Executive Summary:

SoFi Technologies Inc founded in 2011, SoFi is headquartered in San Francisco, California. It is an American online financial platform that offers a wide range of financial products. Their mission is to empower people to achieve financial independence and they do this by providing tools for student loan refinancing, mortgages, personal loans, credit cards, investing, and everyday banking.

SoFi Technologies reported total GAAP net revenue of $645 million. This represented a 37% increase year-over-year.

Stock Overview:

| Ticker | $SOFI | Price | $6.61 | Market Cap | $6.99B |

| 52 Week High | $11.70 | 52 Week Low | $6.20 | Shares outstanding | 1.06B |

Company background:

SoFi Technologies Inc. founded by Mike Cagney, Dan Macklin, James Finnigan, and Ian Brady, SoFi started by offering student loan refinancing with the aim of providing more affordable options for borrowers. The company has since grown significantly and now offers a wide range of financial products to its over 8 million members.

SoFi’s provide everyday banking services through SoFi Money, which offers checking and savings accounts and debit cards. SoFi aims to be a one-stop shop for all your financial needs, helping you borrow, save, spend, invest, and protect your money.

SoFi operates in a competitive financial services market. Their key competitors include traditional financial institutions like Ally Bank and Charles Schwab, as well as online lenders like Better.com and Rocket Mortgage. SoFi differentiates itself by offering a comprehensive suite of products through a user-friendly online platform. They also focus on providing competitive rates and a member-centric experience.

Recent Earnings:

SoFi Technologies reported strong revenue growth. Their total GAAP net revenue reached $645 million, which is a 37% increase year-over-year. This exceeded analyst expectations. Earnings per share (EPS), with analysts predicting a loss of less than $0.01 per share.

The Market, Industry, and Competitors:

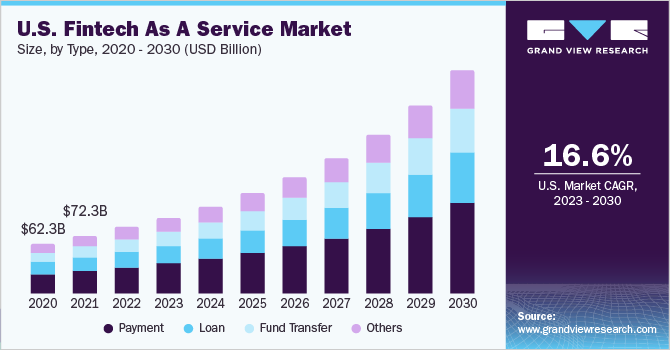

SoFi Technologies Inc. operates in the booming fintech, or financial technology, market. Fintech companies like SoFi are disrupting traditional financial institutions by offering lower fees, faster approvals, and a more streamlined digital experience. The global fintech market is expected to reach a staggering $62.1 billion by 2030, reflecting a Compound Annual Growth Rate (CAGR) of 14.8%.

The company’s large and growing member base, diverse product suite, and focus on innovation position it well to capitalize on the fintech market’s expansion. SoFi’s future seems to be tied to the success of the broader fintech market.

Unique differentiation:

SoFi Technologies faces competition from two main categories: traditional financial institutions and online fintech players.

Traditional institutions like brick-and-mortar banks (Wells Fargo, Chase) and investment firms (Charles Schwab) offer a broad range of financial products but often have slower application processes, higher fees, and less user-friendly interfaces. SoFi can compete by highlighting its streamlined online platform, competitive rates, and focus on member experience.

The group consists of online fintech companies. Better.com and Rocket Mortgage, specialize in specific areas like mortgages. Others, like Ally Bank and Chime, offer similar product suites to SoFi, including checking and savings accounts, loans, and investing options. Here, SoFi differentiates itself by providing a comprehensive one-stop-shop for all financial needs.

SoFi’s success hinges on its ability to keep innovating, expanding its product offerings, and attracting new members through a combination of competitive rates and a user-friendly, member-focused experience.

Comprehensive Product Suite: SoFi boasts a one-stop-shop approach. Members can access student loan refinancing, personal loans, mortgages, credit cards, investing options, and everyday banking services through SoFi Money.

Member-Centric Approach: SoFi prioritizes member experience. They aim to go beyond just offering financial products and strive to be a financial partner for their members. This might involve providing financial education resources, career coaching, and member-exclusive benefits.

Innovation and Technology: SoFi leverages technology to create a user-friendly and efficient platform. This allows for faster loan approvals, streamlined account management, and a seamless digital experience.

Management & Employees:

Anthony Noto (CEO): Noto has been at the helm of SoFi since 2018. He brings extensive experience from his time at Goldman Sachs and Twitter, where he held leadership positions in finance and operations.

William F. Tanona (SVP of Corporate Development & Strategic Partnerships): Tanona spearheads SoFi’s growth through strategic partnerships and potential acquisitions.

Financials:

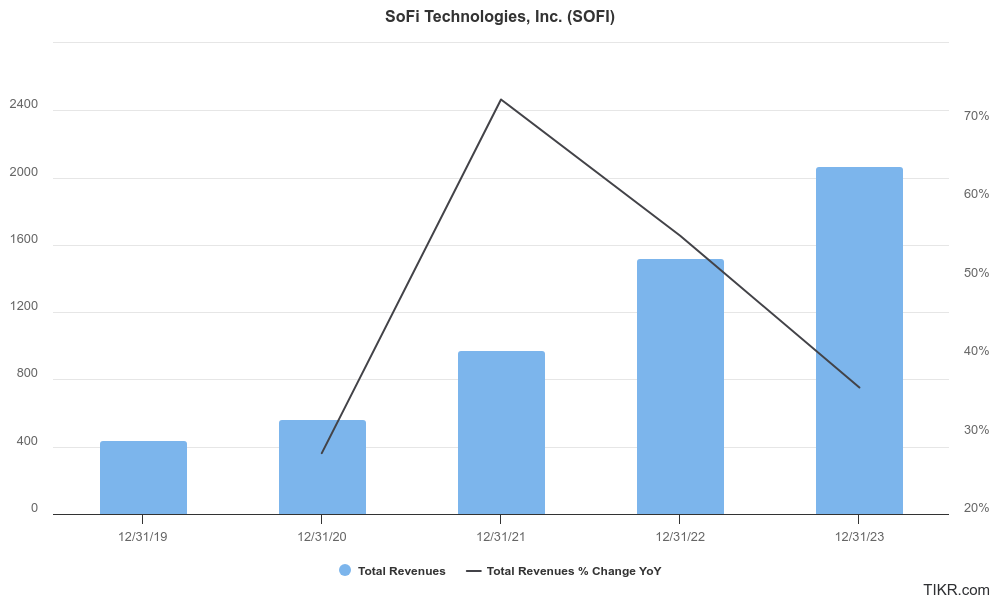

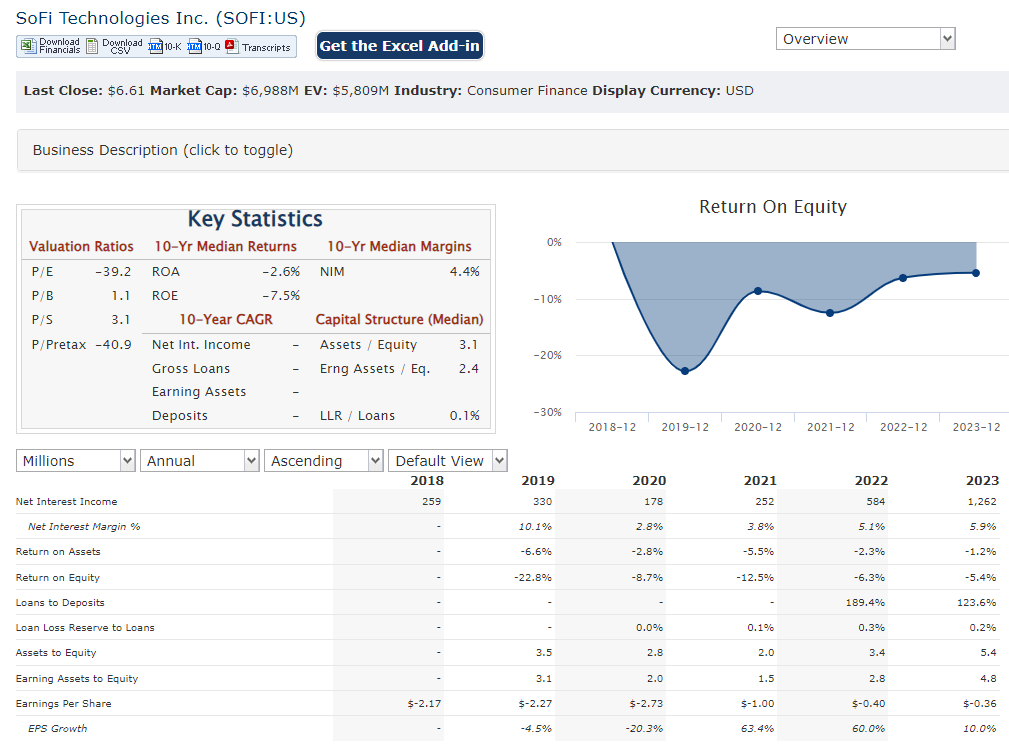

SoFi Technologies Inc. report a 34.91% increase in revenue for 2023 compared to 2022 and a 33.83% year-over-year increase in the twelve months ending March 31, 2024.

SoFi is still in its growth stage, and profitability is not the primary focus at this point. While the company has reported net losses in the past, the losses are narrowing. For instance, SoFi transitioned from a net loss in Q4 2023 to a net income in Q4 2024, albeit a small one.

SoFi is likely focused on building its asset base to fuel future growth. This might involve accumulating cash reserves or investing in loan portfolios. Future earnings reports and filings with the SEC should provide more insights into SoFi’s financial health and asset composition.

Technical Analysis:

The stock is in a decline (stage 4, bearish) on the monthly and weekly chart, but seems to be finding a base, and reversing on the daily chart. While still too early, we think putting this on the watchlist is best for now and waiting for next year might be a better option.

Bull Case:

Member-Centric Approach: SoFi prioritizes its members and aims to be a financial partner, not just a product provider. This might involve providing financial education resources, career coaching, and member-exclusive benefits. This focus on member well-being can foster trust and loyalty, leading to long-term customer relationships.

Potential for Acquisition: As SoFi continues to grow and gain market share, it could become an attractive acquisition target for larger financial institutions. This possibility could lead to a significant increase in SoFi’s stock price.

Bear Case:

Economic Downturn: An economic recession could lead to defaults on loans issued by SoFi, impacting their bottom line. They might also experience a slowdown in new loan applications during an economic downturn.

Regulation: The fintech industry is a relatively new and evolving space. Regulatory changes could restrict SoFi’s ability to offer certain products or services, hindering their growth potential.

Acquisition Risk: Being acquired by a larger financial institution might not be ideal for all investors. An acquisition could lead to changes in SoFi’s business model or focus, potentially affecting shareholder value.