Executive Summary:

Okta Inc. is a leading identity and access management (IAM) company that provides cloud-based software solutions. Its primary focus is to simplify and secure how people access applications and devices. By offering a centralized platform, Okta helps businesses manage user authentication, authorization, and single sign-on (SSO) across various applications. Okta’s services are widely used by enterprises of all sizes, making it a crucial player in the IAM market.

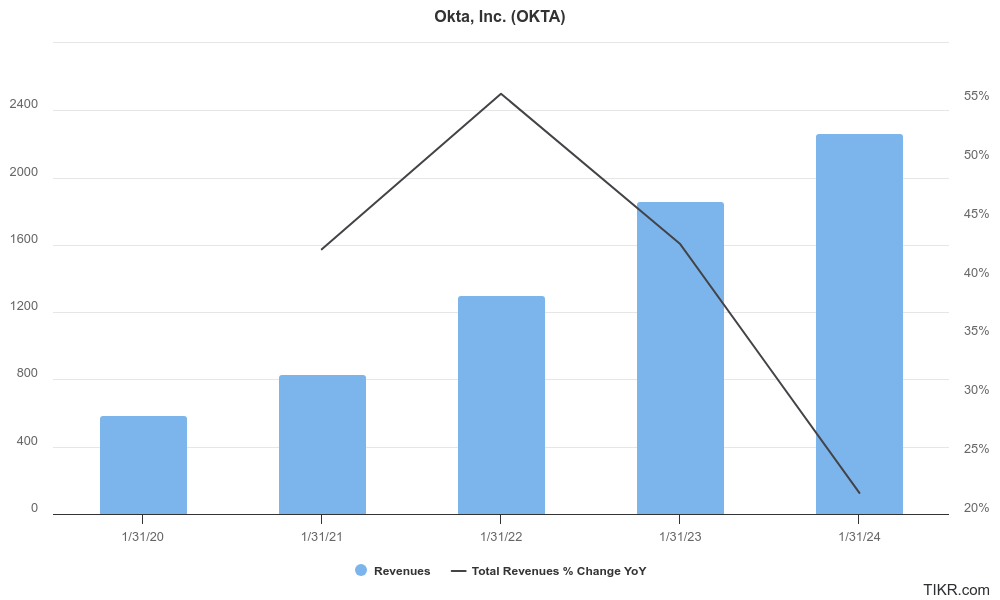

Okta Inc. reported with revenue reaching $2.263 billion, a 22% increase year-over-year. Earnings per share (EPS) came in at $1.75, surpassing estimates.

Stock Overview:

| Ticker | $OKTA | Price | $73.98 | Market Cap | $12.579B |

| 52 Week High | $114.50 | 52 Week Low | $65.04 | Shares outstanding | 162.41M |

Company background:

Okta, Inc., a leading identity and access management (IAM) company, was founded in 2009 by Todd McKinnon and Frederic Kerrest. The company’s mission is to simplify and secure how people access applications and devices. Recognizing the growing need for secure access to cloud-based applications, McKinnon and Kerrest launched Okta with the vision of providing a centralized platform to manage user authentication, authorization, and single sign-on (SSO).

Okta’s funding has come from various sources, including venture capital firms like Andreessen Horowitz, Sequoia Capital, and Greylock Partners. It offers a comprehensive suite of IAM products designed to meet the diverse needs of enterprises.

- Okta Identity Engine: A unified platform that provides authentication, authorization, and lifecycle management for users and devices.

- Okta Access Gateway: A secure gateway that enables seamless access to applications, whether they are cloud-native, on-premises, or hybrid.

- Okta Workforce Identity: A solution that helps organizations manage employee identities and access to company resources.

- Okta Customer Identity: A platform that enables businesses to provide secure and personalized experiences for their customers.

Okta’s key competitors in the IAM market include Microsoft Azure Active Directory, Ping Identity, OneLogin, and SailPoint. These companies offer similar products and services, making the IAM landscape highly competitive.

Okta is headquartered in San Francisco, California, and has offices around the world. The company has a strong customer base, serving enterprises of all sizes across various industries. With its focus on innovation and customer satisfaction, Okta is well-positioned to continue its growth and leadership in the IAM market.

Recent Earnings:

Okta’s reported total revenue of $2.263 billion, a 22% increase year-over-year. Subscription revenue, which accounted for the majority of total revenue, grew by 23% to $2.205 billion. This robust revenue growth was driven by increased customer adoption of Okta’s identity and access management solutions and strong demand for its products.

Earnings per share (EPS) for the quarter came in at $1.75. Okta’s customer base continued to expand, with over 18,800 customers at the end of the quarter. The company’s remaining performance obligations (RPO) grew by 13% year-over-year to $3.385 billion, indicating a healthy pipeline of future revenue.

The company expects revenue to be in the range of $2.33 billion to $2.35 billion, representing year-over-year growth of 19% to 20%. EPS is projected to be between $1.65 and $1.68. Okta’s strong position in the identity and access management market and its ability to capitalize on the growing demand for secure cloud-based solutions.

The Market, Industry, and Competitors:

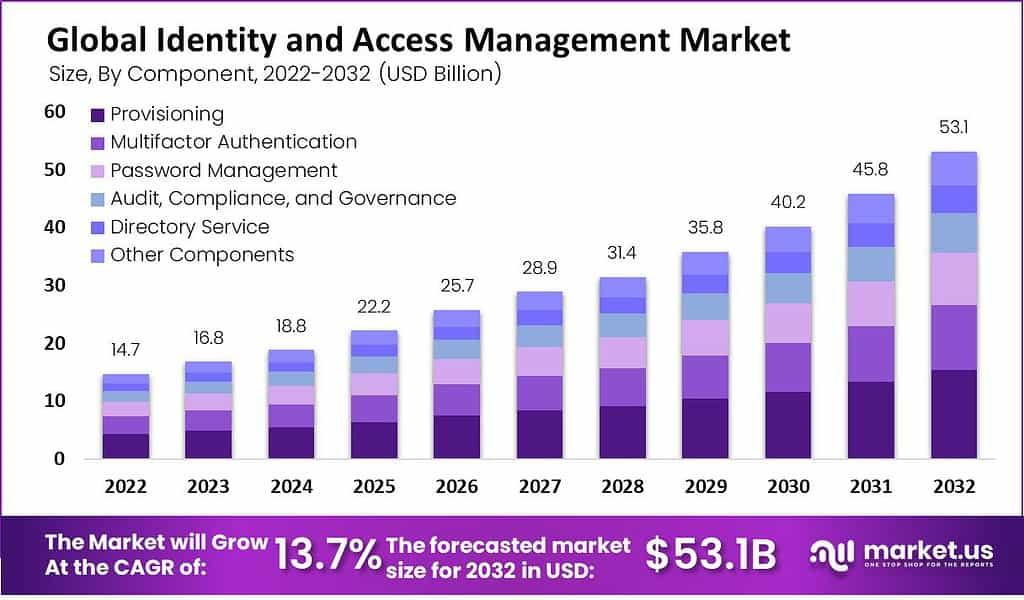

The identity and access management (IAM) market, in which Okta operates of cloud computing and the proliferation of remote work have made secure access to applications and data a critical concern for organizations.The rise in cyber threats and data breaches has heightened the demand for robust IAM solutions.

The IAM market is expected to grow at a Compound Annual Growth Rate (CAGR) of 15% from 2023 to 2030. This growth is fueled by the ongoing digital transformation of businesses and the increasing complexity of IT environments. Okta, with its strong product portfolio and market presence, is well-positioned to capitalize on this growth and expand its customer base.

Unique differentiation:

Microsoft Azure Active Directory: As part of the Microsoft 365 suite, Azure AD is a widely used IAM solution that provides authentication, authorization, and single sign-on capabilities. Microsoft’s extensive customer base and deep integration with its other products give it a significant advantage.

Ping Identity: Ping Identity offers a comprehensive IAM platform that caters to a broad range of enterprise needs. The company’s focus on innovation and customization has helped it establish a strong presence in the market.

OneLogin: OneLogin provides cloud-based IAM solutions with a focus on simplicity and ease of use. The company has gained traction among mid-sized enterprises and is known for its competitive pricing.

SailPoint: SailPoint specializes in identity governance and administration (IGA) solutions, which help organizations manage user lifecycle processes and access controls. The company’s IGA expertise makes it a strong competitor in the IAM market.

Simplicity: Okta’s platform is designed to be easy to use and implement, even for organizations with complex IT environments. This simplicity reduces the time and cost associated with IAM deployment and management.

Scalability: Okta’s solutions can easily scale to accommodate the growth of an organization’s user base and application portfolio. This ensures that the company’s IAM infrastructure can support future business needs.

Integration: Okta integrates seamlessly with a wide range of applications and identity providers, making it a flexible and versatile solution. This reduces the complexity of managing multiple IAM systems and improves overall efficiency.

Management & Employees:

Todd McKinnon: As CEO and co-founder, Todd McKinnon is the visionary leader behind Okta. He brings extensive experience in enterprise software and cloud computing.

Frederic Kerrest: As co-founder and President, Frederic Kerrest is responsible for Okta’s product strategy and development. He has a strong background in software engineering and product management.

Financials:

Okta has total revenue increasing from $399 million in fiscal year 2019 to $1.30 billion in fiscal year 2024, representing a 5-year revenue CAGR of 27%. This growth has been driven by the company’s position as a leading independent identity provider, enabling organizations to securely connect the right people to the right technologies. The company reported a GAAP net loss of $153 million in Q4 FY2024, compared to a GAAP net loss of $44 million in the same period a year earlier.

Okta did achieve record non-GAAP operating income of $129 million in Q4 FY2024, or 21% of total revenue, up from $46 million or 9% in Q4 FY2023. The 5-year CAGR for GAAP net loss per share was 18%, improving from a loss of $0.95 per share in Q4 FY2023 to a loss of $0.26 per share in Q4 FY2024.Okta’s balance sheet remains strong, with $2.2 billion in cash.

The company’s current remaining performance obligations (cRPO), grew 16% year-over-year to $1.952 billion in Q4 FY2024. Okta generated record operating cash flow of $174 million and free cash flow of $166 million in Q4 FY2024.

Technical Analysis:

The stock is in a decline on the monthly chart (Stage 4, bearish) and will retest the $63 range in the weekly chart. The daily chart is more bearish and likely heading to $63 range quicker than most people expect.

Bull Case:

Market Growth: The IAM market is experiencing significant growth due to the increasing adoption of cloud-based applications, remote work, and the rising number of cyber threats. This favorable market dynamic provides a strong tailwind for Okta’s business.

Strategic Acquisitions: Okta has strategically acquired complementary businesses to enhance its product offerings and expand its market reach. These acquisitions have strengthened the company’s position in the IAM market.

Bear Case:

Macroeconomic Factors: Economic downturns or other macroeconomic events can impact the demand for enterprise software, including IAM solutions. A slowdown in the economy could negatively affect Okta’s revenue growth and profitability.

Security Risks: Cyber threats and data breaches are a constant concern for organizations. If Okta’s security solutions are compromised or perceived as inadequate, it could damage the company’s reputation and lead to customer churn.

Integration Challenges: As Okta continues to acquire and integrate other businesses, there is a risk of integration difficulties that could disrupt operations and impact financial performance.