Executive Summary:

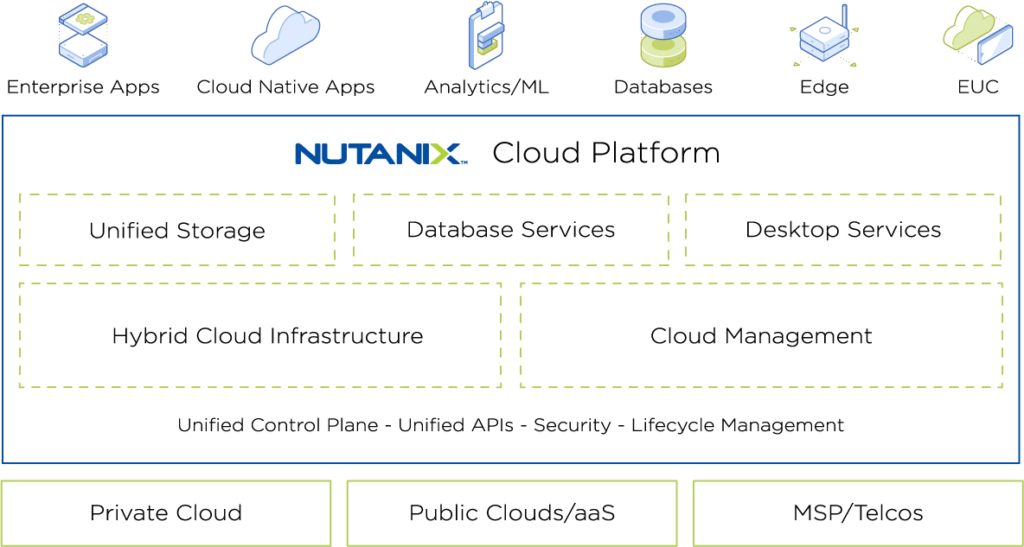

Nutanix Inc. is a leading cloud computing company specializing in software solutions for data centers and hybrid multi-cloud environments. Their platform offers a unified approach to managing infrastructure, applications, and data across various cloud environments, including public, private, and hybrid clouds. Nutanix provides a range of software solutions, such as virtualization, Kubernetes, database-as-a-service, software-defined networking, and security, as well as software-defined storage for file, object, and block storage.

Stock Overview:

| Ticker | $NTNX | Price | $62.77 | Market Cap | $15.48B |

| 52 Week High | $73.69 | 52 Week Low | $33.30 | Shares outstanding | 246.64M |

Company background:

Nutanix Inc., founded in 2009 by former VMware executives, is a leading provider of hybrid cloud computing solutions. The company’s mission is to simplify and consolidate IT infrastructure, enabling businesses to focus on innovation and growth. Nutanix is headquartered in San Jose, California, and has offices worldwide.

Nutanix has secured significant funding through various rounds, including a $235 million Series D funding in 2014 and a $750 million IPO in 2016. This funding has fueled the company’s growth and product development.

Nutanix offers a software-defined products like:

- Nutanix Enterprise Cloud Platform (NCP): A hyperconverged infrastructure solution that combines compute, storage, and networking into a single, integrated platform.

- Nutanix Calm: A cloud management and orchestration platform that simplifies the deployment and management of applications across hybrid cloud environments.

- Nutanix Flow: A software-defined networking solution that provides advanced networking features and automation.

- Nutanix Files: A file storage solution that offers high performance and scalability.

- Nutanix Objects: An object storage solution for unstructured data.

Nutanix competes with other major players in the hybrid cloud market, including Dell Technologies, Hewlett Packard Enterprise (HPE), Cisco Systems, and VMware. The company differentiates itself through its focus on simplicity, scalability, and performance.

The company’s products and services are used by organizations of all sizes across various industries. As the hybrid cloud market continues to evolve, Nutanix is well-positioned to capitalize on the growing demand for its innovative solutions.

Recent Earnings:

Nutanix, has delivered robust performance, exceeding all guided metrics for the quarter and demonstrating solid progress across key operational and financial metrics. They reported revenue of $548 million, an 11% increase year-over-year. The company also saw another quarter of strong free cash flow generation and the highest number of new customers in three years, indicating positive momentum with its go-to-market partnerships and initiatives. Nutanix delivered revenue of $2.149 billion, up 15% year-over-year and above the guidance range of $2.13 billion to $2.14 billion. Annual recurring revenue (ARR) reached $1.91 billion, up 22% year-over-year. The company generated free cash flow of $598 million, almost three times higher than the previous year, resulting in a free cash flow margin of 28% and a Rule of 40 score of 43.

The Market, Industry, and Competitors:

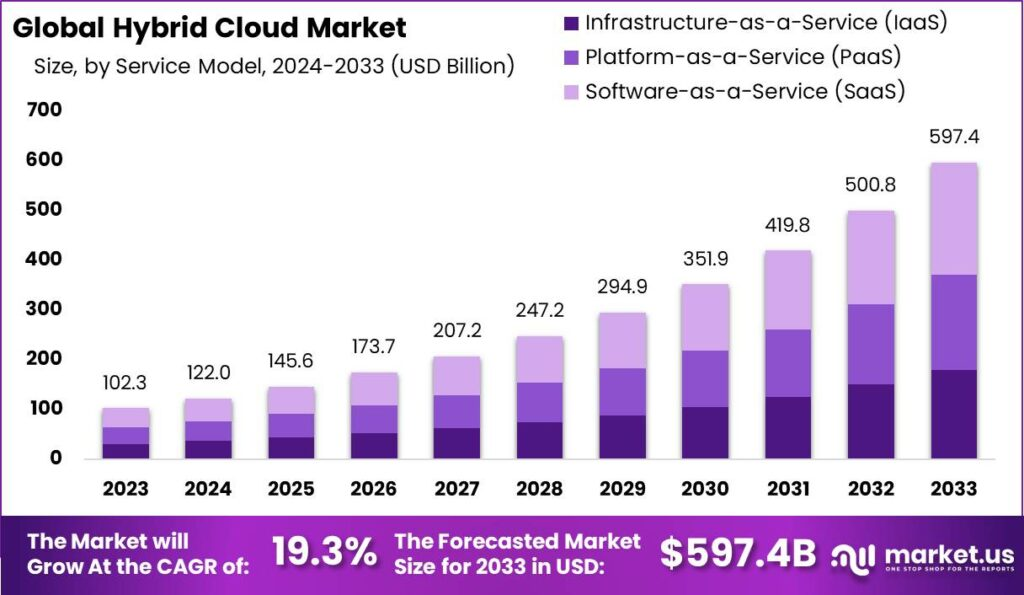

The Nutanix operates in hybrid cloud market and increasing adoption of cloud technologies, the need for flexible and scalable IT infrastructure, and the growing demand for hybrid cloud solutions are driving the market expansion. The global hybrid cloud market size is projected to reach USD 597.43 billion by 2030, growing at a CAGR of 20.00% during the forecast period (2023-2030).

Nutanix is well-positioned to capitalize on the growth opportunities in the hybrid cloud market. The company’s innovative products and services, strong customer base, and focus on simplifying IT infrastructure make it a leading player in the industry.

Unique differentiation:

Dell Technologies: Dell offers a wide range of IT infrastructure solutions, including hyperconverged infrastructure and cloud solutions. Dell’s strong market presence and extensive product portfolio make it a major competitor to Nutanix.

Hewlett Packard Enterprise (HPE): HPE is another leading provider of IT infrastructure solutions, with a focus on hybrid cloud and edge computing. HPE’s deep expertise in the enterprise market and its broad product offerings pose a significant challenge to Nutanix.

Cisco Systems: Cisco is primarily known for its networking solutions, but it also offers hyperconverged infrastructure and cloud solutions. Cisco’s strong brand recognition and established customer base make it a competitive force in the market.

VMware: VMware is a pioneer in virtualization technology and offers a range of cloud solutions, including vSphere, vSAN, and vCloud Suite. VMware’s deep expertise in virtualization and its extensive partner ecosystem make it a formidable competitor to Nutanix.

Simplified Management: Nutanix’s intuitive interface and automated management tools make it easy for IT teams to deploy, manage, and scale their infrastructure.

Hybrid Cloud Flexibility: Nutanix’s platform is designed to work seamlessly across public, private, and hybrid cloud environments, providing businesses with the flexibility to choose the best solution for their needs.

Performance and Scalability: Nutanix’s technology delivers high performance and scalability, ensuring that applications can meet the demands of modern workloads.

Management & Employees:

Rajiv Ramaswami: President and CEO, joined Nutanix in December 2020 from VMware where he served as Chief Operating Officer.

Thomas Cornely: Senior Vice President of Product Management, responsible for driving Nutanix’s product strategy and roadmap.

Shyam Desirazu: Head of Engineering, leads Nutanix’s engineering team and oversees the development of the company’s products.

Tarkan Maner: Chief Commercial Officer, responsible for Nutanix’s commercial operations, including pricing, channel sales, and partner relationships.

Financials:

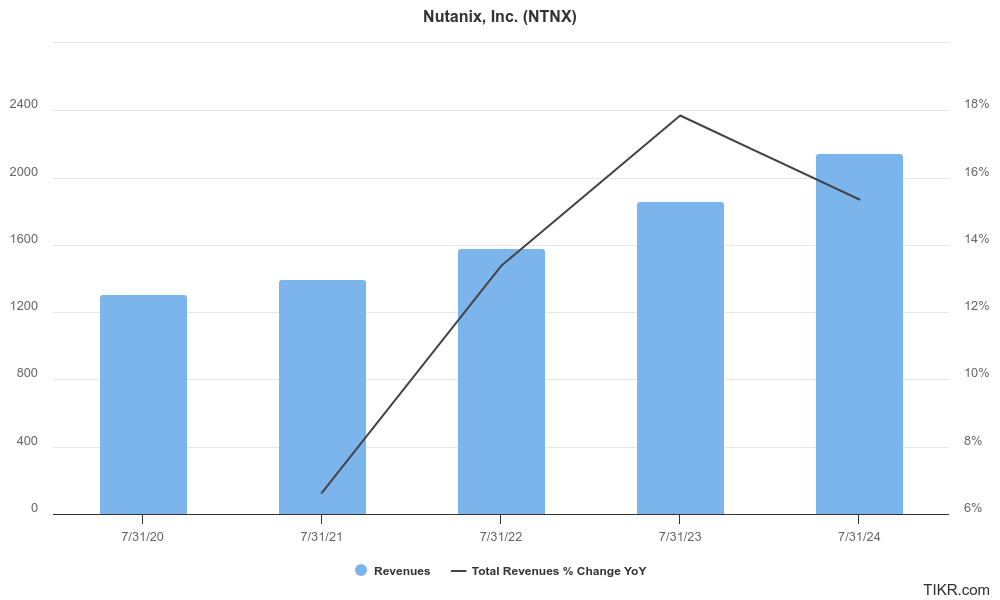

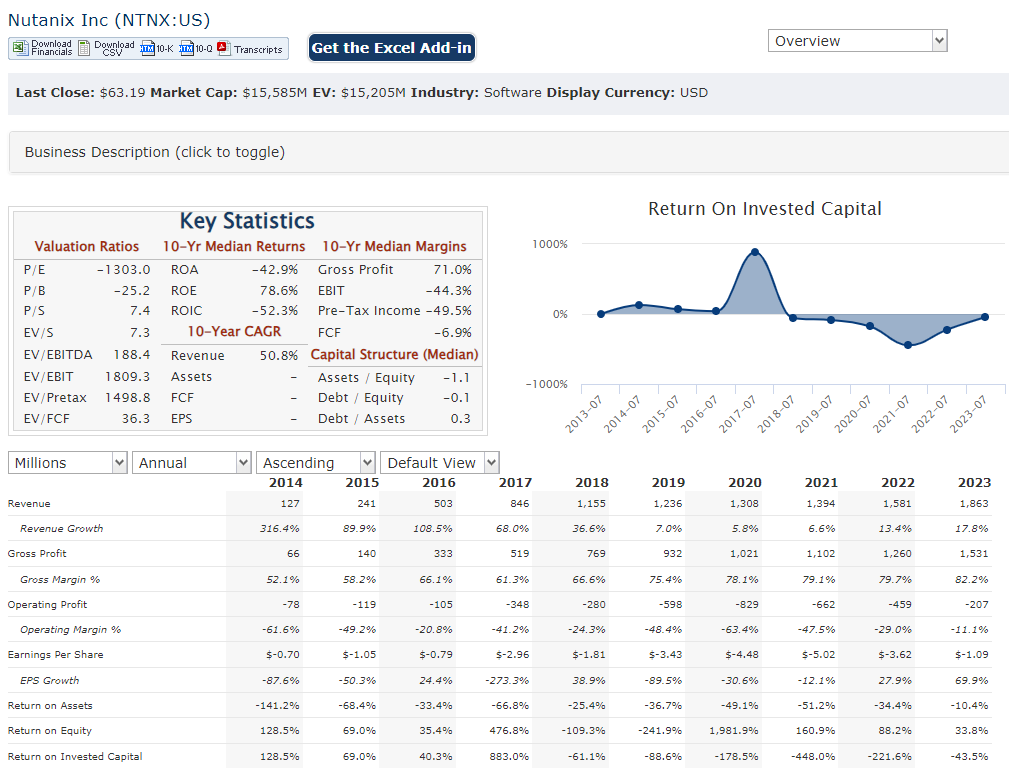

Nutanix has demonstrated with consistent revenue growth and improving profitability. The company has successfully transitioned to a subscription-based business model, which has driven higher recurring revenue and improved margins.

Nutanix reported revenue of $1.24 billion, up 18% year-over-year. The company’s subscription revenue reached $195.6 million, representing 65% of total revenue. Nutanix ended the fiscal year with 14,180 end-customers, adding 990 new customers in the fourth quarter alone.

Nutanix continued to grow its revenue at a healthy pace, reaching $2.149 billion in fiscal year 2024, a 15% year-over-year increase. The company’s annual recurring revenue (ARR) grew to $1.91 billion, up 22% year-over-year, demonstrating the success of its subscription model. The company generated free cash flow of $598 million, almost three times higher than the previous year, resulting in a free cash flow margin of 28%.

Technical Analysis:

After a strong move higher the stock retested the $43 range, and reversed well on the monthly chart. It is in an early stage 2, (bullish) following earnings. The weekly chart is bullish stage 2 as well and the daily chart is positive with consolidation in the 60 range. A gap fill lower is likely in the $53 range, but the near term momentum should take it to $66

Bull Case:

Growth Potential: The hybrid cloud market is expected to continue growing at a rapid pace, driven by the increasing adoption of cloud technologies, the need for flexible and scalable IT infrastructure, and the demand for hybrid cloud solutions. Nutanix is well-positioned to capitalize on this growth.

Product Innovation: Nutanix has a history of product innovation, consistently introducing new features and capabilities to its platform. This focus on innovation helps the company stay ahead of the competition and meet the evolving needs of its customers.

Bear Case:

Pricing Pressure: As the hybrid cloud market matures, there is a risk of increased pricing pressure. Competitors may offer more aggressive pricing or bundled solutions to attract customers, which could impact Nutanix’s revenue and profitability.

Execution Risks: Nutanix’s success depends on its ability to execute on its growth strategy, including product development, go-to-market initiatives, and customer acquisition. If the company faces challenges in executing on its plans, it could impact its financial performance and stock price.