Executive Summary:

DraftKings Inc. is a leading American sports betting and daily fantasy sports company. The company initially focused on daily fantasy sports contests but has since expanded into online and retail sportsbooks. DraftKings aims to provide fans with engaging and immersive gaming experiences.

DraftKings Inc. reported a revenue of $1.1 billion, representing a 26% year-over-year increase. Earnings per share (EPS) came in at $0.22, beating estimates by $0.03.

Stock Overview:

| Ticker | $DKNG | Price | $40.36 | Market Cap | $19.60B |

| 52 Week High | $49.57 | 52 Week Low | $25.73 | Shares outstanding | 485.53M |

Company background:

DraftKings Inc., a prominent American sports betting and daily fantasy sports company, was founded in 2012 by Jason Robins, Matthew Kalish, and Paul Liberman. Initially operating from Liberman’s home, the company launched its first product, a one-on-one baseball competition, to coincide with Major League Baseball’s opening day in 2012. DraftKings has secured significant funding, including investments from major sports leagues like Major League Baseball and strategic partnerships with prominent investors.

The company’s primary products include daily fantasy sports contests and online and retail sportsbooks. DraftKings offers a wide range of betting options across various sports, including football, basketball, baseball, hockey, and more. Through its innovative platform and user-friendly interface, the company aims to provide an engaging and immersive experience for sports fans.

DraftKings faces stiff competition from other major players in the sports betting and daily fantasy sports industry, such as FanDuel, BetMGM, and Caesars Sportsbook. These competitors offer similar products and services, making market differentiation crucial for DraftKings’ success.

Headquartered in Boston, Massachusetts, DraftKings has expanded its operations to various regions across the United States. The company’s commitment to innovation and responsible gaming has contributed to its growth and success in the dynamic sports betting and daily fantasy sports industry.

Recent Earnings:

DraftKings Inc. reported revenue for the quarter reached $1.1 billion, representing a robust 26% year-over-year increase. EPS came in at $0.22, surpassing estimates by $0.03. This positive performance reflects the company’s continued growth in the sports betting and daily fantasy sports market, driven by increased user engagement and expansion into new regions.

DraftKings demonstrated solid execution, with key metrics such as monthly unique active customers and average revenue per customer showing healthy growth. The company’s ability to attract and retain users through its innovative platform and diverse product offerings has contributed to its success.

The company raised its full-year revenue guidance midpoint by $315 million to $3.5 billion, reflecting its confidence in continued growth and market expansion. DraftKings improved its full-year adjusted EBITDA guidance midpoint by $110 million to ($205) million, indicating progress in its efforts to achieve profitability.

The Market, Industry, and Competitors:

The sports betting and daily fantasy sports market, in which DraftKings Inc. operates, is experiencing rapid growth fueled by changing regulations, technological advancements, and increasing consumer interest. The legalization of sports betting in various states across the United States has created significant opportunities for companies like DraftKings to expand their operations and reach a wider audience. The integration of technology, such as mobile apps and live streaming, has enhanced the overall user experience and contributed to market growth.

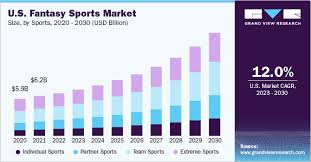

The global market is expected to reach $184.26 billion by 2030, with a compound annual growth rate (CAGR) of 11.4% – 12.00% during the forecast period (2023-2030). This growth is driven by increasing disposable income, rising internet penetration, and the growing popularity of sports betting and fantasy sports among younger demographics.

Unique differentiation:

FanDuel: One of the largest competitors, FanDuel offers a wide range of sports betting and daily fantasy sports products. The company has a strong market presence and has been aggressively expanding its operations.

BetMGM: A joint venture between MGM Resorts International and GVC Holdings, BetMGM is a rapidly growing competitor with a focus on both online and retail sports betting. The company has been making significant investments to enhance its product offerings and customer experience.

Caesars Sportsbook: Powered by the established Caesars Entertainment brand, Caesars Sportsbook is a major competitor in the sports betting market. The company leverages its extensive network of retail casinos to drive customer acquisition and engagement.

WynnBET: A subsidiary of Wynn Resorts, WynnBET is a relatively new entrant to the sports betting market but has quickly gained traction. The company is known for its focus on technology and innovation.

Innovative Product Offerings: The company continuously introduces new products and features to enhance the user experience. For example, DraftKings has been at the forefront of integrating live streaming and in-play betting options.

Strategic Partnerships: DraftKings has formed strategic partnerships with major sports leagues, teams, and media companies. These partnerships provide access to valuable data, marketing opportunities, and customer acquisition channels.

Technological Advantage: The company invests heavily in technology to ensure a seamless and reliable platform. This includes advanced data analytics, risk management tools, and mobile app development.

Management & Employees:

Jason Robins: Co-Founder, Chief Executive Officer

Matt Kalish: Co-Founder, President

Chris Sweda: Chief Technology Officer

Michael Raffensperger: Chief Product Officer

Financials:

DraftKings reported revenues of approximately $323 million, which surged to about $3.67 billion by 2023. This marks a compound annual growth rate (CAGR) of approximately 78% over the five years. The company’s revenue trajectory has been bolstered by the increasing legalization of sports betting across various states in the U.S., alongside a growing customer base and enhanced product offerings. DraftKings has faced challenges, posting net losses each year. The net loss was about $143 million in 2019, escalating to approximately $751 million by 2023. This translates to a negative CAGR of around 18% for net income over the same period.

The company’s focus on aggressive marketing and customer acquisition strategies has been pivotal in driving revenue growth, even as it prioritizes market share over immediate profitability. Total assets stood at approximately $6.74 billion, up from around $0.64 billion in 2019. This increase is indicative of substantial investments in technology and infrastructure to support its operations.

Total liabilities reached about $4.94 billion in 2023 compared to $0.39 billion in 2019. The increase in debt and other liabilities suggests that DraftKings is leveraging capital to fund its expansion efforts. DraftKings has shown impressive revenue growth and an expanding asset base, but it continues to grapple with substantial operational losses and rising liabilities. The company’s strategy appears focused on long-term market dominance rather than short-term profitability, positioning it as a key player in the evolving landscape of online gaming and sports betting.

Technical Analysis:

A very good cup and handle on the monthly chart (Bullish) and a reversal from the low of $28. A strong stage 2 (bullish) mark up on the weekly chart and a resistance at $42 suggests a move to $38 and a reversal is on the cards and a good move back to $42 – $45 zone is on the cards.

Bull Case:

Market Growth: The sports betting and daily fantasy sports industry is experiencing rapid growth, fueled by changing regulations, technological advancements, and increasing consumer interest. As the market expands, DraftKings, as a leading player, is well-positioned to benefit from this growth.

Expansion Opportunities: DraftKings has the potential to expand its operations into new markets, both domestically and internationally. This expansion can drive revenue growth and increase its market share.

Improving Profitability: While DraftKings has faced challenges in achieving profitability, the company has been making strides towards improving its financial performance. As it continues to optimize its operations and scale its business, profitability could improve significantly.

Bear Case:

Regulatory Risks: The sports betting and daily fantasy sports industry is subject to regulatory changes and uncertainties. Changes in regulations, particularly at the federal level, could negatively impact DraftKings’ operations and financial performance.

Technological Risks: The company relies heavily on technology to deliver its products and services. Technological failures, security breaches, or outdated systems could disrupt operations and damage its reputation.

Economic Downturns: Economic downturns can negatively affect consumer spending on discretionary products like sports betting and daily fantasy sports. A recession could lead to reduced user engagement and lower revenue.