Executive Summary:

BioNTech SE is a German biotechnology company focused on developing and manufacturing innovative immunotherapies for various diseases. Their groundbreaking work in mRNA technology led to the development of the Comirnaty COVID-19 vaccine, a major breakthrough in vaccine science. With a strong pipeline of potential treatments for cancer and other infectious diseases, BioNTech is at the forefront of medical innovation.

BioNTech SE reported its earnings per share (EPS) of €1.28 ($1.38). Total revenues for the quarter were €167.7 million.

Stock Overview:

| Ticker | $BNTX | Price | $109.87 | Market Cap | $26.57B |

| 52 Week High | $131.49 | 52 Week Low | $76.53 | Shares outstanding | 237.73M |

Company background:

BioNTech SE, a leading German biotechnology company, was founded in 2008 by Ugur Sahin, a medical oncologist, and Özlem Türeci, a physician specializing in internal medicine. BioNTech’s most notable achievement is the development of the Comirnaty COVID-19 vaccine, which was developed in collaboration with Pfizer. This mRNA-based vaccine was instrumental in combating the COVID-19 pandemic and demonstrated the potential of mRNA technology for vaccine development.

Initially bootstrapped with €1.5 million in funding, BioNTech SE secured investments from venture capital firms and strategic partners, including Fosun Pharma and Eli Lilly and Company. These partnerships provided crucial financial support and expanded the company’s global reach.

BioNTech SE’s product pipeline also includes several other promising immunotherapies for various diseases, such as cancer and infectious diseases. The company’s key competitors in the biotechnology and pharmaceutical industries include Moderna, CureVac, and Inovio Pharmaceuticals.

Headquartered in Mainz, Germany, BioNTech SE has a global presence with research and development facilities in Germany, the United States, and China. The company’s continued innovation and focus on cutting-edge therapies position it as a major player in the biotechnology industry.

Recent Earnings:

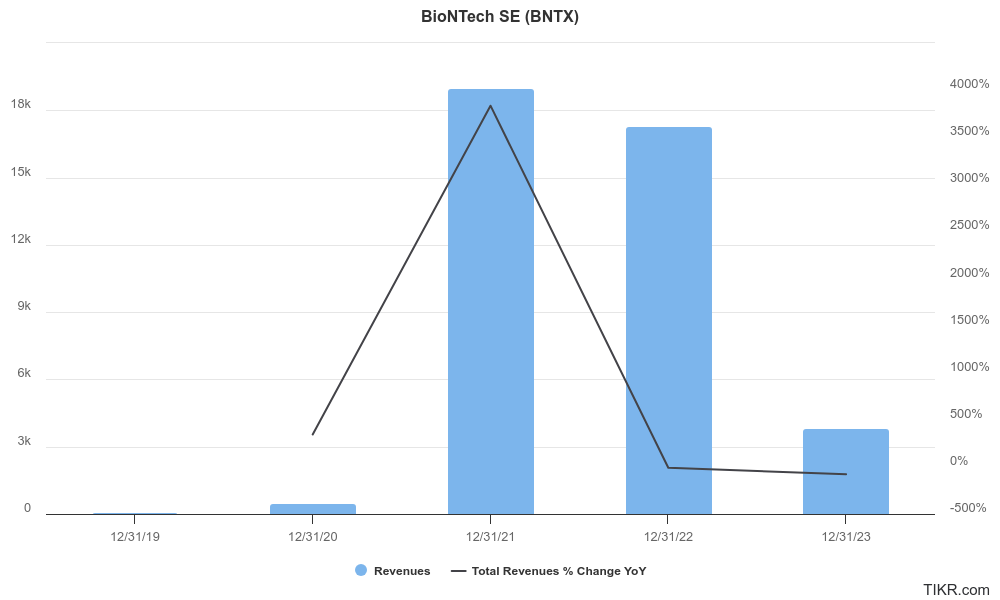

BioNTech SE released its revenue of €167.7 million. This is a dramatic decline from €3.2 billion in the same quarter the previous year, primarily due to reduced demand for its COVID-19 vaccine and significant write-offs by its partner, Pfizer. The revenue fell short and had forecasted approximately €607.8 million for the quarter. This stark contrast highlights the challenges BioNTech faces as it transitions from pandemic-related revenues to a more diversified portfolio focused on mRNA technology and cancer treatments.

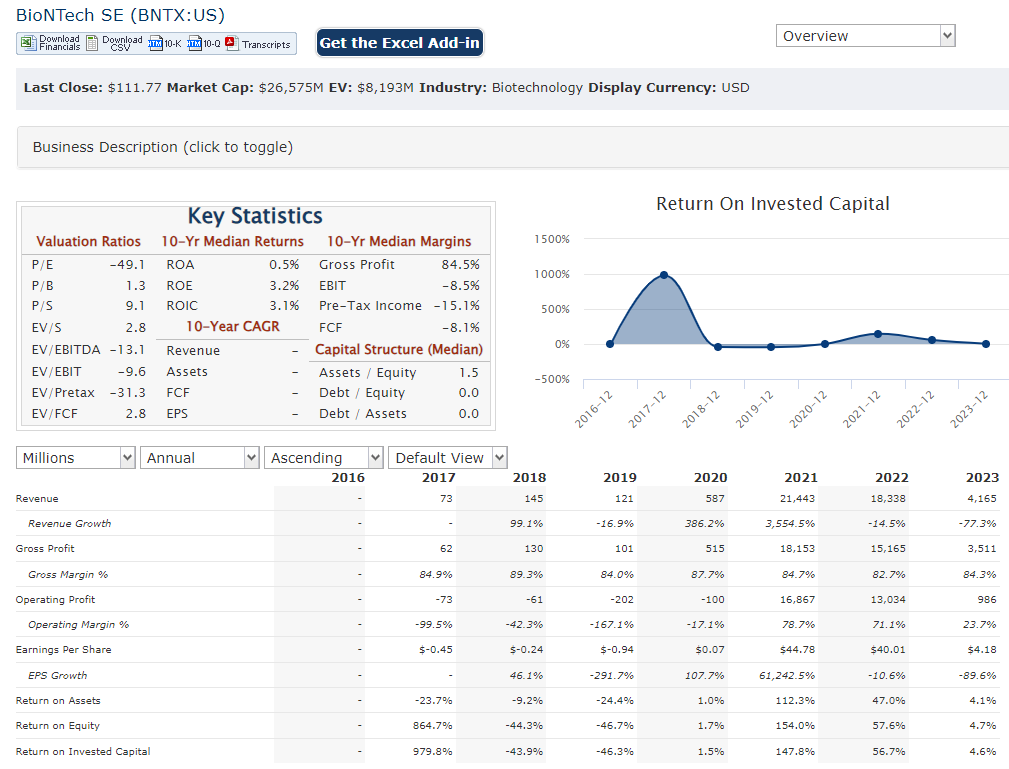

The company’s earnings per share (EPS) for Q2 2023 was reported at -€0.79, missing analysts’ expectations of -€0.83. This marks a significant downturn compared to last year’s EPS of €6.45, reflecting a broader trend of declining profitability as the pandemic-driven surge in vaccine sales wanes. Analysts have adjusted their forecasts for BioNTech, projecting continued losses in upcoming quarters, with expectations of a statutory loss of -€1.92 per share in 2024, indicating a shift in market sentiment regarding the company’s financial trajectory.

BioNTech is pivoting towards developing new mRNA-based therapies beyond COVID-19 vaccines. The company announced positive data from several ongoing clinical trials, including its mRNA cancer vaccine candidates, which could provide future revenue streams and mitigate the impact of declining vaccine sales. The overall outlook remains cautious as analysts predict that BioNTech’s revenue growth will slow significantly compared to historical rates, projecting only a 2.2% increase in revenues for 2024.

The consensus among analysts remains that while BioNTech’s innovative pipeline holds promise, it will require time and successful execution to translate these opportunities into sustainable profitability. The average price target for BioNTech’s stock has stabilized around $115, reflecting a cautious optimism about its long-term potential despite current challenges.

The Market, Industry, and Competitors:

BioNTech SE operates in the dynamic and rapidly growing biotechnology industry, which focuses on the development and commercialization of innovative medical products and therapies. The market is characterized by intense competition, rapid technological advancements, and increasing regulatory scrutiny. BioNTech’s core focus is on immunotherapies, a therapeutic approach that stimulates the immune system to fight diseases like cancer and infectious diseases.

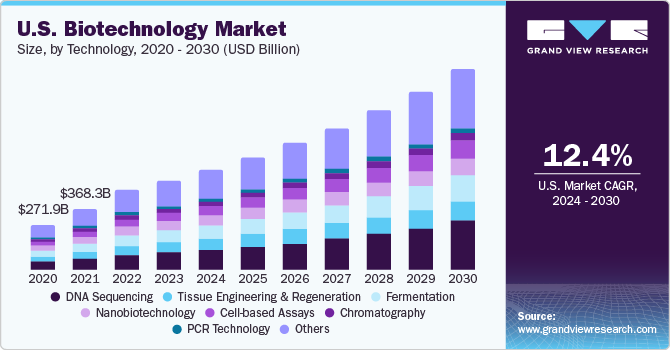

The biotechnology industry is expected to experience significant growth in the coming years, driven by factors such as increasing research and development investments, rising healthcare expenditures, and growing demand for personalized medicine. The global biotechnology market is projected to reach $800 billion by 2030, with a compound annual growth rate (CAGR) of around 10-12.5%. BioNTech SE, with its strong product pipeline, innovative technologies, and strategic partnerships, is well-positioned to capitalize on this growth and expand its market share.

Unique differentiation:

Moderna: One of BioNTech’s closest competitors, Moderna is also a pioneer in mRNA-based therapeutics. The company has developed its own COVID-19 vaccine and is pursuing other mRNA-based therapies for various diseases.

CureVac: Another German biotechnology company, CureVac is focused on developing mRNA-based vaccines and therapeutics. The company’s COVID-19 vaccine candidate is currently in clinical trials.

Inovio Pharmaceuticals: An American biotechnology company, Inovio Pharmaceuticals is developing DNA-based vaccines and therapeutics. The company’s COVID-19 vaccine candidate is also in clinical trials.

Traditional pharmaceutical companies: Established pharmaceutical companies like Pfizer and Eli Lilly and Company also invest in biotechnology and develop their own immunotherapies.

BioNTech SE’s unique differentiation lies in its early and extensive focus on mRNA technology. While other companies have been exploring mRNA-based therapeutics, BioNTech has been at the forefront of this field for several years. This early focus has allowed the company to build a strong foundation of expertise and intellectual property in mRNA technology.

BioNTech has established strategic partnerships with major pharmaceutical companies like Pfizer, which have provided the company with access to significant resources, manufacturing capabilities, and global distribution networks. These partnerships have been instrumental in accelerating the development and commercialization of BioNTech’s products, particularly the Comirnaty COVID-19 vaccine.

BioNTech’s commitment to innovation, research, and development has enabled the company to develop a diverse pipeline of potential therapies for various diseases, beyond just COVID-19. This focus on a broad range of therapeutic applications positions BioNTech as a leader in the field of immunotherapies.

Management & Employees:

- Ugur Sahin: As CEO and co-founder, Sahin is a renowned medical oncologist with extensive experience in cancer research and immunotherapy.

- Özlem Türeci: As Chief Medical Officer and co-founder, Türeci is a physician specializing in internal medicine and has played a key role in the development of BioNTech’s mRNA-based therapies.

- Ralf Dinkelacker: As Chief Technology Officer, Dinkelacker leads BioNTech’s research and development efforts, focusing on the development of innovative mRNA-based therapies.

Financials:

BioNTech SE has reported revenues of approximately €128 million. This figure skyrocketed in 2020 to around €482 million as the company ramped up its vaccine development efforts. The peak came in 2021 when revenues soared to €18.977 billion, showcasing an extraordinary compound annual growth rate (CAGR) of about 1,500%. Revenue fell to €17.311 billion, and further declined to €1.444 billion in the first half of 2023, reflecting a shift in market dynamics as the pandemic transitioned to an endemic phase.

BioNTech reported a net loss of approximately €48 million, which turned into a profit of €15 per share in 2021 due to unprecedented vaccine sales. This instability, with growth rates fluctuating dramatically from profitability during peak vaccine sales to anticipated losses as demand normalizes.

The company reported cash and cash equivalents totaling approximately €18.5 billion. This strong liquidity allows BioNTech to invest heavily in research and development, particularly in its oncology pipeline and other mRNA-based therapies. The company’s focus on diversifying its product offerings is critical as it navigates the post-pandemic landscape where COVID-19 vaccine revenues are expected to decline.

BioNTech’s revenue will stabilize at around €2.5 to €3.1 billion for the full year of 2024. Earnings are expected to continue declining, with forecasts suggesting a loss of approximately €1.92 per share for that year. BioNTech successfully transitioned from being primarily a COVID-19 vaccine provider to a multi-product biotechnology company focused on innovative therapies for various diseases.

Technical Analysis:

The stock is on a stage 4 markdown (bearish) on the monthly chart and has recovered nicely off its lows at $80s, but there is a lot of resistance at the $130 mark. The daily chart, however has a bull flag which indicates a likely reversal at $109 range with a move back to $130s. The stock would be a buy over $112 zone with a move to $130s.

Bull Case:

Innovative mRNA technology: BioNTech is a pioneer in mRNA-based therapeutics, a technology that has shown significant promise in various disease areas. The company’s expertise in this field positions it well for future growth.

Diverse product pipeline: Beyond the COVID-19 vaccine, BioNTech has a promising pipeline of other mRNA-based therapies for diseases such as cancer and infectious diseases. These therapies could drive significant revenue growth in the future.

Growing market for immunotherapies: The market for immunotherapies is expected to continue growing, driven by increasing healthcare expenditures, rising demand for personalized medicine, and advancements in technology.

Bear Case:

Regulatory risks: The development and commercialization of new drugs and therapies are subject to stringent regulatory approval processes. Delays or denials of regulatory approvals could significantly impact BioNTech’s product pipeline and financial performance.

Manufacturing challenges: Scaling up the production of mRNA-based therapies can be complex and costly. BioNTech may face manufacturing challenges that could impact supply and demand.

Intellectual property risks: BioNTech’s success is partially dependent on its intellectual property, including patents and proprietary technology. If competitors are able to develop similar technologies or challenge BioNTech’s intellectual property rights, it could have a negative impact on the company’s business.