Executive Summary:

Abercrombie & Fitch Co., or A&F, is a major American retailer known for its casual, contemporary clothing. Founded in 1892, it started out as a supplier of high-end outdoor gear for adventurers. The company operates over 800 stores across several brands, including Abercrombie Kids and Hollister.

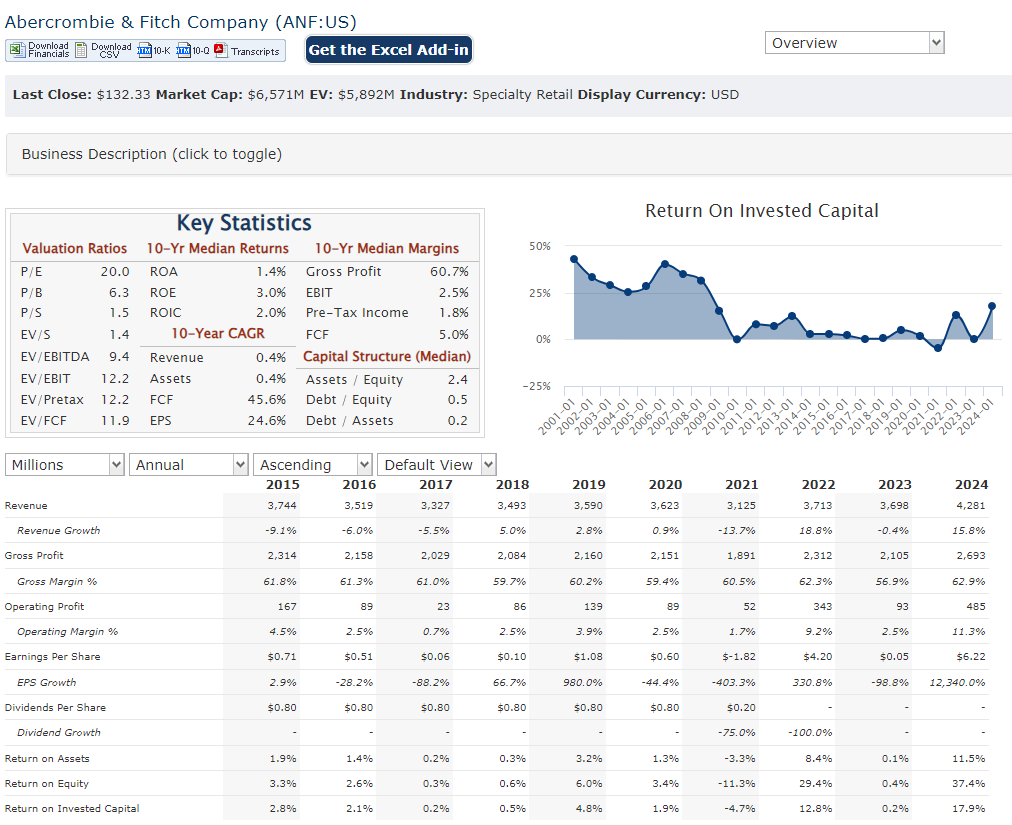

Analysts predict an EPS (earnings per share) of $1.53, which is a significant increase over the $0.39. Revenue is also expected to jump, with some estimates suggesting a 21% rise year-over-year.

Stock Overview:

| Ticker | $ANF | Price | $130.43 | Market Cap | $6.66B |

| 52 Week High | $140.28 | 52 Week Low | $22.21 | Shares outstanding | 51.09M |

Company background:

Abercrombie & Fitch Co. (A&F) is a major American retailer known for its casual, contemporary clothing. Abercrombie & Fitch evolved into a popular apparel brand targeting young adults, known for its marketing campaigns and distinct store atmosphere.

Thiey have Abercrombie Kids, offering clothes for children, and Hollister Co., a brand with a focus on laid-back California style. Abercrombie & Fitch has moved away from its exclusive image and embraced inclusivity in its marketing and clothing lines.

A&F’s core products include casual clothing for men, women, and kids. They offer a variety of styles, including jeans, graphic tees, sweatshirts, underwear, and fragrances. Their key competitors in the retail space include American Eagle Outfitters, Urban Outfitters, Gap Inc., H&M, and Forever 21.

Recent Earnings:

Abercrombie & Fitch’s revenue is expected to be around $1.45 billion for Q1 2024, reflecting a year-over-year increase of approximately 21%. This growth would be on top of the 21% increase they reported in Q4 2023. Earnings per share (EPS) are also projected to be high, with estimates around $1.53 – a significant jump from $0.39 in the same quarter last year.

The Market, Industry, and Competitors:

Abercrombie & Fitch operates in the competitive landscape of apparel retail, targeting young adults and teenagers. This market is dynamic, influenced by fast-changing fashion trends and consumer preferences. Abercrombie & Fitch has shown an ability to adapt, with a focus on omnichannel retailing and a more inclusive brand image.

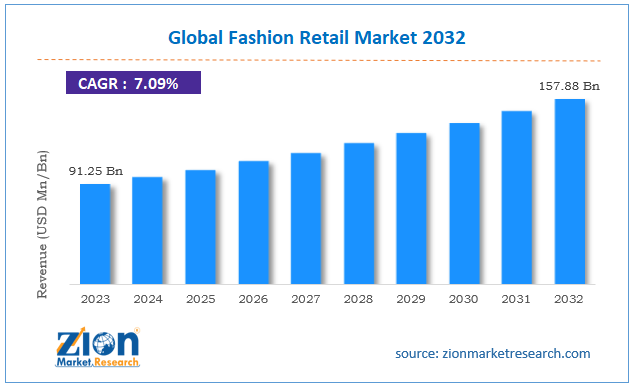

The global apparel market is expected to experience steady growth, driven by factors like rising disposable income in developing economies and an increasing demand for comfortable and casual clothing. Analysts forecast a Compound Annual Growth Rate (CAGR) in the range of 5-8% for the company between 2 and 2030.

Unique differentiation:

Head-on competitors: These companies target a similar young adult and teenager demographic with casual, contemporary styles. American Eagle Outfitters (AEO) is a major rival, offering a slightly more relaxed and bohemian vibe compared to A&F’s classic cool aesthetic. Forever 21 and H&M compete on price point, offering trendy styles at a lower cost.

Brand differentiation competitors: Companies like Urban Outfitters and Zara cater to a young adult audience as well, but with distinct brand identities. Urban Outfitters offers a more vintage-inspired and eclectic selection, while Zara focuses on fast fashion trends at a slightly higher price point than A&F.

Indirect competitors: The rise of online retailers and secondhand clothing platforms like ThredUp and Poshmark has also impacted Abercrombie & Fitch’s market share. These platforms offer a wider variety of styles and brands, often at discounted prices. Abercrombie & Fitch has had to adapt by strengthening their online presence and embracing a more sustainable image.

Shifting from exclusivity to inclusivity: A&F’s past strategy of targeting a cool-kid image is no longer the main differentiator. They’ve successfully pivoted towards a more inclusive brand that celebrates diversity in body types, ethnicities, and styles. This resonates with today’s socially conscious consumers.

Omnichannel experience: A&F offers a seamless shopping experience across online and physical stores. Customers can easily browse online, buy online and pick up in-store, or utilize features like online returns in-store.

Distinct store atmosphere: While toned down from the intense focus in the past, A&F stores still maintain a unique atmosphere with their signature Fierce cologne scent and energetic music selection. This creates a memorable shopping experience for some customers.

Focus on quality and fit: Although not strictly high-end, A&F offers better quality materials and construction compared to some fast-fashion competitors. They also emphasize fits that flatter a variety of body types.

Management & Employees:

Fran Horowitz: CEO (Chief Executive Officer) – Responsible for the overall strategy and direction of the company.

Scott Lipesky: Executive Vice President, Chief Financial Officer (CFO) and Chief Operating Officer (COO) – Oversees financial performance and day-to-day operations.

Samir Desai: Executive Vice President, Chief Digital and Technology Officer – Leads the company’s digital initiatives and technology infrastructure

Financials:

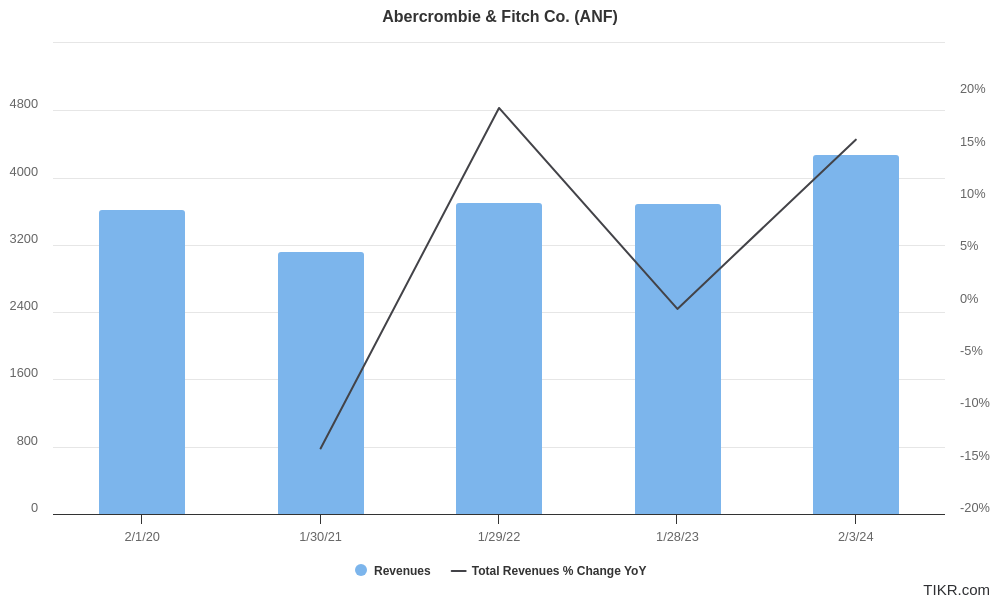

Revenue Growth: After a period of stagnation, the company has seen steady growth in revenue. They reported a 16% increase in net sales for fiscal year 2024 compared to 2022.

Earnings Growth: They reported a net income of $328 million, a substantial jump compared to the prior year. Earnings per share (EPS) have also risen dramatically.

Technical Analysis:

After a dramatic rise in shares over 18 months, the weekly and daily chart are in a stage 3 consolidation (bearish) and still finding their base. There is good support at $109, but RSI and MACD shows momentum is strong, so we expect shares to move higher to $140s but should head lower after that point.

Bull Case:

Brand Revival and Target Audience: A&F has successfully shed its past image of exclusivity and embraced inclusivity. This resonates with today’s socially conscious young adult and Gen Z shoppers.

Financial Performance: A&F’s recent financial performance is strong, with consistent revenue and earnings growth. This indicates healthy business fundamentals and the potential for continued profitability.

International Expansion: A&F has room for further international expansion, particularly in developing economies where disposable income is rising. This could be a significant driver of future growth.

Bear Case:

Economic Downturn: Consumer spending habits can be impacted by economic downturns. Since Abercrombie & Fitch targets young adults, who may be more discretionary with their spending, a recession could negatively affect their sales.

Shifting Trends: The success of apparel retailers relies heavily on keeping pace with ever-changing fashion trends. If A&F fails to adapt or misjudges future trends, they risk losing customer interest.

Online Retail Disruption: The rise of online shopping and secondhand clothing platforms continues to disrupt traditional retailers. A&F needs to continuously strengthen their online presence and find ways to compete effectively in this space.