Executive Summary:

Dropbox Inc. is a leading cloud storage and content collaboration platform. It offers a user-friendly way to store, synchronize, and share files across various devices. Initially focused on individuals, Dropbox has expanded its services to cater to businesses, providing tools for team collaboration and productivity.

Dropbox Inc. reported revenue of $634.5 million, marking a 1.9% year-over-year increase. Dropbox’s GAAP operating margin came in at a strong 20.0%, and the company generated a substantial $230.6 million in net cash from operating activities.

Stock Overview:

| Ticker | $DBX | Price | $21.89 | Market Cap | $7.23B |

| 52 Week High | $33.43 | 52 Week Low | $20.68 | Shares outstanding | 250.34M |

Company background:

Dropbox Inc. is a prominent cloud storage and file-sharing platform founded in 2007 by MIT students Drew Houston and Arash Ferdowsi. Initially bootstrapped, the company gained traction and secured funding from seed accelerator Y Combinator.

Dropbox has expanded its offerings beyond individual users to cater to businesses and teams. The company introduced features like file sharing, version control, and real-time collaboration to enhance productivity. Dropbox Paper, a document collaboration tool, was also launched to compete with other productivity suites. While cloud storage remains a core business, Dropbox has diversified its product portfolio to include other tools aimed at streamlining workflows.

Dropbox’s primary competitors in the cloud storage market include Google Drive, Microsoft OneDrive, and Box. The company has faced challenges related to data security and privacy concerns, but it has consistently worked to address these issues and maintain customer trust. Headquartered in San Francisco, California, Dropbox has established itself as a leading player in the cloud storage industry, serving millions of users worldwide.

Recent Earnings:

Dropbox Inc. generated $634.5 million in revenue, marking a modest 1.9% year-over-year increase. It highlighted a robust GAAP operating margin of 20.0%. This demonstrates the company’s ability to manage costs effectively and drive profitability. Dropbox generated a substantial $230.6 million in net cash from operating activities, underscoring its strong cash flow position.

Dropbox remains optimistic about its growth prospects. The company’s focus on expanding its product suite beyond traditional cloud storage, including offerings like Dropbox Paper and other productivity tools, is expected to drive future revenue growth. Dropbox’s emphasis on operational efficiency and cost management positions it well to navigate potential economic uncertainties.

The Market, Industry, and Competitors:

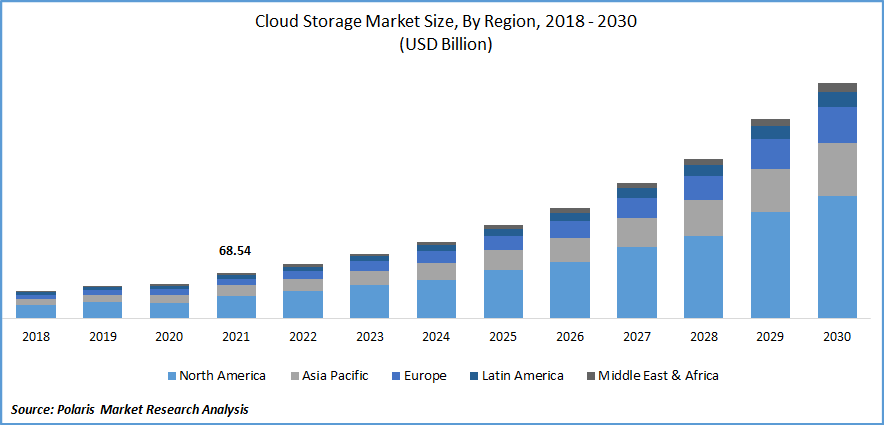

Dropbox Inc. operates in the highly competitive cloud storage and file-sharing market. This space has witnessed by the increasing reliance on digital data and remote work. Key players in this market include Google Drive, Microsoft OneDrive, and Box, among others. While Dropbox was an early pioneer, it faces stiff competition from tech giants with deep pockets and extensive product portfolios. The industry is projected to expand significantly over the next decade, driven by factors such as increasing data generation, the adoption of cloud computing, and the growing demand for remote collaboration tools. Dropbox is challenging due to the competitive landscape and evolving market dynamics. While the company aims to maintain its market position and expand its user base, achieving a high CAGR (Compound Annual Growth Rate) will depend on its ability to differentiate its offerings, innovate effectively, and capitalize on emerging trends.

Unique differentiation:

Dropbox operates in a highly competitive market dominated by tech giants. Its primary competitors include Google Drive, Microsoft OneDrive, and Box. These companies boast substantial resources, extensive user bases, and integrated ecosystems that pose significant challenges to Dropbox. Google Drive, for instance, benefits from its integration with the popular Gmail and Google Workspace suite, while OneDrive is closely tied to the Microsoft Office ecosystem.

While its competitors often bundle cloud storage with a suite of productivity tools, Dropbox has maintained a core focus on providing a clean, intuitive platform for storing and sharing files. This simplicity has been a key factor in attracting both individual users and small businesses.

Dropbox has invested in features that enhance collaboration and productivity, such as file version history, real-time editing, and integration with other popular tools. By offering a balance of simplicity and functionality, Dropbox aims to differentiate itself from competitors and maintain a loyal user base.

Management & Employees:

Drew Houston: As the co-founder and CEO, Houston has been instrumental in shaping Dropbox’s vision and direction.

Melanie Rosenwasser: The Chief People Officer, Rosenwasser is responsible for human resources, talent acquisition, and employee development.

Financials:

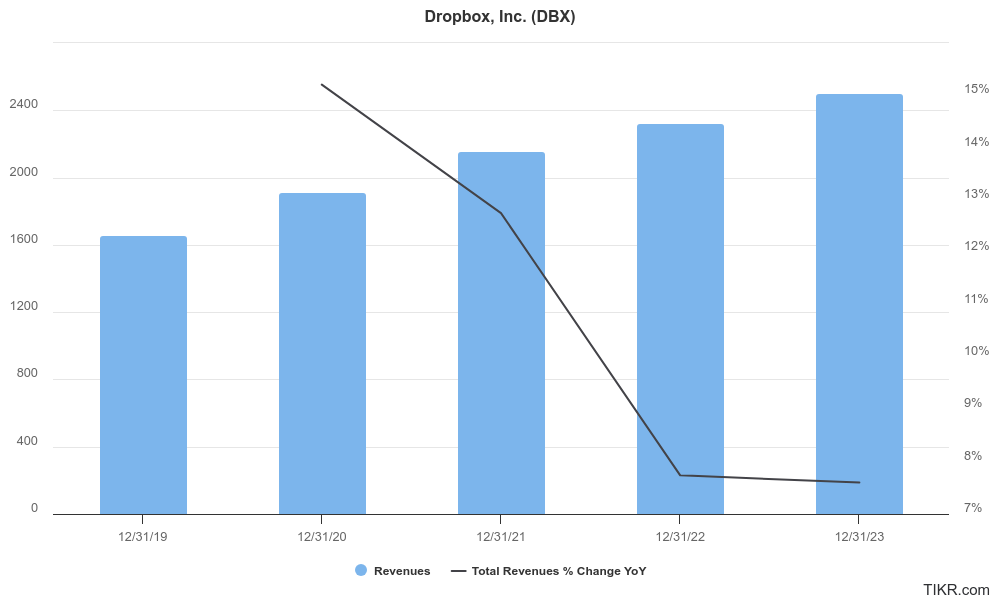

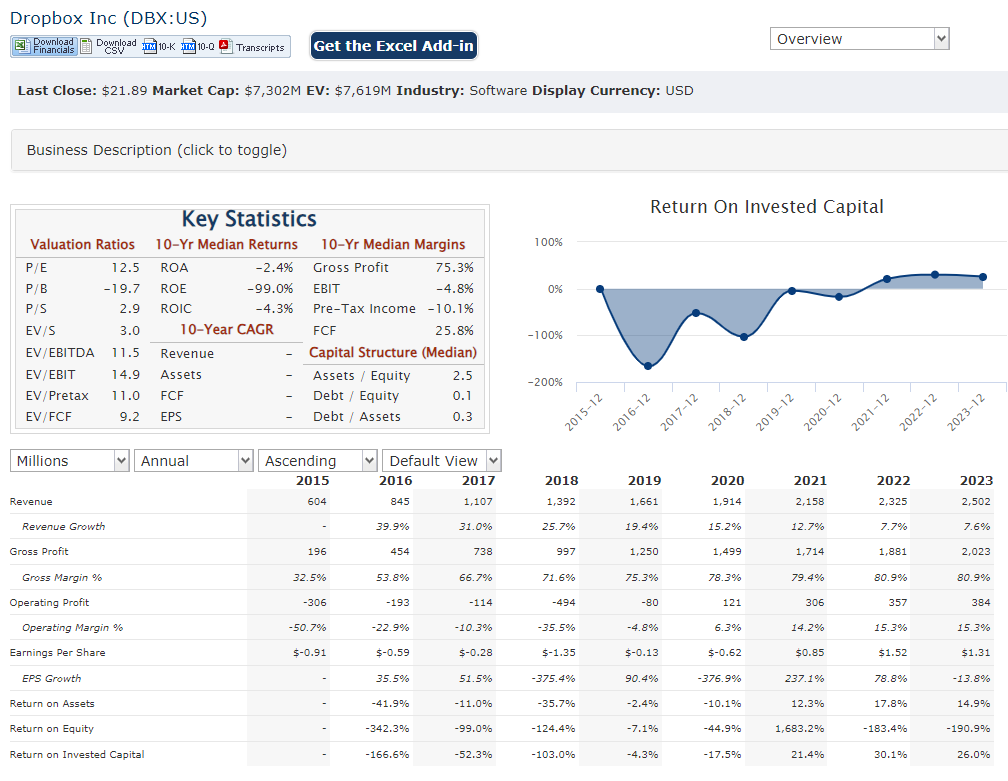

Dropbox Inc. has successfully expanded its customer base and introduced new features to drive revenue. While the exact CAGR (Compound Annual Growth Rate) would require specific numerical data, Dropbox has generally maintained a positive revenue trajectory.

Earnings growth has been more volatile. The company has faced challenges in balancing revenue growth with operational expenses. Overall profitability has been inconsistent. The CAGR for earnings is likely to be lower than that of revenue.

Dropbox’s balance sheet generally reflects a solid financial position with a healthy cash balance. The company has managed its liabilities effectively, maintaining a manageable debt-to-equity ratio. As with any technology company, significant investments in research and development, as well as potential acquisitions.

Technical Analysis:

The stock is reversing (early stage 2, bullish) on the monthly chart and consolidating (stage 1) on the weekly chart. On the daily chart the reversal is more visible, with a bottom at $21.33 which is close to a retest of the bottom. The near term move to $24 range is more likely which has a lot of resistance.

Bull Case:

- Operational Efficiency: Dropbox has demonstrated a strong ability to manage costs and generate cash flow, which can enhance profitability.

- Valuation: The stock may be undervalued relative to its growth prospects and potential for future earnings.

- AI Integration: The potential integration of AI into Dropbox’s platform could create new opportunities for growth and efficiency.

Bear Case:

- Maturity of the Market: The cloud storage market is maturing, which could lead to slower revenue growth and margin compression for Dropbox.

- Economic Downturns: Economic downturns can impact spending on cloud storage services, potentially affecting Dropbox’s revenue.

- Data Security Concerns: The increasing importance of data security could expose Dropbox to potential risks and reputational damage.