stability and predictability.

Bear Case:

Regulatory Risks:

- Changing Regulatory Landscape: The payments industry is subject to evolving regulations, which can increase compliance costs and operational risks.

- Data Privacy Concerns: Stricter data privacy regulations can impose additional compliance burdens and potential liabilities.

Cybersecurity Threats:

- Increased Cyberattacks: The company is exposed to cyberattacks that could compromise sensitive customer data and disrupt operations.

- Significant Financial Losses: Successful cyberattacks can result in significant financial losses and reputational damage.

Integration Risks:

- Complex Acquisitions: The company’s growth strategy often involves acquisitions, which can be complex and time-consuming to integrate.

- Operational Disruptions: Integration challenges can lead to operational disruptions and increased costs.