Executive Summary:

Arcadium Lithium plc is a leading global producer of lithium chemicals for a variety of applications. Founded in 1944 and headquartered in Philadelphia, the company offers battery-grade lithium hydroxide, carbonate and other products for electric vehicles, electronics, and more. Arcadium Lithium is committed to sustainability and collaboration as they look to be a key player in the clean energy transition.

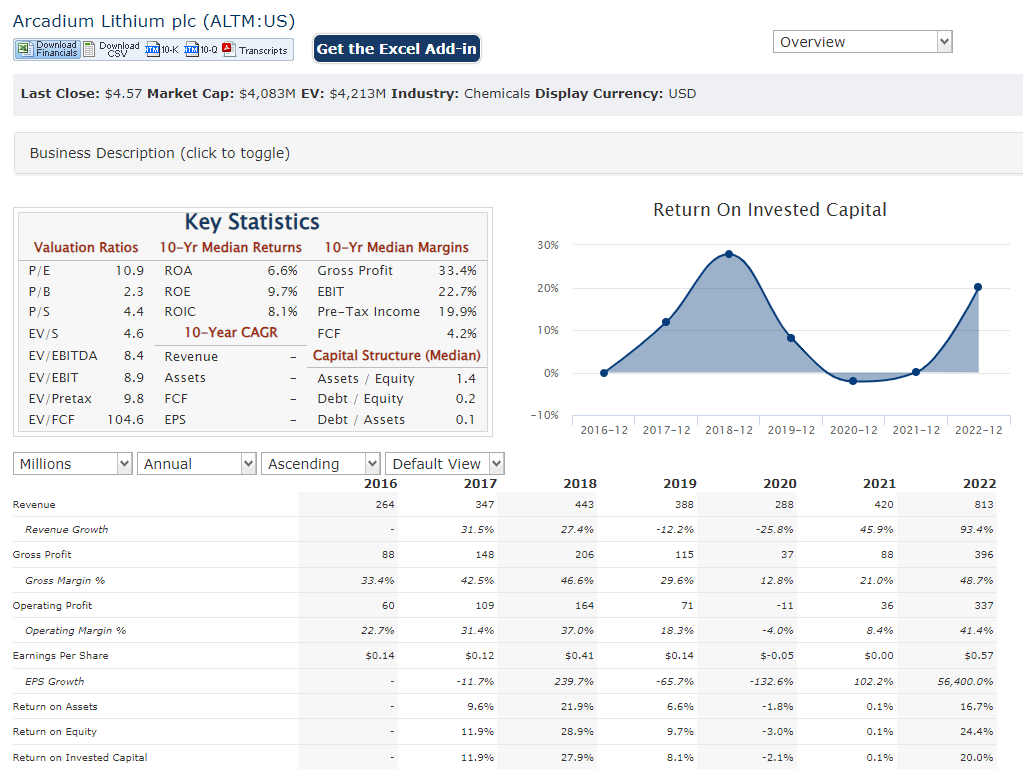

Arcadium Lithium delivered earnings per share (EPS) of $0.06, which beat analyst expectations of $0.03 by a significant 100%. Revenue came in at $261.2 million, which represents a modest increase year-over-year compared to $253.5 million.

Stock Overview:

| Ticker | $ALTM | Price | $4.57 | Market Cap | $4.91B |

| 52 Week High | $12.13 | 52 Week Low | $3.67 | Shares outstanding | 1.07B |

Company background:

Arcadium Lithium plc, a global leader in lithium chemicals production, was formed in December 2023 through the merger of two established companies: Allkem Limited and Livent Corporation.

The company offers a diversified product portfolio encompassing battery-grade lithium hydroxide, lithium carbonate, spodumene, and specialty lithium products. These chemicals are used in a wide range of applications including electric vehicles, electronics, greases, and pharmaceuticals. Arcadium Lithium operates production facilities and holds interests in properties across several continents, strategically positioning itself to meet the growing demand for lithium in the clean energy transition.

Arcadium Lithium faces competition from other major lithium producers like Albemarle Corporation, Sociedad Quimica y Minera de Chile (SQM), and Livent Corporation (which was one of the merging entities that formed Arcadium Lithium).

Recent Earnings:

Revenue came in at $261.2 million, marking a modest year-over-year increase compared to $253.5 million. Arcadium delivered $0.06 EPS, exceeding analyst expectations of $0.03 by a significant 100%. This positive surprise indicates the company might be managing costs effectively or experiencing higher than anticipated demand for its lithium products.

The report also lacked explicit forward guidance, which would have shed light on Arcadium’s future production targets, cost projections, or any major capital expenditure plans.

The Market, Industry, and Competitors:

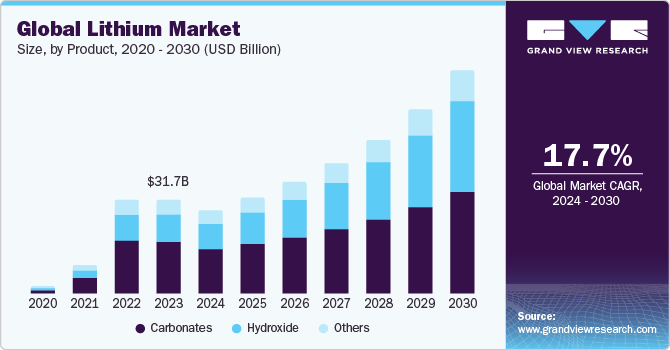

Arcadium Lithium plc operates in the lithium market, this surge is fueled by the escalating demand for lithium-ion batteries in electric vehicles (EVs) and consumer electronics. As the world transitions towards clean energy, lithium, a key component in these batteries, is expected to be a critical material.

Market analysts predict a Compound Annual Growth Rate (CAGR) of between 30% and 50% for the lithium market by 2030. Arcadium Lithium, as a major producer of lithium chemicals, is well-positioned to benefit from this booming market as the need for lithium for battery production continues to rise.

Unique differentiation:

- Chemical giants: Albemarle Corporation (ALB) and Sociedad Quimica y Minera de Chile (SQM) are major players in the lithium market. They possess significant production capacity and geographical reach, making them formidable competitors.

- Specialty lithium producers: Livent Corporation (LTHM) is another major competitor, interestingly, it was one of the entities that merged to form Arcadium Lithium. Other specialty lithium producers focus on specific lithium products or cater to niche markets.

Companies are vying to expand production capacity, secure lithium resources, and develop innovative extraction techniques.Arcadium Lithium will need to focus on factors like efficient production processes, cost control measures, securing reliable supply chains, and potentially expanding into new markets or product segments.

Recent Merger Synergy: The company was formed through the December 2023 merger of Allkem Limited and Livent Corporation. This merger has the potential to create a more efficient and cost-competitive entity by combining the strengths of both legacy businesses.

Global Presence: Inheriting the reach of the merging companies, Arcadium Lithium has production facilities and interests in properties across several continents. This global presence allows them to cater to a wider customer base and navigate potential disruptions in any single region.

Management & Employees:

Paul Graves: Chief Executive Officer (CEO) and member of the Board of Directors. Graves played a key role in the merger that created Arcadium Lithium and brings prior experience as CEO of Livent Corporation and executive positions at FMC Corporation and Goldman Sachs.

Gilberto Antoniazzi: Chief Financial Officer (CFO). Antoniazzi’s background is not publicly available, but his role involves overseeing the company’s financial health.

Sara Ponessa: General Counsel and Secretary. Ponessa’s expertise lies in legal matters and corporate governance, ensuring Arcadium Lithium complies with regulations.

Financials:

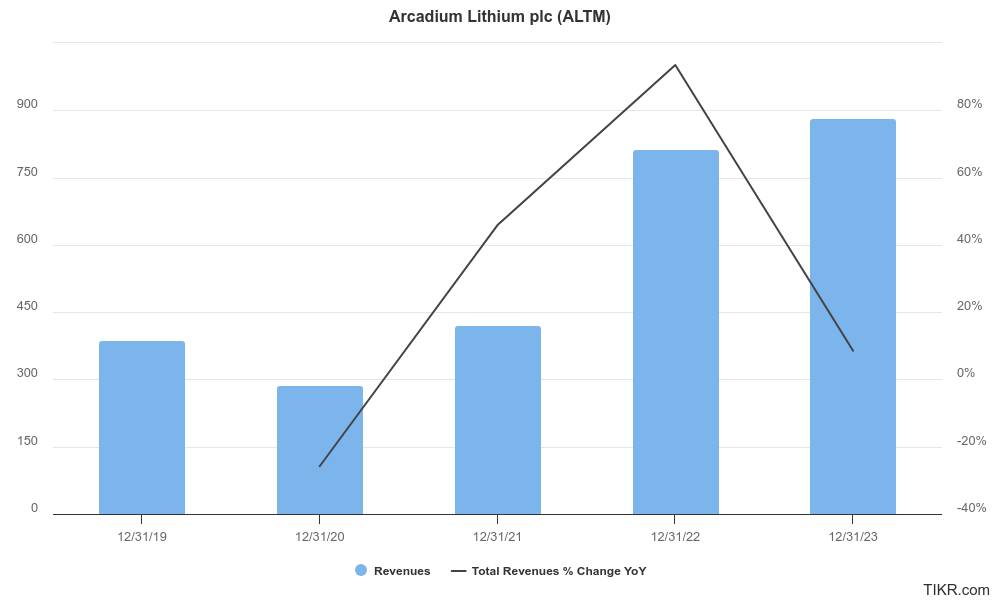

Arcadium Lithium’s recent financial performance of the two merging companies, Allkem Limited and Livent Corporation, to get a sense of Arcadium Lithium’s potential financial trajectory.

Both Allkem and Livent experienced revenue growth in the years leading up to the merger. Analysts estimate an average annual revenue growth rate (CAGR) in the range of 15-20% for each company over the past 5 years.

Earnings growth for both companies might be a bit more volatile. While some years might have seen significant profit increases, others could have faced fluctuations due to factors like production costs, lithium prices, or global economic conditions.

Technical Analysis:

The recent IPO indicates a stage 4 decline and markdown (Bearish) below its IPO price on the monthly chart. On the weekly, the stock is on a stage 4 decline as well, retesting the lows of $4.1 range from its recent recovery. On the daily chart, the stock decline (stage 4 markdown) is more pronounced, which means it will likely retest the $4.2X and maybe $4.15 range before it reverses. We would not be buyers here yet for the long term.

Bull Case:

Soaring Lithium Demand: The lithium market is projected for explosive growth by 2030, driven by the electric vehicle (EV) revolution and increasing demand for lithium-ion batteries in consumer electronics. As a major producer of lithium chemicals, Arcadium Lithium is well-positioned to capitalize on this surge in demand.

Focus on Sustainability: The emphasis on environmentally friendly practices throughout the extraction and production process could attract eco-conscious investors and customers.

Bear Case:

Execution Risk of the Merger: While the merger has the potential for synergy, there’s always a risk of integration challenges. Merging company cultures, streamlining operations, and eliminating redundancies can be complex and time-consuming.

Volatile Lithium Prices: Lithium prices can fluctuate based on supply and demand dynamics. If new lithium resources are discovered or alternative battery technologies emerge, it could lead to a drop in lithium prices, impacting Arcadium’s profitability.

Geopolitical Risks: Lithium production is geographically concentrated, with South America and China holding a significant share of resources. Political instability or trade wars in these regions could disrupt supply chains and increase production costs for Arcadium.