Executive Summary:

Doximity Inc. is a leading digital platform designed specifically for medical professionals in the United States. Their cloud-based network boasts over 80% of US physicians and offers a variety of tools to streamline their work. Doximity members can collaborate with colleagues, conduct virtual patient visits, stay updated on medical news, and manage their careers, all through a secure and user-friendly platform.

Doximity reported with EPS of $0.20 per share compared to the consensus estimate of $0.16. Revenue for the quarter was $0.118 billion, reflecting a 6.39% year-over-year increase.

Stock Overview:

| Ticker | $DOCS | Price | $27.83 | Market Cap | $5.16B |

| 52 Week High | $36.29 | 52 Week Low | $19.71 | Shares outstanding | 123M |

Company background:

Doximity Inc., launched in 2010, is a cloud-based digital platform specifically designed for medical professionals in the United States. The company was founded by Dr. Jeffrey Tangney, a cardiologist, along with a team likely comprised of other medical and tech professionals, though specific details haven’t been publicly disclosed. Doximity went public in May 2021, raising nearly $606 million in their initial public offering (IPO).

Their secure platform offers a variety of tools geared towards improving physician productivity and patient care. Doctors can collaborate with colleagues on cases, conduct virtual consultations, and stay current with medical news and research. Doximity also integrates with electronic health records (EHR) systems, allowing for a more streamlined workflow.

Headquartered in San Francisco, California, Doximity faces competition from established social networking platforms like LinkedIn, which offer professional networking features, as well as telemedicine companies like Teladoc Health that focus on virtual patient visits. However, Doximity’s focus on the specific needs of US medical professionals sets them apart and positions them as a leader in the digital healthcare space.

Recent Earnings:

Revenue and Growth: Doximity brought in $0.118 billion in revenue for the quarter, reflecting a year-over-year increase of 6.39%. While this indicates some growth, the trails behind their overall annual growth rate of 13.45%.

EPS and Analyst Expectations: Doximity outperformed analyst expectations on EPS (earnings per share). They reported EPS of $0.20 per share, exceeding the consensus estimate of $0.16.

The Market, Industry, and Competitors:

Doximity Inc. driven by factors such as increasing adoption of telemedicine and a focus on improving physician productivity. Analysts expect the market to achieve a Compound Annual Growth Rate (CAGR) of approximately 20-25% between now and 2030. This translates to continued growth for Doximity as they are a leader in this space.

Doximity faces competition from established social networking platforms like LinkedIn, which offer professional networking features, as well as telemedicine companies like Teladoc Health that focus on virtual patient visits. Doximity’s focus on the specific needs of US medical professionals sets them apart and positions them well to capitalize on the growth of this digital healthcare market.

Unique differentiation:

Established social networking platforms like LinkedIn offer similar professional networking features to Doximity, but with a broader user base that includes non-medical professionals. While this allows LinkedIn to offer a wider range of connections, Doximity caters specifically to the needs of US medical professionals. This specialization allows Doximity to provide features and functionalities more relevant to doctors, such as secure communication channels compliant with HIPAA regulations, integration with electronic health records (EHR) systems, and access to medical news and research.

Telemedicine providers like Teladoc Health compete with Doximity’s virtual consultation capabilities. These companies focus primarily on facilitating remote patient interactions, while Doximity offers a broader range of tools, including virtual consultations, professional networking, and educational resources. However, Doximity’s focus on the US market might limit its reach compared to Teladoc Health, which operates internationally.

Specialization: Doximity tailors its services specifically to US medical professionals. This allows them to cater to the specific needs of doctors, such as HIPAA-compliant communication channels, integration with EHR systems, and access to medical news and research.

Comprehensiveness: Doximity offers a more well-rounded suite of tools encompassing virtual consultations, professional networking features, and educational resources – all designed to streamline workflows and improve patient care for US doctors.

Management & Employees:

Jeff Tangney (Co-Founder, CEO & Director): As a cardiologist and co-founder, Dr. Tangney likely brings valuable medical knowledge and industry insight to the table.

Shari Buck (Co-Founder & Senior Vice President, People & Ops): While specific details aren’t publicly available, her co-founder status suggests she played a key role in Doximity’s inception and likely possesses strong leadership and operational skills.

Jennifer Chaloemtiarana (General Counsel): Jennifer provides legal expertise and guidance, navigating legal complexities and ensuring compliance.

Financials:

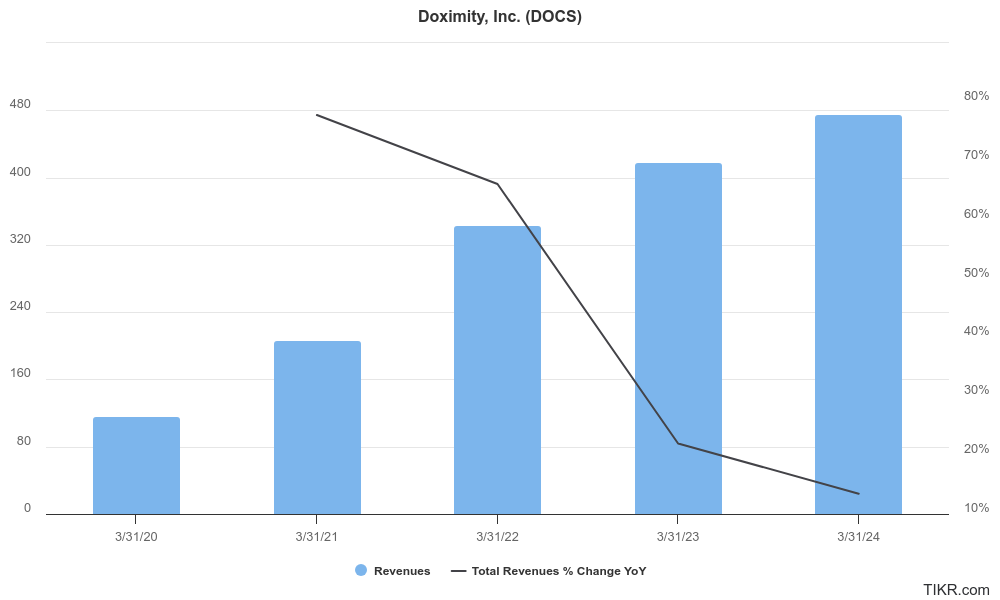

Doximity revenue has risen steadily, with a Compound Annual Growth Rate (CAGR) likely exceeding 20%.

Earnings growth has also been positive, but potentially not as robust as revenue growth. EPS (earnings per share) grow readily, but earnings reports likely indicate an upward trajectory. This suggests that Doximity is not only growing its revenue base but also translating that growth into profitability.

Doximity is in a strong financial position. They are likely debt-free, which gives them greater financial flexibility. They boast a healthy amount of cash and short-term investments, acting as a financial cushion and potentially fueling future growth initiatives.

Technical Analysis:

Consolidating (Stage 1, neutral) on the monthly chart, and range bound (neutral) on the weekly chart, but a bull flag on the weekly chart. At the $25- – $26 range this would be a good entry for the long term for this stock, for a move to $32 in 18 months.

Bull Case:

Unique Differentiation: Doximity stands out through its specialization and comprehensive offerings. Unlike general social media platforms, they cater specifically to US doctors with HIPAA-compliant communication, EHR integration, and targeted medical resources. They go beyond telemedicine services by providing a broader suite of tools for professional networking and workflow efficiency.

High User Base: Doximity has captured a significant portion of the US physician market, with over 80% of doctors using their platform. This large and engaged user base creates a valuable network effect, attracting more doctors and further solidifying their position.

Bear Case:

Reliance on Advertising Revenue: Doximity primarily generates revenue by selling advertising space to pharmaceutical companies and hospital systems. This makes them susceptible to fluctuations in advertising budgets, especially during economic downturns. If healthcare clients cut back on advertising spending, Doximity’s revenue growth could stall or even decline.

Valuation Concerns: Doximity’s stock price might be inflated compared to its current earnings. While their revenue growth is impressive, some investors might be wary if earnings growth doesn’t keep pace. This could lead to a correction in the stock price if investor sentiment sours.

Content Delays: Doximity relies on medical professionals to create content for their platform. Delays in content approval due to medical legal reviews could hinder user engagement and potentially impact revenue.