Executive Summary:

Zoom Video Communications Inc. is a cloud communications company that provides video telephony, online meetings, and webinars. The company’s platform has been widely adopted for various purposes, including remote work, education, and social interactions. Zoom’s success can be attributed to its focus on delivering a high-quality video conferencing experience and its ability to adapt to changing market demands.

Zoom Video Communications Inc. recently reported earnings per share (EPS) of $2.12, exceeding analysts’ expectations of $2.07. The company’s revenue for this period reached $4.53 billion, also surpassing projections of $4.52 billion.

Stock Overview:

| Ticker | $ZM | Price | $68.32 | Market Cap | $21.03B |

| 52 Week High | $74.77 | 52 Week Low | $55.06 | Shares outstanding | 262.13M |

Company background:

Zoom Video Communications Inc., often simply referred to as Zoom, is a cloud communications company that provides video telephony, online meetings, and webinars. Founded in 2011 by Eric Yuan, a former engineer at Cisco Systems, Zoom has rapidly grown to become a leading player in the remote work and collaboration market.

Zoom to create a more accessible and user-friendly video conferencing platform. The company initially focused on enterprise customers but quickly expanded its reach to include individuals and small businesses. Zoom’s success can be attributed to its intuitive interface, reliable performance, and affordable pricing.

The company’s primary product is the Zoom Meetings platform, which provides features such as video conferencing, screen sharing, chat, and recording. Zoom also offers other products, including Zoom Phone, a cloud-based phone system, and Zoom Webinar, a platform for hosting large-scale online events.

Key competitors to Zoom include Microsoft Teams, Google Meet, Cisco Webex, and BlueJeans. These companies offer similar video conferencing and collaboration solutions and compete with Zoom for market share. Zoom has maintained a strong position by continuously innovating and delivering a high-quality user experience. It is headquartered in San Jose, California, and has offices worldwide.

Recent Earnings:

Zoom Video Communications Inc. recently reported a revenue of $4.53 billion, which reflects a 3% year-over-year growth. This revenue figure slightly surpassed analysts’ expectations, which were $4.52 billion. The growth can be attributed to the company’s strategic focus on expanding its enterprise solutions and enhancing customer engagement, even as the post-pandemic landscape continues to evolve.

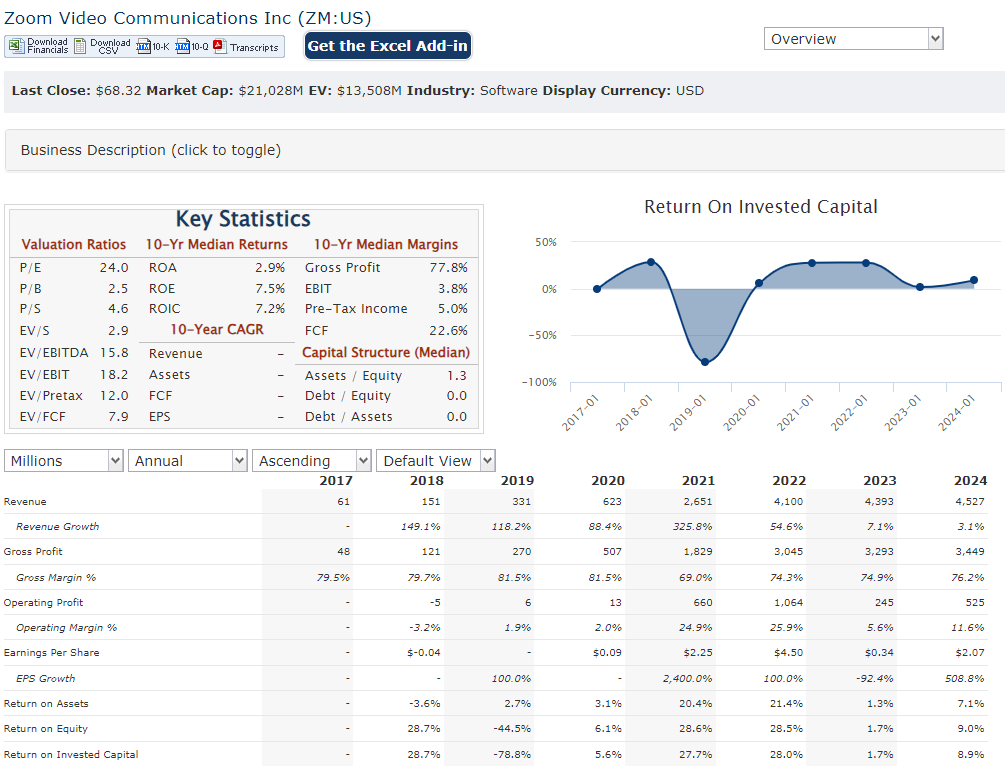

Earnings per share (EPS), Zoom reported $2.12, exceeding analyst forecasts of $2.07. The EPS growth is indicative of effective cost management and operational efficiencies that Zoom has implemented in recent months, allowing it to enhance its bottom line despite fluctuating revenue streams.

The company reported an increase in its enterprise customer base, with more than 200,000 customers contributing to its revenue growth. Zoom’s gross profit margin improved to 76%, reflecting its ongoing efforts to optimize service delivery and reduce costs. The company also noted a strong retention rate among existing customers, which is crucial for sustaining long-term growth.

Zoom provided optimistic forward guidance for the remainder of fiscal 2024, projecting revenues between $4.55 billion and $4.60 billion for the next quarter. They continued demand for its services and products, particularly as businesses increasingly adopt hybrid work models that leverage video communication technologies.

The Market, Industry, and Competitors:

Zoom Video Communications Inc. operates in the rapidly evolving video communication and collaboration market, which has grown due to the increasing demand for remote work solutions. This market encompasses a variety of services, including video conferencing, webinars, and online chat, catering to both enterprise and individual users. As businesses continue to embrace hybrid working models, the need for reliable and scalable communication tools is expected to drive further adoption of platforms like Zoom. The global video conferencing market is projected to grow substantially, with estimates suggesting a compound annual growth rate (CAGR) of around 11-15% through 2030, reaching a valuation of approximately $50 billion.

The growth expectations for Zoom are bolstered by its strategic initiatives aimed at enhancing its enterprise offerings and expanding its customer base. With over 191,600 enterprise customers and a notable 98% net dollar expansion rate, Zoom is well-positioned to capitalize on the increasing reliance on digital communication tools. The company has also introduced new features and products that cater specifically to large organizations, further solidifying its presence in the enterprise segment.

The company projects total revenue between $4.63 billion and $4.64 billion, indicating a steady growth trajectory as it navigates the post-pandemic landscape. The combination of a robust product portfolio, a growing customer base, and an expanding addressable market positions Zoom favorably for future success in the competitive video communications sector.

Unique differentiation:

Microsoft Teams: As part of the Microsoft 365 suite, Teams offers integrated video conferencing, messaging, and collaboration features. Its strong presence in the enterprise market and integration with other Microsoft products make it a formidable competitor.

Google Meet: Google’s video conferencing platform is tightly integrated with its G Suite productivity tools, providing a seamless experience for users. Google’s extensive user base and brand recognition give it a significant advantage.

Cisco Webex: A long-standing player in the video conferencing market, Cisco Webex offers a comprehensive suite of communication and collaboration tools. Cisco’s strong enterprise focus and established customer base make it a major competitor.

BlueJeans: BlueJeans provides cloud-based video conferencing and collaboration solutions, focusing on delivering a high-quality user experience. The company has gained traction in the enterprise market and is a notable competitor.

Reliability and performance: Zoom is known for its reliable and high-quality video and audio performance, even in challenging network conditions. This is essential for ensuring a smooth and productive meeting experience.

Cross-platform compatibility: Zoom is compatible with a wide range of devices and operating systems, making it accessible to users on different platforms. This ensures that participants can join meetings from their preferred devices.

Extensive feature set: Zoom offers a comprehensive range of features, including video conferencing, screen sharing, chat, recording, and integration with other applications. This allows users to customize their meeting experience based on their specific needs.

Management & Employees:

Eric S. Yuan: As CEO and founder, Yuan oversees the company’s overall strategy and direction. He has extensive experience in the technology industry, having previously worked at Cisco Systems.

Jenae Huang: As COO, Huang is responsible for Zoom’s day-to-day operations, including product development, sales, and marketing. She has a proven track record in scaling technology companies and driving growth.

Gina King: As CPO, King is responsible for Zoom’s product strategy and development. She has a strong background in product management and has a proven track record of delivering innovative products to market.

Financials:

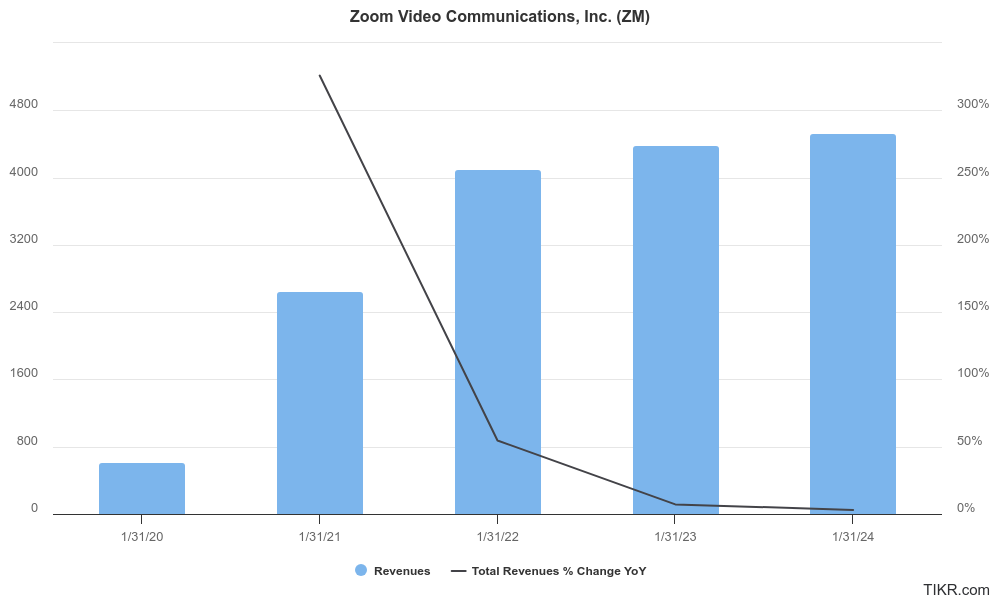

Zoom Video Communications Inc. reported revenue of approximately $622.7 million, which skyrocketed to $4.53 billion by fiscal year 2024. This impressive growth translates to a compound annual growth rate (CAGR) of around 90% over this period. The company capitalized on the shift toward virtual communication, establishing itself as a leader in the video conferencing space.

Earnings per share (EPS) was just $0.09, but by fiscal year 2024, it had risen to $2.12. This represents a CAGR of approximately 76%, highlighting the company’s ability to not only grow its top line but also enhance profitability effectively. Zoom has maintained a solid earnings trajectory through strategic investments and product enhancements.

The company has consistently increased its cash reserves, with cash and cash equivalents reaching about $1.56 billion by the end of fiscal year 2024. Zoom’s total assets have grown substantially, reflecting its successful scaling of operations to meet increasing customer demands while managing liabilities effectively.

The explosive growth rates seen during the pandemic may moderate, but analysts remain optimistic about Zoom’s potential for sustained growth in the evolving landscape of digital communication. The company’s focus on expanding its enterprise solutions and enhancing user experience positions it well for future opportunities, particularly as businesses continue to adopt hybrid work models that rely on effective collaboration tools.

Technical Analysis:

The stock is range bound (stage 1, neutral) on the monthly chart and similar on the weekly chart with a narrow $47 to $70 trading range for years. The near term (daily) is on a stage 1 consolidation but a bull flag shows room to beak the resistance at $70s to get to $72 and possibly to $74. The stock is not a buy for the long or medium term yet, however.

Bull Case:

Opportunities for expansion: Zoom has the potential to expand its market reach by entering new geographic regions, targeting new customer segments, and developing additional product offerings. This expansion could drive significant revenue growth and shareholder value.

Favorable regulatory environment: The regulatory environment for cloud communications is generally supportive, with governments recognizing the importance of these technologies for economic growth and innovation. This favorable environment provides a conducive backdrop for Zoom’s operations.

Bear Case:

Security concerns: Data breaches or security vulnerabilities could damage Zoom’s reputation and lead to customer churn. The company must invest heavily in security measures to mitigate these risks.

Integration challenges: As Zoom expands its product offerings and acquires other companies, there is a risk of integration difficulties that could disrupt operations and impact financial performance.

Valuation concerns: Zoom’s stock price has experienced significant growth in recent years. If the company fails to meet investor expectations or if the broader market experiences a correction, the stock price could decline.