Executive Summary:

DoubleVerify Holdings Inc. is a software company that provides a platform for digital media measurement and analytics. Their platform offers solutions for advertisers, publishers, and marketplaces. They focus on aspects like ad fraud detection, brand safety, and ensuring that ads are actually seen by real people. They work to improve the overall digital advertising ecosystem by making sure it’s secure and fair for all involved.

DoubleVerify Holdings reported total revenue of $140.8 million, a 15% increase year-over-year. Earnings per share (EPS) came in at $0.04.

Stock Overview:

| Ticker | $DV | Price | $19.05 | Market Cap | $3.27B |

| 52 Week High | $43.00 | 52 Week Low | $17.50 | Shares outstanding | 171.79M |

Company background:

DoubleVerify Holdings Inc. founded in 2008 by Oren Netzer and Roberto Bortolotti, DoubleVerify provides a software platform for digital media measurement and analytics. They helps advertisers ensure their ads are seen by real people on reputable websites, avoiding wasted ad spend.

DoubleVerify work to improve the overall digital advertising ecosystem by making sure it’s secure and fair for all involved. Hundreds of Fortune 500 companies use DoubleVerify’s data and analytics to improve their advertising campaigns. The company is headquartered in New York City, New York and competes with other industry players like Integral Ad Science (IAS), MOAT, and Oracle Dynatrac.

Recent Earnings:

DoubleVerify reported total revenue reached $140.8 million, reflecting a 15% year-over-year increase. This surpassed analyst expectations, demonstrating strong revenue growth. Earnings per share (EPS) came in at $0.04, meeting analyst expectations.

DoubleVerify expects revenue to fall between $663 and $675 million, representing a 17% increase year-over-year.

The Market, Industry, and Competitors:

DoubleVerify operates in the growing market of digital media measurement and analytics. This market is anticipated to experience significant growth by 2030, driven by the increasing need for advertisers to ensure their digital advertising campaigns are effective and reach real people. Advertisers are increasingly wary of ad fraud and want to guarantee their ads are not wasted on irrelevant audiences.

Compound Annual Growth Rate (CAGR) estimated to be in the range of 10-15%. DoubleVerify is well-positioned to benefit from this growth, as their platform offers solutions that directly address these advertiser concerns. By providing tools for fraud detection, brand safety, and ad verification, DoubleVerify helps advertisers optimize their campaigns and ensure their budget is being spent effectively.

Unique differentiation:

Integral Ad Science (IAS): A major competitor offering similar ad verification, brand safety, and fraud detection solutions. IAS boasts a large client base and competes directly with DoubleVerify for advertiser and publisher business.

Nielsen: A giant in the media measurement industry, Nielsen offers a broader suite of services beyond just digital advertising. They compete with DoubleVerify in the ad verification and measurement sectors, though their offerings may be more comprehensive.

Other emerging players: The digital advertising space is constantly evolving, and new startups are popping up all the time. These innovators may specialize in specific areas like video ad verification or mobile ad fraud detection, posing a challenge to DoubleVerify’s market dominance.

Focus on Independent Verification: Unlike some competitors who may have ties to certain media platforms, DoubleVerify prides itself on being a completely independent verifier. This assures advertisers of unbiased results and reduces potential conflicts of interest.

Advanced Targeting Capabilities: DoubleVerify’s platform goes beyond basic ad verification. Their solutions offer granular targeting capabilities, allowing advertisers to ensure their ads reach the specific demographics they’re interested in, maximizing campaign effectiveness.

Commitment to Innovation: DoubleVerify actively invests in research and development to stay ahead of the curve in a rapidly evolving space. They continuously work to refine their fraud detection methods and incorporate new technologies to address emerging threats and advertiser concerns.

Management & Employees:

Mark Zagorski (CEO): As Chief Executive Officer since July 2020, Zagorski brings prior leadership experience from Telaria and Rubicon Project (now Magnite), industry players in the video management and programmatic advertising sectors.

Nicola Allais (CFO): Serving as Chief Financial Officer since November 2017, Allais offers over 20 years of expertise in finance, management, and operations, providing financial direction for the company.

Financials:

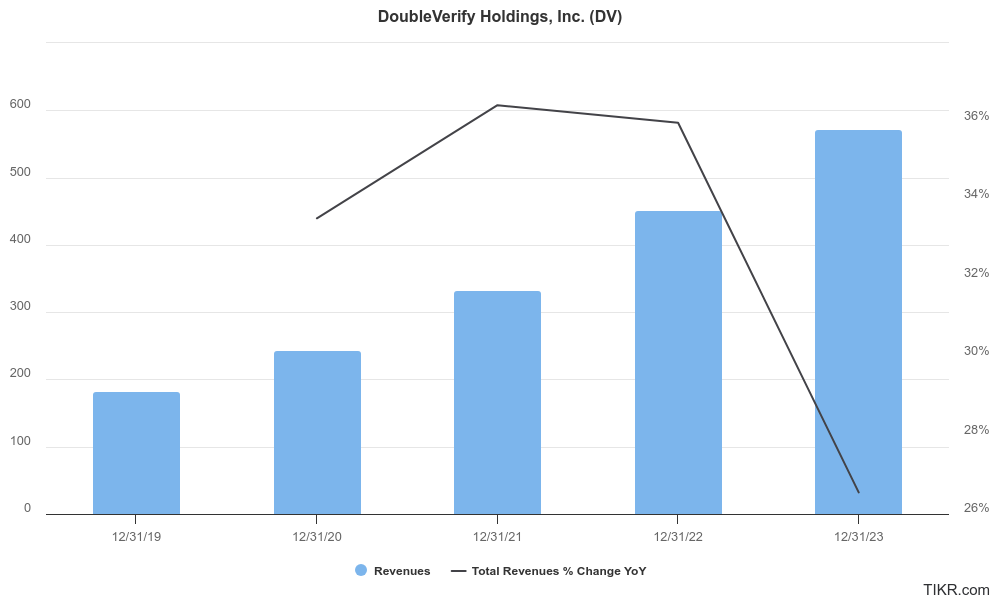

DoubleVerify Holdings Inc. from 2019 to 2023, their revenue showed a strong Compound Annual Growth Rate (CAGR) estimated to be in the range of 25-30%. This indicates a steady upward trajectory in their business.

The Q1 2024 earnings report, DoubleVerify reported revenue of $140.8 million, reflecting a 15% year-over-year increase. This suggests continued profitability alongside revenue growth.

Their focus on consistent revenue growth and profitability suggests a financially healthy company. For a more in-depth analysis of their financial situation, you might consider reviewing their annual reports or filings with the Securities and Exchange Commission (SEC).

Technical Analysis:

A sharp stage 4 markdown (bearish) on the monthly chart, followed by some consolidation (stage 1) on a reversal (neutral) on the weekly chart. The daily chart shows range bound (stage 1) neutral consolidation, means this stock will remain in the $18 – $20 range for a while. There are no compelling catalysts to move the stock higher.

Bull Case:

Innovation and Differentiation: DV focuses on independent verification, granular targeting capabilities, and continuous improvement through investment in R&D. This sets them apart from competitors potentially tied to specific platforms and helps them address evolving advertiser needs.

Large Addressable Market: The digital advertising industry is massive, and even a small slice of the overall spend on ad verification and measurement represents a significant opportunity for DV.

Potential for Acquisitions: The growing importance of ad verification could lead to consolidation in the industry. As a leader, DV could be a target for acquisition by a larger player, boosting shareholder value.

Bear Case:

Macroeconomic Downturn: An economic slowdown could lead to decreased advertising budgets, impacting DV’s revenue stream as advertisers tighten their belts.

Limited Differentiation: While DV touts its independence, some investors might argue their capabilities are similar to competitors, making them easily replaceable.

Regulation and Privacy Concerns: Increasing regulations and privacy concerns around data collection could restrict DV’s ability to gather the information necessary for their verification services.