Executive Summary:

Nuvei Corporation is a Canadian payment processor that helps businesses accept payments and make payouts around the world. Founded in 2003, the company offers a wide range of payment solutions, including credit card processing, alternative payment methods, and fraud management services. Nuvei went public in 2020 on the Toronto Stock Exchange.

Stock Overview:

| Ticker | $NVEI | Price | $32.28 | Market Cap | $4.50B |

| 52 Week High | $42.50 | 52 Week Low | $13.32 | Shares outstanding | 63.50M |

Company background:

Nuvei Corporation is a Canadian financial services provider was founded by Philip Fayer and Morris Rosenberg. Their technology is designed to be modular, flexible, and scalable, allowing businesses of all sizes to integrate their systems seamlessly.

Nuvei is headquartered in Montreal, Canada, and has grown into a global company. They compete with other industry giants like PayPal, Stripe, and Adyen. In order to keep up with the ever-changing payments landscape, Nuvei prioritizes staying ahead of trends. They invest in research and development to ensure their offerings are cutting-edge. The company has also expanded its global reach through strategic acquisitions and listings on prominent stock exchanges.

Recent Earnings:

Nuvei has excluded digital assets and cryptocurrencies, Nuvei boasted a strong 17% year-over-year growth in organic revenue at constant currency. Analysts’ consensus forecasts for EPS currently sit at $0.28 for the fiscal quarter ending March 2024 and $1.27 for the full fiscal year ending December 2024.

The Market, Industry, and Competitors:

Nuvei operates in the global payments processing market, a sector anticipated to experience significant growth in the coming years. Analysts predict a Compound Annual Growth Rate (CAGR) of 10.2% from 2023 to 2030. This growth is fueled by several trends, including the surging popularity of e-commerce, the increasing adoption of digital wallets like Apple Pay and Google Pay, and a growing demand for mobile payment solutions. Nuvei is well-positioned to capitalize on these trends with its comprehensive payment solutions, global reach, and focus on innovation. Their flexible technology allows them to integrate seamlessly with businesses of all sizes, making them a strong contender in the ever-evolving landscape of global payments.

Unique differentiation:

- PayPal: A household name in online payments, PayPal boasts a vast global presence and offers a wide range of solutions for businesses and consumers alike. They compete directly with Nuvei in traditional payment processing, but also extend into areas like digital wallets and point-of-sale systems, making them a one-stop shop for many businesses.

- Stripe: This fast-growing fintech company is known for its user-friendly developer tools and focus on innovation. Stripe caters particularly towards modern internet businesses with its emphasis on easy integration and a robust suite of application programming interfaces (APIs). Their competitive fees and emphasis on mobile payments make them a significant competitor for Nuvei, especially in the online space.

These are some of the competitive landscape is further crowded by regional players and niche specialists. To stay ahead, Nuvei needs to constantly innovate, refine its product offerings, and emphasize its strengths, such as its global reach, security features, and focus on high-risk industries.

Focus on specific verticals: Nuvei caters to specific industries, including high-risk sectors like online gambling and adult entertainment. This tailored approach allows them to understand the unique needs and challenges of these businesses and provide specialized solutions.

Global reach with a focus on emerging markets: Nuvei has a strong presence in established markets like North America and Europe, but also prioritizes expansion into high-growth emerging markets. This gives them a wider reach than some competitors who might be more concentrated in developed regions.

Modular and flexible technology: Nuvei’s technology is designed to be modular, allowing businesses to pick and choose the features they need. This flexibility makes it easier for businesses of all sizes to integrate Nuvei’s systems seamlessly into their existing infrastructure.

Emphasis on security and fraud prevention: Nuvei prioritizes robust security measures and advanced fraud prevention tools. This is crucial for businesses in high-risk industries and gives Nuvei an edge in building trust with merchants.

Management & Employees:

Philip Fayer (Founder, Chair and Chief Executive Officer): Fayer is the founder of Nuvei and has over 20 years of experience in the electronic payments industry. He has overseen the company’s growth through both organic expansion and strategic acquisitions.

Yuval Ziv (President): Ziv plays a key role in Nuvei’s overall business strategy and execution.

Max Attias (Group Chief Technology Officer): Attias leads Nuvei’s technology strategy and development, ensuring the company’s technological infrastructure remains secure and scalable.

Financials:

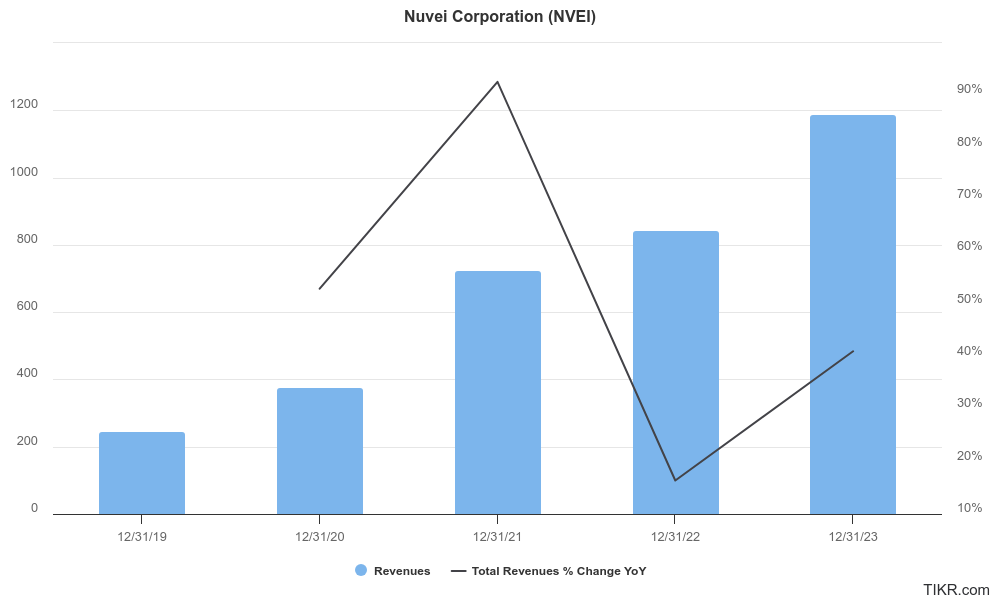

Nuvei their latest earnings report showcased a strong 17% year-over-year increase in organic revenue for the fiscal year ending December 2023, excluding digital assets and cryptocurrencies. Analysts estimate a Compound Annual Growth Rate (CAGR) of around 34.1% for Nuvei’s revenue over the past five years

Nuvei is still a relatively young company and hasn’t reached consistent profitability yet. While they’ve been reducing losses year-over-year, they haven’t reported positive

Their recent acquisition of Paya expanded their Total Addressable Market (TAM) and bolstered.

Technical Analysis:

The stock is still forming a base on the monthly chart after an attempted move higher. It is consolidating (Range bound) in the weekly chart, and has very little volume over the last few days. The tight range bound nature on the daily chart indicates a pause before earnings. We will keep the stock on the watchlist until after earnings.

Bull Case:

Acquisition-Fueled Growth: Nuvei has a history of strategic acquisitions that expand their reach and product offerings. This inorganic growth strategy could continue to fuel their market share and capabilities.

Potential Private Equity Buyout: Recent rumors of a potential private equity buyout suggest Nuvei might be undervalued, offering an opportunity for existing shareholders if a deal materializes.

Analyst Optimism: Analysts maintain a bullish outlook on Nuvei, with a consensus price target suggesting significant upside potential for the stock.

Bear Case:

Acquisition Integration Risk: Nuvei’s acquisition strategy can be a double-edged sword. Integrating new companies can be complex and lead to unexpected challenges. Unsuccessful integrations could hinder Nuvei’s overall growth trajectory.

Short Seller Scrutiny: Nuvei faced accusations from short sellers in the past, raising questions about their accounting practices and business model. While the company refutes these claims, such scrutiny can damage investor confidence.

Emerging Market Volatility: Nuvei’s expansion into emerging markets exposes them to currency fluctuations and potential political instability, which could disrupt their operations.