Executive Summary:

Primerica Inc. is a financial services company that caters to middle-income families in North America. They offer term life insurance, investments, and other financial products through a network of independent licensed representatives. They promote a financial philosophy of “Buy Term and Invest the Difference” which focuses on protecting families with term life insurance while investing for the future.

Primerica reported earnings per share (EPS) of $3.91. Total revenue for the quarter reached $742.8 million.

Stock Overview:

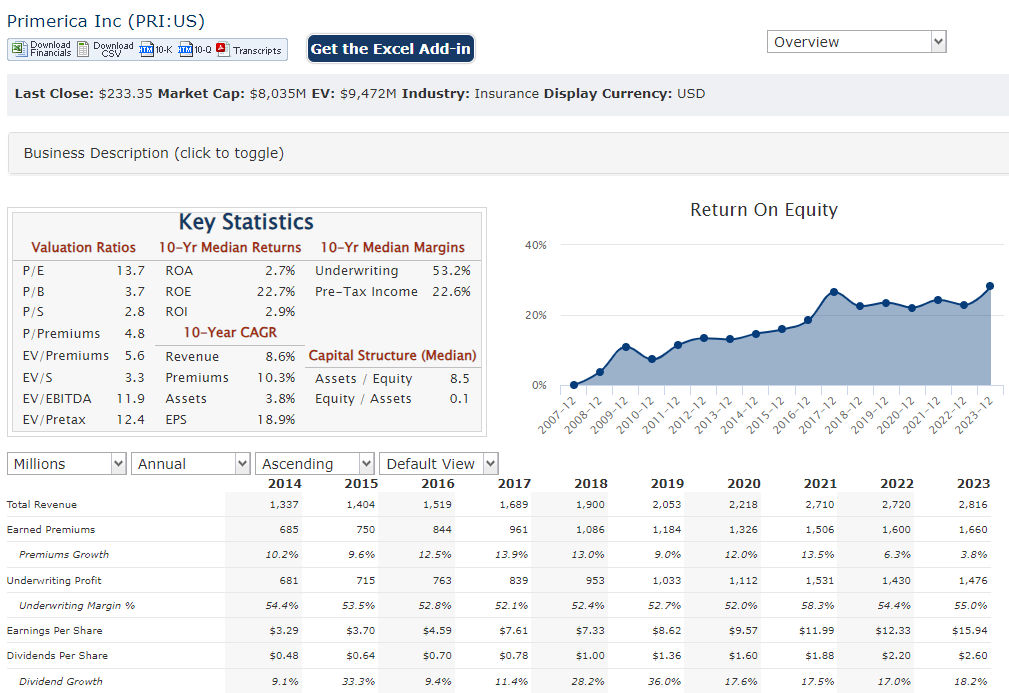

| Ticker | $PRI | Price | $233.35 | Market Cap | $8.03B |

| 52 Week High | $256.56 | 52 Week Low | $184.76 | Shares outstanding | 34.41M |

Company background:

Primerica Inc., founded in 1977 by Art Williams. The company initially operated under the name A.L. Williams and Associates. Primerica doesn’t rely on traditional advertising but instead utilizes a multi-level marketing strategy. Their independent representatives, often referred to as “financial advisors,” sell products and recruit new representatives, earning commissions on both.

Primerica offers a variety of financial products, with a core focus on term life insurance. Beyond term life insurance, Primerica representatives sell mutual funds, annuities, and other financial products through partnerships with third-party providers.

Headquartered in Duluth, Georgia, Primerica faces competition from established financial institutions and independent insurance agencies. Major competitors include MetLife, Prudential Financial, and Northwestern Mutual, all offering similar financial products and services.

Recent Earnings:

Revenue and EPS Growth: Total revenue reached $742.8 million, reflecting an 8% increase year-over-year. Earnings per share (EPS) came in at $3.91, representing a 12% increase compared to the same quarter in 2023. While positive, it fell short of analysts’ expectations of $4.11 per share.

Operational Metrics: Primerica boasts a strong operational foundation with over 5.7 million insured lives, indicating a large and loyal customer base.

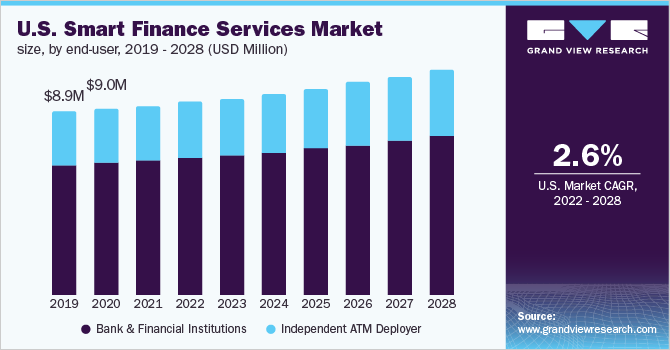

The Market, Industry, and Competitors:

- Increasing awareness of financial planning among middle-income households, who are realizing the importance of financial protection and long-term investing.

- Rising healthcare costs make life insurance more attractive, as it provides a financial safety net for beneficiaries in case of death.

- Growth of the middle class in developing economies creates a larger target audience for affordable financial products.

Analysts predict a Compound Annual Growth Rate (CAGR) of around 5-7% for the middle-income life insurance market in the next decade (2024-2030). This bodes well for Primerica’s core business model, which caters specifically to this market segment. Primerica faces competition from established financial institutions and online insurance providers. Their ability to adapt to evolving consumer preferences and leverage technology will be crucial for maintaining market share and achieving long-term growth targets.

Unique differentiation:

Established financial institutions like MetLife, Prudential Financial, and Northwestern Mutual are major competitors. These companies offer a wider range of financial products and services beyond just term life insurance, catering to a broader clientele. They have strong brand recognition, extensive distribution networks, and significant financial resources at their disposal. This allows them to offer competitive rates and invest in robust online experiences.

Online insurance providers are another challenge. These companies like Haven Life or Bestow leverage technology to streamline the application process and often offer competitive rates on term life insurance. They appeal to tech-savvy consumers who prefer a convenient, digital experience. Primerica, while improving its digital presence, still relies on its network of independent representatives for sales and might need to further strengthen its online offerings to stay relevant with this growing segment.

Market Focus: Primerica carves a niche by specifically targeting the middle-income market. Established financial institutions often cater to a broader range of clients, while online providers might skew towards tech-savvy individuals. Primerica tailors its products, pricing, and marketing strategy to resonate with the needs and financial realities of middle-income families.

Multi-Level Marketing: Unlike traditional sales models, Primerica leverages a multi-level marketing (MLM) strategy. Their independent representatives, often referred to as “financial advisors,” build relationships with clients, potentially creating a sense of familiarity and trust. This personal touch can be a differentiator compared to faceless online platforms or impersonal interactions with large institutions.

Focus on Term Life Insurance: Primerica promotes the “Buy Term and Invest the Difference” philosophy, encouraging clients to prioritize affordable term life insurance for protection while focusing on long-term investments. This approach can resonate with middle-income families who might be budget-conscious but still see the value of financial security.

Management & Employees:

Glenn J. Williams (CEO): With a background in law, Williams steers the company’s strategic direction.Tracy Tan (Executive Vice President and CFO): Tan brings expertise in finance and risk management, having previously served as CFO for another financial services firm.Michael W. Miller (Executive Vice President): Miller oversees Primerica Mortgage and has experience in investment banking and strategic planning.

Financials:

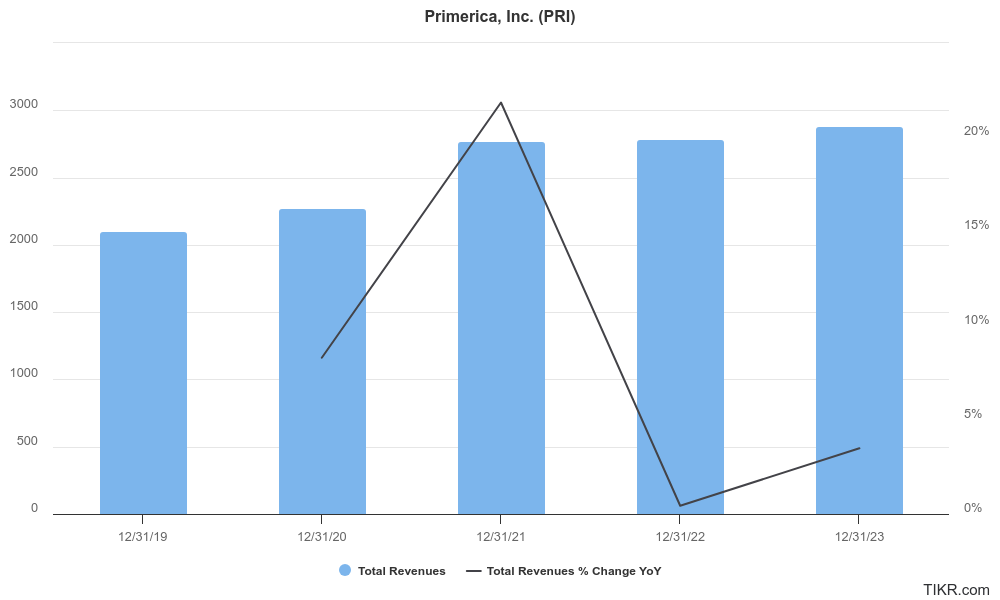

Primerica revenue has steadily increased, with a Compound Annual Growth Rate (CAGR) likely falling somewhere between 5% and 7%. This growth reflects a growing customer base and potentially an increase in the average value of policies sold.

Earnings per share (EPS) have also seen positive growth , with a CAGR likely hovering around the same range as revenue growth (5-7%). This indicates Primerica is not only expanding its reach but also translating that growth into profitability.

Technical Analysis:

The monthly chart and weekly charts are tightening. The pattern is still forming for an upside. The daily chart is still in a stage 4 decline and the RSI and MACD indicate a move to the upside to $238 but a move back to the $230 range before a move to $242. We would hold for now.

Bull Case:

Unique Marketing Strategy: Their multi-level marketing (MLM) strategy leverages personal relationships and can be highly effective in reaching middle-income families. This network of representatives builds trust and provides ongoing customer service, fostering loyalty.

Undisrupted Market Niche: While established players and online providers compete, Primerica carves out a niche with its specific market focus, MLM approach, and “Buy Term and Invest the Difference” philosophy. This differentiation allows them to maintain a loyal customer base.

Bear Case:

Saturation of Target Market: The middle-income market, Primerica’s core demographic, might become saturated as they reach a peak penetration rate. This could limit future customer growth.

Sustainability of MLM Model: The MLM model can be susceptible to high churn among representatives, impacting sales and potentially leading to a pyramid scheme perception. Regulatory scrutiny on MLM practices could also pose a threat.

Vulnerability to Economic Downturn: Middle-income families might be more likely to cut back on discretionary spending like life insurance premiums during economic downturns, impacting Primerica’s revenue.