Executive Summary:

Ollie’s Bargain Outlet Holdings is a retailer that sells brand-name merchandise at discount prices. They offer a variety of products including housewares, food, and toys. The company prides itself on its unique shopping experience, which they describe as a “treasure hunt.” Ollie’s Bargain Outlet Holdings is growing rapidly and recently increased their target number of stores from 1,050 to 1,300.

Analysts predict earnings per share (EPS) to be around $0.65, which would be a significant increase over the $0.49 reported for the same quarter last year.

Stock Overview:

| Ticker | $OLLI | Price | $76.80 | Market Cap | $4.71B |

| 52 Week High | $84.38 | 52 Week Low | $52.93 | Shares outstanding | 61.29M |

Company background:

Ollie’s Bargain Outlet Holdings was founded in 1982 by Mark Butler in Harrisburg, Pennsylvania, the company offers a treasure hunt shopping experience with a wide variety of products including housewares, food, stationary, toys and more. Their business model focuses on constantly changing inventory, giving customers the thrill of finding a great bargain.

Ollie’s Bargain Outlet Holdings has been experiencing consistent growth. Their main competitors include other discount retailers like TJ Maxx, Marshalls, and Ross Dress for Less. With their unique shopping experience and focus on value, Ollie’s Bargain Outlet Holdings is a well-established player in the discount retail market.

Recent Earnings:

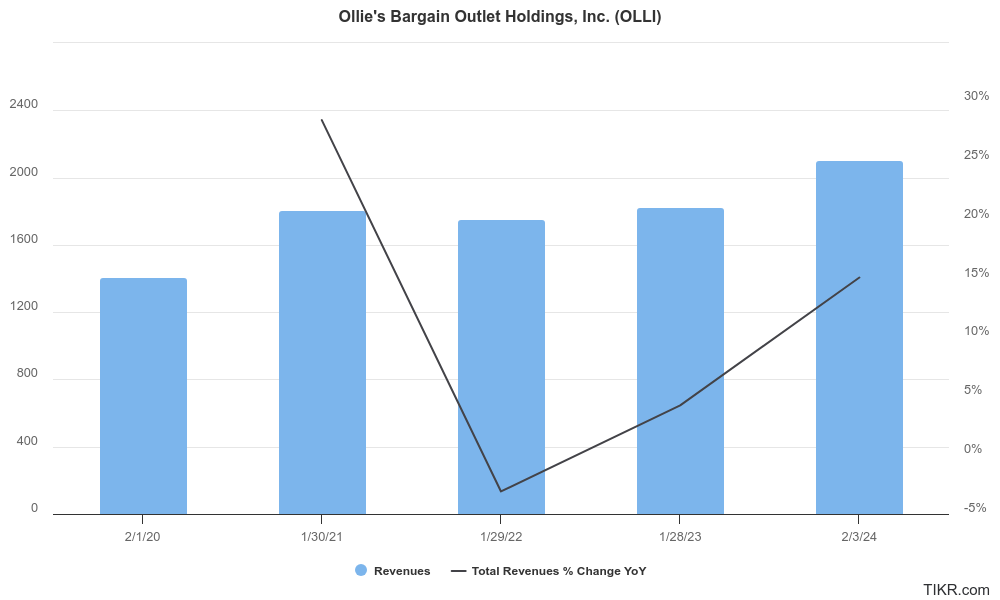

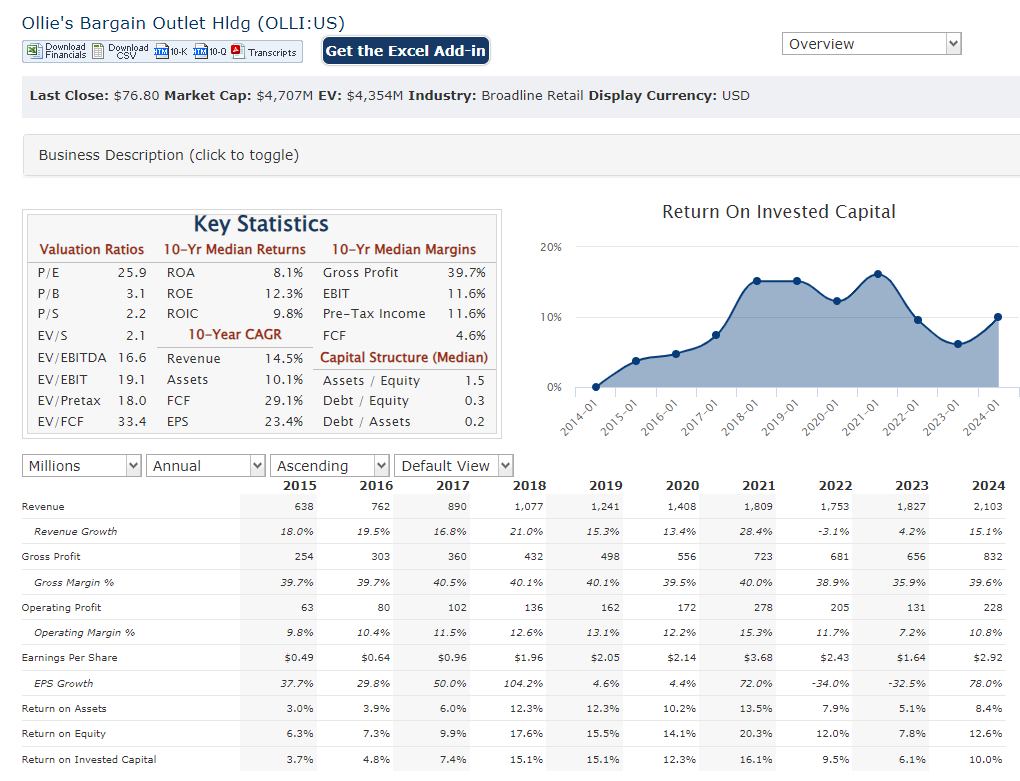

Analysts’ estimates predict Earnings Per Share (EPS) to be around $0.65, reflecting a significant increase year-over-year compared to $0.49 for the same quarter in 2023. Revenue is also expected to show strong growth. Revenue grew 18% to over $648M. Ollie’s Bargain Outlet Holdings performed on operational metrics like gross margin and selling, general & administrative (SG&A) expenses. In their fiscal 2023 report, they benefited from favorable supply chain costs, leading to a higher gross margin.

The Market, Industry, and Competitors:

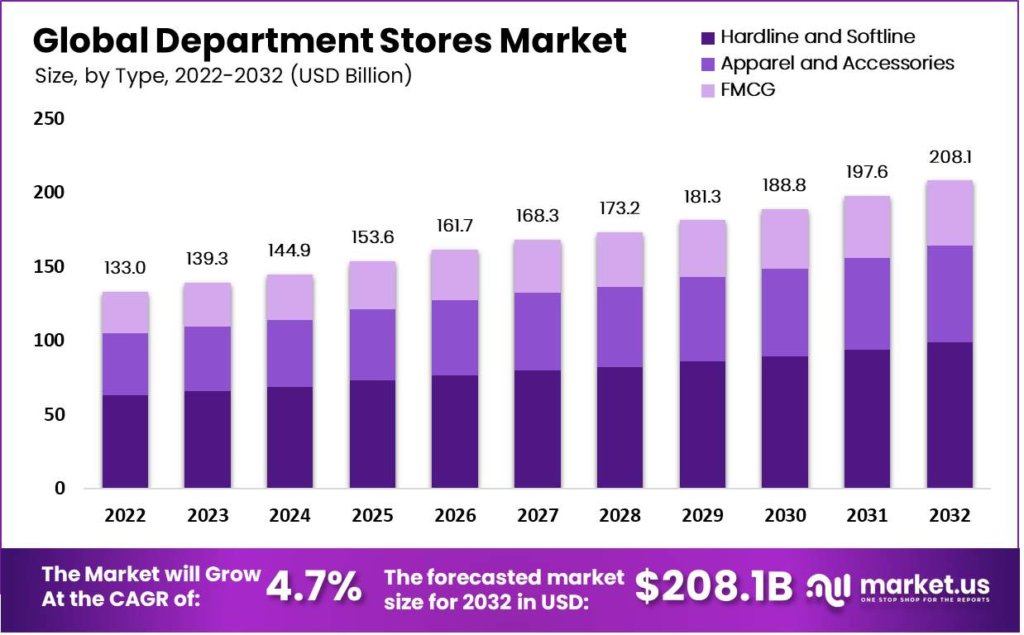

Ollie’s Bargain Outlet Holdings operates in the discount retail market, a large and thriving industry in the United States. This market benefits from several tailwinds, including a growing number of value-conscious consumers and the increasing popularity of off-price shopping.

Specifically for Ollie’s Bargain Outlet Holdings, growth expectations are optimistic. Due to their unique business model, strong brand recognition, and ambitious store expansion plans, analysts predict a Compound Annual Growth Rate (CAGR) in the low double-digits for the next five years. This means Ollie’s Bargain Outlet Holdings’ revenue is expected to grow by around 10-12% annually for the next half-decade.

Established Discount Retailers: The biggest competitors are retail giants like TJ Maxx, Marshalls, Ross Dress for Less, and Burlington. These companies offer similar product categories, encompassing homeware, apparel, food, and toys, at competitive discount prices. They also boast a vast store network and brand recognition, making them strong contenders in the market.

Dollar Stores: While Ollie’s Bargain Outlet focuses on brand-name merchandise at discount prices, dollar stores take a different approach. Dollar General and Family Dollar, for instance, offer a wider selection of private-label products alongside some national brands, all priced at a dollar or slightly higher. These stores cater to budget-conscious shoppers seeking everyday essentials at rock-bottom prices.

Off-Price Specialty Retailers: Ollie’s Bargain Outlet isn’t the only player offering brand-name products at a discount. There are specialty stores like HomeGoods (homeware), Nordstrom Rack (apparel), and TJ Maxx’s offshoot, Sierra Trading Post (outdoor gear and apparel) that target specific customer segments with discounted merchandise from popular brands. These stores can pose a threat to Ollie’s Bargain Outlet in specific product categories.

Treasure Hunt Shopping Experience: Ollie’s offers a unique “treasure hunt” experience with an ever-changing inventory. This approach excites customers who enjoy the thrill of finding hidden gems and one-of-a-kind deals. Unlike competitors with more predictable product selection, Ollie’s encourages browsing and discovery, potentially leading to higher basket sizes as customers stumble upon unexpected bargains.

Focus on Brand-Name Inventory: While some competitors offer a mix of private label and national brands, Ollie’s prioritizes brand-name merchandise at discounted prices. This strategy attracts customers who specifically seek deals on recognizable brands, building trust and potentially leading to a perception of higher product quality.

Lower Price Points: Ollie’s is known for offering deeper discounts compared to some competitors. This caters to budget-conscious shoppers seeking the absolute best bargains, potentially attracting a different customer segment than those who might prioritize a more curated selection at competitors.

Management & Employees:

John Swygert (President & CEO): Swygert has extensive experience in discount retail finance. He joined Ollie’s in 2004 as CFO, working his way up to CEO in 2019. His leadership has been instrumental in the company’s growth.

Eric van der Valk (Executive Vice President & COO): Van der Valk brings expertise in discount retail operations. He joined Ollie’s in 2021 after serving as President and COO of Christmas Tree Shops, another discount retailer.

Rob Helm (Senior Vice President & CFO): Helm is responsible for Ollie’s financial operations. He assumed the CFO role in 2023 after holding various positions within the company.

Financials:

Ollie’s Bargain Outlet Holdings revenue has grown steadily, with a Compound Annual Growth Rate (CAGR) likely exceeding 10%. Earnings growth has mirrored the positive trend in revenue. Ollie’s has managed to translate higher sales into significant profit increases, with a CAGR likely falling in the high single digits to low double digits. This growth can be attributed to factors like a rising gross margin, potentially due to favorable supply chain conditions in previous years, and improved operational efficiency.

Ollie’s maintains a healthy debt-to-equity ratio, indicating they haven’t relied heavily on debt to finance their growth.

Technical Analysis:

On the monthly and weekly charts the stock is range bound (neutral) after forming a base, within the $69 to $83 range. On the daily chart, a double top forming should see shares move lower before earnings (on June 5th), but momentum is strong which should see the stock reach $83-$84 range before a pullback.

Bull Case:

Thriving Discount Retail Market: The discount retail market is expected to keep expanding due to a growing number of value-conscious consumers and the popularity of off-price shopping. This trend bodes well for Ollie’s as it capitalizes on this consumer behavior.

Unique Shopping Experience: Ollie’s offers a differentiated “treasure hunt” experience with an ever-changing inventory. This excites customers who enjoy the thrill of finding deals and unique products, potentially leading to higher sales and loyal customers.

Aggressive Discounts: Ollie’s is known for offering deeper discounts compared to some competitors. This caters to budget-conscious shoppers seeking the best bargains, potentially attracting a different customer segment than those who prioritize a curated selection.

Bear Case:

Supply Chain Disruptions: Recent supply chain issues have impacted many retailers. If these problems persist, it could disrupt Ollie’s ability to source products or lead to higher costs, potentially squeezing margins.

Rising Costs: Inflation and rising costs of goods could eat into Ollie’s profit margins, especially if they’re unable to fully pass on these increases to customers while maintaining their competitive discount pricing.

Limited Product Selection: Ollie’s ever-changing inventory can be a double-edged sword. While it excites some customers, it might also frustrate others looking for specific items. This could limit their customer base compared to competitors with a more predictable selection.