Executive Summary:

Celsius Holdings Inc. is a global beverage company specializing in premium energy drinks. Its flagship product, CELSIUS, is a zero-sugar, better-for-you alternative to traditional energy drinks, designed to appeal to fitness enthusiasts and health-conscious consumers. The company’s unique MetaPlus formulation, which includes ingredients like guarana, green tea extract, and ginger, provides a sustained energy boost without the crash often associated with other energy drinks.

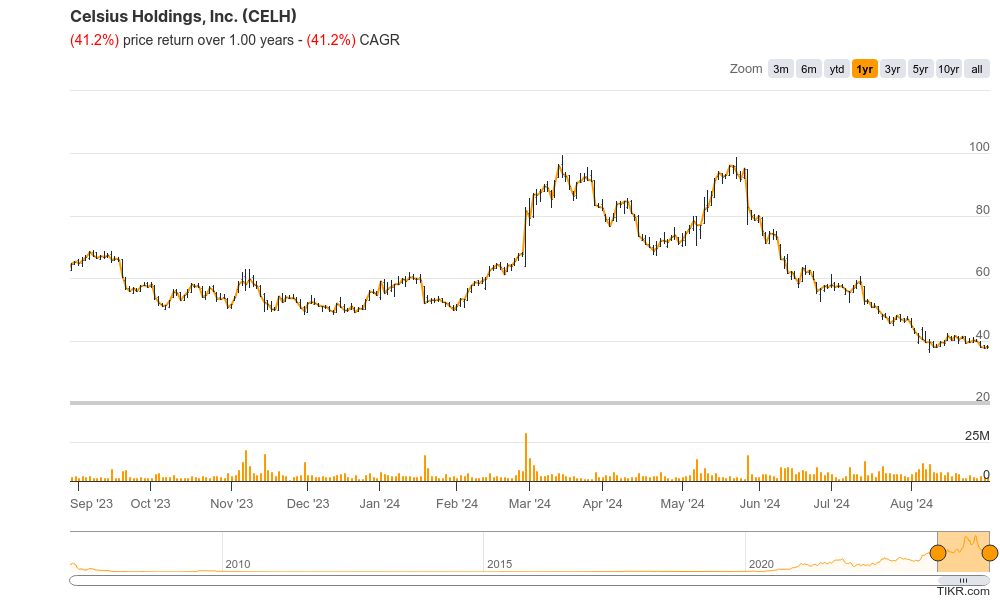

Stock Overview:

| Ticker | $CELH | Price | $38.04 | Market Cap | $8.86B |

| 52 Week High | $99.62 | 52 Week Low | $36.17 | Shares outstanding | 233.07M |

Company background:

Celsius Holdings Inc., a global beverage company, was founded in 2004 by Steve Haley. The company is headquartered in Boca Raton, Florida, and specializes in premium energy drinks. The company’s flagship product is CELSIUS, a zero-sugar energy drink marketed as a better-for-you alternative to traditional energy drinks.

Celsius Holdings Inc. has driven by increased consumer demand for healthier beverage options and strategic partnerships with major distributors. The company’s products are available in various flavors and are sold in retail channels across the United States, as well as in certain international markets.

Some of the key competitors of Celsius Holdings Inc. include Red Bull, Monster Energy, and Bang Energy. These companies also offer energy drinks, but they may have different formulations and target different consumer segments.

Recent Earnings:

Celsius Holdings Inc. reported revenues of $401.98 million, marking a 23.3% increase from the previous year’s $325.88 million. The Zacks Consensus Estimate of $388.5 million by 3.37%. Celsius reported a diluted EPS of $0.28, which not only beat the consensus estimate of $0.23 by 21.74% but also represented a substantial increase from $0.17 per share, reflecting a growth of 64.7%.

The company’s gross profit for the second quarter was $182.2 million, up 60% year-over-year, indicating improved profitability alongside revenue growth. The stock has experienced a decline of approximately 24.2% year-to-date, contrasting with the broader S&P 500’s gain of 8.7%, raising.

The consensus EPS estimate stands at $0.30, with projected revenues of $451.56 million. For the fiscal year, analysts anticipate an EPS of $1.05 on revenues of $1.61 billion.

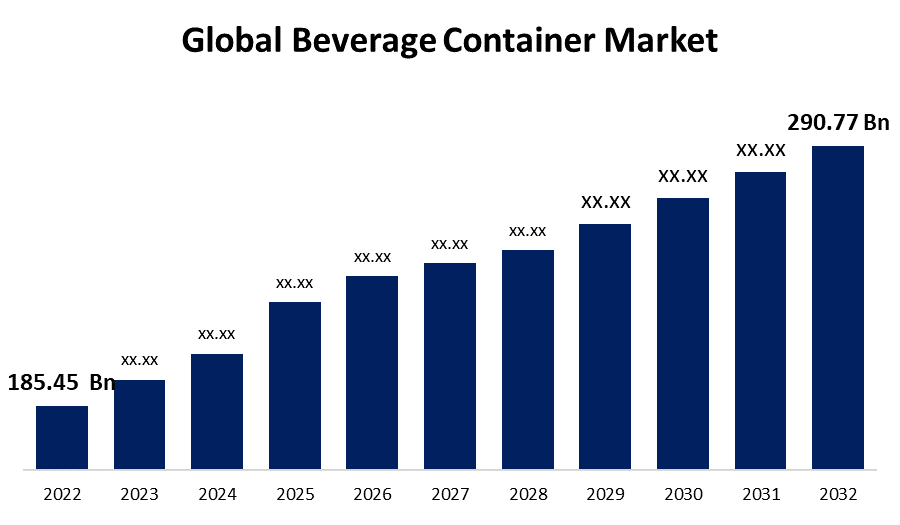

The Market, Industry, and Competitors:

Celsius Holdings Inc. operates within the rapidly growing functional beverage market, which includes energy drinks, dietary supplements, and wellness products. This sector has gained significant traction due to rising consumer demand for healthier alternatives to traditional sugary drinks. The global energy drinks market alone is projected to reach approximately $61.3 billion by 2030, growing at a compound annual growth rate (CAGR) of 7.6% from 2023 to 2030.

Celsius, with its emphasis on performance-oriented and health-conscious products, is well-positioned to capitalize on this trend as consumers increasingly seek functional beverages that support active lifestyles. Analysts forecast that the company will maintain a strong presence in the health and wellness segment, with a projected CAGR of around 20% for its revenue over the next several years. This growth is supported by Celsius’s strategic initiatives, including new product launches and partnerships with retailers, which enhance its market reach.

Unique differentiation:

Red Bull: One of the largest and most well-known energy drink brands globally, Red Bull has a strong presence in various markets and offers a wide range of products.

Monster Energy: Another major player in the energy drink market, Monster Energy is known for its aggressive marketing and distribution strategies.

Bang Energy: A relatively newer entrant, Bang Energy has gained popularity due to its high caffeine content and bold flavors.

Rockstar Energy: A subsidiary of PepsiCo, Rockstar Energy has a significant market share and offers a variety of energy drink options.

- Zero-Sugar Formulation: Unlike many traditional energy drinks that are high in sugar, Celsius is a zero-sugar option, catering to consumers seeking healthier alternatives.

- MetaPlus Ingredient Blend: The company’s proprietary MetaPlus formula includes ingredients like guarana, green tea extract, and ginger, providing sustained energy without the crash often associated with other energy drinks.

- Focus on Fitness and Wellness: Celsius targets fitness enthusiasts and health-conscious consumers, positioning itself as a drink that supports a healthy lifestyle.

- Natural Ingredients: The company emphasizes the use of natural ingredients, appealing to consumers who prefer products with cleaner labels.

Management & Employees:

John Fields: Chief Executive Officer

Steve Haley: Chief Innovation Officer and Co-Founder

Scott Black: Chief Commercial Officer

David Feeney: Senior Vice President, Global Marketing

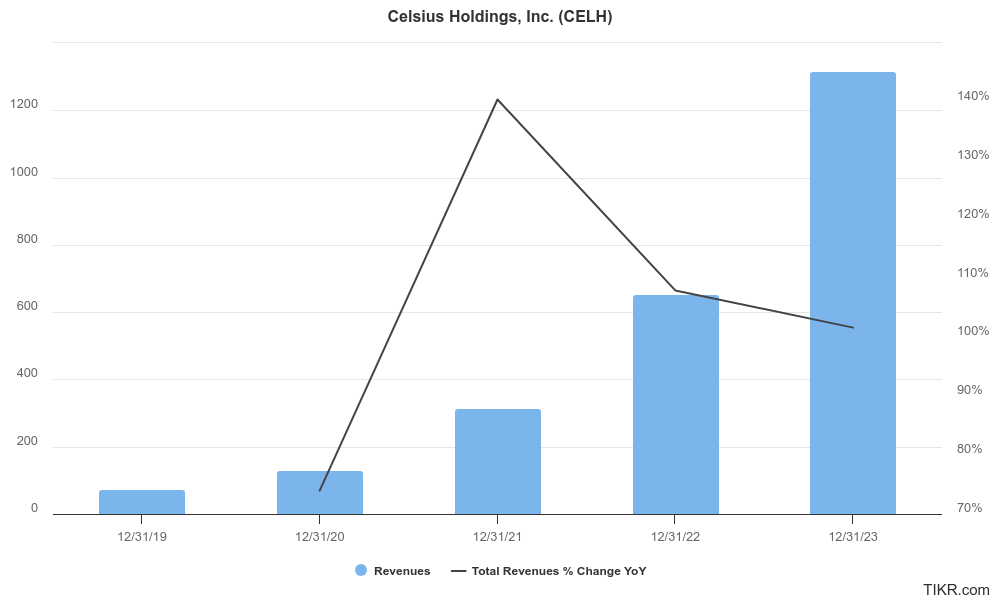

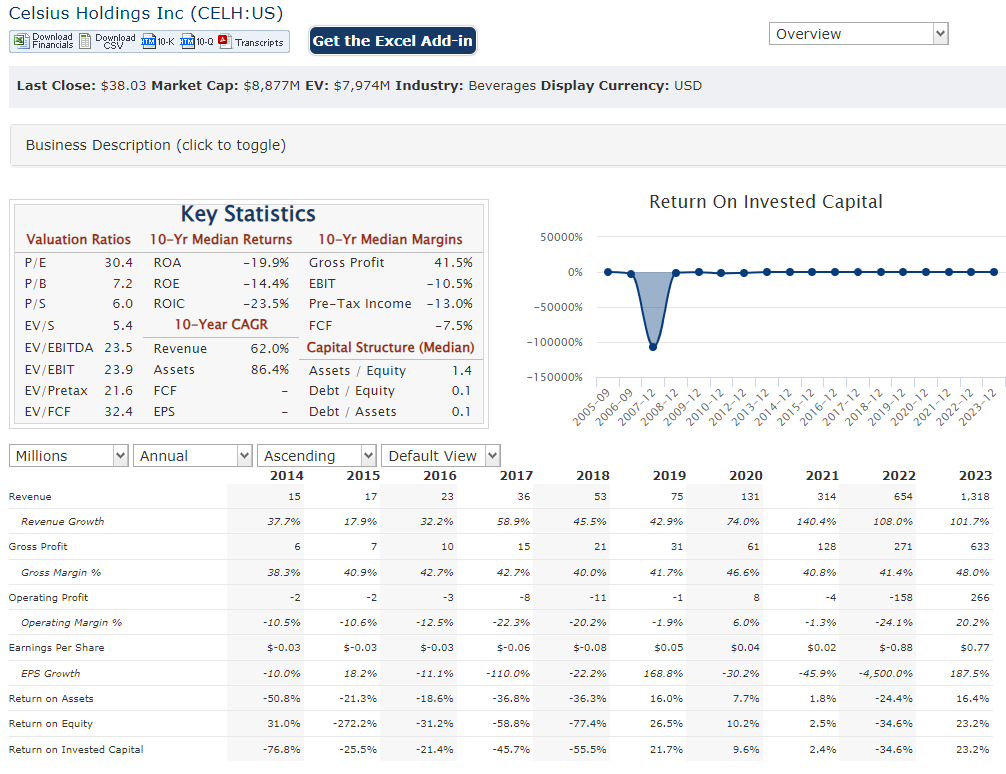

Financials:

Celsius Holdings Inc. revenue has consistently increased, reaching $401.98 million in the second quarter of 2024, a 23.35% increase from the same period in the previous year. Celsius’s revenue growth has been particularly impressive, with a compound annual growth rate (CAGR) of approximately 56.5% over the last twelve months ending June 30, 2024.

The company’s earnings per share (EPS) have also seen substantial growth, with diluted EPS reaching $0.28 in the second quarter of 2024, up 64.7% from $0.17 in the same quarter of 2023. This strong earnings growth has resulted in a CAGR of approximately 108%.

Celsius Holdings with total assets of $1.484 billion as of March 31, 2023. The company’s market capitalization stood at $10.61 billion as of June 2, 2023, indicating investor confidence in its growth potential. Celsius Holdings will continue its strong performance, with projected revenue of $451.56 million and an EPS of $0.30 for the upcoming quarter. For the fiscal year, the consensus estimates are $1.61 billion in revenue and an EPS of $1.05.

Technical Analysis:

The stock is in a deep stage 4 markdown (bearish) on the monthly and weekly charts. The supports at $32 and $30 could be easily breached to hit $27. The daily chart is showing a retest of the recent low at $36 range, where it could reverse, but this stock wants to head lower.

Bull Case:

Unique Product Positioning: Celsius differentiates itself from competitors by offering a zero-sugar, better-for-you energy drink with a proprietary MetaPlus formula. This positions the company to capitalize on the growing trend towards healthier beverage choices.

Expanding Market Presence: Celsius has been successfully expanding its distribution network both domestically and internationally, reaching a wider range of consumers.

Favorable Industry Trends: The energy drink market is expected to experience continued growth, driven by factors such as increasing disposable incomes, changing lifestyles, and a growing preference for functional beverages.

Bear Case:

Regulatory Risks: The beverage industry is subject to various regulatory requirements, including those related to labeling, ingredients, and marketing. Changes in regulations could impact Celsius’ operations and product offerings.

Supply Chain Disruptions: Global supply chain disruptions, such as those experienced during the COVID-19 pandemic, could impact Celsius’ ability to source ingredients, manufacture products, and distribute them to customers.

Execution Risks: The company’s success depends on its ability to execute its growth strategy effectively. Challenges in marketing, distribution, or product development could hinder its growth potential.