Executive Summary:

Gap Inc., founded in 1969 by Donald and Doris Fisher, is a global apparel and accessories retailer headquartered in San Francisco, California. The company operates through four primary divisions: Gap, Banana Republic, Old Navy, and Athleta. Gap Inc. is the largest specialty retailer in the United States and boasts a significant international presence. With a focus on casual clothing and a commitment to sustainability and inclusivity, Gap Inc. has grown from a single store selling jeans to a multi-brand retail giant.

Gap Inc. reported their earnings per share (EPS) of $0.4. Revenue of $3.4 billion showed a 3% increase year-over-year.

Stock Overview:

| Ticker | $GPS | Price | $23.88 | Market Cap | $8.96B |

| 52 Week High | $30.75 | 52 Week Low | $8.51 | Shares outstanding | 375.06M |

Company background:

Gap Inc., a global apparel and accessories retailer. The company started with a single store selling jeans and has since grown into a retail giant with a presence across the globe.

These brands offer a variety of clothing and accessories for men, women, and children, catering to different styles and price points. Gap Inc. focuses on casual wear, but also offers activewear, professional attire, and personal care products.

The company faces stiff competition from other major apparel retailers like Fast Retailing (Uniqlo), H&M, Inditex (Zara), and Levi Strauss & Co. These competitors offer similar styles and price ranges, making it a competitive market for Gap Inc. to maintain its market share.

Recent Earnings:

Revenue and Growth: Gap Inc. reported revenue of $3.4 billion, which represents a 3% increase compared to the same quarter in the previous year.

EPS and Growth: Earnings per share (EPS) came in at $0.41, meeting analyst expectations.

Comparisons to Analyst Expectations: Gap Inc. exceeded analyst expectations for both revenue and EPS. Revenue surpassed analyst estimates by $0.05 billion, demonstrating stronger than anticipated sales performance.

The Market, Industry, and Competitors:

Gap Inc. operates in the competitive apparel market, facing major players like Fast Retailing (Uniqlo), H&M, Inditex (Zara), and Levi Strauss & Co. This market is expected to show steady growth, driven by factors like rising disposable income in developing economies and increasing consumer demand for athleisure and casual wear. Analysts project the global apparel market to reach a size of around $2.5 trillion by 2030, with a Compound Annual Growth Rate (CAGR) of approximately 3.5%.

Analysts project the company’s revenue to reach approximately $19.72 billion by 2030, assuming a CAGR of 3.5%. The actual growth rate could be higher or lower depending on various factors such as Gap Inc.’s ability to adapt to changing consumer preferences, compete effectively, and navigate economic fluctuations.

Unique differentiation:

- Fast Retailing (Uniqlo): This Japanese multinational is known for its basic and everyday wear, often at competitive price points. Uniqlo leverages a strong emphasis on innovation and utilizes high-quality materials to distinguish itself.

- H&M (Hennes & Mauritz): A Swedish multinational giant, H&M is a leader in fast fashion. They churn out trendy styles quickly and affordably, catering to a fashion-conscious audience seeking the latest looks.

- Inditex (Zara): The Spanish retail giant Inditex, known for its Zara brand, is a major competitor. Zara is renowned for its ability to rapidly adapt to current trends, offering high-fashion looks at accessible prices. Their quick turnaround time from design to store shelves allows them to capitalize on fleeting trends.

Like Levi Strauss & Co. and American Eagle Outfitters, all vie for market share in the apparel industry. Gap Inc. must constantly innovate, adapt its product offerings, and maintain a strong brand identity to stay ahead in this competitive environment.

Focus on Casual Wear: Gap Inc. has a strong legacy in casual clothing. While competitors like H&M dabble in fast fashion trends, Gap Inc. positions itself as a provider of classic, everyday essentials with a focus on quality and comfort.

Sustainability and Inclusivity: Gap Inc. has made a concerted effort towards sustainability in its manufacturing practices and inclusivity in its marketing and sizing. This resonates with a growing segment of consumers who value ethical and socially responsible brands.

Digital Integration: Gap Inc. has invested in omnichannel experiences, allowing customers to seamlessly shop online and in-store. This caters to the evolving shopping habits of today’s consumers who expect a convenient and integrated shopping journey.

Management & Employees:

Richard Dickson (President and CEO): Dickson leads the entire Gap Inc. organization, bringing experience from his previous role as President and COO of Mattel.

Zac Posen (Executive Vice President, Creative Director of Gap Inc. and Chief Creative Officer of Old Navy): Posen is a renowned fashion designer who oversees the creative direction for both Gap Inc. as a whole and the Old Navy brand specifically.

Mark Breitbard (Head of Gap Global): Breitbard leads the Gap brand specifically, overseeing its strategy, merchandising, and marketing efforts.

Financials:

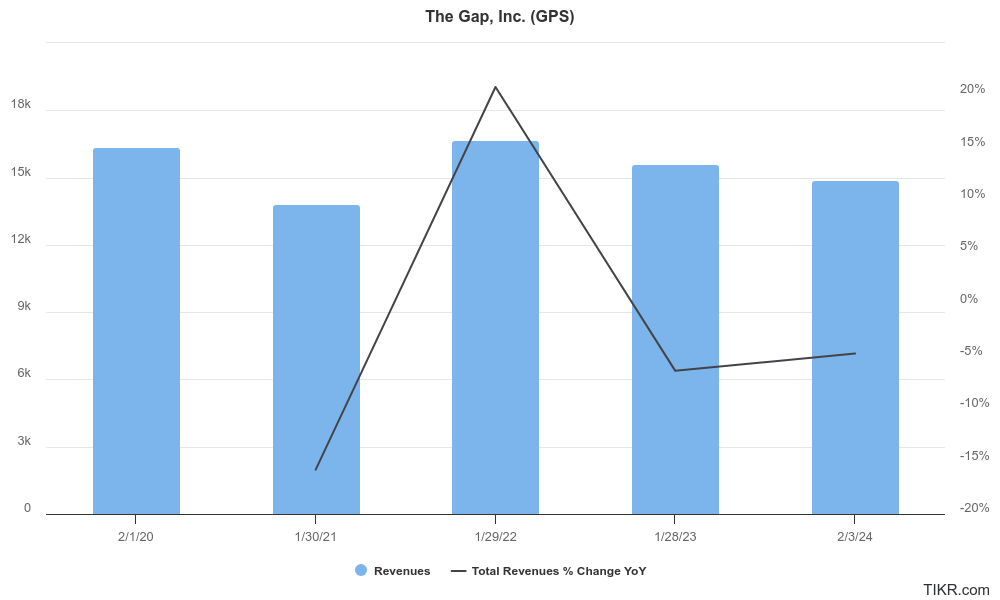

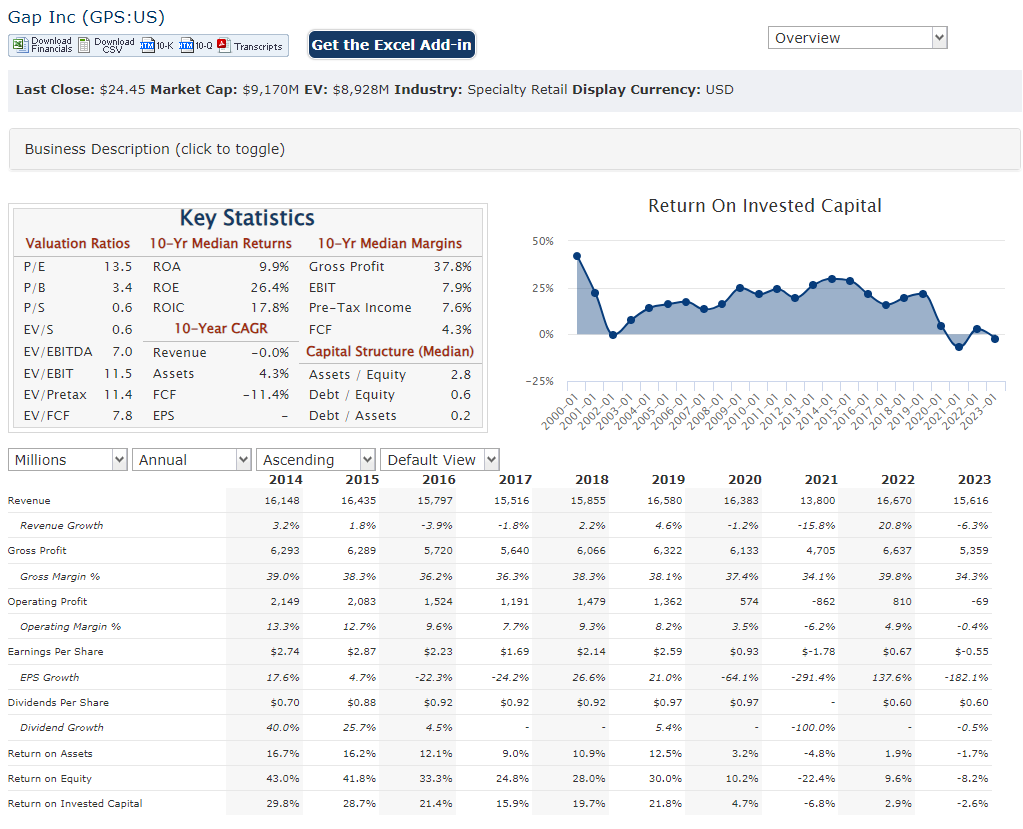

Gap Inc.’s revenue has seen a slight decline, with a Compound Annual Growth Rate (CAGR) estimated to be around -2%. This indicates stagnant or slightly decreasing sales over the period. Earnings growth has also been inconsistent. The company has experienced some quarters with losses and others with modest gains. It’s likely the overall earnings CAGR would be negative as well.

Gap Inc. has been working to improve its financial health. They’ve implemented cost-cutting measures and focused on inventory management. This might be reflected in a potentially lower debt-to-equity ratio, indicating a healthier balance sheet compared to previous years.

Technical Analysis:

On the monthly the stock is consolidating (neutral, stage 1) and weekly chart the stock is stage 4 (bearish) markdown. On the daily chart the stock is still in stage 4 as well (markdown, bearish) with a likely support at $22 range. This is still a stock to avoid for now.

Bull Case:

Turnaround Potential: The recent positive earnings report, exceeding analyst expectations, suggests a potential turnaround for the company. Gap Inc.’s focus on cost-cutting, inventory management, and omnichannel experiences could lead to improved profitability in the future.

Value Proposition: Gap Inc. positions itself as a provider of quality, comfortable, and casual clothing, appealing to a large segment of consumers who may not be swayed by fleeting trends.

Undervaluation: If the company successfully executes its turnaround strategy and achieves future growth, the stock price could be undervalued compared to its true potential.

Bear Case:

Stagnant Sales and Declining Market Share: Gap Inc. has experienced stagnant or slightly declining revenue in recent years. This, coupled with strong competition from fast-fashion giants like H&M and Zara, could lead to further market share loss.

Brand Identity Challenges: Managing a portfolio of brands can be complex. Gap Inc. might struggle to maintain brand consistency across its various labels, potentially confusing consumers. The focus on casual wear might not resonate with younger demographics seeking trendier options.

Macroeconomic Factors: Economic downturns or rising inflation could lead to decreased consumer spending, impacting Gap Inc.’s sales and profitability.