Executive Summary:

Floor & Decor Holdings Inc. is a leading specialty retailer and commercial flooring distributor focused on hard surface flooring. They offer an extensive in-stock selection of tile, wood, laminate, vinyl, and natural stone flooring, along with complementary products and accessories, at competitive prices. With a strong emphasis on sourcing directly from manufacturers, Floor & Decor aims to deliver high-quality products at everyday low prices.

Floor & Decor Holdings Inc. reported its net sales came in at $1.13 billion, a slight decrease of 0.2%. Earnings per share (EPS) was $0.52. Comparable store sales declined by 9.0%.

Stock Overview:

| Ticker | $FND | Price | $103.91 | Market Cap | $11.13B |

| 52 Week High | $135.67 | 52 Week Low | $76.30 | Shares outstanding | 107.16M |

Company background:

Floor & Decor Holdings Inc. is a leading specialty retailer and commercial flooring distributor focused on hard surface flooring. Founded in 2000 and headquartered in Atlanta, Georgia, the company has grown significantly to operate over 230 warehouse-format stores across the United States. Floor & Decor offers a vast selection of in-stock tile, wood, laminate, vinyl, and natural stone flooring, along with complementary products like decorative accessories, wall tile, and installation materials. By maintaining a warehouse-style format, the company provides competitive pricing and a wide array of options for both homeowners and professional contractors.

Floor & Decor has a unique business model that emphasizes direct sourcing from manufacturers, allowing them to offer everyday low prices. Floor & Decor’s growth has been fueled by its ability to cater to a broad customer base, including DIY enthusiasts, professional installers, and commercial clients.

Key competitors in the flooring industry include Home Depot, Lowe’s, and other regional flooring retailers. However, Floor & Decor differentiates itself by offering a specialized focus on hard surface flooring, a wider selection of in-stock products, and a warehouse-style shopping experience.

Recent Earnings:

Floor & Decor Holdings Inc. faced a challenging macroeconomic environment marked by declining home sales and a contracting flooring industry. Net sales for the quarter came in at $1.048 billion. Comparably store sales declined by 9.4%, the company’s diluted earnings per share (EPS) of $0.34 surpassed analysts’ expectations. The company also opened 14 new warehouse stores during the quarter, bringing its total store count to 221.

Floor & Decor remains optimistic about its long-term growth prospects. The company plans to open 30 to 35 new warehouse stores in fiscal 2024 as part of its goal to reach 500 stores.

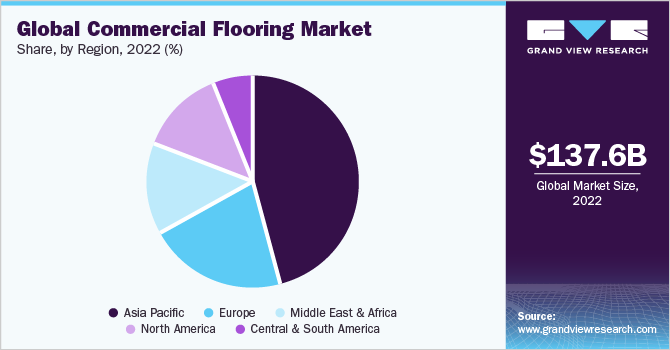

The Market, Industry, and Competitors:

Floor & Decor Holdings Inc. operates in the highly competitive home improvement and flooring retail market. The company competes with both big-box retailers like Home Depot and Lowe’s, as well as smaller regional flooring specialists. Despite the competitive landscape, Floor & Decor has carved a niche for itself by focusing on hard surface flooring and offering a vast in-stock selection at competitive prices.

Factors such as increasing disposable income, rising homeownership rates, and ongoing renovation and remodeling activities are anticipated to drive demand. Floor & Decor, with its strong market position and growth strategy, is well-positioned to capitalize on these trends. The company has previously projected a total net sales CAGR of at least 20%, indicating its ambitious growth targets.

Unique differentiation:

Floor & Decor Holdings Inc. competitors are the home improvement giants, such as The Home Depot and Lowe’s. These retailers offer a vast array of products, including flooring, and benefit from strong brand recognition and extensive store networks. While their focus is broader, they can significantly impact the flooring market due to their scale and purchasing power. On the other hand, specialized flooring retailers like The Tile Shop and Lumber Liquidators directly compete with Floor & Decor by offering a narrower but deeper selection of flooring products. It has adopted a unique warehouse-format store model and emphasizes a vast in-stock selection of hard surface flooring.

Warehouse-format stores: Unlike traditional retail stores, Floor & Decor’s warehouse-style format offers a vast in-stock selection of hard surface flooring, allowing customers to see and touch products before purchasing.

Specialized focus: The company exclusively focuses on hard surface flooring, providing a deeper product assortment and expertise in this category compared to general home improvement retailers.

Value proposition: Floor & Decor positions itself as a value-oriented retailer, offering everyday low prices and a wide range of products to cater to both homeowners and professional contractors.

Management & Employees:

- Thomas V. Taylor: Chief Executive Officer

- Trevor Lang: President

- David Christopherson: Executive Vice President, Chief Administrative Officer & Chief Legal Officer

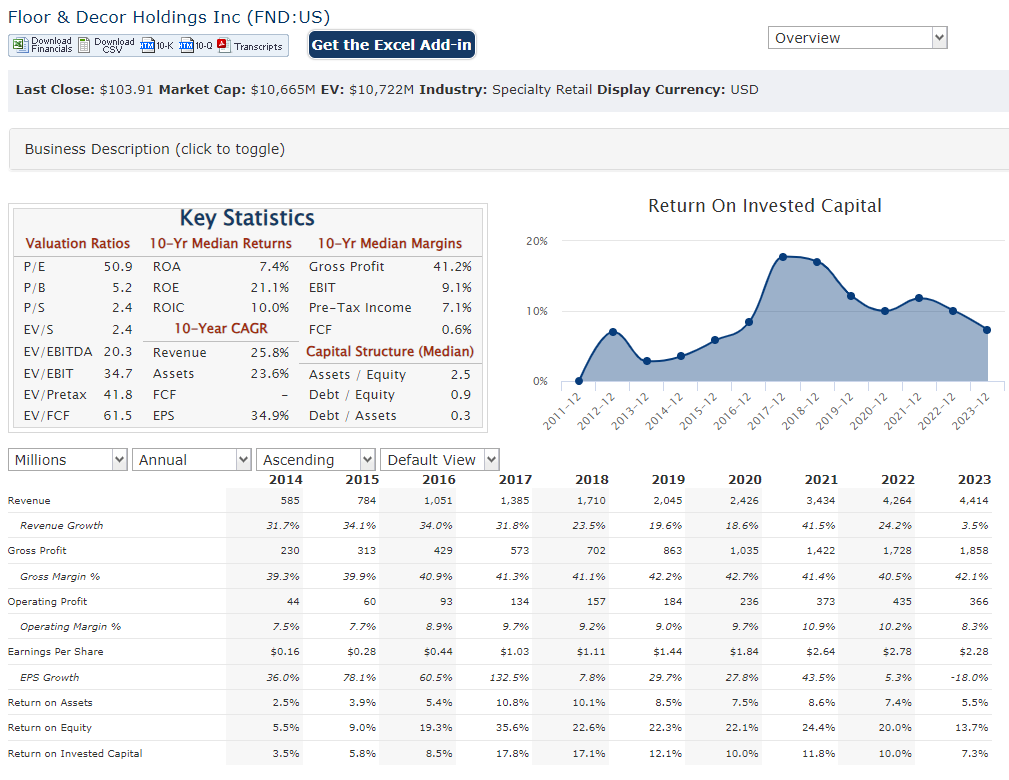

Financials:

Floor & Decor Holdings Inc. has driven by its strategic focus on hard surface flooring and aggressive store expansion. This growth trajectory has been supported by a growing customer base, both in the residential and commercial segments. Consequently, Floor & Decor has achieved an impressive compound annual growth rate (CAGR) in revenue, outpacing the overall home improvement industry.

On the profitability front, the company has demonstrated steady earnings growth, reflecting its ability to manage costs effectively and leverage its scale. Earnings per share (EPS) have shown consistent improvement, contributing to a healthy CAGR. This profitability expansion has been driven by factors such as gross margin expansion, operating leverage, and disciplined expense management.

Floor & Decor maintains a solid balance sheet characterized by ample liquidity and a manageable debt-to-equity ratio. The company has generated substantial cash flow from operations, enabling it to fund store openings, invest in supply chain infrastructure, and return capital to shareholders through share repurchases.

Technical Analysis:

The stock is in a stage 2 (markup, bullish) on the monthly chart, and reversing off a retest in a stage 2 on the weekly chart as well. On the daily chart, the reversal is more clear, and a clear move to $113 in the short term is the likely scenario.

Bull Case:

Market Leadership in Hard Surface Flooring: The company has established itself as a dominant player in the hard surface flooring market. This specialization allows it to offer a wider selection, deeper expertise, and potentially better pricing compared to general home improvement retailers.

Warehouse Store Model: The company’s warehouse-format stores provide a unique shopping experience, offering a vast in-stock selection and competitive pricing. This model has proven successful in attracting both DIY customers and professional contractors.

Store Expansion: The company has a robust store expansion plan, which provides significant growth opportunities. As Floor & Decor expands its geographic footprint, it can capture market share and increase revenue.

Bear Case:

Economic Downturn: A significant economic downturn could lead to a decline in home improvement spending, negatively impacting Floor & Decor’s sales.

Supply Chain Disruptions: Ongoing supply chain challenges could impact product availability, increase costs, and disrupt operations, affecting the company’s financial performance.

Interest Rate Environment: Rising interest rates can impact the housing market and consumer spending on home improvement projects, potentially affecting Floor & Decor’s sales.