Executive Summary:

Vertiv Holdings LLC is a global leader in critical digital infrastructure solutions. The company provides power, cooling, and IT infrastructure to ensure continuous operation of vital applications. With a focus on data centers, communication networks, and commercial and industrial facilities, Vertiv offers a wide range of products and services, from hardware and software to analytics and ongoing support.

Vertiv Holdings LLC reported revenue for the quarter at $1.953 billion, up 13% from the previous year. Earnings per share (EPS) were $0.48, surpassing the consensus estimate of $0.42.

Stock Overview:

| Ticker | $VRT | Price | $107.54 | Market Cap | $40.29B |

| 52 Week High | $109.27 | 52 Week Low | $34.60 | Shares outstanding | 375.15M |

Company background:

Vertiv Holdings LLC, a global leader in critical digital infrastructure solutions, was formed in 2016 through the merger of Emerson Network Power and Starwood Energy Group. The company’s founders include former Emerson executives and private equity investors from Starwood.

Vertiv’s products are designed to ensure the reliability, efficiency, and scalability of critical digital applications. Some of the company’s key competitors include Schneider Electric, Legrand, and ABB. It is headquartered in Westerville, Ohio, and operates in over 130 countries. The company has a strong global presence and serves a diverse customer base, including data center operators, cloud service providers, and enterprises across various industries. Vertiv’s commitment to innovation and customer satisfaction has enabled it to lead in the critical digital infrastructure market.

Recent Earnings:

Vertiv Holdings LLC reported revenue for the quarter reached $1.953 billion, up 13% from the previous year, while earnings per share (EPS) came in at $0.48, surpassing the consensus estimate of $0.42. Organic orders grew by 57% year-over-year, indicating strong demand for Vertiv’s critical digital infrastructure solutions.

The company’s performance was driven by robust growth in its data center and communication network segments. Vertiv’s data center solutions continued to benefit from the increasing demand for data center capacity, while its communication network solutions saw strong growth in the deployment of 5G infrastructure. The company’s strong order book and backlog provide visibility into future revenue growth. The company’s gross margin expanded to 33.2%, up from 32.6% in the previous year. Operating income increased to $336 million, representing a margin of 17.2%, compared to 15.6% in the previous year. Vertiv’s free cash flow was $139 million for the quarter.

The Market, Industry, and Competitors:

Vertiv Holdings LLC operates in the critical digital infrastructure market, which is experiencing rapid growth driven by the increasing demand for data centers, cloud computing, and 5G networks. The global market for data center infrastructure is projected to reach $253.4 billion by 2030, growing at a CAGR of 8.3% from 2023 to 2032. The growth in the data center market is being driven by factors such as the increasing adoption of cloud computing, the rise of artificial intelligence and machine learning, and the growing demand for data analytics.

Unique differentiation:

Schneider Electric: Schneider Electric is a global leader in energy management and automation solutions. The company offers a wide range of products and services, including power distribution, cooling systems, and data center infrastructure management software. Schneider Electric has a strong global presence and a diverse customer base.

Legrand: Legrand is a global specialist in electrical and digital infrastructure for buildings. The company offers a wide range of products, including power distribution, wiring devices, and home automation systems. Legrand has a strong market position in Europe and is expanding its presence in other regions.

ABB: ABB is a leading global technology company that provides products, systems, and solutions for electrification, industrial automation, and robotics. The company offers a range of power distribution and cooling solutions for critical digital infrastructure. ABB has a strong presence in the industrial automation market and is expanding its offerings in the data center and communication network sectors.

Product breadth and depth: Vertiv offers a comprehensive portfolio of critical digital infrastructure solutions, covering power, cooling, and IT infrastructure. This breadth and depth allow the company to provide customers with integrated solutions that address their specific needs.

Sustainability and environmental responsibility: Vertiv is committed to sustainability and environmental responsibility. The company’s products and solutions are designed to be energy-efficient and reduce environmental impact.

Management & Employees:

David Cote: Executive Chairman of the Board. Cote has a long and distinguished career in the industrial sector, having previously served as CEO of Honeywell International.

Chris King: Chief Executive Officer. King joined Vertiv in 2016 and has been instrumental in leading the company’s growth and transformation. Prior to joining Vertiv, King held senior leadership positions at Emerson Network Power.

Rob Shafer: Chief Financial Officer. Shafer is responsible for Vertiv’s financial strategy and operations. He has a strong track record in financial management and has held senior finance roles at various companies.

Financials:

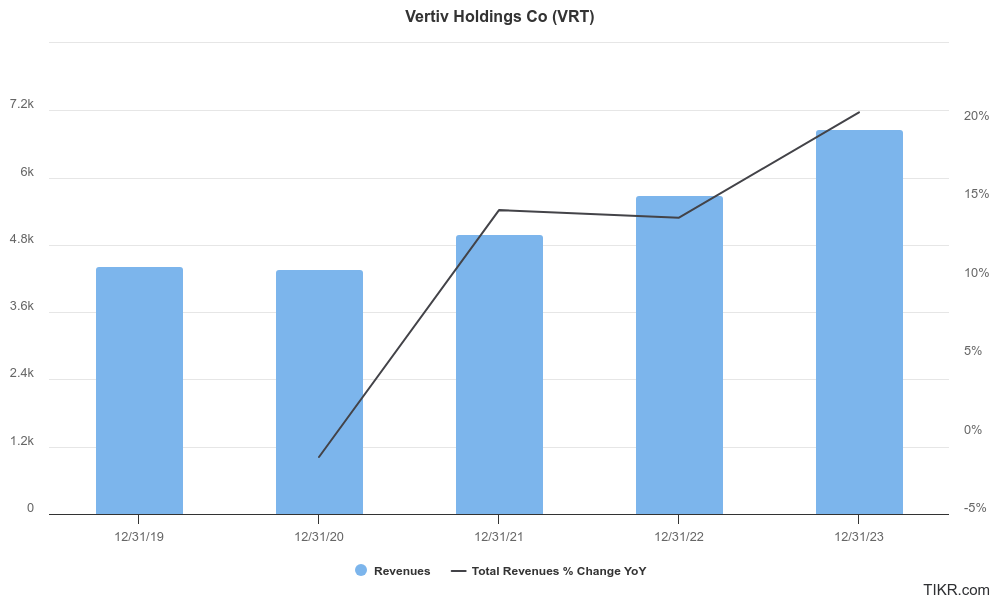

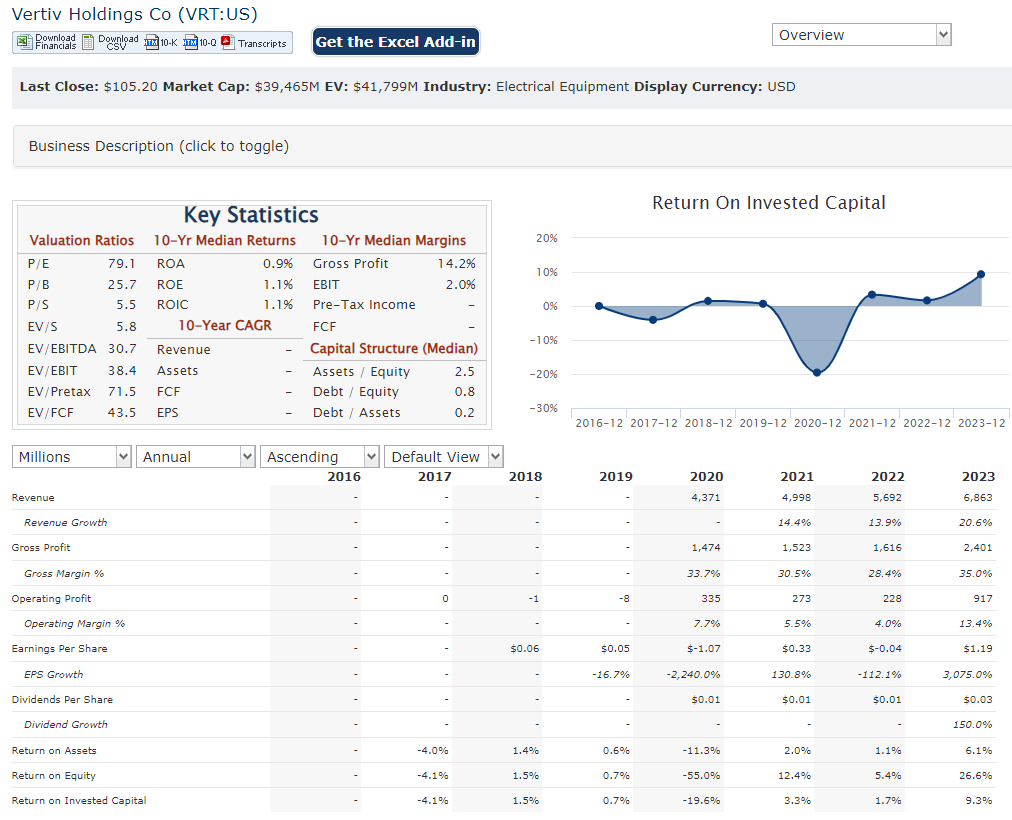

Vertiv Holdings LLC has reported revenues of approximately $4.43 billion, which grew to about $6.86 billion by 2023. This represents a compound annual growth rate (CAGR) of around 9.4%. The revenue growth trajectory reflects Vertiv’s effective strategies in expanding its product offerings and enhancing operational efficiencies within the data center infrastructure sector.

Earnings performance has also shown improvement, although it has experienced fluctuations. In 2019, Vertiv reported a net loss of approximately $104 million. By 2023, the company achieved a net income of around $534 million, indicating a notable turnaround and a CAGR of approximately 59% in net income over the five years. This growth in earnings can be attributed to increased operational efficiency and cost management initiatives that have allowed Vertiv to leverage its growing revenue base effectively.

Vertiv’s financial position has strengthened considerably. The total assets stood at approximately $7.99 billion, up from about $4.66 billion in 2019. This growth in assets is supported by an increase in cash and cash equivalents from $224 million in 2019 to over $780 million in 2023.

Technical Analysis:

Strong stage 2 (markup, very bullish) on the monthly chart, stronger on the weekly chart with a stage 2 (bullish) and should get to $109 on the daily chart (bullish). The stock is extended, but it should move past the 52 week high and get to $120s soon and a good long term hold as well.

Bull Case:

Strong financial performance: Vertiv has a strong track record of financial performance, with consistent revenue and earnings growth. The company’s balance sheet is healthy, and it has a solid cash position.

Favorable industry trends: The ongoing digital transformation and the increasing adoption of cloud computing and artificial intelligence are driving demand for critical digital infrastructure solutions. These trends are expected to benefit Vertiv and its competitors.

Attractive valuation: Vertiv’s stock is currently trading at a [valuation metric] compared to its peers. This suggests that the company is undervalued, and there is potential for significant upside.

Bear Case:

Economic uncertainty: The global economy is subject to various risks and uncertainties, including economic downturns, trade wars, and geopolitical tensions. If the economy weakens, businesses may reduce their spending on capital expenditures, including critical digital infrastructure, which could impact Vertiv’s revenue.

Technological disruption: The critical digital infrastructure market is constantly evolving, with new technologies and trends emerging. If Vertiv is unable to adapt to these changes or if its products and services become obsolete, the company’s competitive position could be weakened.

Supply chain disruptions: Vertiv relies on a global supply chain to source components and materials. Disruptions to the supply chain, such as those caused by natural disasters, geopolitical events, or labor shortages, could impact the company’s production and delivery capabilities.