Executive Summary:

CDW Corporation is a leading technology solutions provider specializing in serving businesses, governments, education institutions, and healthcare organizations across the United States, the United Kingdom, and Canada. Their extensive product and service offerings encompass hardware, software, and integrated IT solutions such as security, cloud, hybrid infrastructure, and digital experience. CDW is committed to empowering its customers with the right technology solutions to achieve their business objectives.

CDW Corporation reported earnings per share (EPS) of $2.42, surpassing analysts’ expectations of $2.23. Revenue for the quarter reached $6.1 billion, slightly below the consensus estimate of $6.15 billion.

Stock Overview:

| Ticker | $CDW | Price | $191.91 | Market Cap | $25.57B |

| 52 Week High | $263.37 | 52 Week Low | $187.73 | Shares outstanding | 133.26M |

Company background:

CDW Corporation, a leading technology solutions provider, was founded in 1984 by Michael Krasny. It started as a small computer reseller and has since grown into a Fortune 500 company. CDW is headquartered in Vernon Hills, Illinois.

As a technology solutions provider, CDW offers a wide range of products and services, including hardware, software, networking equipment, and cloud solutions. They cater to various industries, including businesses, government agencies, education institutions, and healthcare organizations. CDW’s business model revolves around providing comprehensive IT solutions, from procurement and implementation to maintenance and support.

CDW’s key competitors in the technology solutions market include companies like SHI International, Insight Enterprises, and CompuCom. These companies offer similar products and services to CDW, competing for market share in various segments. CDW differentiates itself through its customer-centric approach, strong relationships with technology vendors, and its ability to deliver complex IT solutions.

Recent Earnings:

CDW Corporation reported its revenue of $6.1 billion, slightly below the consensus estimate of $6.15 billion. They represented a solid performance considering the current economic climate. The company’s earnings per share (EPS) for the quarter came in at $2.42, surpassing analysts’ expectations of $2.23.

Gross margin expanded, reflecting a favorable product mix and pricing strategies. The company also continued to invest in its digital transformation initiatives, which are expected to drive long-term growth.

The company also reiterated its commitment to delivering strong profitability and cash flow generation. While the near-term outlook remains uncertain due to macroeconomic factors, CDW’s strong financial performance, strategic focus, and customer-centric approach position it well to navigate potential challenges and capitalize on emerging opportunities.

The Market, Industry, and Competitors:

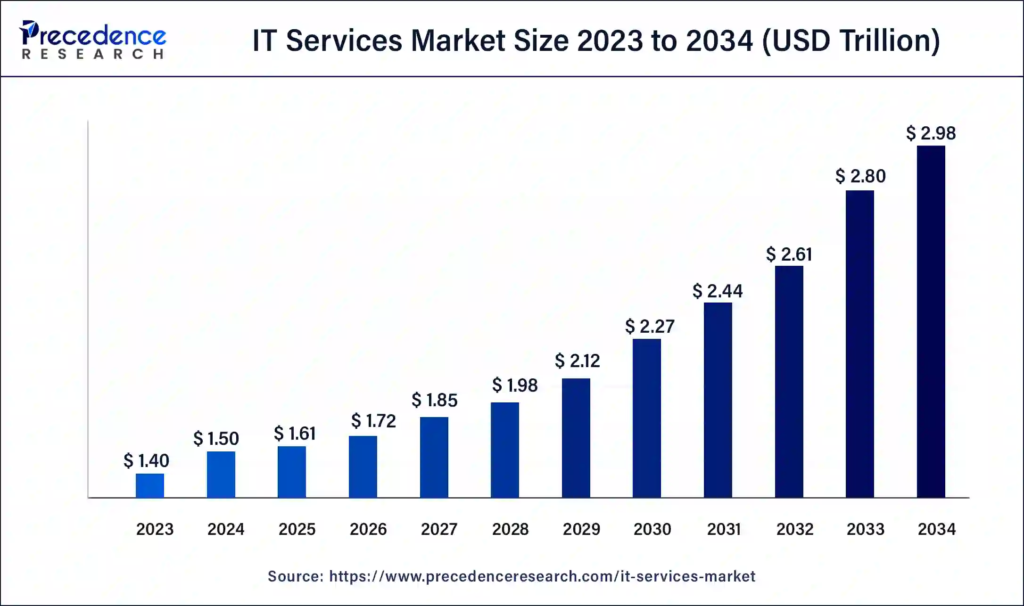

CDW Corporation operates within the expansive IT solutions market, which is currently valued at approximately $1.3 trillion across the U.S., UK, and Canada, with CDW’s addressable market estimated at around $440 billion. The IT spending in this sector has shown a CAGR of 5.1% from 2009 to 2023, and CDW aims to capture a larger share through strategic initiatives focusing on high-growth areas and enhanced service capabilities.

CDW is projected to experience growth, with stock price forecasts suggesting an average price of $354.31, reflecting a potential increase of 74.23% from current levels. This optimistic outlook aligns with the company’s strategy to outpace the broader U.S. IT market by 200-300 basis points, driven by leadership changes aimed at strengthening its international presence and operational efficiency. Its robust financial performance and strategic initiatives leverage emerging technology trends, positioning it well for sustained growth in a dynamic market landscape.

Unique differentiation:

SHI International: A leading global provider of IT solutions, SHI offers a wide range of products and services, including hardware, software, and cloud solutions. They have a strong presence in the US and international markets and compete with CDW in various segments.

Insight Enterprises: Insight is a global technology solutions provider focused on digital innovation, cloud and data center transformation, and connected workforce solutions. They offer a comprehensive portfolio of products and services, competing with CDW in areas such as cloud services, cybersecurity, and data center solutions.

Computacenter: A leading independent provider of IT infrastructure services, Computacenter offers a range of services, including IT infrastructure support, software licensing, and IT consultancy. They have a strong presence in Europe and compete with CDW in the international market.

They compete on various factors, including pricing, product offerings, customer service, and market reach. CDW must continuously innovate, differentiate its offerings, and strengthen its customer relationships to maintain its competitive edge in this dynamic market.

Comprehensive Product and Service Portfolio: CDW offers a wide range of products and services, including hardware, software, networking equipment, and cloud solutions. This comprehensive portfolio allows them to meet the diverse needs of their customers.

Robust Distribution Network: CDW has a well-established distribution network, ensuring efficient delivery and high customer satisfaction.

Focus on Digital Transformation: CDW actively invests in digital transformation initiatives, helping customers adopt emerging technologies and improve their operations.

Management & Employees:

Chris Leahy: Chair and Chief Executive Officer

Chris Corley: President, International & Vice Chair

Michael Drory: Senior Vice President, Strategy & Corporate Development

Anand Rao: Senior Vice President and Chief Marketing and Digital Officer

Kate Sanderson: Chief Human Resources Officer and Senior Vice President, Coworker Success

Financials:

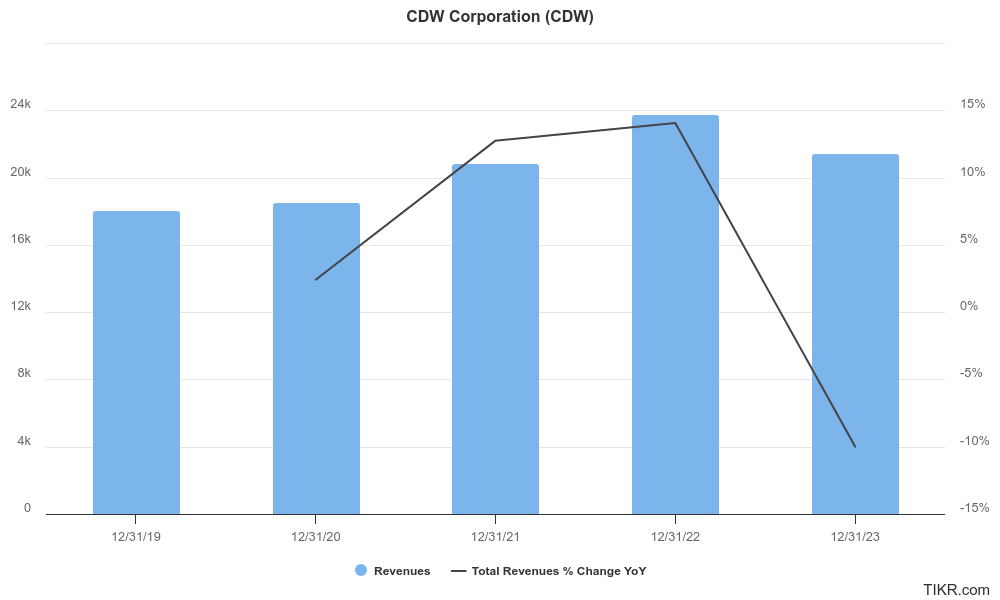

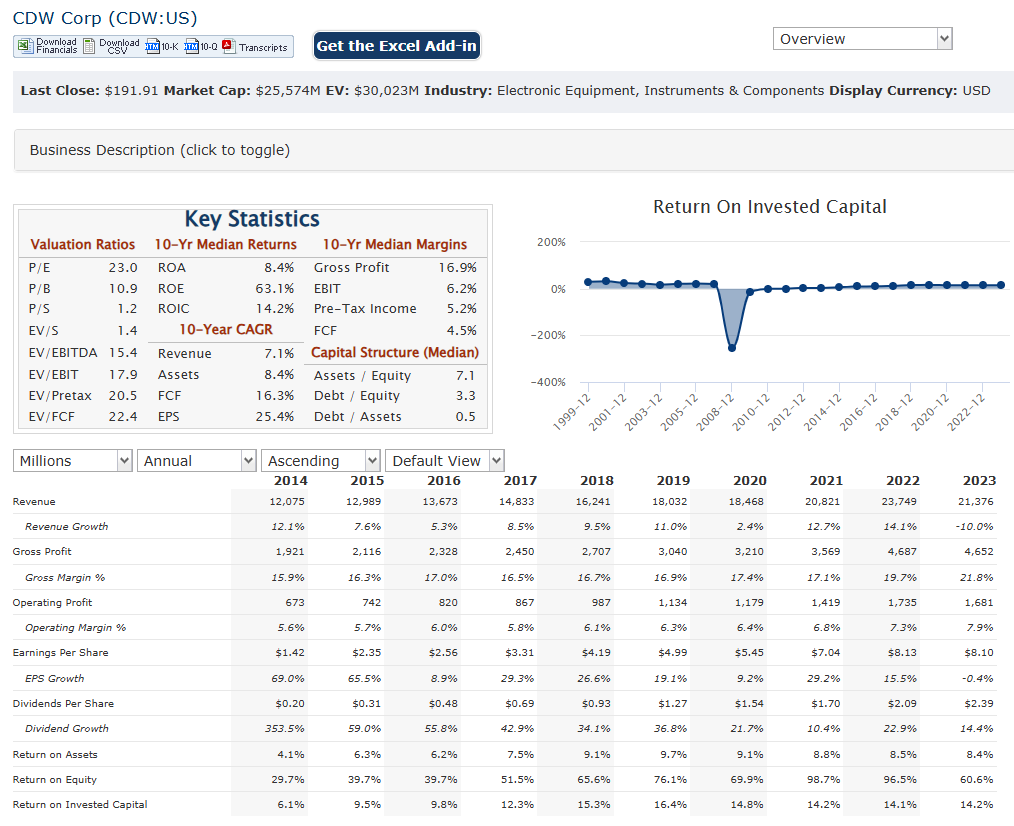

CDW Corporation reported net sales of approximately $21.4 billion, reflecting a decline from the previous year’s $23.7 billion due to challenging market conditions and economic uncertainty. The company has maintained a CAGR of about 5% in revenue over the last five years, driven by strategic acquisitions and an expanding service portfolio that includes cloud solutions and security services. This growth underscores CDW’s ability to adapt to shifting customer demands and technological advancements.

CDW achieved a CAGR of approximately 13% in earnings per share (EPS) over the same period. The company reported a net income of around $1.1 billion, slightly down from $1.2 billion in 2022, but still indicative of its resilience in a competitive landscape. The increase in EPS reflects effective cost management and operational efficiencies, which have allowed CDW to enhance profitability even amid revenue fluctuations. The gross profit margin improved to 23% in Q4 2023 from 21.7% in Q4 2022, demonstrating the company’s focus on higher-margin products and services.

CDW has maintained a strong financial position with healthy liquidity ratios and manageable debt levels. The company’s total assets were estimated at approximately $8 billion, with total liabilities around $4 billion, resulting in a favorable debt-to-equity ratio that supports its operational flexibility. This solid balance sheet enables CDW to pursue strategic investments, including mergers and acquisitions, while also returning value to shareholders through dividends and share repurchases. The company’s commitment to shareholder returns is evidenced by its consistent dividend payments.

CDW Corporation’s illustrates a blend of resilience and strategic growth initiatives that position it well for future opportunities in the evolving IT solutions market. With expectations of continued demand for technology services and solutions, CDW is poised to leverage its strengths to navigate challenges and capitalize on growth prospects.

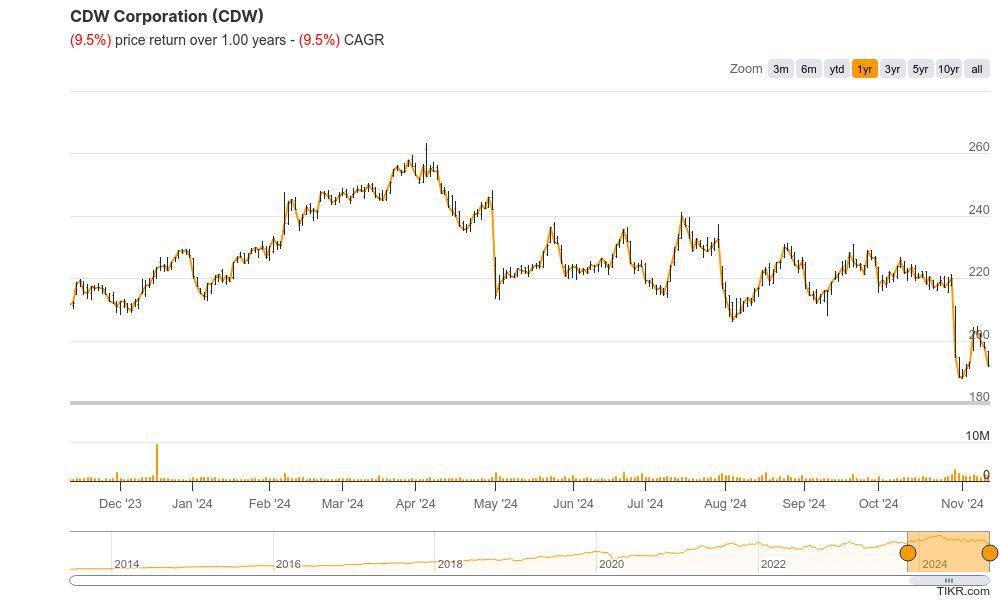

Technical Analysis:

The stock is in a stage 4 markdown (bearish) on all 3 timeframes and is expected to move lower to test the $150 – $160 zone for support and a reversal.

Bull Case:

Digital Transformation and Innovation:

- CDW is actively investing in digital transformation initiatives to enhance its operations and customer experience.

- The company’s focus on innovation and emerging technologies positions it to capitalize on future growth opportunities.

Favorable Industry Trends:

- The ongoing digital transformation, increasing cloud adoption, and growing demand for cybersecurity solutions are driving demand for CDW’s products and services.

Bear Case:

Competitive Pressure: The technology solutions market is highly competitive, with several major players vying for market share. Increased competition could erode CDW’s pricing power and profitability.

Cybersecurity Threats: As cyber threats continue to evolve, companies like CDW may face increased costs related to cybersecurity measures, such as investing in advanced security solutions and incident response plans.

Market Volatility: The broader market volatility can impact CDW’s stock price, especially during periods of economic uncertainty or geopolitical tensions.