Executive Summary:

Halozyme Therapeutics Inc. is a biotech company founded in 1998 that develops products targeting a specific part of the human body called the extracellular matrix. They are especially focused on an enzyme called hyaluronidase and its applications. Halozyme markets a product called Cumulase for in vitro fertilization and has several oncology drugs in development. Their most promising investigational drug is PEGPH20, which is being tested in combination with other therapies for various cancers.

Stock Overview:

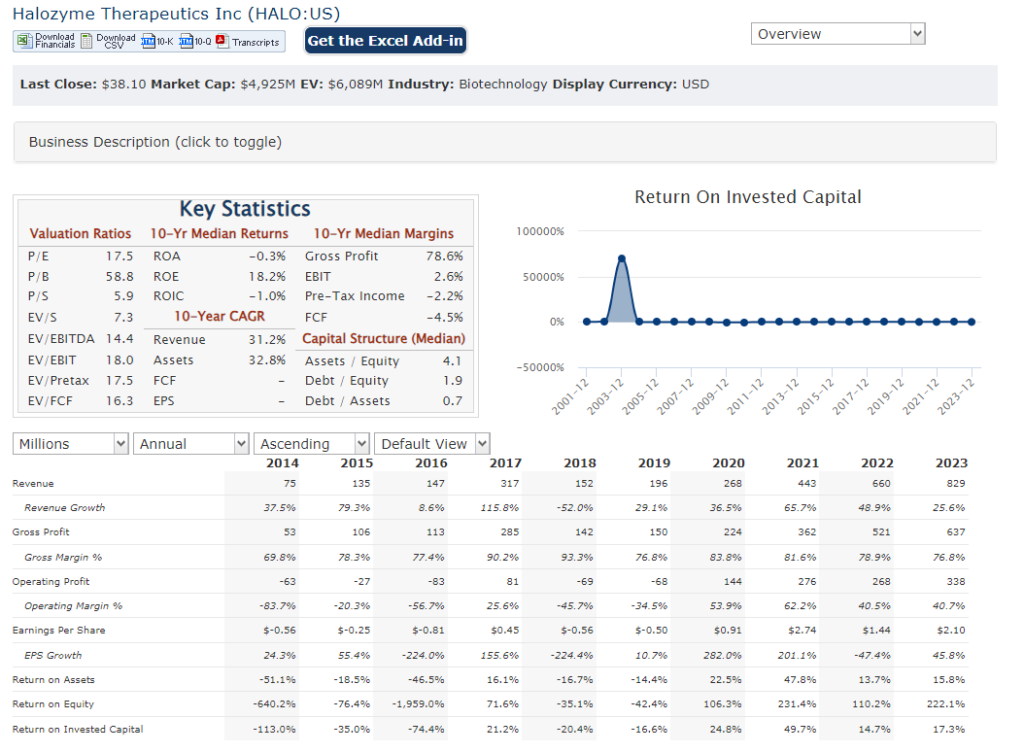

| Ticker | $HALO | Price | $39.54 | Market Cap | $5.02B |

| 52 Week High | $45.00 | 52 Week Low | $29.85 | Shares outstanding | 127.05M |

Company background:

Halozyme Therapeutics Inc. is a biotech company. Halozyme’s product portfolio leverages their expertise in enzymes, particularly hyaluronidase. They market Cumulase, a hyaluronidase injection used in in vitro fertilization. Halozyme has a robust oncology pipeline with PEGPH20, a pegylated version of hyaluronidase, as the most promising candidate. Halozyme’s mission is to improve patient experiences by making treatments more effective and easier to administer.

Halozyme faces competition from other biotechnology companies developing enzyme therapies. The company’s headquarters are located in San Diego, California.

Recent Earnings:

Analysts’ predictions suggest an EPS of $0.64, which would be a considerable increase compared to $0.43 reported for the same quarter in the previous year.

Revenue reached $230.0 million, reflecting a significant growth compared to $181.5 million in the same period of 2022. These metrics provide insight into a company’s efficiency and profitability.

Halozyme’s future plans including potential new product launches, partnerships, and developments in their oncology pipeline, particularly regarding PEGPH20. The company’s guidance on future revenue and EPS will also be closely scrutinized.

The Market, Industry, and Competitors:

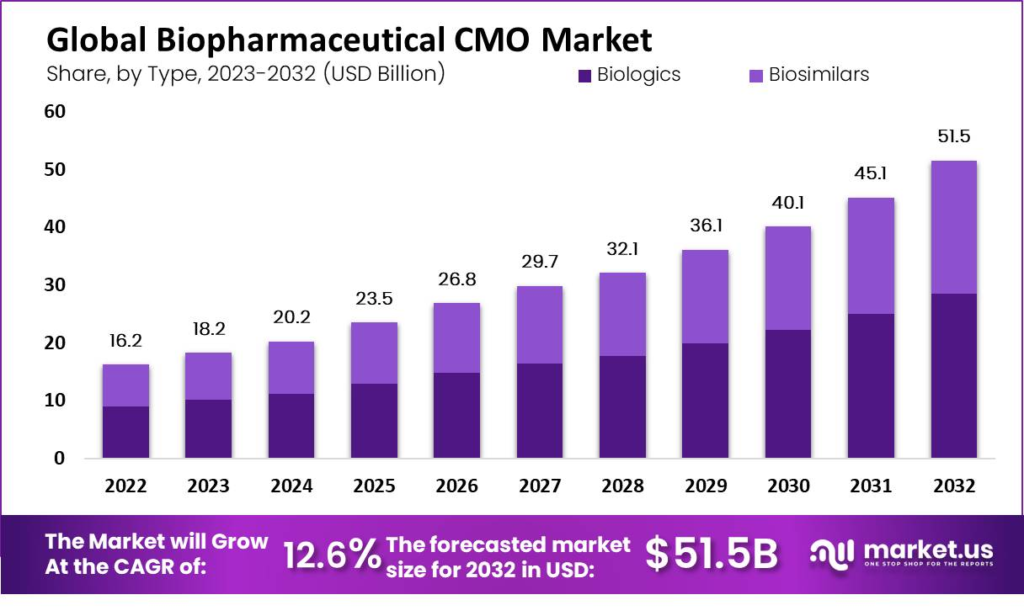

Halozyme Therapeutics is expected to experience significant growth due to factors like rising demand for personalized medicine, increasing prevalence of chronic diseases, and growing investments in research and development. Analysts predict the global enzyme therapy market to reach a staggering $28.5 billion by 2030, reflecting a Compound Annual Growth Rate (CAGR) of around 8.5% over the next six years

Halozyme is well-positioned within this growing market. Their expertise in hyaluronidase, an enzyme that breaks down barriers in the body, holds promise for improving drug delivery and efficacy. Their oncology pipeline, particularly PEGPH20, has the potential to be a game-changer in cancer treatment.

Unique differentiation:

Direct Enzyme Therapy Competitors: Companies like Partner Therapeutics, Verastem Oncology, and Rakuten Medical are developing their own enzyme therapies, potentially targeting similar applications or disease areas.

Indirect Delivery Technology Competitors: Broader pharmaceutical and biotech companies might develop alternative methods for drug delivery, bypassing the need for enzyme therapies altogether.

Oncology Drug Developers: Specifically for Halozyme’s oncology pipeline, they compete with companies developing other cancer treatments, including traditional chemotherapy drugs, targeted therapies, and immunotherapies.

ENHANZE® Platform: Their core advantage lies in their proprietary ENHANZE® technology platform. This platform utilizes specifically engineered forms of hyaluronidase, an enzyme that breaks down hyaluronic acid, a major component of the extracellular matrix. ENHANZE® can improve the absorption and distribution of other drugs administered subcutaneously (under the skin) or intravenously (into a vein). This allows for potentially faster-acting treatments, lower doses, and reduced side effects associated with traditional delivery methods.

Focus on Hyaluronidase Expertise: Unlike some competitors with broader enzyme therapy pipelines, Halozyme has deep expertise specifically in hyaluronidase. This focus allows them to refine their technology and potentially develop more effective applications compared to companies spreading their resources across various enzymes.

Strategic Partnerships: Halozyme leverages partnerships with pharmaceutical and biotech companies to integrate their ENHANZE® platform with other drugs. This allows them to expand their reach and potentially unlock new applications for their technology without solely relying on in-house drug development.

Promising Oncology Pipeline: While competitors may have established enzyme therapies, Halozyme’s oncology pipeline, particularly PEGPH20, holds promise for innovation. PEGPH20’s potential to improve the efficacy of other cancer treatments positions them well within the growing field of combination therapies.

Management & Employees:

Helen Torley, M.B. Ch. B., M.R.C.P.: President, Chief Executive Officer (CEO) and Member of the Board of Directors. Dr. Torley brings extensive commercial and business experience, having led successful product launches in the past.

Steve Knowles: Chief Medical Officer (CMO). Dr. Knowles is responsible for leading the development of Halozyme’s product pipeline, ensuring scientific and medical advancements.

Connie L. Matsui: Chairman of the Board. Ms. Matsui brings a wealth of experience in board governance and strategic leadership to Halozyme.

Financials:

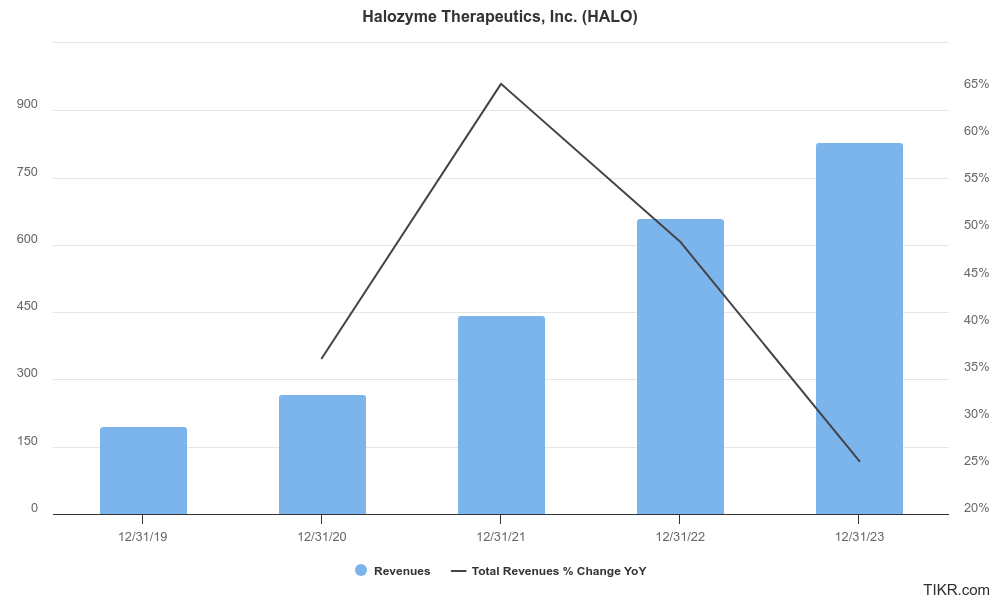

Halozyme Therapeutics revenue has been steadily increasing, reflecting a strong Compound Annual Growth Rate (CAGR). Their fourth-quarter revenue in 2023 reached $230.0 million, a significant jump compared to $181.5 million in the same period of 2022.

Their net income for the full year 2023 was $281.6 million, compared to $202.1 million in 2022. This growth indicates a positive trend in profitability for Halozyme.

A growing company like Halozyme would aim to maintain a healthy balance between debt and equity financing. Their cash flow from operations, a key metric on the balance sheet, would ideally be increasing as well, reflecting their ability to generate cash through their core business activities.

Technical Analysis:

The stock is forming a symmetric triangle in the monthly chart (bullish) and has a bull flag on the weekly chart as well. The reversal on the bull flag is seen on the daily chart, so the stock should get to $42 in a few weeks.

Bull Case:

- Expanding Market Opportunity: The global enzyme therapy market is anticipated to experience significant growth in the coming years. Halozyme is well-positioned to capitalize on this trend by leveraging their ENHANZE® platform for partnerships and potentially expanding into new disease areas.

- Experienced Management Team: Halozyme’s leadership boasts extensive experience in the biopharmaceutical industry. Their expertise in areas like commercialization, finance, and drug development can be instrumental in navigating the competitive landscape and driving future growth.

Bear Case:

ENHANZE® Platform Limitations: The effectiveness of the ENHANZE® platform hinges on its ability to efficiently improve drug delivery across various applications. If the technology doesn’t perform as expected or has unforeseen limitations, it could undermine Halozyme’s core business strategy.

Oncology Pipeline Risks: The success of PEGPH20, Halozyme’s most promising oncology drug, is far from guaranteed. Clinical trials can be lengthy and expensive, with the possibility of failure at any stage. Regulatory approval is another hurdle, and even if approved, PEGPH20 might not be as effective as anticipated in real-world use.