Executive Summary:

Transocean Ltd. is a leading American company in offshore drilling for oil and gas wells. Their headquarters are in Vernier, Switzerland, but they have offices in 20 countries around the world. The company offers a variety of services including deepwater and harsh environment drilling, project management, and crew for oil and gas rigs.

They achieved a net income of $98 million, translating to earnings per share (EPS) of $0.11.

Stock Overview:

| Ticker | $RIG | Price | $5.22 | Market Cap | $4.28B |

| 52 Week High | $8.88 | 52 Week Low | $4.45 | Shares outstanding | 819.6M |

Company background:

Transocean Ltd., though an American company, is the world’s largest offshore drilling contractor based on revenue. Their headquarters are located in Vernier, Switzerland, with offices in 20 other countries around the globe.

Transocean Ltd. focuses on deepwater and harsh environment drilling services for oil and gas exploration. This one-stop shop approach allows them to offer a streamlined solution to their clients.

The company was found partially liable for the Deepwater Horizon oil spill in 2010. The offshore drilling industry has also seen fluctuations, with oil prices impacting the demand for Transocean’s services.

Recent Earnings:

Revenue and Growth: Transocean’s revenue grew sequentially by $22 million, reaching $763 million for the first quarter of 2024.

EPS and Growth: Earnings per share (EPS) came in at $0.11, marking a significant improvement compared to a net loss of $0.64 per share in Q1 2023.

Comparisons to Analysts’ Expectations: Analysts had predicted an EPS of -$0.13, making the actual results a positive surprise of 76.92%.

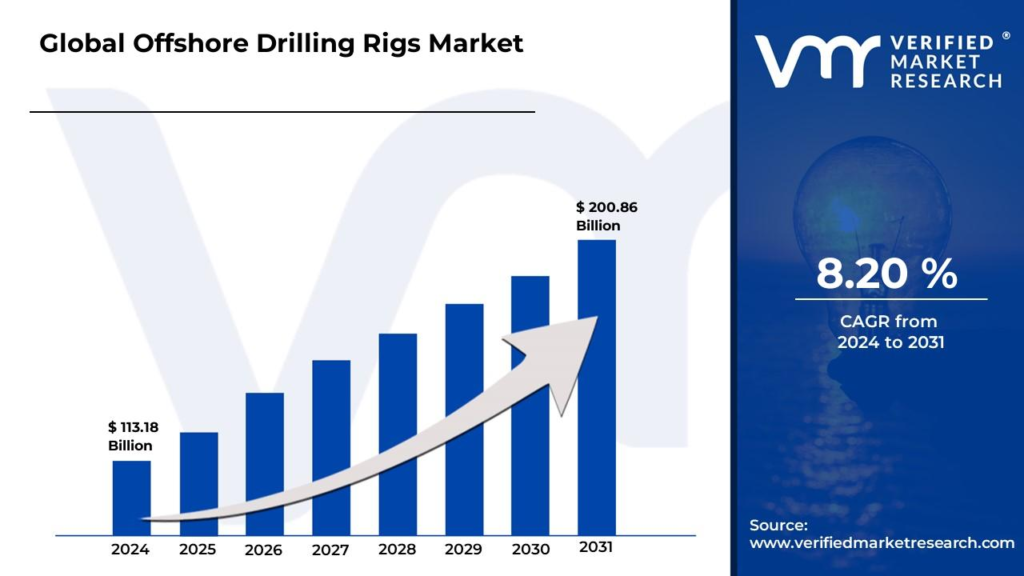

The Market, Industry, and Competitors:

Transocean Ltd. operates in the offshore drilling for oil and gas exploration market. When oil prices are high, there’s more demand for oil and gas exploration. With growing environmental concerns and a push towards renewable energy sources, the long-term outlook for the offshore drilling industry is uncertain.

Some predict a decline in offshore drilling due to a shift towards renewable energy sources. Others suggest that growing global energy demand, coupled with limited onshore drilling opportunities, could lead to a rebound in offshore drilling in the long term.

Staying informed about trends in global oil prices, government regulations on offshore drilling, and advancements in renewable energy will be crucial in understanding the future direction of this market and Transocean’s place within it.

Unique differentiation:

Noble Corporation (NE): Noble Corporation is a major competitor of Transocean. They offer similar services, specializing in offshore drilling for oil and gas exploration and production. Noble Corporation boasts a large fleet of rigs, including jackups, semi-submersibles, and drillships.

Valaris plc (VAL): This British offshore drilling contractor is another strong competitor. Formed by the 2020 merger of Ensco plc and Diamond Offshore Drilling, Valaris offers a comprehensive range of drilling services across various water depths and locations.

Maersk Drilling A/S (DRLD.CO): Danish company Maersk Drilling is a significant player in the high-end jackup market. They specialize in harsh environment and deepwater drilling, offering advanced technology and experienced crews.

Fleet Composition: Transocean might have a strategic advantage in the makeup of their rig fleet. They could possess a higher concentration of rigs suited for specific, in-demand drilling projects (e.g., deeper waters, harsher environments).

Global Presence: With offices in 20 countries, Transocean boasts a wider geographical reach compared to some competitors. This could be advantageous when it comes to mobilizing crews and equipment for projects in remote locations.

Service Integration: Their one-stop-shop approach, offering project management, crews, well services, and logistics alongside drilling, might streamline operations and reduce complexities for clients compared to managing multiple contractors.

Management & Employees:

Jeremy D. Thigpen (CEO): Appointed in 2015, Thigpen brings extensive experience from his previous role as CFO at National Oilwell Varco.

Keelan Adamson (President & COO): Adamson has climbed the ranks at Transocean, holding various leadership positions in operations before his current appointment in 2022.

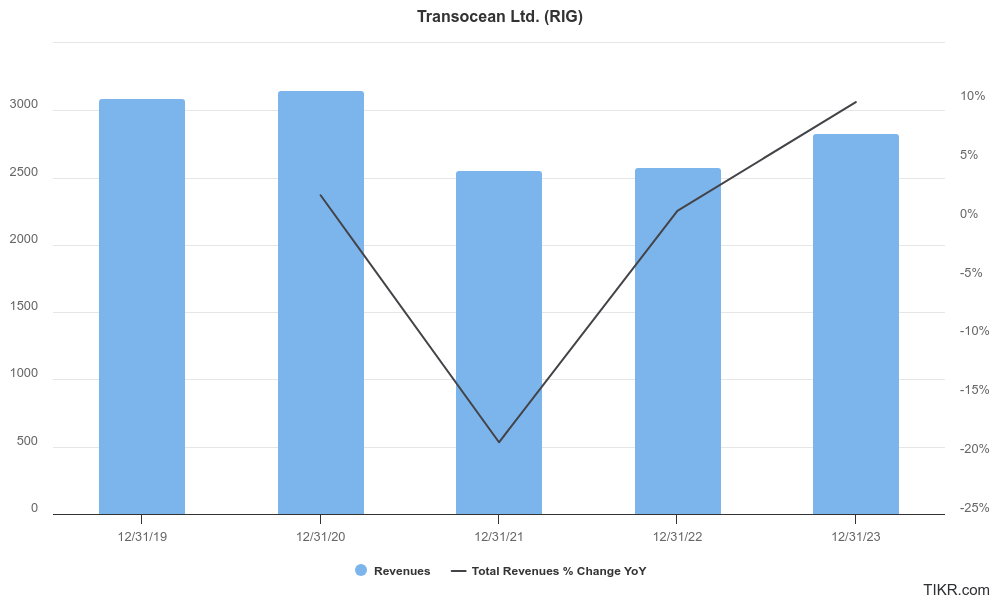

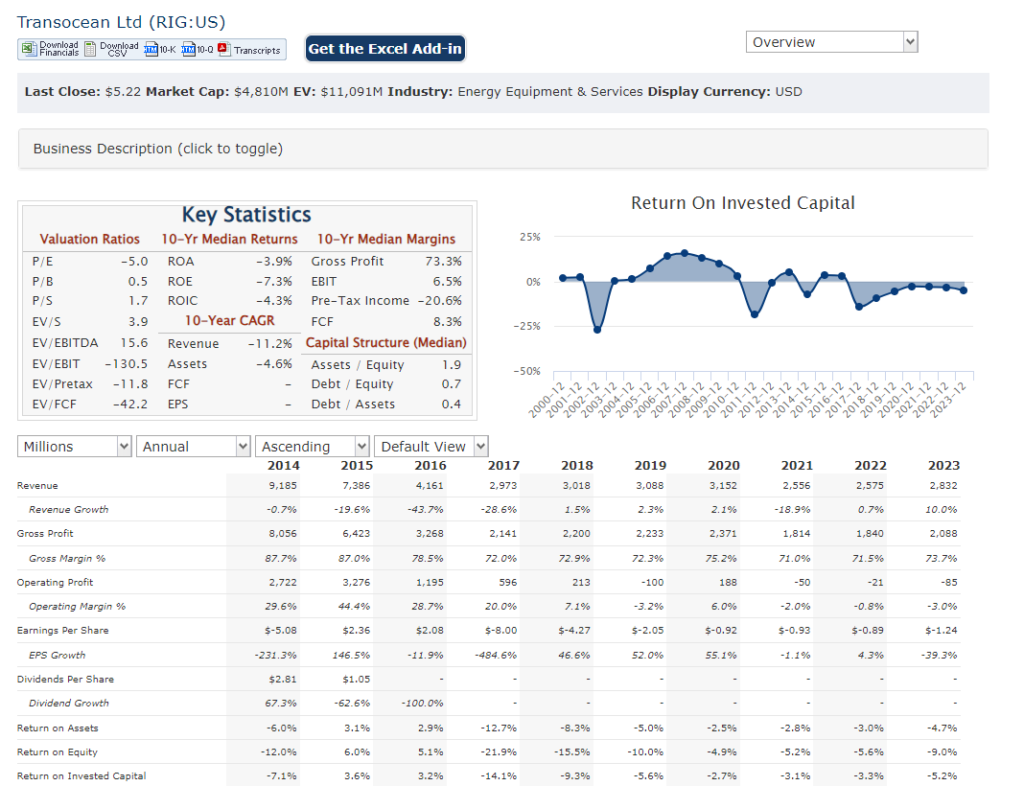

Financials:

Revenue has fluctuated, reflecting the cyclical nature of the offshore drilling industry. Earnings have also been volatile. Transocean reported net losses in some years, including 2023. However, the latest earnings report for Q1 2024 showed a significant improvement, with a net income compared to the net loss in Q1 2023.

Looking at the balance sheet, Transocean Ltd. carries a significant debt burden. Their debt-to-equity ratio remains high, which could limit their financial flexibility.

Transocean Ltd. is navigating a challenging financial landscape. While the recent quarter shows promise, the company needs to secure consistent revenue and profitability to ensure long-term financial health.

Technical Analysis:

Consolidating (stage 1) on the monthly chart, a head and shoulders pattern (bearish) on the weekly chart (stage 4) and stage 4 declining on the daily chart, makes $RIG an easy stock to avoid.

Bull Case:

Rebound in Oil Prices: If global oil prices rise consistently, there would likely be a corresponding increase in demand for oil and gas exploration. This would benefit offshore drillers like Transocean, leading to higher contract activity and potentially increased revenue.

Limited Onshore Opportunities: As onshore drilling opportunities become depleted or restricted by environmental regulations, offshore drilling might become a more attractive option for oil and gas companies. This could translate into a larger pool of potential clients for Transocean.

Bear Case:

Declining Oil Demand: The global push towards renewable energy sources could lead to a long-term decrease in demand for oil and gas. This would directly impact the need for offshore drilling, reducing Transocean’s core business and potentially leading to lower revenue and profitability.

High Debt Levels: Transocean’s substantial debt burden creates financial strain. High debt servicing costs limit their ability to invest in new technologies or rigs, potentially hindering their competitiveness in the long run.

Competition and Aging Fleet: The offshore drilling market is fiercely competitive. If Transocean’s competitors have a larger fleet of modern rigs or offer more competitive rates, they could lose valuable contracts.